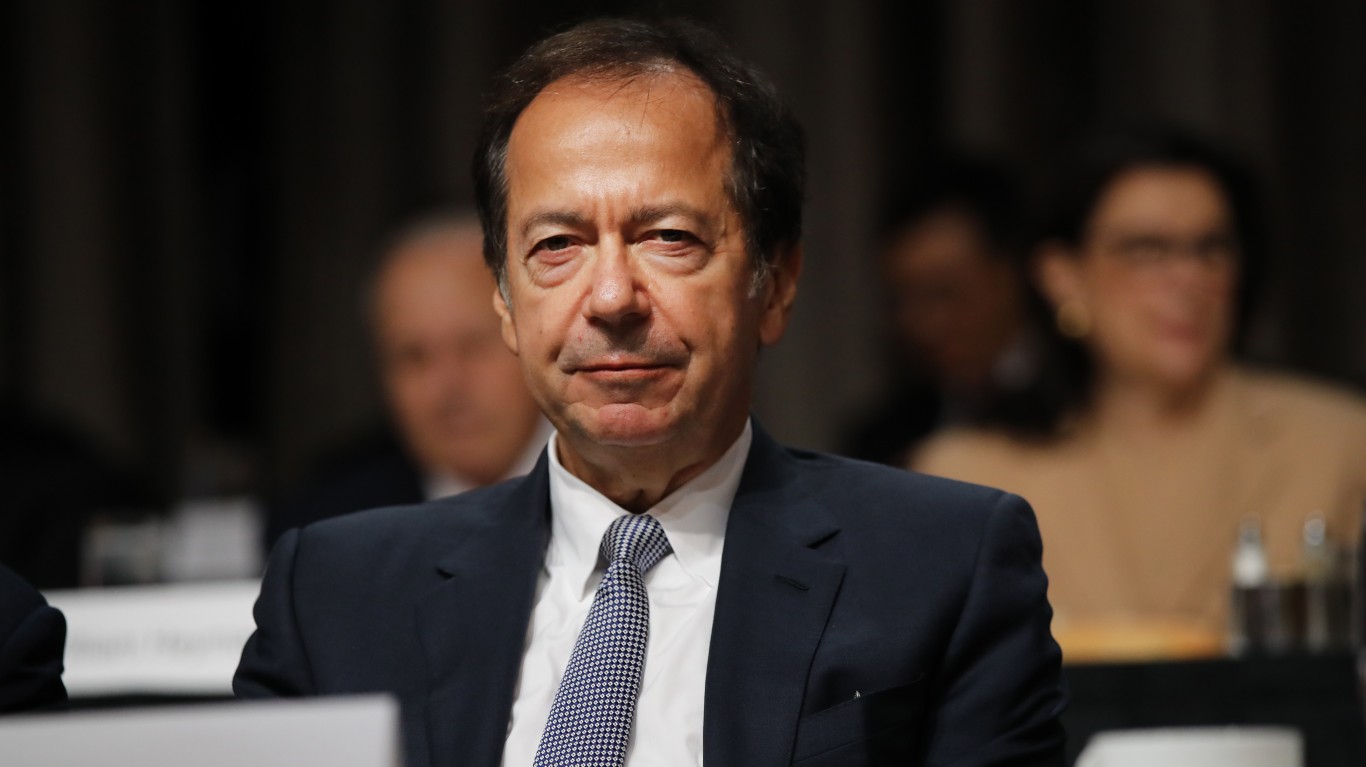

John Paulson is among the most well-known billionaires, famous for his long-term investing returns via his hedge fund Paulson & Co. The hedge fund manager has concentrated his portfolio in interesting stocks, and his top holding is currently Madrigal Pharmaceuticals (NASDAQ:MDGL). As of June 30, 2024, Paulson held 1.85 million shares of Madrigal Pharmaceuticals, which would currently be worth around $386 million as of the time of writing.

This position is a significant one for his portfolio, representing more than 38% of his holdings, as well as a 5.60% ownership stake in the company itself. So, suffice it to say, John Paulson remains very bullish on this name.

Madrigal Pharmaceuticals Inc is a clinical-stage biopharmaceutical company primarily focusing on developing novel therapeutics for the treatment of liver diseases. The company has honed its efforts on non-alcoholic steatohepatitis (NASH), a condition characterized by liver inflammation and damage due to fat accumulation not caused by alcohol consumption. For the non-medically-inclined person, this condition represents one of the more common forms of fatty liver disease, and is a prevalent problem particularly for those battling obesity.

Given the target market for the company’s endeavors, Paulson clearly has strong confidence in the company’s ability to continue to grow. Let’s dive into what to make of this top pharma stock, and whether it’s worth buying at current levels, or waiting on.

Key Points About This Article:

- John Paulson is among the most renowned billionaire hedge fund managers, who has placed a big bet on one particular pharma company.

- Let’s dive into whether Madrigal Pharmaceuticals is a suitable choice for long-term investors at current levels.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

There’s a Strong Catalyst Investors Are Focusing On

Madrigal’s stock price is up more than 40% this year, which is great for John Paulson and those who have placed large bets on the company. Much of that appears to be fundamentally driven, but there’s one key catalysts that’s created plenty of buzz around this name of late.

In particular, Madrigal saw its stock price surge 23% in March of this year, after the company received approval for its oral drug Rezdiffra to be used in the treatment of non-alcoholic steatohepatitis (NASH) without requiring a liver biopsy. This drug was the first of its kind to be approved for this indication, leading analysts to upgrade their price targets on the company promptly.

Perhaps Paulson had advanced notice that this approval was in the works. But the market clearly had priced in some enthusiasm over this drug’s prospects, and the stock is down roughly 30% from its 52-week high around the time of this announcement, so perhaps this is old news.

But any time a big pharma company can show that it has regulators on its side, that’s a good thing for investors. This could still be a major catalyst that could drive even higher cash flows than what analysts are predicting – we’ll have to wait and see.

Risks Are Clear, But Could Be Worth It

There are a number of risks facing Madrigal as a company focused on the fatty liver disease market. For one, the rise of GLP-1 drugs could lead to less obesity, and therefore less of an overall market for its NASH drugs. Existing medications that prevent mild liver conditions from escalating to NASH, such as Novo Nordisk’s Ozempic and Eli Lilly’s Mounjaro, could significantly reduce Madrigal’s market share. While demand for these therapies remains strong, it’s uncertain how decreasing risk factors for NASH will impact Madrigal’s target patients in the near term.

Additionally, competition is heating up in the NASH market, with many biopharma firms targeting this specific problem. Thus, a range of factors could also work against Madrigal over the long-term, which the market appears to clearly be pricing in.

That said, it’s also true that Madrigal is pursuing the expansion of Rezdiffra into other untapped niches, which could ultimately offset these pressures. Right now, there are plenty of unknowns, and the market doesn’t like uncertainty. But it’s also true that from a growth perspective, the company’s drug portfolio has performed well. Thus, it’s a risky play, but one Paulson and other very influential investors think is worth making right now.

Madrigal Looks Like a Buy

Madrigal Pharmaceuticals remains a top biotech stock I think is worth considering right now. That’s not just because John Paulson owns this name, though it certainly helps with the stocks’ cache. It’s the fact that the company’s core fatty liver disease drug could revolutionize treatment for a terrible illness, and one that the market has clearly been screaming for over many years. NASH remains a leading cause of liver transplants in the U.S., so better treatment of this disease using drugs could save insurance companies a lot of money, while freeing up donors who require organs with the supply they need.

Right now, the company’s core drug faces no direct competition, though aforementioned risks do exist. This is a stock that’s hard to value, on the basis of the assumptions that need to go into one’s forward cash flow estimates for the name.

But on a balance of risks, I like this bet by John Paulson, and MDGL stock is one I’ve added to my watchlist after diving into his portfolio deeper.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.