Investing

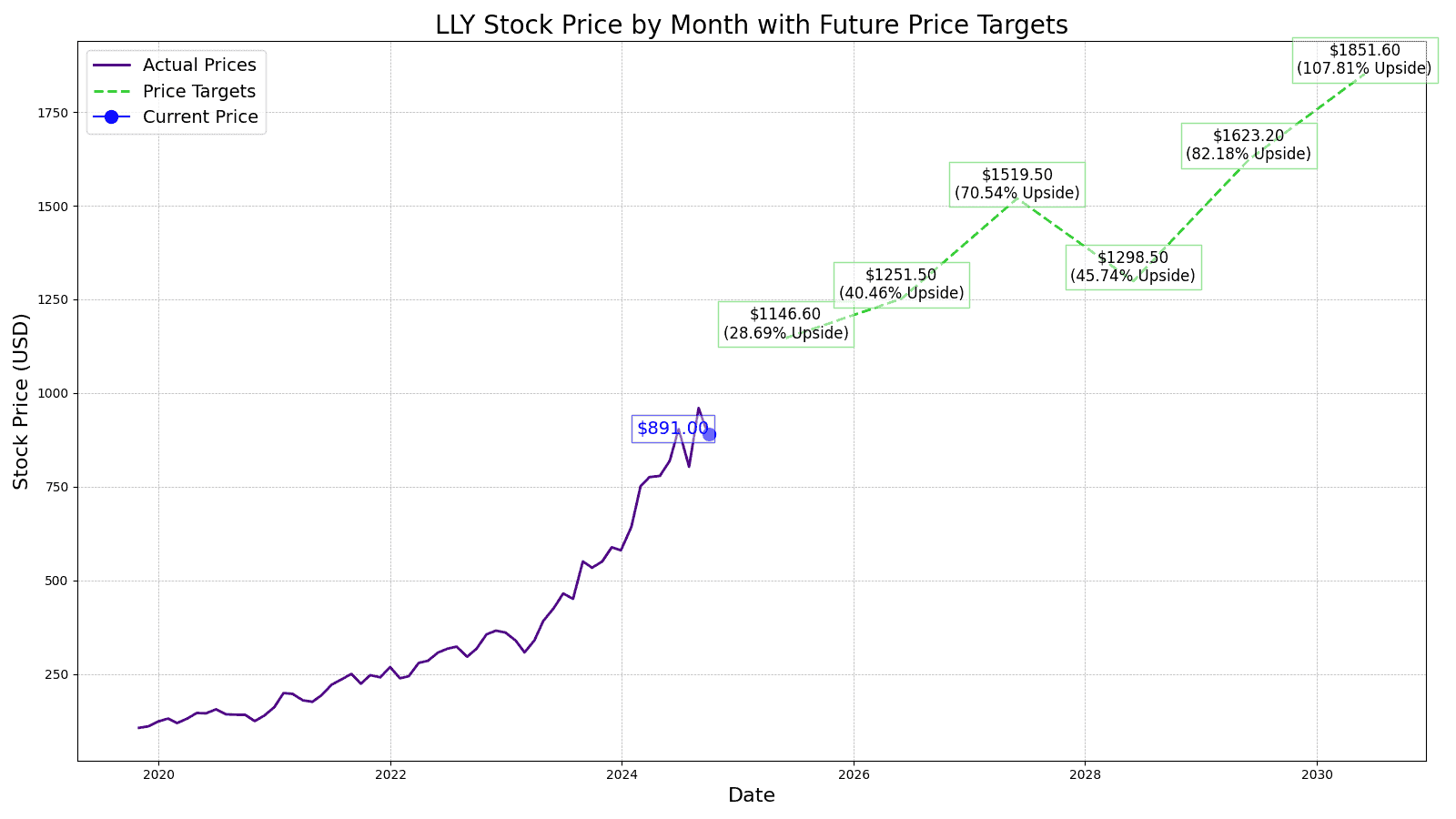

Eli Lilly (LLY) Stock Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Since the start of 2020, Eli Lilly’s (NYSE: LLY) stock price chart has been straight up and to the right, up 573.93% and currently trading at $891.00.

The company has been around since 1876 and the stock didn’t go public until 1952 but in the last 4 years, Eli Lilly went from a $100 billion market capitalization to $740 billion today, which also makes it a potential stock split stock.

However, as investors, we care about the stock price years down the line and what Eli Lilly will do in the next 3 to 5 years and beyond.

That is why 24/7 Wall Street looks at projected revenue and net income to give you our best estimate of future stock prices from 2025 to 2030.

Other “experts” look at past growth rates and assign future stock prices to those past numbers. However, we will walk you through our assumptions and give you the key drivers we see propelling Eli Lilly’s stock in the future.

10/2/2024

Today Eli Lilly announced plans for the Lilly Medicine Foundry. The company is investing $4.5 billion into the new center, located in Lebanon, Indiana, which will be home to drug development and advanced manufacturing.

10/1/2024

Eli Lilly is exploring the possibility of expanding its weight-loss drugs Mounjaro and Zepbound beyond just obese patients. The company is considering testing these medications on people who aren’t overweight but are at risk of gaining weight. CEO Dave Ricks theorizes that these medications might be beneficial for people who are at risk of developing diabetes, vascular dementia, or stroke, even if they’re not overweight.

9/30/2024

J.P. Morgan’s forecast for Eli Lilly estimates the company’s third quarter sales at $11.8 billion, driven by strong growth in U.S. GLP-1 sales and the international expansion of Mounjaro. While this forecast is slightly below consensus estimates, J.P. Morgan also estimates a significant increase in Mounjaro and Zepbound sales in Q4.

9/27/2024

Eli Lilly’s stock has seen a slight decline of 2.57% over the past month. Investors are keenly focused on the company’s upcoming earnings report. Eli Lilly is anticipated to report a substantial increase in earnings per share, a staggering 4,430% compared to the previous year.

9/26/2024

A recent investigation published in The BMJ raised serious concerns about the safety and efficacy of Eli Lilly’s Alzheimer’s drug, donanemab. Although recently approved by the U.S. Food and Drug Administration, the drug was linked to multiple patient deaths during clinical trials.

9/25/2024

Eli Lilly announced positive long-term results for Ebglyss, a treatment for moderate to severe eczema. The drug helped 80% of participants maintain control of their eczema for up to three years in two clinical trials.

9/24/2024

Eli Lilly’s Alzheimer’s drug, Kisunla, has received approval from the Japanese Ministry of Health, Labour and Welfare. This approval marks Kisunla’s second major market launch.

9/23/2024

Eli Lilly plans to expand its research center in India. The company plans to collaborate with local companies with the aim of bringing its products to the Indian market on a larger scale.

9/19/2024

Eli Lilly’s stock price rose by 0.3% during mid-day trading yesterday. The stock reached a high of $910.82 and closed at $908.45. Trading volume was significantly lower than average, with only 290,448 shares traded compared to the typical 3,015,460 shares.

9/17/2024

Eli Lilly is anticipated to report strong earnings growth in the current quarter. According to the consensus estimate, earnings are expected to reach $4.53 per share, a substantial increase of 4,430% compared to the same period last year. These estimates have been relatively stable over the past month, with minor changes of -0.2% and +5.2% for the current and next fiscal year, respectively.

How did Eli Lilly’s stock price soar so much in the past few years? Let’s take a look at the numbers:

| Share Price | Revenues* | Net Income* | |

| 2016 | $80.36 | $21.22 | $2.74 |

| 2017 | $77.55 | $19.94 | ($0.21) |

| 2018 | $122.13 | $21.49 | $3.23 |

| 2019 | $140.83 | $22.32 | $8.32 |

| 2020 | $206.46 | $24.54 | $6.19 |

| 2021 | $238.31 | $28.32 | $5.58 |

| 2022 | 329.07 | $28.54 | $6.25 |

| 2023 | $745.91 | $34.12 | $5.24 |

*Revenue and Net Income in Billions

Since 2016, Eli Lilly’s revenue grew by 60% but income grew by 91%. Typically you wouldn’t expect a company growing at its top line by 7% annually to see an 828% increase in share price, however, investor sentiment for the next line of drugs front ran the stock price.

For example, in 2016 Eli Lilly was trading 13 times the trailing 12 months earnings and the market has increased its valuation each year and currently trades at a 125 times earnings multiple.

This raises the valid question, is Eli Lilly overvalued or will future revenues make up for the expensive valuation?

The current Wall Street consensus 1-year price target of Eli Eli Lilly stock is $898, which is 0.79% higher than today’s price of $891.00. Of the 26 analysts covering Eli Lilly stock, the current rating is 1.71 or “Outperform” with 1-year price targets as high as $1,100 and as low as $540.00.

24/7 Wall Street sets its 1-year price target at $1,040. Taking a look at the sum of its parts, we see Eli Lilly’s vertices valued as follows:

| Endocrinology | $735/ share |

| Oncology | $122/ Share |

| Cardiovascular | $4/ Share |

| Neuroscience | $16/ Share |

| Immunology | $38/ Share |

| Others and Pipeline | $110/ Share |

| Cash | $17/ Share |

Valuing Eli Lilly’s stock price for the coming years, we will take a look at expected revenue and net income and give our best estimate of the market value of the company by assigning a price-to-earnings multiple.

| Revenue | Net Income | EPS | |

| 2025 | $52.8 | $17.29 | 19.11 |

| 2026 | $62.5 | $22.49 | 25.03 |

| 2027 | $70.87 | $27.12 | 30.39 |

| 2028 | $80.68 | $32.2 | 25.97 |

| 2029 | $87.99 | $36.45 | 40.58 |

| 2030 | $96.67 | $41.12 | 46.29 |

*Revenue and net income reported in billions

We expect Eli Lilly’s P/E ratio in 2025 to be 60 with an EPS of $19.11, resulting in a price target of $1140.00 This prediction is based on strong revenue growth of 18.37% to $52.80 billion and net income expansion to $17.29 billion, continuing the upward trajectory from previous years.

For 2026, we anticipate a P/E ratio of 50 with an EPS of $25.03, leading to a price target of $1250.00. This reflects significant revenue growth of 18.37% to $62.50 billion and an increase in net income to $22.49 billion, driving higher earnings per share.

Heading into 2027, we project the P/E ratio to remain at 50, with EPS increasing to $30.39. This results in a price target of $1520.00. Continued revenue growth of 13.39% to $70.87 billion and net income expansion to $27.12 billion justifies this substantial increase in stock price.

With an EPS of $25.97 and a P/E ratio of 50 in 2028, we forecast the stock price to be $1300.00. A slight dip in EPS growth is expected, but sustained strong performance in net income to $32.20 billion and revenue growth of 13.84% to $80.68 billion keeps the stock highly valued.

By 2029, we estimate Eli Lilly’s EPS to rise to $40.58, with the P/E ratio adjusting to 40. This gives us a price target of $1623.00. The continuous revenue growth of 9.06% to $87.99 billion and net income expansion to $36.45 billion supports this higher valuation.

Price Target: $1850.00

Upside: 107.63%

By 2030, we estimate Eli Lilly’s EPS to rise to $46.29, with the P/E ratio adjusting to 40. This gives us a price target of $1850.00. The continuous revenue growth of 9.86% to $96.67 billion and net income expansion to $41.12 billion supports this higher valuation.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2025 | $1140.00 | Upside of 27.95% |

| 2026 | $1250.00 | Upside of 40.29% |

| 2027 | $1520.00 | Upside of 70.59% |

| 2028 | $1300.00 | Upside of 45.90% |

| 2029 | $1623.00 | Upside of 82.15% |

| 2030 | $180.00 | Upside of 107.63% |

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.