Investing

Dividend Aristocrat AbbVie Just Paid Investors; Here's How Much They Received

Published:

AbbVie Inc. (NYSE: ABBV) is rewarding its shareholders once again with a quarterly dividend of $1.55, payable on Tuesday Oct. 15th. While investors will wait to hear about quarterly earnings on Oct. 30th, today’s dividend payment underscores the managements commitment to delivering consistent value to investors.

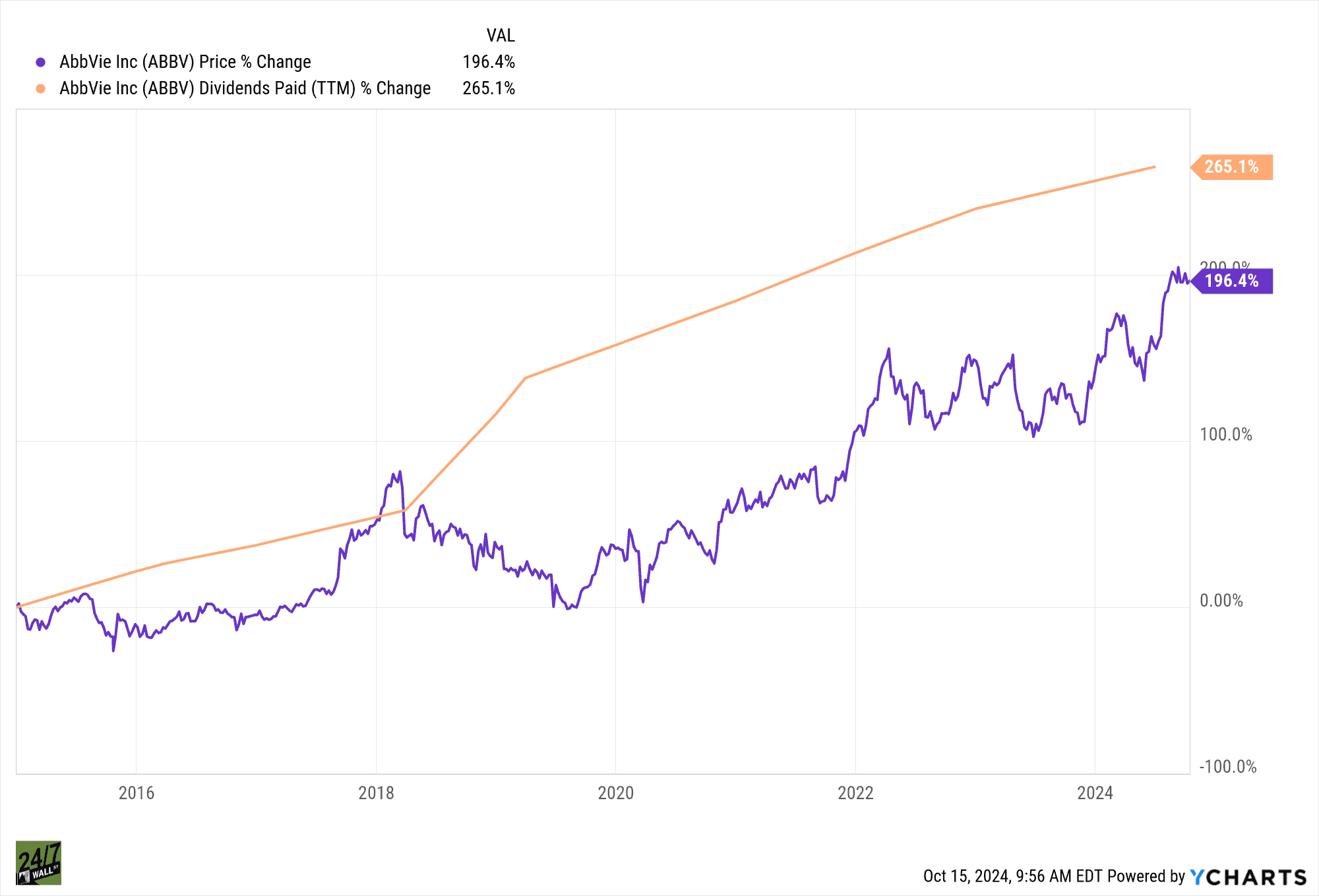

AbbVie has solidified its reputation among dividend-paying stocks, having increased its dividend by 265.1% since its inception in 2013. As a member of the S&P Dividend Aristocrats Index, AbbVie is part of a select group of companies that have increased dividends annually for at least 25 consecutive years. Although AbbVie IPO’s 11 years ago, it spun off from Abbott Laboratories which had a long history of paying and growing dividends, giving the AbbVie the requisite to be called a “dividend aristocrat”.

At the current stock price of $194.61, AbbVie offers a dividend yield of 3.19%. In addition to being a top-tier dividend stock, AbbVie has rewarded shareholders with a 31.24% over the past year which is appealing to both growth and income oriented investors.

If you had invested $1,000 in AbbVie at its inception in January 2013, when the stock was priced at $34.97 per share, you would have purchased approximately 28.6 shares of AbbVie stock.

Fast forward to today, with AbbVie currently priced at $194.61 per share, your initial 28.6 shares would now be worth about $5,566.85.

In terms of dividends, AbbVie’s dividend has grown significantly since 2013, from a quarterly payment of $0.40 per share to $1.55 per share today. This means you would be receiving $1.55 per share each quarter, for an annual dividend payout of approximately $177.64 today.

Wall Street analysts have a positive outlook on AbbVie, with a consensus “Outperform” rating and a score of 1.96 out of 5. The consensus price target is $199.64, indicating a modest 8.8% upside from the current price. TD Cowen set a high target of $225.00, while Credit Suisse Group is the least optimistic with a price target set at $170.00.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s made it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.