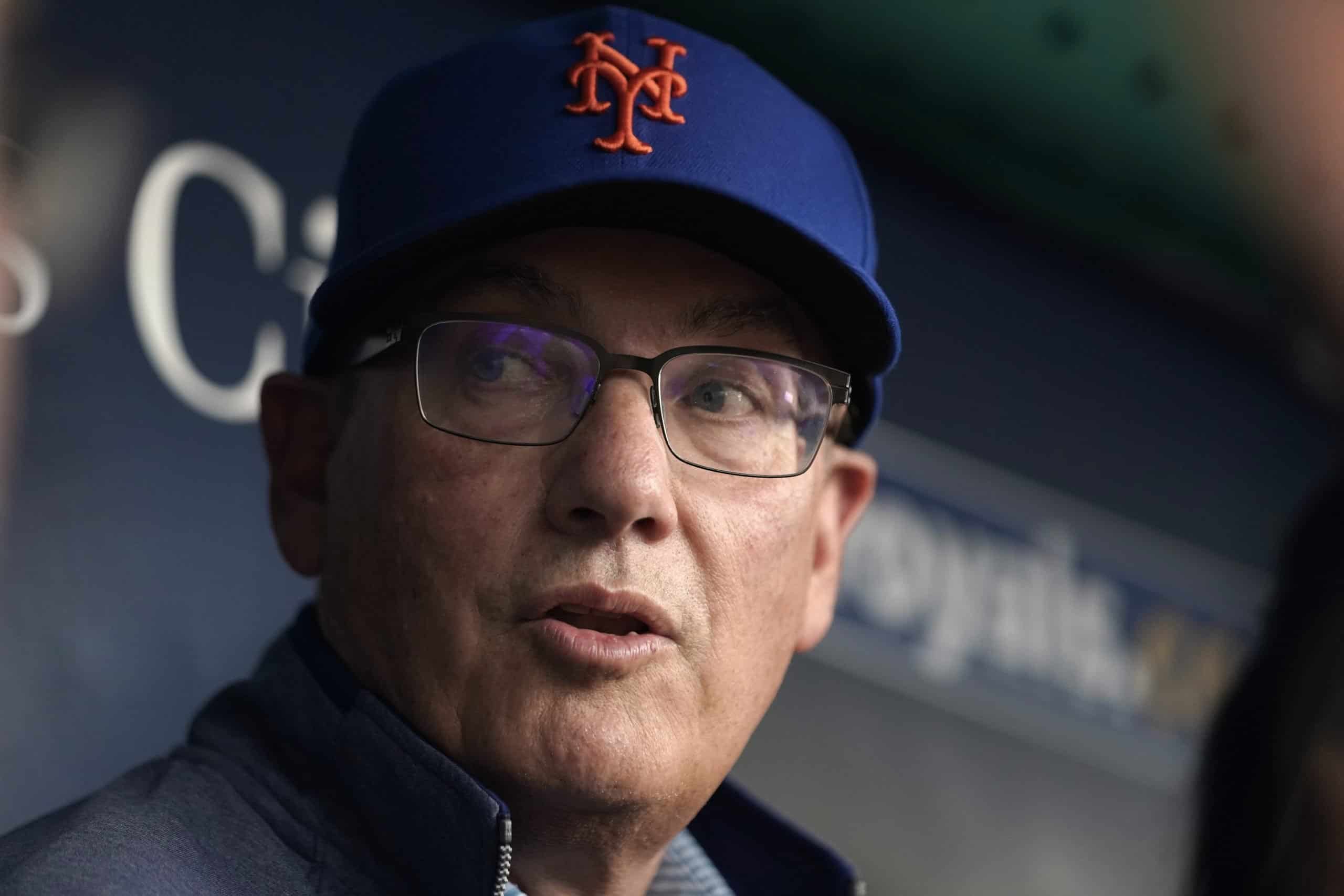

Hedge fund operator Steve Cohen recently surprised the market by announcing he was stepping down from trading his own book at Point72 Asset Management. The billionaire investor has been the point man for the hedge fund, which has $35 billion in assets under management.

Bloomberg reports Cohen is contemplating returning capital to investors to prevent the hedge fund from growing too large. As a fund increases in size, it becomes harder to deploy the money and generate good returns. Since Point72’s inception in 2014, Cohen has generated over $33 billion in profits.

The billionaire investor recently sold down his stakes in two artificial intelligence stocks and did so seemingly well in advance of the tech stock selloff in July. While his fund owns more than 1,100 stocks, you can’t make a generalized view that he soured on AI because of those sales, though they were notable reductions in his holdings.

Yet the No. 1 holding in his portfolio is Amazon (NASDAQ:AMZN) and it is also an AI-adjacent stock. Cohen dumped 16% of it, too. So let’s see if the hedge fund manager was just limiting his exposure to AI across the board or if there is something else he saw in the e-commerce giant that should make it a sell for your portfolio too.

Key Points About This Article:

- Billionaire Steve Cohen has been one of the top hedge fund operators for over a decade and his Point72 Asset Management firm has generated tens of billions of dollars in profits for his investors.

- While Cohen will be stepping back from choosing stocks to manage the day-to-day affairs of his hedge fund, he has made a pointed effort to pullback his investments in AI stocks, including his No. 1 holding.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

A growing AI giant

Considering the $4 billion Amazon poured into AI startup Anthropic, it might be more cheek-to-jowl with AI than just “adjacent.” Anthropic is now using Amazon Web Services (AWS) as its primary cloud provider.

Further, the e-commerce and cloud services giant also committed significant sums developing its in-house built AI semiconductor chips, Trainium and Inferentia. The former is a purpose-built chip for training deep learning models while the latter enables models to generate inferences more quickly and at lower cost.

Amazon is also one of the largest hyperscalers in the data center market. It operates some 125 data centers globally for AWS, which itself has been infused with AI capabilities. So insatiable is the energy demands of these facilities that Amazon bought a nuclear-powered data center to help offset its electricity demands, and that came after announcing it was spending $11 billion to build another data center in Indiana.

The coming AI crash

While it is difficult to say exactly why Cohen sold his shares in Amazon, it could very well be an attempt to limit his exposure to the technology until greater clarity is achieved on AI’s benefits to business.

Companies have been pouring billions of dollars into AI capabilities and the payoff and returns on the investments remain uncertain. The promise is there will be significant cost savings and greater efficiencies realized. Investing guru Cathie Wood believes the global economy will enjoy a $200 trillion increase in productivity by 2030. But there is no way of knowing whether the hype will match the reality.

Right now, it is quite possible we will see an “AI crash.” Virtually every single technological advance over the past few decades has experienced a bubble in the early stages of their lifecycle that was followed by a crash. The metaverse is a very recent example, but also cryptocurrencies and nanotechnology.

This is still the very early innings for AI and even if a crash does happen it doesn’t mean it will disappear. It is all part of the growth cycle. We may very soon see businesses halt their runaway spending on generative AI technology that could cause the industry to take a pause, particularly if the economy crumbles.

Amazon will still stand tall

That doesn’t mean Amazon still won’t be a good investment. Its leadership in e-commerce and cloud computing won’t diminish from a pullback in AI, and the continued growth of digital advertising is adding billions of dollars to the retailer’s top and bottom line.

Because Amazon is using AI to improve its services, I don’t believe it will be affected much by an AI correction. It is not the same as Nvidia (NASDAQ:NVDA), who’s lifeblood is directly tied to greater AI spending.

AMZN stock is up 45% over the past year, but down 10% from its all-time high. There seems to be room for further growth even if the AI spending spigot is shut off.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.