Investing

Is a 70% Yield on Nvidia Stock Too Good to Ignore? Get to Know NVDY

Published:

Nvidia (NASDAQ:NVDA) has been an incredible stock to own. Over the past decade, the chipmaker has produced mind-blowing 30,700% returns, yet a significant percentage of those returns occurred since the end of 2022 when NVDA stock went parabolic and surged from a split-adjusted $14 a share to over $300 a share as the artificial intelligence mania swept the market.

Yet even though the chipmaker pays a dividend, with a yield of just 0.03%, no one is paying many bills living off Nvidia’s dividend check.

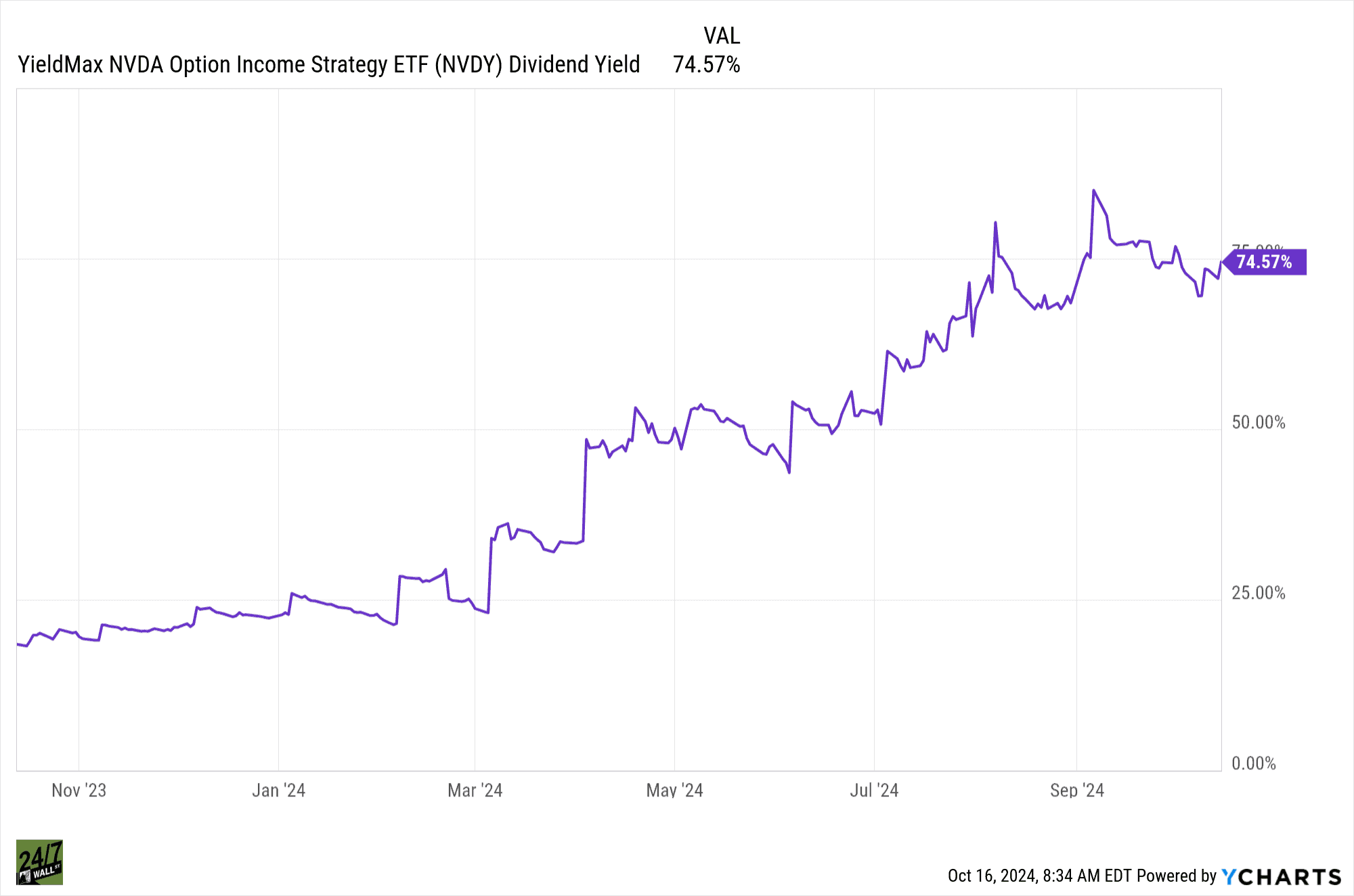

But what if there was a way for income investors to earn a better than 70% yield on Nvidia? Now you’re talking some real money! And it just so happens there is such a way: the YieldMax NVDA Option Income Strategy ETF (NYSEARCA:NVDY).

This exchange-traded fund is gaining a lot of attention lately because of that eye-popping number. In fact, at Nvidia’s current price, the yield is now nearly 75%. Time to rush in? Unfortunately, I’m going to burst your bubble. This YieldMax ETF likely isn’t for you and you should ignore it and the headlines touting it.

YieldMax ETFs target some of the market’s most popular stocks like Nvidia, Apple (NASDAQ:AAPL), Advanced Micro Devices (NASDAQ:AMD), and Tesla (NASDAQ:TSLA), and use an option strategy to extract mouth-watering income from them. The AMD ETF has Nvidia-like yields while the Tesla-focused fund is over 97%!

If you’ve heeded warnings about the risks involved in stocks with ultra-high yields around 10% to 15%, then you should definitely listen to them at these sky-high rates.

The YieldMax NVDA Option Income Strategy ETF doesn’t actually own any Nvidia stock (nor do any of the stock-specific ETFs). Instead, it uses a synthetic covered call strategy to produce income, and that makes it especially risky. It’s also an expensive way to play the stock because it carries an expense ratio of 0.99%, which is very high for an ETF.

The YieldMax NVDA ETF buys a lot of Treasuries. As of this writing, it held almost $1.1 billion in Treasuries with various maturities. It uses these to buy and sell calls and puts tied to Nvidia’s stock to create income-generating option spreads. Essentially, it’s a naked option.

The ETF notes its primary objective is “to harvest compelling yields, while retaining capped participation in the price gains of NVDA.”

The strategy used is to sell call options on NVDA to generate income, while simultaneously selling put options. It has a secondary strategy selling and buying call options as a means of capturing some of the upside potential possible if NVDA stock moves higher.

It is a complex combination that entails a lot of risk and is truly an investment only for those who are fluent in options and option trading strategies.

And counting on it for a steady stream of income is not something you want to do because distributions will fluctuate, sometimes wildly so. Over the past year, distributions have ranged from $0.415 per share to $2.6219 per share and back down again. Its distribution this month was $1.0999 per share. And it can be extremely volatile month-to-month.

In short, if you’re bullish about Nvidia, you’re better off just buying the stock. Over the past year, NVDA stock is up 168% while the NVDY ETF has only gained 8%. Sure, the yield demonstrably closed the gap, but you would still be better off buying the chipmaker’s shares outright.

Moreover, if the stock declines, you could be sitting on even worse losses. Tesla, for example, is down 11% in the last 12 months, but the YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY) has tumbled 52%. And the income generated wasn’t enough to offset the decline. TSLA’s total return has been a loss of 12.5%; TSLY’s total return is negative 18.7%.

There is a place for investment vehicles like the YieldMax NVDA ETF and they are tailor-made for certain types of investors. For the vast majority of the rest of us, it is better to ignore these esoteric securities and focus on the long-term fundamentals of the stock instead.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.