Investing

Eli Lilly (LLY) Stock Price Prediction and Forecast 2025-2030

Published:

Last Updated:

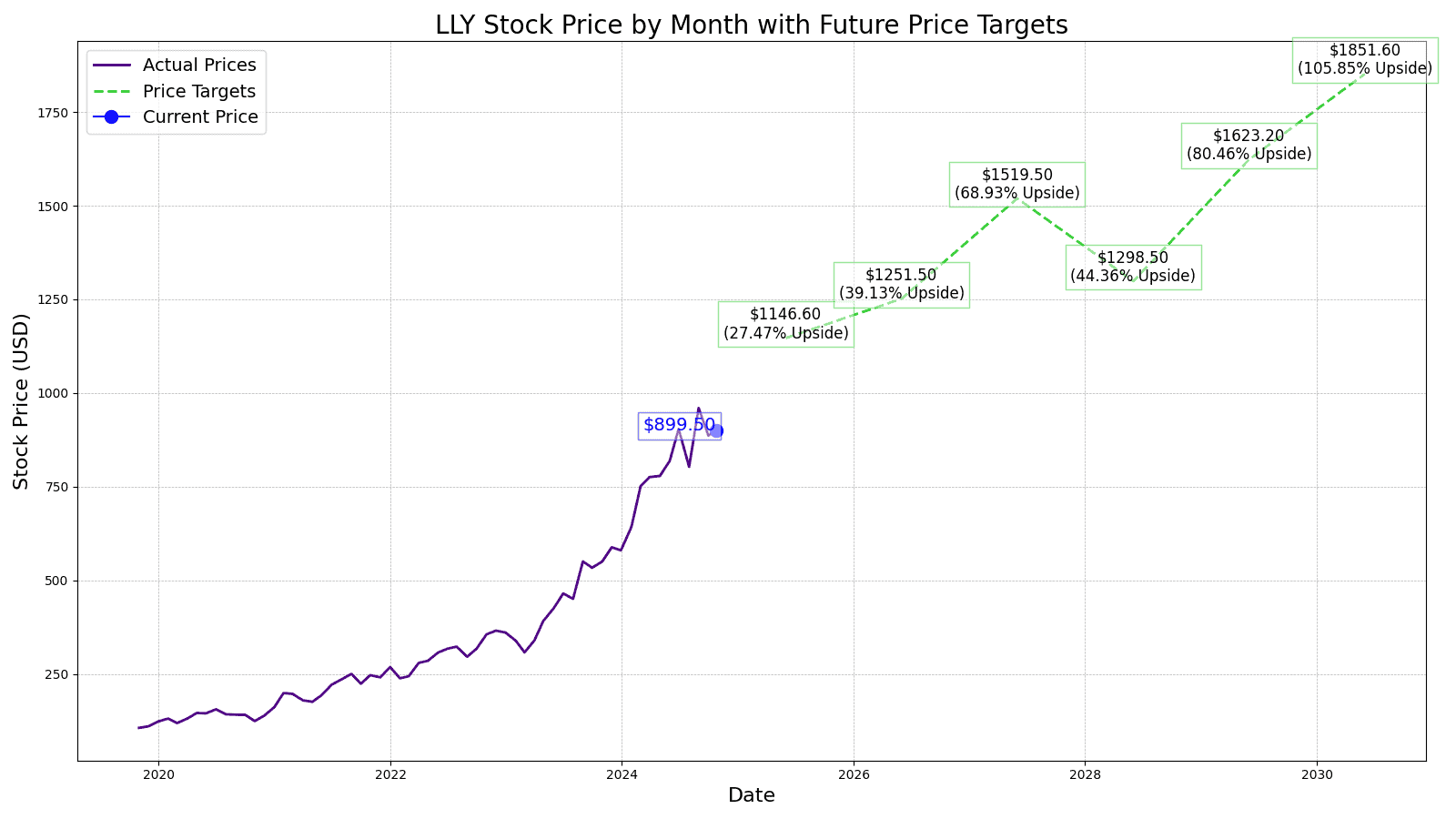

Since the start of 2020, Eli Lilly’s (NYSE: LLY) stock price chart has been straight up and to the right, up 580.36% and currently trading at $899.50.

The company has been around since 1876 and the stock didn’t go public until 1952 but in the last 4 years, Eli Lilly went from a $100 billion market capitalization to $740 billion today, which also makes it a potential stock split stock.

However, as investors, we care about the stock price years down the line and what Eli Lilly will do in the next 3 to 5 years and beyond.

That is why 24/7 Wall Street looks at projected revenue and net income to give you our best estimate of future stock prices from 2025 to 2030.

Other “experts” look at past growth rates and assign future stock prices to those past numbers. However, we will walk you through our assumptions and give you the key drivers we see propelling Eli Lilly’s stock in the future.

10/23/2024

A group of U.S. senators is investigating Eli Lilly and Pfizer’s new direct-to-consumer telehealth platforms, raising concerns about potential conflicts of interest for prescribers. LillyDirect and PfizerForAll offer virtual and in-person healthcare appointments, as well as convenient home delivery of prescription medications and other health products.

10/21/2024

Eli Lilly announced that it is suing three different companies for selling products claiming to contain tirzepatide, the main ingredient in its weight-loss drug Zepbound. The companies include Pivotal Peptides, MangoRx, and Genesis Lifestyle Medicine of Nevada.

10/18/2024

Eli Lilly recently joined the Obesity Action Coalition (OAC) in the latest phase of its “Stop Weight Bias” campaign to challenge the often negative and stereotypical portrayals of people with obesity.

10/17/2024

Eli Lilly is going beyond its traditional role as a pharmaceutical company and supporting an app designed to help people with inflammatory bowel diseases (IBD) find public restrooms. The “We Can’t Wait” app was launched by the Crohn’s and Colitis Foundation in 2022 and is a valuable resource for IBD patients who often experience urgent bowel movements.

10/15/2024

Eli Lilly is investigating to see if its obesity drugs, like Zepbound, could be used to improve employment rates. The company has committed £279 million ($364 million) to support healthcare initiatives in the UK. Eli Lilly will conduct a real-world study to examine the relationship between its weight loss drugs and employment outcomes within the country.

10/14/2024

Eli Lilly is expanding its Gateway Labs program to the United Kingdom, marking the first European location for the incubator program.

10/10/20024

Eli Lilly is taking legal action against compounding pharmacies that were temporarily allowed to produce generic versions of its weight loss drugs.

10/9/2024

Eli Lilly has entered into three agreements with Insitro, a machine-learning drug development company. The two will collaborate on new medicines for metabolic diseases.

10/8/2024

Eli Lilly has partnered with Qinotto, a company that is working on new ways to deliver large medicine molecules to the brain. The partnership will work to create new kinds of antibodies that can be used to transport medicines into the brain.

10/7/2024

Eli Lilly has received a positive analyst rating from Deutsche Bank. The analyst maintained a “Buy” rating for the company’s stock and set a price target of $1,025. This positive outlook is largely due to the resolution of a supply shortage for Tirzepatide.

How did Eli Lilly’s stock price soar so much in the past few years? Let’s take a look at the numbers:

| Share Price | Revenues* | Net Income* | |

| 2016 | $80.36 | $21.22 | $2.74 |

| 2017 | $77.55 | $19.94 | ($0.21) |

| 2018 | $122.13 | $21.49 | $3.23 |

| 2019 | $140.83 | $22.32 | $8.32 |

| 2020 | $206.46 | $24.54 | $6.19 |

| 2021 | $238.31 | $28.32 | $5.58 |

| 2022 | 329.07 | $28.54 | $6.25 |

| 2023 | $745.91 | $34.12 | $5.24 |

*Revenue and Net Income in Billions

Since 2016, Eli Lilly’s revenue grew by 60% but income grew by 91%. Typically you wouldn’t expect a company growing at its top line by 7% annually to see an 828% increase in share price, however, investor sentiment for the next line of drugs front ran the stock price.

For example, in 2016 Eli Lilly was trading 13 times the trailing 12 months earnings and the market has increased its valuation each year and currently trades at a 125 times earnings multiple.

This raises the valid question, is Eli Lilly overvalued or will future revenues make up for the expensive valuation?

The current Wall Street consensus 1-year price target of Eli Lilly stock is $1030.00, which is 14.51% higher than today’s price of $899.50. Of the 26 analysts covering Eli Lilly stock, the current rating is 1.67 or “Outperform” with 1-year price targets as high as $1,100 and as low as $540.00.

24/7 Wall Street sets its 1-year price target at $1,040. Taking a look at the sum of its parts, we see Eli Lilly’s vertices valued as follows:

| Endocrinology | $735/ share |

| Oncology | $122/ Share |

| Cardiovascular | $4/ Share |

| Neuroscience | $16/ Share |

| Immunology | $38/ Share |

| Others and Pipeline | $110/ Share |

| Cash | $17/ Share |

Valuing Eli Lilly’s stock price for the coming years, we will take a look at expected revenue and net income and give our best estimate of the market value of the company by assigning a price-to-earnings multiple.

| Revenue | Net Income | EPS | |

| 2025 | $52.8 | $17.29 | 19.11 |

| 2026 | $62.5 | $22.49 | 25.03 |

| 2027 | $70.87 | $27.12 | 30.39 |

| 2028 | $80.68 | $32.2 | 25.97 |

| 2029 | $87.99 | $36.45 | 40.58 |

| 2030 | $96.67 | $41.12 | 46.29 |

*Revenue and net income reported in billions

We expect Eli Lilly’s P/E ratio in 2025 to be 60 with an EPS of $19.11, resulting in a price target of $1140.00 This prediction is based on strong revenue growth of 18.37% to $52.80 billion and net income expansion to $17.29 billion, continuing the upward trajectory from previous years.

For 2026, we anticipate a P/E ratio of 50 with an EPS of $25.03, leading to a price target of $1250.00. This reflects significant revenue growth of 18.37% to $62.50 billion and an increase in net income to $22.49 billion, driving higher earnings per share.

Heading into 2027, we project the P/E ratio to remain at 50, with EPS increasing to $30.39. This results in a price target of $1520.00. Continued revenue growth of 13.39% to $70.87 billion and net income expansion to $27.12 billion justifies this substantial increase in stock price.

With an EPS of $25.97 and a P/E ratio of 50 in 2028, we forecast the stock price to be $1300.00. A slight dip in EPS growth is expected, but sustained strong performance in net income to $32.20 billion and revenue growth of 13.84% to $80.68 billion keeps the stock highly valued.

By 2029, we estimate Eli Lilly’s EPS to rise to $40.58, with the P/E ratio adjusting to 40. This gives us a price target of $1623.00. The continuous revenue growth of 9.06% to $87.99 billion and net income expansion to $36.45 billion supports this higher valuation.

Price Target: $1850.00

Upside: 105.67%

By 2030, we estimate Eli Lilly’s EPS to rise to $46.29, with the P/E ratio adjusting to 40. This gives us a price target of $1850.00. The continuous revenue growth of 9.86% to $96.67 billion and net income expansion to $41.12 billion supports this higher valuation.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2025 | $1140.00 | Upside of 26.74% |

| 2026 | $1250.00 | Upside of 38.97% |

| 2027 | $1520.00 | Upside of 68.98% |

| 2028 | $1300.00 | Upside of 44.52% |

| 2029 | $1623.00 | Upside of 80.43% |

| 2030 | $1850.00 | Upside of 105.67% |

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.