An investment in small-cap stocks over the past three years has been dead money. The Russell 2000 small-cap index has gone exactly nowhere over that time period compared to a 32% gain by the S&P 500.

The reason is obvious. The combination of inflation that hit 40-year highs combined with an unprecedented ratcheting up of interest rates by the Federal Reserve was a one-two punch to small-cap stocks.

Because small-caps don’t have the same financial resources available as their larger brethren, higher costs and the high cost of borrowing unfairly walloped smaller businesses. But that is starting to change. Inflation has come down and the Fed initiated the first of what is expected to be numerous interest cuts over the next year.

Investors are rushing into small-cap stocks as a result. Over the past three months, the Russell 2000 has trounced the benchmark index three-to-one, rising over 9% versus a 3% gain by the S&P. There is likely more to come and investors can use the opportunity to get on the rocket ride that is developing. Below are three unstoppable Russell 2000 stocks ready to run higher.

Key Points About This Article:

- Small-cap stocks have fared badly during the era of high inflation and high interest rates, but with the one down to more workable levels and the other at the start of numerous rate cuts, the Russell 2000 small-cap index is ready to soar.

- Here are three companies with strong fundamentals investors with substantial long-term tailwinds that investors should take a closer look at in October.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Rocket Lab USA (RKLB)

Speaking of rocket rides, Rocket Lab USA (NASDAQ:RKLB) has already been turning on the afterburners. Its shares are up 77% in 2024 and are 127% higher over the past year. Although SpaceX grabs all the headlines, such as with its recent rescue of astronauts stranded on the International Space Station, Rocket Lab is the second most successful space company. It has 53 successful launches that have put 197 satellites into orbit from three separate launch pads.

Yet it is much more than a simple rocket stock. Rocket Lab also designs and manufactures spacecraft for other companies, makes satellite components, and designs space software for itself and others. It is a very well-rounded business with multiple streams of income.

It generated $106 million in revenue in the second quarter, up 71% from last year, and has signed 17 new launch contracts this year. If there is one knock against the company is it still unprofitable on both a GAAP and adjusted basis.

Rocket Lab’s primary launch vehicle is its Electron rocket, but it is developing the Neutron rocket that is intended for manned, deep-space exploration. Expect RKLB stock to go where no space stock has gone before.

Powell Industries (POWL)

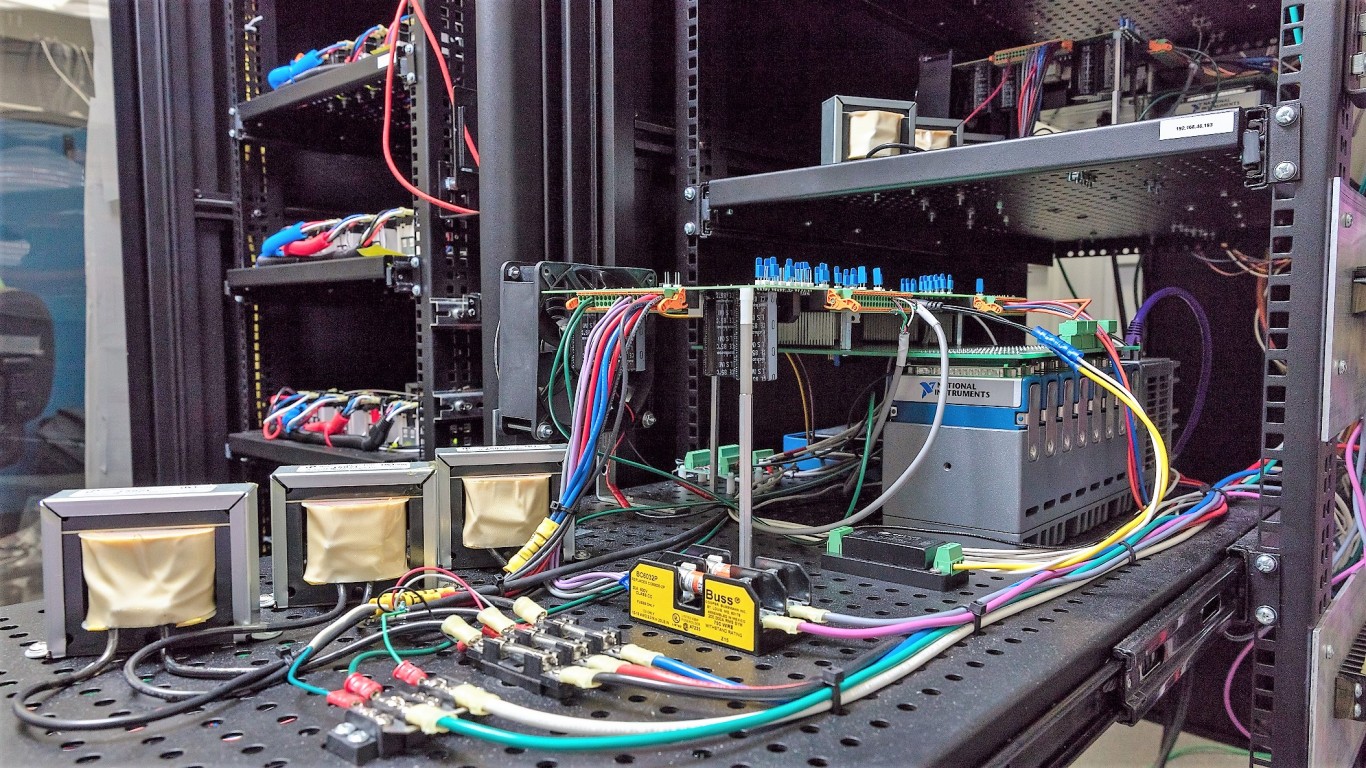

A more down to earth stock to consider in October is Powell Industries (NASDAQ:POWL), a manufacturer of electrical systems for petroleum, oil and gas producers, refineries, liquefied natural gas (LNG) facilities and utilities.

Business is booming and Powell has enjoyed 50% increases in revenue for three consecutive quarters with all segments its serves firing on all cylinders. CEO Brett Cope maintains Powell’s performance underscores its position as “as an integrator of complex, engineered-to-order electrical solutions.” It also has a robust order flow with $356 million in new orders in the quarter and a backlog valued at $1.3 billion.

The stock is up 175% so far this year and has tripled over the past 12 months. Profits of $3.79 per share soared from the year-ago period’s $1.52 per share and over the first three quarters of the fiscal year they’ve raced higher by more than 3.6 times to $8.52 per share.

Powell also pays a dividend that yields 1.1% annually. It has made a payout for 30 consecutive years and has raised the dividend several times, making it a stock to buy for growth and income.

Archer Aviation (ACHR)

The last Russell 2000 stock to buy this month is Archer Aviation (NYSE:ACHR), one of the foremost leaders in the electric vehicle takeoff and landing (eVTOL) industry. Helping to create a regional air taxi service from the ground up, Archer is on track to launch its commercial service next year once it gains Federal Aviation Administration certification.

In anticipation of making it through the regulatory labyrinth, the eVTOL stock has signed numerous contracts with various industry players. Automaker Stellantis (NYSE:STLA) is helping to finance the construction of Archer’s manufacturing facilities that will produce 650 aircraft a year while deals with United Air Lines (NASDAQ:UAL) and Southwest Airlines (NYSE:LUV) will allow the electric aircraft maker to operate its air taxi service out of major airports on both coasts.

As a pre-revenue company, Archer Aviation has no revenue to speak of, but it has plenty of liquidity to make it through to launch. It ended the second quarter with $364 million in cash and equivalents along with gross proceeds of $55 million from selling stock to Stellantis. Management says that’s enough for it to make it through the next 12 months at least.

Archer’s stock is down 55% so far this year, but that gives investors the opportunity to literally get in on the ground floor of a completely new industry at a very discounted price.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.