Investing

Billionaire Stanley Druckenmiller Is Increasingly Bullish On These 3 Stocks: Here's Why

Published:

Stanley Druckenmiller is among the most prominent billionaire hedge fund managers many investors continue to follow closely. The founder of Duquesne Capital, Druckenmiller’s recent 13-F filing shed some interesting light on where the billionaire investor sees the market headed from here.

A former fund manager at George Soros’ Quantum Fund, Druckenmiller has certainly made a name for himself as a top-down investor who balances both long and short positions in his portfolio in a range of asset classes. In addition to equities, he also is heavily involved in trading bonds, currencies and futures.

This past quarter, Druckenmiller added 18 new stocks to his portfolio, but his holdings remain concentrated in large positions in three stocks I’ve found are compelling, and have had the opportunity to dive into them as a result of assessing his portfolio.

Here are three of Druckenmiller’s most prominent bets, and why I think they may be compelling for investors at current levels.

Coherent (NYSE:COHR) is a leader in providing optical transceivers for hyperscaler data center providers. Obviously, this is a space that’s seen incredible growth due to the rise of artificial intelligence technology of late. So long as investment continues to pour into this sector, data center spending appears poised to continue to grow at breakneck pace. And as a significant player in the data center and hyperscaler space, Coherent is one of those stocks I don’t think get the attention it deserves.

The company’s FY’24 Q4 report highlighted strong performance from its communications segment (responsible for more than 50% of the company’s revenue). This segment saw revenue surge and incredible 189% on a year-over-year basis, and up 47% on a quarter-over-quarter basis. That kind of growth is certainly hard to find, and it’s one of the reasons why COHR stock is valued at roughly 3-times sales.

Now, in the grand scheme of things, given how fast Coherent is growing, that multiple doesn’t seem too rich. In fact, I’d argue that’s cheap relative to many of the other AI beneficiaries in the market today.

So long as Coherent can maintain its dominant market position in its niche transceivers business, I think this is a stock that could have much more upside from here. This is perhaps Druckenmiller’s most compelling bet, and a stock I want to dive into deeper over time.

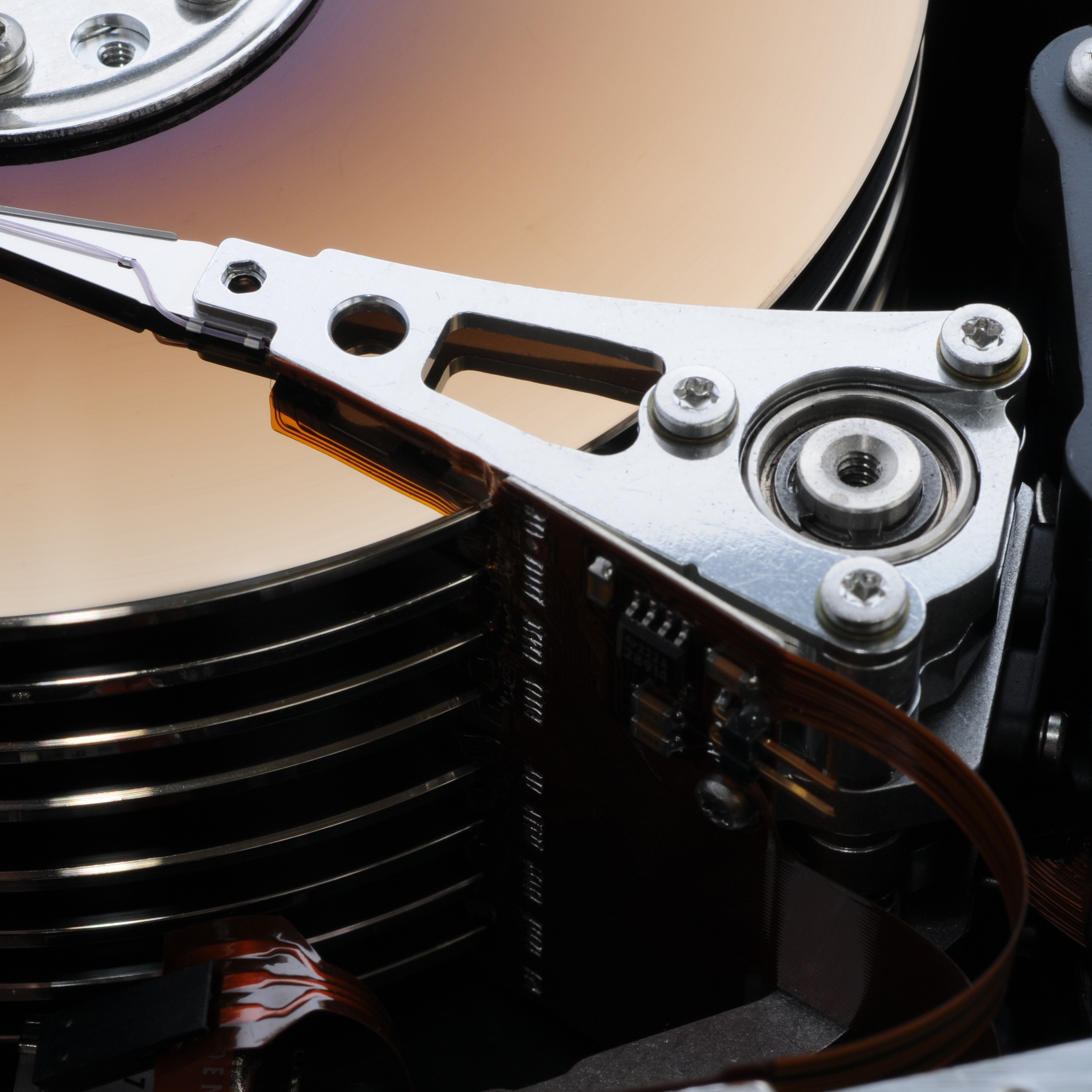

Seagate Technology (NASDAQ:STX) is a leading hard disk drive maker that has also been a key AI beneficiary of late. The company’s disk drive business is a key component in data storage. Thus, given the absolutely insatiable demand our society has for data, this is a stock with some of the strongest secular growth tailwinds out there, making it an easy growth pick for those with a truly long-term investing time horizon.

In addition to posting stronger-than-expected fiscal fourth-quarter results and a positive sales forecast, the company also recently introduced its Heat-Assisted Magnetic Recording (HAMR) technology for improved data storage efficiency. CEO Dave Mosley continues to stress the company’s product roadmap for next year and Seagate’s focus on efficiency and margins. If the company is able to successfully balance its growth and efficiency initiatives, this is a stock that could certainly be poised for a nice move higher.

Seagate’s recent strong results support its valuation of just 17-times forward earnings. Indeed, like Coherent, this is a stock I think is undervalued relative to its long-term growth prospects, and I like this pick from Druckenmiller quite a bit.

Kinder Morgan (NYSE:KMI) is a much slower-growth company on this list, but one that really balances out a portfolio nicely. In my view, investors should be focused on creating a portfolio that can win in an outsized way during bull markets, but has some protection to the downside in poor markets. Kinder Morgan is a pipeline operator that provides that kind of stability, particularly as geopolitical risks ratchet up and the desire for energy independence in North America remains a top priority.

The Texas-based company is more than just a pipeline operator, providing gas and refined petroleum storage and transportation services as well. The company does generate a majority (around 58%) of its revenue from natural gas pipelines, so those betting on a long-term transition from oil toward clean energy largely view this company as a long-term buy.

Analysts seem to agree, with Morgan Stanley raising its price target on Kinder Morgan to $24.00, indicating confidence in its growth in the natural gas market. Analysts expect new projects to enhance earnings visibility, aligning with Kinder Morgan’s pipeline expansion strategy. Recent results showed a 4% increase in adjusted EPS, driven by rising natural gas demand from LNG facilities and AI advancements.

I think this is a nice safe pick to offset the previous two stocks, and highlights Druckenmiller’s focus on balance right now.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.