Investing

Here Are 3 Stocks Steve Cohen of Big Short Fame Likes Right Now

Published:

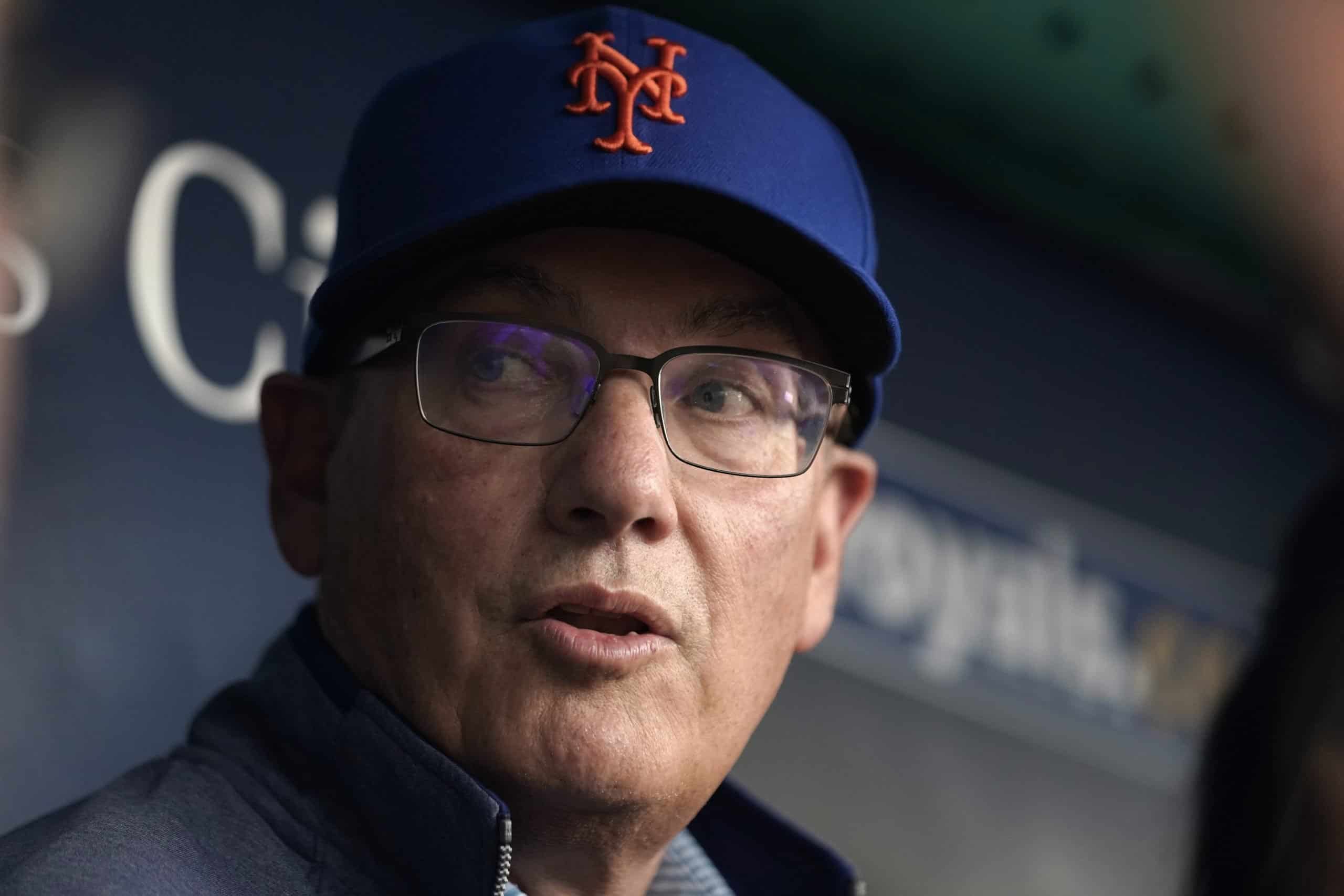

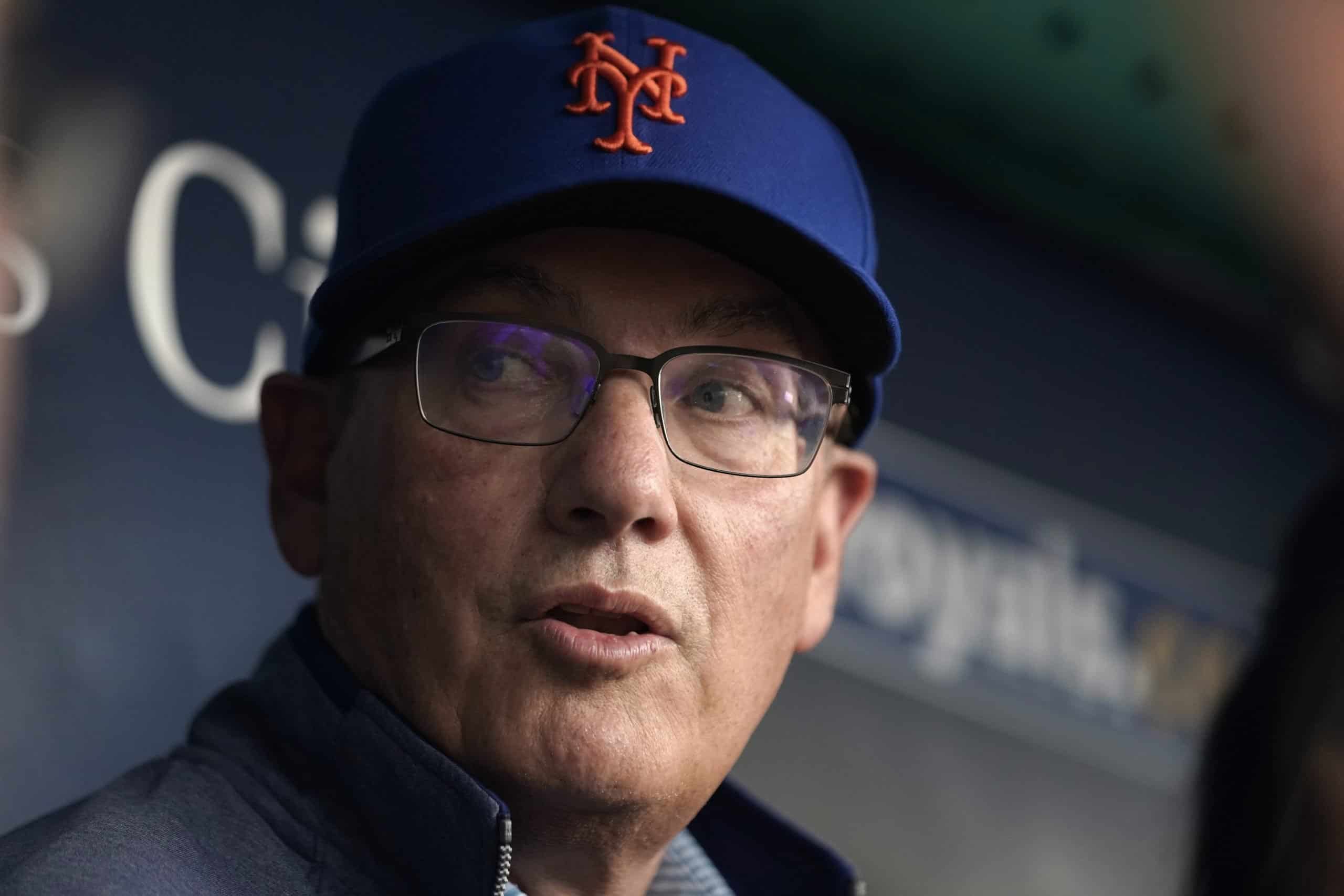

Steven Cohen is among the most closely-watched billionaire investors, for good reason. The New York Mets owner is also the manager of hedge fund Point72, among the leading institutional investors many watch closely every 13-F filing season, to see how Cohen is positioning his portfolio, and whether his various ideas are worth piling into as well.

Cohen’s career has been impressive, creating significant wealth for early investors in his SAC Capital Advisors fund, which averaged 30% returns over a 20 year span. Made famous by the book and move The Big Short, Cohen’s directionally correct bets on the housing market implosion in 2008 were prescient, making him among the most oracle-like money managers in the world, and one many in the financial community continue to respect.

Accordingly, Cohen’s views are worth paying attention to, at least in my books. Looking at the construction of his current portfolio, here are three of Cohen’s largest bets I think are worth considering right now.

Amazon (NASDAQ:AMZN) is among the so-called Magnificent 7 stocks many long-term investors continue to want to own, and for good reason. The e-commerce giant has continued to provide stellar returns to investors, posting $1.26 in earnings per share in Q2 2024, far exceeding the consensus forecast of only $1.03 in EPS for the past quarter. These earnings were driven by impressive operating income growth of 91% (to $14.7 billion) on overall revenue of $148 billion, which was up 11% on a year-over-year basis.

From a fundamentals standpoint, Amazon does appear to be firing on all cylinders. The company’s core profit center, its Amazon Web Services (AWS) cloud division, grew nearly 19%, as increasing cloud migration and rising AI demand continue to provide tailwinds for this core business. So long as these factors remain in place, I do think plenty of institutional and retail capital will continue to flow toward Amazon, and this is a bet Cohen looks content to make.

Additionally, Amazon’s advertising business generated more than $50 billion in revenue for the first time last year, as AI spending and adtech improvements drove the majority of this increase. The company’s continuing strategic investments in AI initiatives could provide more robust long-term growth, which does appear to be factored into the company’s current multiple of around 44-times trailing earnings.

It’s unclear whether Amazon is a trade or a long-term holding for Cohen and his team, but I wouldn’t be surprised to see the hedge fund manager hold onto this position for a while, given how strong the company’s tailwinds appear to be right now.

Apple (NASDAQ:AAPL) is another mega-cap tech stock investors have not been punished for owning for a very long time.

Yes, the company’s revenue and profit growth have stagnated over the past few years. But rising earnings per share numbers, driven by consistent and increasing share buybacks, continue to provide investors with a share price that can increase over time. And increase it has – AAPL stock is up nearly 18% on a year-to-date basis this year, after being down for most of the year on aforementioned concerns around growth.

I think investors like Cohen view Apple’s cash flow stability as a much more important factor to the market than its slowing growth. The company still has incredible pricing power, despite inflationary forces dissipating and many of its peers being forced to lower prices. Consumer spending has also remained strong, signaling to many investors that Apple’s underlying earnings and cash flows may not take as hard a hit (if any) from an incoming recession. Indeed, a bet on Apple does appear to represent a view on a soft landing scenario playing out, which Cohen appears to be in favor of.

Again, we’ll have to see if Cohen holds onto his Apple stock heading into the coming quarter, or if he trims this position given its impressive recent moves. But with the upcoming launch of Apple Intelligence software next month and continued interest around Apple as an AI beneficiary, there’s clearly a lot to like about how the iPhone maker is positioned right now.

Dell Technologies (NASDAQ:DELL) is perhaps the more intriguing pick of the three, for good reason. The PC maker had seen significant stagnation in its share price headed into 2024. However, this past year has seen some rather impressive returns for investors like Cohen, as the company has delved into the world of AI in a big way.

The company is looking to enable CSPs to deploy AI solutions for improved network performance. Integrating Dell’s AI expertise and infrastructure with partners like Nvidia and Meta’s technology, the hope is that Dell can continue to enhance customer service efficiency, and drive outsized returns for investors over time.

This is a bet many money managers appear to want to make. As far as companies with AI tailwinds are concerned, Dell’s current multiple of just 22-times trailing earnings is cheap. Thus, this is a stock that’s at the intersection of what many believe is a value stock and a growth play. Given the company’s strong fiscal Q2 2025 results, in which Dell secured $3.2 billion in AI-optimized server orders, there’s big growth potential ahead. Let’s see if things play out as Cohen envisages. He’s been very right in the past, so I wouldn’t put it past Dell to continue to see outsized upside over the course of the next year or so.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.