Investing

Nasdaq Composite Today: Earnings Season Heating Up and Inflation Looming

Published:

Last Updated:

At 3:00 p.m. ET, the us markets looking to ride into the weekend on a high note.

At 11:55 a.m. ET, the us markets made up for earlier losses with all 4 major U.S. indices in the green.

Tomorrow marks the second anniversary of the current bull market, with the Nasdaq up 75% over the past two years. Looking ahead to year three, history suggests the bull market may have more room to run. Since 1945, the average bull market lasts 5.5 years and typically gains 110% overall. However, returns tend to moderate after the early stages. Following 75% gains, the third year historically is more sluggish and averages just 2% growth.

Top Gainers:

Fastenal (FAST) Up 8.82%

Moderna (MRNA) Up 4.82%

DoorDash (DASH) Up 3.68%

Zscaler (ZS) Up 3.58%

MecadoLibre (MELI) Up 3.07%)

Top Losers:

Tesla (TSLA) Down 7.76%

Braodcom (AVGO) Down 2.29%

Adobe (ADBE) Down .99%

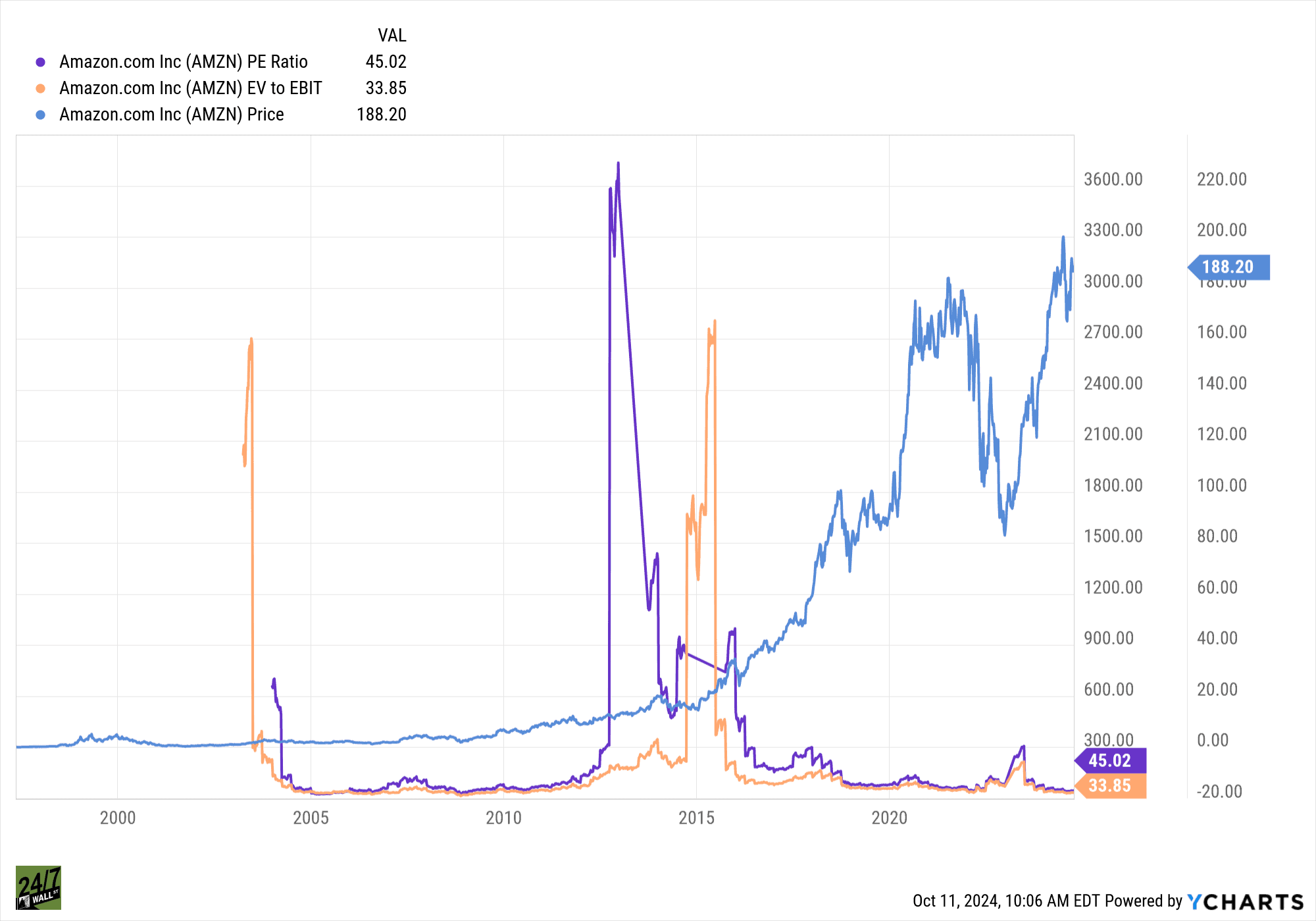

Amazon (AMZN) stock is up 42% over the past year and gained 25% in the past 6 months alone, bringing its market cap to $1.9 billion. However, the stock hasn’t been this cheap in over a decade.

With a forward price to earnings (PE) ratio of 39 and EV/EBIT of 33.85, one would need to go back to 2010 the last time the stock was this affordable.

The Nasdaq Composite opened the last trading day of the week down -48.91 or -.34% but Fastenal (FAST) is one of the bigger gainers on the day, up 4%.

Software developer Atlassian (TEAM) is up 3.87% on the day and Amazon (AMZN) is up a modest .59%.

As of 8:45 a.m. ET today, US stock futures are trading lower as the unofficial start to earning season kicks off with large banks releasing quarterly earnings.

Investors are paying close attention to how the Fed’s potential rate hikes could affect lending margins and profits in the financial sector.

JPMorgan Chase (JPM) reported a decline in profits due to credit loss provisions, even as its investment banking arm posted strong results. The bank’s shares edged up 1% in premarket trading. Meanwhile, Wells Fargo (WFC) saw a nearly 4% rise after reporting a drop in both net interest income and profit.

Asset management giant BlackRock (BLK) recorded its third consecutive quarterly high in assets under management, benefiting from the stock market’s rally, while BNY Mellon (BK) reported a 16% increase in profit as net interest income climbed.

At the same time, investors continued to scrutinize the latest consumer inflation data, which left uncertainty about the Fed’s next move on interest rates. The lack of clear signals regarding potential rate cuts or hikes kept markets cautious.

In the Nasdaq, Tesla (TSLA) is an taking one on the chin down over 6% as investors were not impressed with the company’s Cybercab and Robotaxi event last night.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.