24/7 Insights

- Bill Gates’ largest positions include Microsoft, Berkshire Hathaway, Caterpillar, and more.

- These large positions are due to the large amounts of stock and the extremely high prices of those stocks.

- 24/7 is your home for all things related to investing. To get started, download our free report on the two stocks we recommend every investor buy and hold forever.

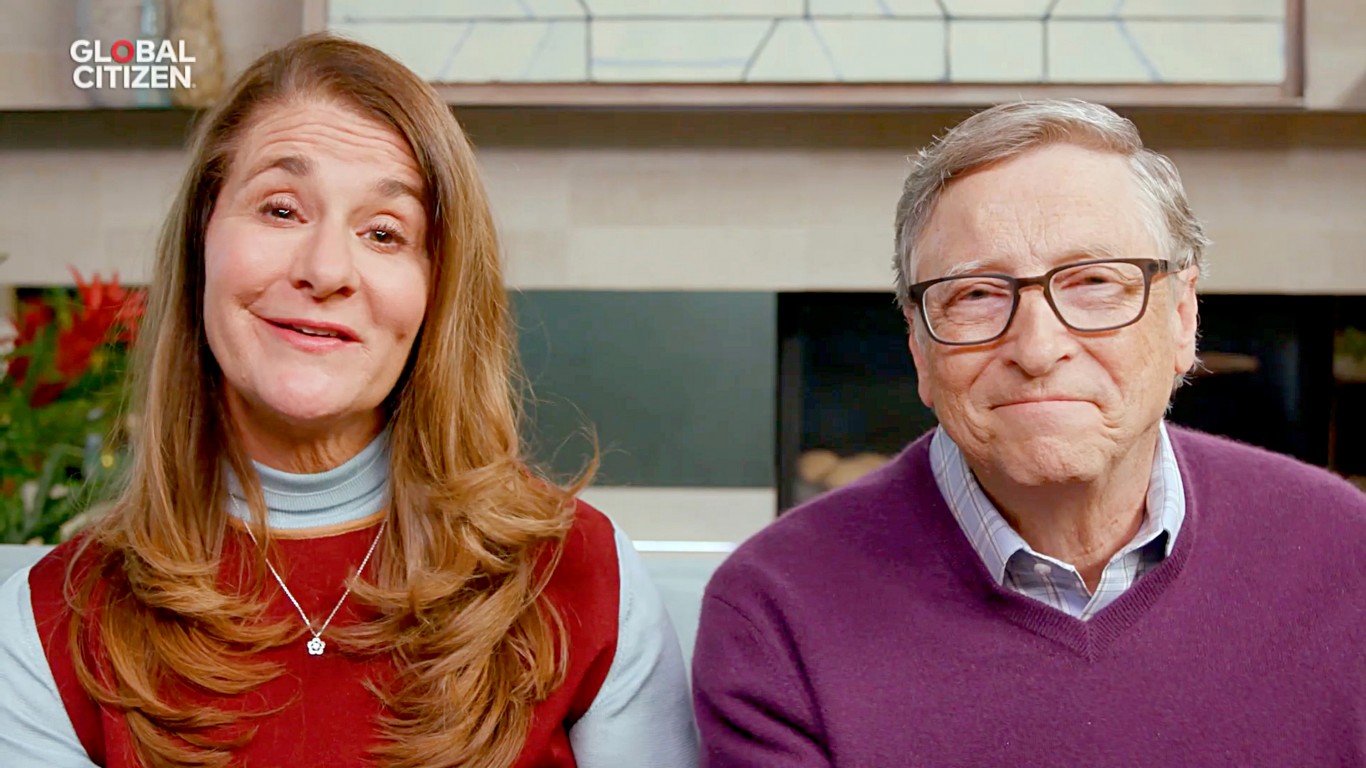

If you are looking for financial advice, you can definitely do worse than Bill Gates. As one of the richest people in the world, Gates has his fingers in just about every industry on the globe, and his charitable foundation, the Bill & Melinda Gates Foundation, is one of the largest charitable organizations in the world and owns tens of billions of dollars’ worth of assets, including significant amounts of stock.

One would confidently assume that with so much money and so many organizations relying on the Bill & Melinda Gates Foundation, that their investments would be based on sound financial analysis. That analysis, therefore, could be used to guide your own investment strategy. You would not be alone in thinking this, and many people follow the investment behavior of the Bill & Melinda Gates Foundation for this exact reason.

But even with billions invested in the stock market, not everybody agrees on whether Bill Gates’ investments are a good idea or not. As with any investment strategy, there is wide disagreement and even those who agree don’t all agree on the reasons why certain companies on this list are rated a ‘buy’ or a ‘hold’. That being said, most investment strategists and industry experts generally agree that following Bill Gates’ investment strategy is at least a good idea, and better than picking stocks at random.

So, what are the five largest positions held by Bill Gates, should you copy these investments, and what does Wall Street have to say about these investment options?

All the data on this list is taken from public records and is current as of the writing of this article. Prices of the stocks listed are current as of 10/3/2024. The holdings are ranked in order of position value, not the number of stocks held.

Why Are We Talking About This?

You shouldn’t follow the investing practices of anyone, no matter who they are, without doing your own research and comparing the investment against your own financial situation. We want to help new and experienced investors make the best decision for them and their financial goals by giving them straightforward information instead of opinions. A little bit of research can help you avoid catastrophic financial mistakes.

Background on Bill Gates’ Stock

All the stock owned by Bill Gates is actually owned by the Bill & Melinda Gates Foundation Trust. This trust currently owns stock in 23 companies with a total market value of over $47.67 billion, the total value of the foundation is over $69 billion.

The Bill & Melinda Gates Foundation was created in 2000 and is the second-biggest charitable foundation on the planet, well behind the Novo Nordisk Foundation in Denmark. Bill and Melinda founded the organization with the intent of improving healthcare, reducing poverty, and increasing education around the world.

The foundation uses capitalist business practices in its operations, making it one of the most successful leaders in “venture philanthropy”.

The irony is that the foundation, which is focused on increasing healthcare, is based in a country that has among the worst healthcare systems in the developed world, and it is not lost on its critics.

The Bill & Melinda Gates Foundation is actually divided into two entities: the foundation itself and the trust. The trust, which owns the stock on this list, is responsible for managing the investing of the foundation’s assets and transferring funds to the foundation in order for it to operate. Bill and Melinda are the only trustees of the trust and it receives significant financial support from Warren Buffett.

While the foundation has come under its fair share of criticism, the trust itself has faced criticism for the companies in which it invests. It has been criticized for increasing poverty in the countries where the foundation says it is attempting to eliminate poverty. It invests in companies that exploit local populations, pollutes the ground and water of local communities, pharmaceutical companies that do not sell drugs to the developing world or charge extreme prices for medication, and more.

Despite these criticisms and evidence that the harm it is doing is more than counteracting the benefits of the foundation, the trust continues to invest solely to maximize returns.

#5 Caterpillar Inc.

- Number of shares: 7.3 million

- Value: $2 billion

Caterpillar (NYSE:CAT) is the largest manufacturer of construction equipment in the world. It manufactures and sells construction and mining equipment around the world. Most recently, Caterpillar has faced severe and widespread criticism for selling equipment and vehicles to the Israeli Defense Force. This equipment was used in the illegal destruction of Palestinian farms, the illegal demolition of Palestinian villages and homes, and the construction of illegal Israeli settlements. Caterpillar hired private investigators to spy on the families of activists who reported on Caterpillar’s contribution to the ongoing genocide, and several organizations have said that Caterpillar, along with other companies, is willingly complicit in Israel’s ethnic cleansing in Palestine.

Expert recommendations range from hold to strong buy for Caterpillar, with the general consensus being a ‘hold’ rating. It currently trades at around $388 per share and has steadily grown over the last few years. If you do plan on buying any Caterpillar stock, the recommendation is that you do so with long-term trades in mind.

#4 Canadian National Railway Co.

- Number of shares:54.8 million

- Value: $6.4 billion

The Canadian National Railway Company (NYSE:CNI) is the largest railway company in Canada in terms of the physical size of the network and revenue. It serves the entire area of Canada and areas through the Chicago-Louisiana corridor.

It is currently in the middle of a labor dispute with the Teamsters Canada labor union, first instituting a lockout that resulted in a union strike, and then relying on Canadian lawmakers to force workers to return to work without a new deal. The union has appealed that decision.

Canadian National Railway has remained relatively steady over the last five years, usually hovering around its current price of $114. The vast majority of financial experts recommend holding onto any CNI stocks, giving it a ‘hold’ rating. Or, if you want to buy stocks that have a reliably stable history, CNI is a great option, with experts giving it a soft ‘buy’ rating for that reason.

#3 Waste Management Inc.

- Number of shares: 35.2 million

- Value: $7.5 billion

As one of the largest garbage collection companies in the world, Waste Management (NYSE:WM) has grown steadily over the years with many notable acquisitions. Most recently, it announced a deal to acquire Stericycle for over $7 billion at the end of 2024.

Waste Management has been a reliable and strong performer for years. After all, no matter what happens in the world, people always need their garbage collected. It currently trades at around $208 per share, and if it continues on its current trajectory, it should steadily climb over the next few years.

Most experts recommend holding onto any Waste Management stock you may have, or picking up a couple extra if you have good reason.

#2 Berkshire Hathaway Inc.

- Number of shares: 24.6 million

- Value: $10 billion

Berkshire Hathaway (NYSE:BRK.B) is one of the largest employers in the United States and its A shares have the highest per-share price of any public company in the entire world, at $600,000.

After it transitioned to being a corporate conglomerate in 1965, Berkshire Hathaway had negative stock growth in only eleven years and had an average annual growth of 19.8%. It became the eighth public company in America to reach a $1 trillion valuation.

Currently, Berkshire Hathaway trades at around $415 per share. It has steadily climbed over the last five years, from a price low of around $166 in 2020, including this year-to-date. It has been one of the most reliable and predictable market performers in recent history, providing consistent returns to owners of this stock.

Analysts remain split on their recommendations and ratings regarding Berkshire Hathaway, but a slight majority maintain that it is a stock you should pick up. It currently has a ‘buy’ rating on most expert pages.

#1 Microsoft Corp

- Number of shares: 34.8 million

- Value: $15.6 billion

So far in 2024, Microsoft (NYSE:MSFT) has become the most valuable public company in the world and greatly expanded its AI product offerings and development with more than $1.7 billion in AI investments, this is in addition to an AI hub in Wisconsin that it will build for $3.3 billion.

At the same time, it fired more than 1,000 employees from its cloud computing division and eliminated its diversity, equity, and inclusion team.

It then partnered with notorious private equity firm, BlackRock, and invested $30 in the Global AI Infrastructure Investment Partnership. Good to see that Microsoft is choosing morally bankrupt artificial intelligence over real, breathing people! It is possible the public backlash against AI will severely impact Microsoft’s recent investments.

Most recently, Microsoft is facing allegations that its Edge browser is anti-competitive, echoing the talk of decades past when Microsoft faced anti-trust lawsuits over its use of Internet Explorer.

As of the writing of this article, Microsoft is trading at around $415 per share and has been on a slight downward trend for the past few months. It currently sits well below its average trading price.

Even so, Microsoft has had a near-unanimous ‘buy’ rating across the industry and a ‘Strong Buy’ recommendation from aggregate financial analysts. It would seem that most experts believe the mild slump is about to turn around for Microsoft shares.

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.