Investing

Billionaire David Tepper Likes These 3 Stocks, Are They Must Buys?

Published:

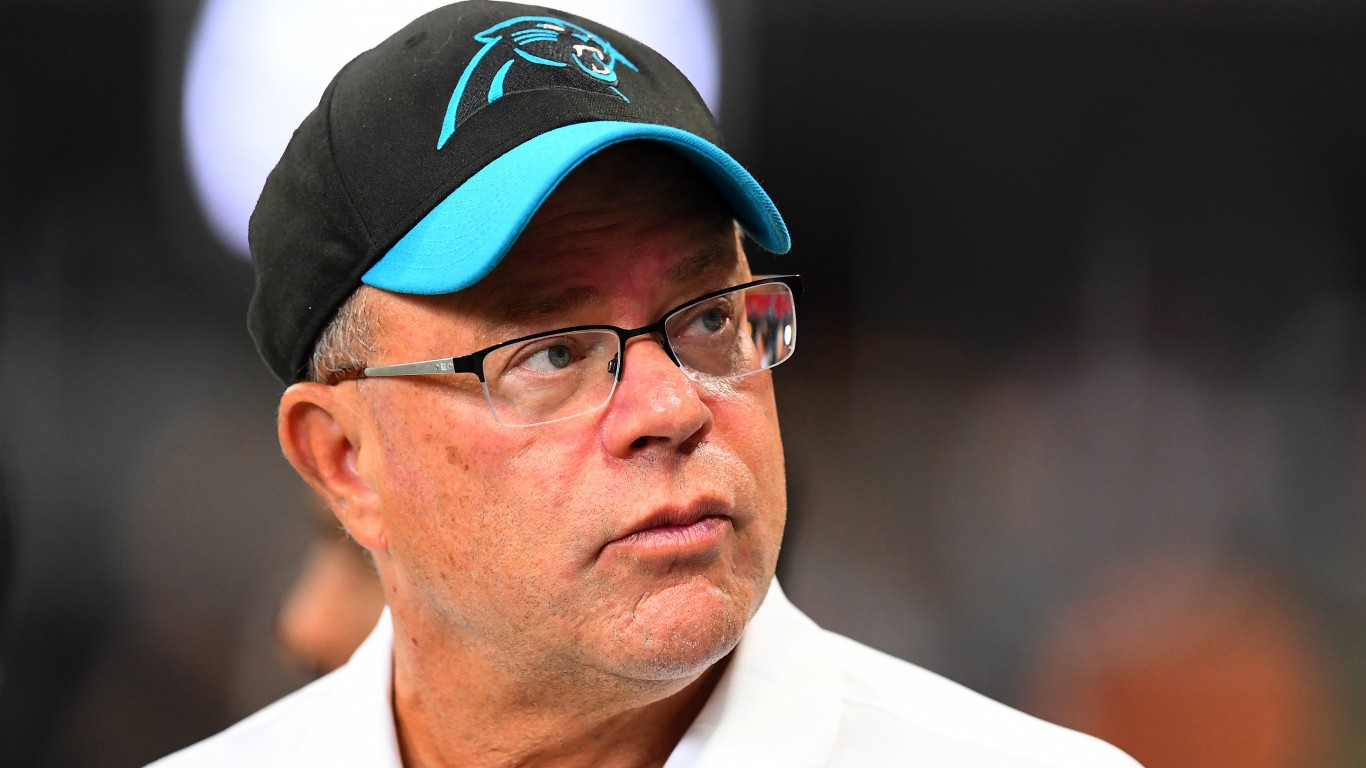

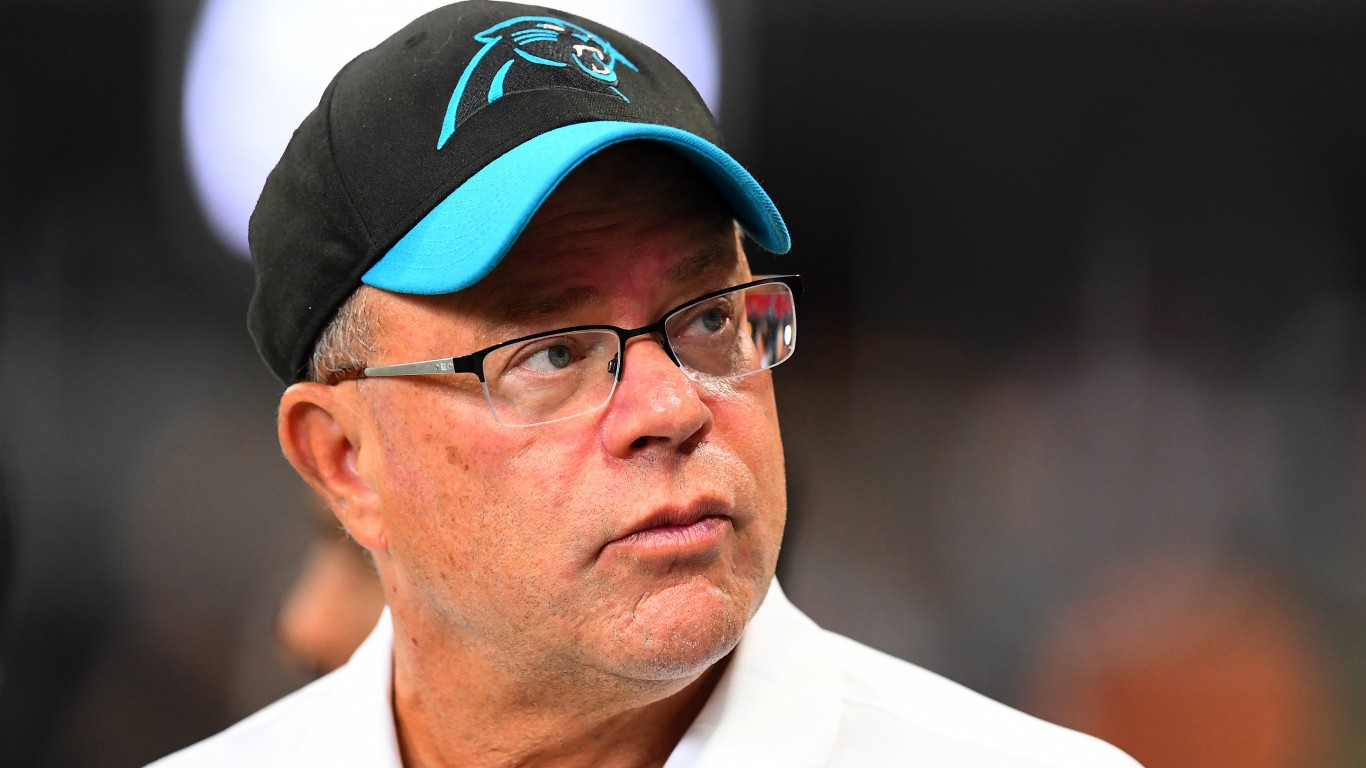

David Tepper is a notable figure in finance, most notably the billionaire founder of global hedge fund Appaloosa management based in Florida. However, the institutional investor is also notably the owner of the Carolina Panthers in the NFL as well as Charlotte FC in the MLS, so this is a man with many ambitions that’s clearly become a household name for a few reasons.

As an investor, Tepper has repeatedly taken contrarian views on the market, and has emphasized risk management in the past as key to his investing strategy. A long-term bull on the stock market, David Tepper has repeatedly emphasized the importance of staying invested during bull markets, and staying calm during market downturns.

I tend to agree wholeheartedly that over the long-term, optimism around companies that can grow their earnings faster than the market usually pays off. And while significant corrections do take place, long-term consistency with investing are far more important principles to live by.

With that said, here are three of Tepper’s largest portfolio holdings investors may want to consider right now.

Chinese e-commerce giant Alibaba Group (NASDAQ:BABA) has certainly been an under-performer in recent years. Indeed, over the past five years, BABA stock is actually down more than 30%. This move compares to relatively strong revenue and earnings growth from the Chinese giant, which many investors see continuing for a very long time due to demographic tailwinds in emerging markets.

Notably, BABA stock has recently been showing signs of life, surging over the near-term. Over the past three months, Alibaba has seen its share price soar more than 50%, indicating investors are growing increasingly bullish on the long-term potential of China-based companies right now. This comes as the Chinese government announced a range of stimulus measures many think are aimed at supporting valuations. And with a myriad of crackdowns from the CCP hampering BABA stock in the past, this move is certainly one that investors have been waiting for as a green light to get in.

From here, it will be interesting to see if Tepper looks to take profits on his large stake, or wants to ride this one out. The Chinese stock market has been notoriously volatile, so I’d bet at least some trimming activity is likely from his hedge fund in future 13-F filings.

But for now, Tepper once again looks like a genius with his big position in this growth stock that’s finally moving higher.

Since 2010, Amazon (NASDAQ:AMZN) has been a strong growth story, outpacing the overall market by a wide margin. Many long-term investors, including Tepper, appear to believe the growth story is far from over for this e-commerce and cloud giant.

There could certainly be a solid case to be made on this front. For one, Amazon’s dominant position in the cloud computing and U.S. digital advertising market are compelling high-margin businesses many investors want exposure to. And with a near-40% market share in the U.S. e-commerce market, Tepper’s Alibaba and Amazon holdings really indicate he’s bullish on this global space over the long-term.

Perhaps more importantly to Amazon’s bottom line is its market share of more than 30% in the cloud computing sector, which continues to be the earnings powerhouse supporting the company’s AI investments and other growth initiatives.

If this cash cow of a tech giant can continue to funnel its capital toward higher-margin growth businesses, it’s entirely possible this growth story could continue. David Tepper appears to believe so.

Microsoft (NASDAQ:MSFT) really needs no introduction to most readers as to why this growth stock is a top pick of Tepper’s fund (or any hedge fund manager’s portfolio for that matter).

The software and cloud giant has become a major force in the world of artificial intelligence, with a number of multi-billion dollar investments in the likes of OpenAI and a range of other smaller companies of late. The company is looking to cement its position at the top of the AI food chain, looking to integrate AI solutions within its software suite to widen its moat and produce even more ridiculously high profit growth over the long-term.

For now, the market appears to be rewarding Microsoft’s recent moves, and there are fundamental reasons to do so. In fiscal 2024, Microsoft reported $245.1 billion in revenue and $88.1 billion in net income. These numbers translate into 15.7% top-line growth, and even higher bottom-line growth of nearly 22%. Those are the kinds of numbers one might expect from a much smaller company, not a $3 trillion behemoth.

But this is the market we’re in, where the big keep getting bigger. In this case, owning Microsoft stock in an overweight fashion indicates Tepper may believe the stock market will stay top-heavy for some time.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.