24/7 Wall St. Insights

- Insider buying slowed to a trickle ahead of the third-quarter earnings reporting season.

- Yet, an IPO tempted one insider to acquire shares, and a repeat buyer came back for more shares of an entertainment giant.

- Three health care stocks also saw notable insider buying.

- Also: 2 Dividend Legends to Hold Forever.

Insider buying slowed to a trickle in the past week, ahead of the beginning of the third-quarter earnings reporting season. Yet, the buying did not stop altogether. The initial public offering (IPO) of a real estate investment trust tempted a beneficial owner to make a move. Three heath care-related stocks also saw notable insider buying, and a repeat buyer came back for more shares of an entertainment giant. Let’s take a quick look at these transactions.

Is Insider Buying Important?

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

As mentioned, a new earnings-reporting season has begun, so many insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week or so, starting with the largest and most prominent.

FrontView REIT

- Buyer(s): 10% owner Alyeska Investment Group

- Total shares: more than 810,800

- Price per share: $18.87 to $19.25

- Total cost: almost $15.5 million

FrontView REIT Inc. (NYSE: FVR) is a Dallas-based real estate trust that just had its initial public offering, which raised $251 million. It is an internally managed net-lease REIT focused on outparcel properties on high-traffic roads that are highly visible to consumers, including restaurants and fuel stations. The buyer is an Illinois-based hedge fund manager. Its top holdings include Amazon.com Inc. (NASDAQ: AMZN) and Coca-Cola Co. (NYSE: KO). Note that Alyeska Investment also sold some FrontView shares last week. The stock was last seen trading within the buyer’s share price range.

Cartesian Therapeutics

- Buyer(s): a director

- Total shares: over 205,700

- Price per share: $17.17 to $24.00

- Total cost: almost $4.3 million

This director is also a 10% owner, with a stake now up to more than 8.0 million Cartesian Therapeutics Inc. (NASDAQ: RNAC) shares. The Maryland-based clinical-stage biotechnology company received an FDA nod for one of its drug candidates last month, and it began a Phase 1 trial of another. The share price is more than 36% higher than a month ago but still within the buyer’s purchase price range. Analysts anticipate that share price will more than double in the coming year to $43. Their consensus recommendation is to buy shares.

Oncocyte

- Buyer(s): 10% owner Broadway Partners and chief financial officer

- Total shares: more than 1.3 million

- Price per share: $2.94 to $2.97

- Total cost: over $3.9 million

Broadway Partners acquired most of those shares and now has a stake of over 6.2 million shares of this molecular diagnostics company. Oncocyte Corp. (NASDAQ: OCX) announced Andrea James as CFO back in the summer. The stock has outperformed the S&P 500 year to date and is up almost 5% in the past 90 days to above $3.10. The consensus price target is $4.13, which would be a gain of over 33% in the next 12 months. All four analysts who follow the stock have Buy or better ratings. Note that, in the past year, Broadway Partners also has been a repeat buyer of Staar Surgical Co. (NASDAQ: STAA) shares.

Lions Gate Entertainment

- Buyer(s): 10% owner Liberty 77 Capital

- Total shares: less than 183,600

- Price per share: $6.70 to $6.75

- Total cost: more than $1.2 million

This same buyer has been scooping up Lions Gate Entertainment Corp. (NYSE: LGF-A) shares since June. When the entertainment giant reported its fiscal first-quarter results in August, they fell short of expectations on both the top and bottom lines. Since the report, the share price is over 12% lower, but it is handily above the buyer’s latest purchase price range. Analysts anticipate over 53% upside in the coming year to their consensus price target of $11.62. Note that the highest price target is up at $15.

GATX

- Buyer(s): 10% owner State Farm Mutual Automobile Insurance

- Total shares: less than 9,000

- Price per share: $133.26 to $133.62

- Total cost: Around $1.2 million

Chicago-based railcar leasing company GATX Corp. (NYSE: GATX) posted second-quarter results in line with expectations, and the third-quarter report is upcoming soon. The stock is down more than 8% since that report, underperforming the broader markets. Shares were last seen trading above the buyer’s purchase price range. However, the consensus price target is $135.00, which means analysts do not see much upside for the time being. If they boost price targets after the coming quarterly report, that would change. Note that the high price target is up at $148.00.

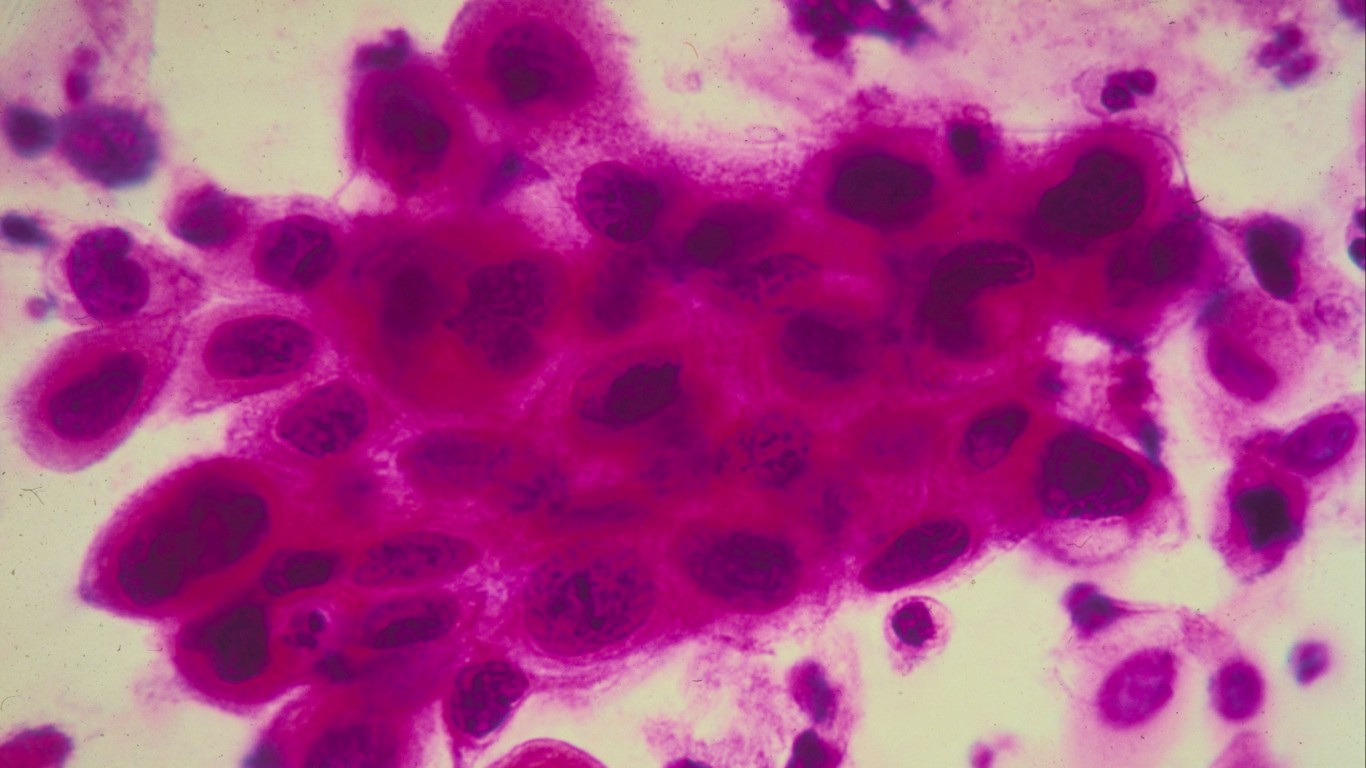

Grail

- Buyer(s): 10% owner Chun R. Ding

- Total shares: over 78,800

- Price per share: $12.57 to $13.81

- Total cost: more than $1.0 million

Health care company Grail Inc. (NYSE: GRAL) is focused on cancer detection and is a spin-off from Illumina (NASDAQ: ILMN). The buyer is with an investment firm focused on health care and technology, and the stake is now up to over 3.6 million shares. Since the spin-off in June, the stock is down over 4%, but the share price is higher than the buyer’s purchase price range. While the buyer above may be optimistic about the company’s prospects, note that almost 13% of the shares are held short.

And Other Insider Buying

In the past week, some insider buying was reported at Dave & Buster’s Entertainment, Goldman Sachs, Ibotta, Mueller Water Products, Pagaya Technologies, Texas Pacific Land, and Vail Resorts as well.

Prediction: This Will Be the Best-Performing Growth Stock Over the Next 5 Years

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.