Investing

Here's Why David Tepper Thinks Nuclear Power May Not Be That Big of a Deal After All

Published:

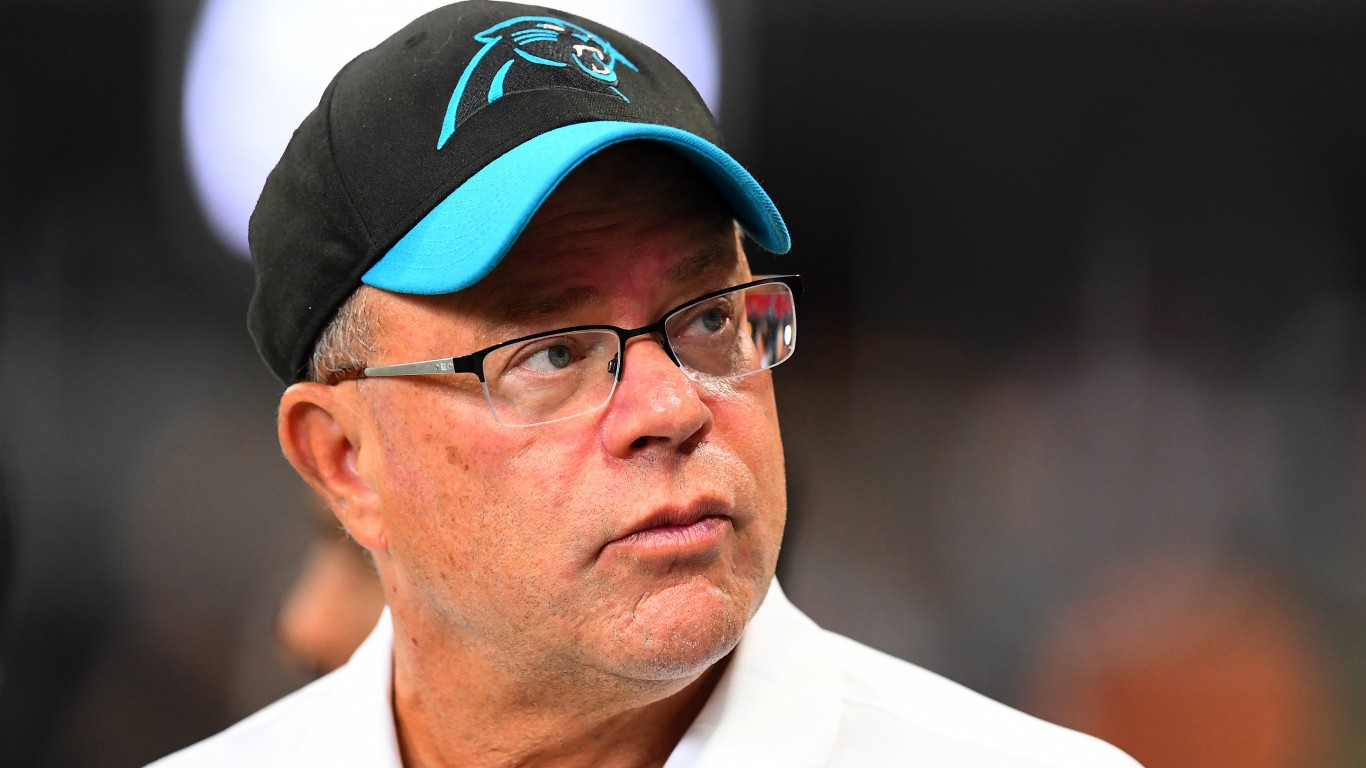

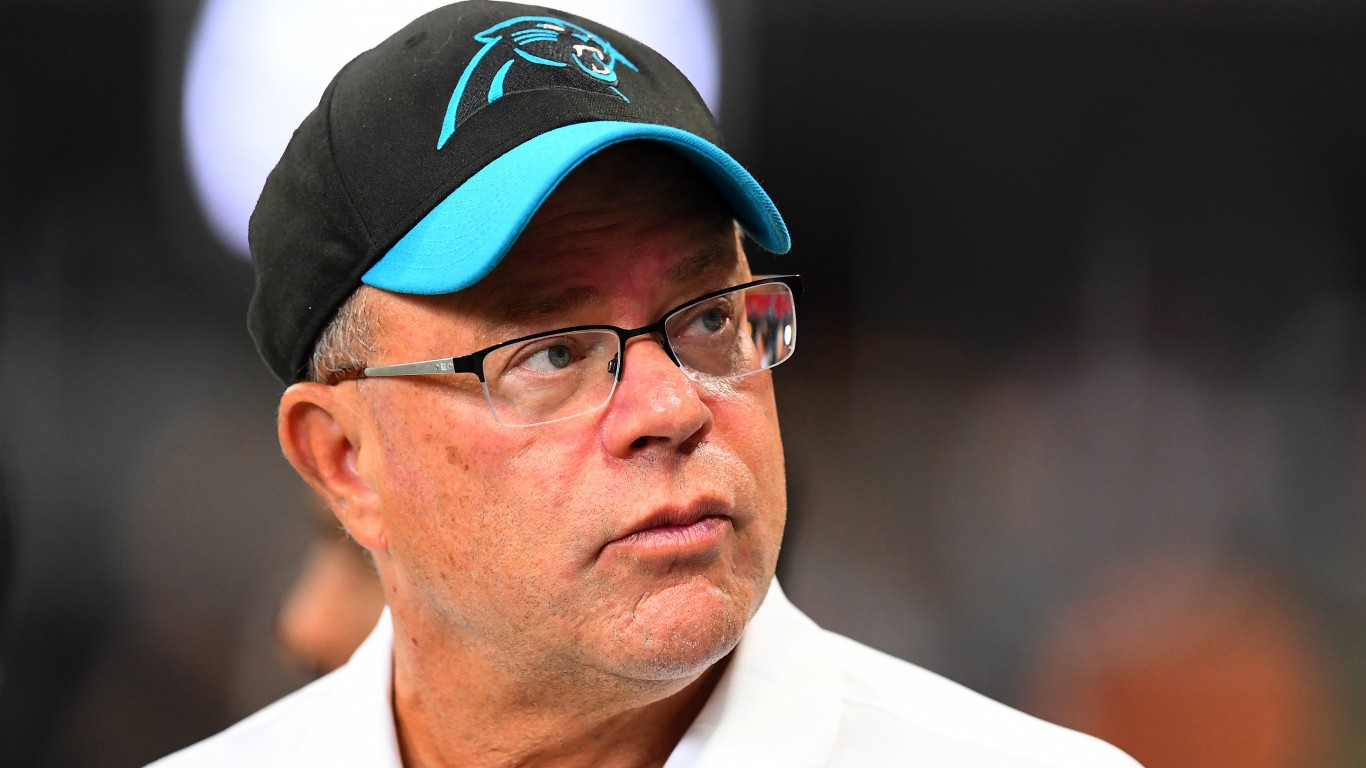

The debate over how viable and truly sustainable nuclear power is continues to rage on. It’s not just pundits and talking heads taking a stab at this debate, though. Certain prominent figures, such as Carolina Panthers owner and hedge fund magnate David Tepper have recently weighed in on the topic, providing their feelings as to why nuclear power may not necessarily be the golden bullet so many think it will.

It’s true that many of the “Magnificent 7” companies are starting to look at renewable power sources for their data centers and AI ambitions more closely. From Microsoft (NASDAQ:MSFT) to Amazon (NASDAQ:AMZN), seemingly every company out there is seeking more reliable power at locked in rates. Nuclear power can certainly provide that kind of baseline these companies are looking for, and that’s part of the reason why so many nuclear stocks are gaining so much value of late.

That said, there’s a divergent view building among certain billionaire investors and thought leaders that this power source simply won’t be enough. Let’s dive into this argument further, and why Tepper and others believe this is the case.

Appaloosa Management founder David Tepper has been rather explicit in his skepticism about the potential of nuclear power to meet future energy demands, particularly in relation to artificial intelligence (AI). His views seem to rest on a few key factors that are relatively unknown.

First, some of the small modular nuclear reactor (SMR) technology that’s being talked about is unproven. There is one such SMR being built in China, but none operational globally. Thus, the projections that existing nuclear power plants in combination with more SMRs may significantly support the energy requirements of future data centers are ones Tepper believes are unrealistic. His argument appears to be that nuclear power doesn’t really align with the practical realities of how energy is actually consumed (be it for AI technology or other needs), and a reliance on natural gas is more likely going to drive greater demand for this particular energy source, at least over the medium term.

That’s certainly a rational argument, given the significant hurdles existing nuclear power plants must clear in passing reviews by Public Utility Commissions. Tepper has suggested that the economic implications of shutting down or reviving these plants would be detrimental to consumers, making it unlikely that such actions will be taken.

In my view, environmentally-friendly energy sources are great, and if nuclear is going to play a bigger role in the longer-term energy production picture, that’s a good thing. But I have to agree that everything is ultimately based on timeline – Tepper’s view is that if (and it’s a big if) nuclear power does become mainstream, it might take far too long for investors to realize any meaningful upside from investing right now.

The argument put forward by Tepper, that nuclear power will not adequately meet the energy demands of artificial intelligence (AI), is one that most energy experts don’t necessarily disagree with. Again, it’s a question of an individual investor’s timeline. Nuclear won’t be around tomorrow, but the question is whether that might change over the next five, 10, or 20 years. That part is uncertain.

Where many energy experts diverge from Tepper’s view is their advocacy for nuclear power as a crucial component in achieving carbon-free energy goals. Most experts would suggest that nuclear power is going to be necessary for providing reliable baseload power, especially as renewable sources like wind and solar may not suffice alone to meet future energy demands. I think that’s also a very true statement, so encouraging investment at this stage of the game (even if we’re really early) is probably a good thing over the long-term.

I keep coming back to timeline, as even energy experts do pare their optimism about the future of this power source with the realities that a tremendous amount of investment is going to be needed to make this source of power a meaningful part of what goes into the grid. So many questions, and so few answers – even from the experts on this front.

I think David Tepper certainly has a very pragmatic view of the situation. I agree that over the next five to 10 years for sure, natural gas demand is likely going to spike far more than nuclear power supply, for the simple reason that reactors can take decades to build. Turning on some existing power plants, such as Three Mile Island, can speed things up. But there are other concerns as well around the potential for another catastrophe, and what that would spell for the entire industry.

New reactors are remarkably safe, and I do think we’re unlikely to see any sort of significant disaster in this sector, barring some sort of act of God, in the future. However, I do think investing is about timing as much as anything else, and I don’t know if now is the right time to put capital to work. As with many stories, when the buzz dies down, investors tend to focus on the next big thing.

Right now, nuclear is a hot topic. But I’m not sure many of the companies trading in this sector are worth their current valuations, given the amount of hype that has been built up lately in this space. On that point, Tepper and I definitely agree.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.