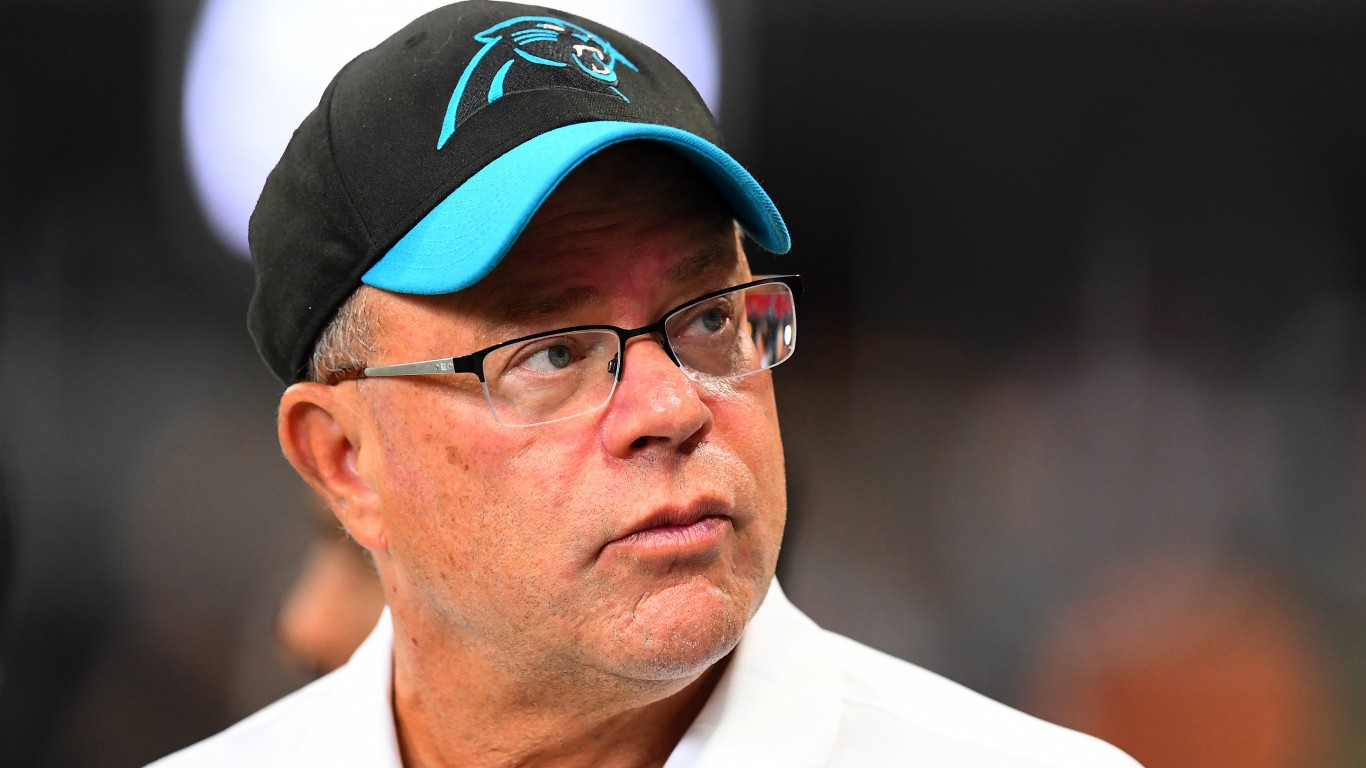

David Tepper is a legendary billionaire investor behind the hedge fund Appaloosa Management, a fund that has a solid track record of impressive gains in stocks and distressed debt. With a robust portfolio concentrated in high-tech, large-cap stocks, many of which stand to capitalize on the generative AI boom, I would not be surprised if Tepper’s fund can outpace the S&P 500 in the coming years.

Undoubtedly, Appaloosa is one of the hedge funds that’s gained on the back of the run in Magnificent Seven stocks. Though most of the seven tech darlings have since run out of steam, I do think that fortune will continue to favor the big as the next wave of AI arrives. Either way, Tepper and Appaloosa are ready to ride it high.

Key Points About This Article

- David Tepper is a genius investor to follow if you seek to thrive in markets long-term.

- Appaloosa is heavy on the large-cap tech stocks, including those found in the Magnificent Seven group.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

For investors wondering what’s underneath the hood, this piece will look into the top four stocks, which comprise a weight of close to 37% at the time of writing. Let’s have a brief look at the five:

Alibaba

Chinese internet giant Alibaba (NASDAQ:BABA) is currently the largest holding in Tepper’s hedge fund, contributing just over 12% of the portfolio. In recent weeks, BABA stock has made up for lost time, thanks in part to news of China’s stimulus plans.

Though Alibaba shares could be risky to chase after gaining more than 50% year to date, I see room for further upside as the e-commerce, AI, and cloud giant and other bruised Chinese stocks look to rise as the Chinese trade heats up again.

Even after last month’s parabolic melt-up, BABA stock is still off 63% from its high. After enduring such pain, it should be no mystery as to why Tepper, a seeker of deep-value opportunities, is in the name.

Amazon

Cloud and E-commerce juggernaut Amazon (NASDAQ:AMZN) sits as the second-largest holding (10.9% weight) in the Tepper portfolio.

Recently, the firm pulled the curtain on a slew of impressive AI innovations, the most notable among them being a fully autonomous supply chain. As the “industrial AI” wave kicks into high gear, look for robotics and “physical AI” to capture the heart of investors as the early productivity gains make their way into quarterly results.

It’s not just the warehouse where Amazon can automate. According to Morgan Stanley (NYSE:MS), Amazon could cut close to 14,000 managers to shore up $3 billion. My guess is AI innovation will play a huge part in automating these managerial roles.

In any case, AMZN stock stands out as a top Tepper stock to consider buying before shares can get running again on the back of new AI catalysts.

Microsoft

Microsoft (NASDAQ:MSFT) is the third-largest (8.6%) Tepper stock and is likely to be a huge driver of outperformance moving forward as the $3 trillion enterprise behemoth triples down on all things AI.

With its investment in so much AI innovation under the hood and its lofty investment in OpenAI, I think Microsoft could be closest to achieving artificial general intelligence (AGI).

In any case, the Magnificent Seven company really does seem like a must-own for any portfolio seeking a shot to one-up the market. Though Tepper has trimmed his stake in Q2, I’d say it’s likely he’ll buy back on a pullback. After all, booking gains after a good year is not a terrible idea.

Meta Platforms

Meta Platforms (NASDAQ:META), Tepper’s fourth-largest holding (7.6%) stock, just hit a new all-time high last week, and higher highs could be ahead as the firm leads the charge into the metaverse.

The company’s latest pair of smart glasses is intriguing and may offer a glimpse of what consumers can expect to use in the post-smartphone era. In any case, META stock stands out as cheap at 29.8 times trailing price-to-earnings and, like Microsoft, a must-own for upside-seeking investors.

Sure, missing out on a past-year gain of 90% can be painful. However, with many growth drivers in place, investors may wish to focus on the road ahead rather than the one behind.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.