Investing

Did 'The Greatest Trade Ever' Billionaire Make a Great Trade Selling These 3 Stocks?

Published:

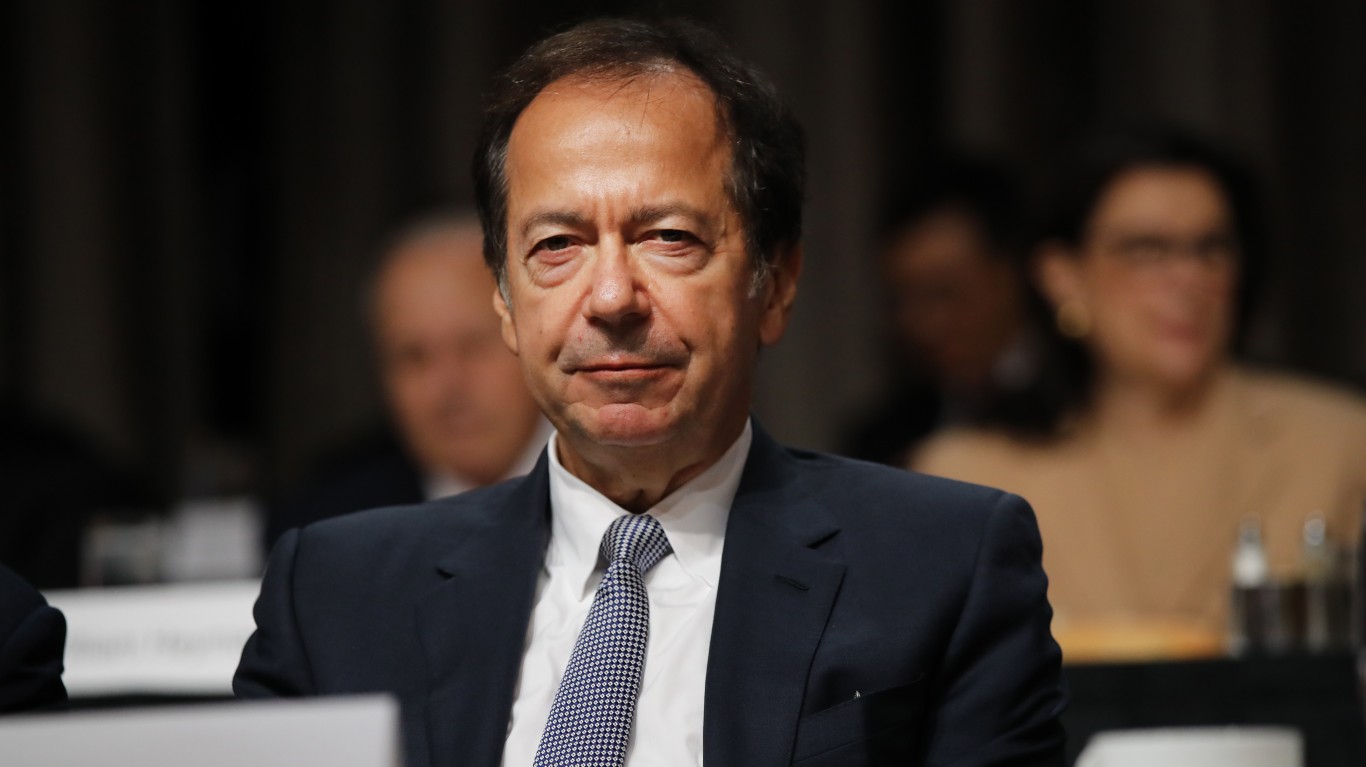

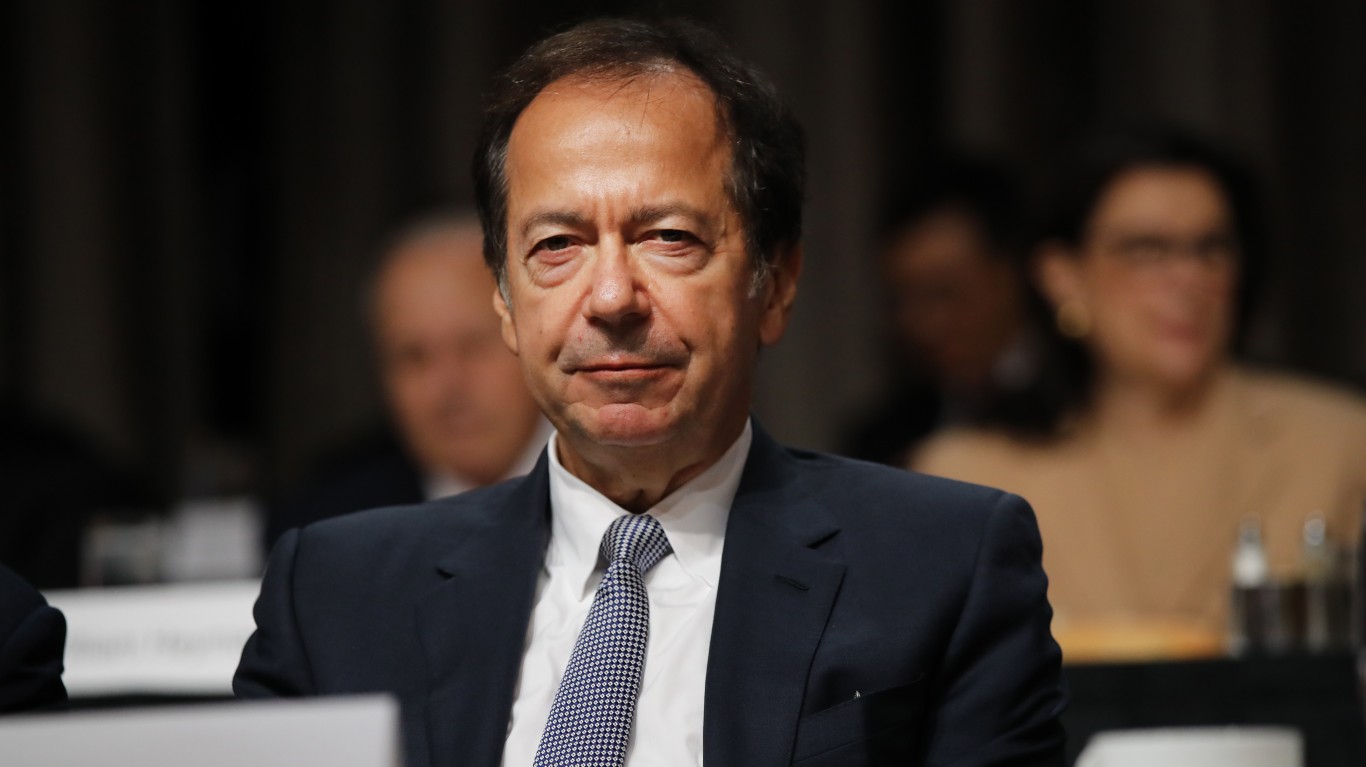

John Paulson became an investing legend by parlaying bets against the subprime mortgage lending business into massive profits when the housing market collapsed in 2007. His story was recounted in the book, The Greatest Trade Ever, which details how he made a whopping $15 billion for his Paulson & Co. hedge fund by correctly calling the mortgage crisis.

While the billionaire has since closed the fund, he now invests through his family office, a vehicle for the uber-rich that only invests on behalf of the individual, his family, and a select few others.

Paulson only owns a relative handful of stocks compared to other billionaire investors. Where Paul Tudor Jones owns almost 1,500 stocks and Jim Simons Renaissance Technologies is a veritable index fund with over 3,400 stocks, Paulson only owns 16 companies.

Actually at the end of the first quarter he had owned three others, but he sold off all the shares he held in the ensuing three months. Let’s look to see if jettisoning them from his portfolio was a great trade.

The first stock he sold down is the easiest to understand. Carrols Restaurant Group was the world’s largest franchisee of Burger King restaurants, but also owned several dozen Popeye’s Louisiana Kitchen locations as well. However, in January, Restaurant Brands International (NYSE:QSR), which owns Burger King and Popeyes — as well as Tim Horton’s and Firehouse Subs — announced it was acquiring the franchisee for $1 billion.

Burger King franchisees, on the whole, have been experiencing difficult times, losing sales to McDonald’s (NYSE:MCD) and others. Last year, two large franchisees operating some 200 restaurants, Toms King and Meridian Restaurants Unlimited, declared bankruptcy.

Burger King was stumbling before the Covid pandemic hit and where other quick-serve operators surged afterwards, the fast-food chain continued on a downward trajectory. That led Restaurant Brands International to launch its “Reclaim the Flame” initiative to turn the burger chain around. While it acquired a few of the locations from the failed franchisees, it negotiated a buyout of Carrols for $9.55 per share. Paulson, with an average buy price of $8.70 per share for his 58,000 shares of TAST stock, earned a near-10% profit.

The second stock the billionaire investor dumped in the second quarter was Newmark Group (NASDAQ:NMRK), a commercial real estate services company, that Paulson previously owned 3 million shares of.

It was a curious trade because while Newark’s stock had largely traded sideways through the first half of the year, bouncing around a narrow band between $10 and $11 per share, the outlook for the commercial real estate market itself is strong.

Although office vacancy rates remain elevated, the prospects for interest rate cuts (now confirmed by the Federal Reserve’s half percentage point cut), suggested growth was coming. Analysts at JPMorgan Chase (NYSE:JPM) said, “On the pricing side, it’s going to be a landmark year when it comes to price discovery.”

That seems to be playing out with Newmark Group’s stock. Shares are up 39% year-to-date, but since the end of the second quarter NMRK stock is soaring 55% higher, meaning Paulson missed out on some significant potential gains. Even so, with an average buy price of $10.25 per share, he still made an implied 48% profit on his holdings.

The third stock Paulson sold off was Chinese e-commerce giant Alibaba (NYSE:BABA). It seems to be another stock the billionaire got out of too early. While the company had been under intense regulatory scrutiny by Beijing, which had charged it with using monopolistic practices, Alibaba just got the all-clear signal that it would no long be under the government’s watchful eye. It had reformed its ways and could pursue growth once more.

BABA shares are up 25% since the end of the second quarter and now trade at new 52-week highs. However, they are still down 70% from their pandemic highs.

Paulson had maintained a 50,000-share position for some time, but chose to close out his holdings in the second quarter. As he had an average buy-in price of $151 per share, he may have grown tired of waiting for a turnaround that never seemed to materialize. By selling when he did, Paulson had an implied 47% loss.

Now there was a run-up in the stock in late-April to early-May that had brought Alibaba’s stock almost to where it trades today, so the billionaire investor may have recouped some of his investment if he sold out when shares were running hot.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.