Investing

Microsoft (MSFT) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Everyone knows Microsoft (NASDAQ: MSFT) and its best-known products, including the Windows operating system and Microsoft 365 suite of productivity apps, but its growing cloud computing platform, Azure, is the future of the company.

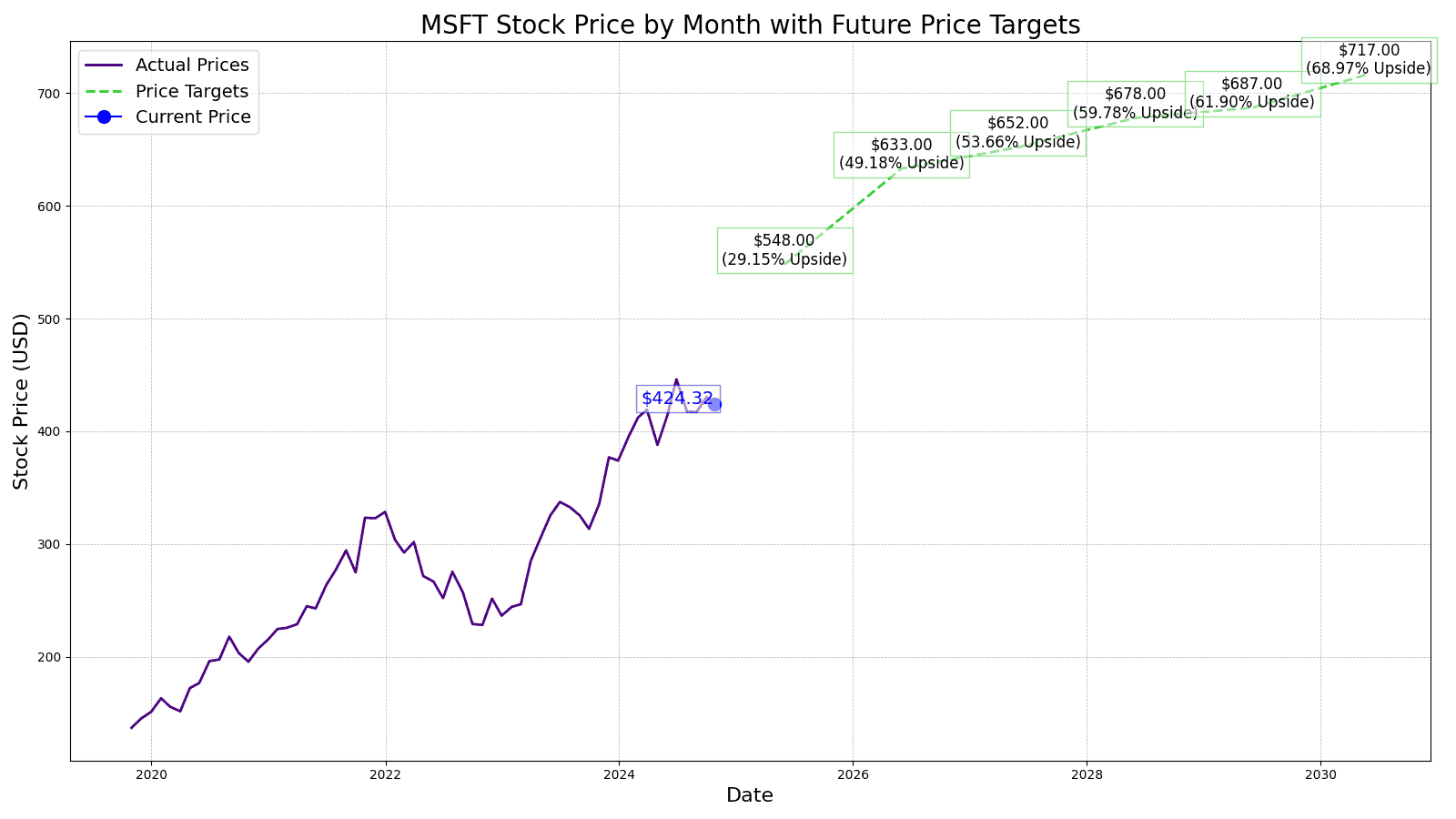

Microsoft stock has been a millionaire maker for decades, with a stock split-adjusted IPO price of $0.14, which means at today’s stock price of $424.32, the stock is up 435999.69%. That would have turned a $1000 investment at Microsoft’s IPO into $4.36 million today.

As one of the most valuable companies in the world, the only thing investors focus on is what the stock will do over the coming years. Wall Street analysts only go as far as 1 year out when giving a stock prediction. But long-term investors want to know where Microsoft might be several years down the road.

24/7 Wall Street aims to give you our assumptions on the stock and provide our insights around the numbers coming from Microsoft and which markets the company is operating in that are most exciting to us.

10/24/2024

Microsoft is facing increasing turnover among women, Black, and Latinx employees, even as the company tries to make its workforce more diverse. The company released its diversity and inclusion report this week, which showed that women made up 32.7% of employees who left the company in the past year, an increase from 32% in 2023. In the U.S., Black employees accounted for 10% of those who left (up from 8.7%), and Latinx employees accounted for 9.8% (up from 8%).

10/23/2024

Microsoft will be implementing “AI employees” next month. These software agents are designed to assist with tasks such as customer service and supply chain management.

10/21/2024

As part of Microsoft’s efforts to stay competitive in the AI market, the company’s Copilot Studio will allow businesses to build custom AI assistants called “copilots”.

10/18/2024

The partnership between Microsoft and OpenAI is facing challenges recently. OpenAi has requested more funding and resources, while Microsoft has hired executives from a competing AI company. In addition, there are uncertainties about Microsoft’s ownership stake in a potential for-profit version of OpenAI.

10/17/2024

The CEO of Salesforce, Marc Benioff, openly criticized Microsoft’s Copilot AI, suggesting that it is not up to par and will be a disappointment to consumers.

10/15/2024

Microsoft released its fifth annual Digital Defense Report and announced that the number of ransomware attacks that successfully encrypt data has decreased significantly by 300% in the past two years.

10/14/2024

Microsoft’s share price increased by 1.6% today, reaching a high of $423.25. Trading activity was lower than usual, with around 3.37 million shares changing hands.

10/10/2024

Microsoft is introducing new tools and features to its healthcare cloud platform. These updates aim to improve patient care experiences, enhance teamwork among healthcare professionals, and provide valuable insights for clinical and operational decision-making.

10/9/2024

Microsoft is warning millions of Windows users about a surge in phising attacks targeting their defense mechanisms. The company has advised users to take specific precautions, including using Microsoft Edge to automatically identify and block malicious websites, in addition to the early warning system provided by Microsoft Defender SmartScreen.

10/8/2024

Investors are watching Microsoft closely as the company is scheduled to release its earnings report for the quarter. Analysts expect Microsoft to report earnings per share of $3.08, which would be 3.01% higher than compared to the same quarter last year. Microsoft’s revenue is predicted to be $64.42 billion, 13.98% higher than the same quarter last year.

10/7/2024

Microsoft is investing €4.3 billion into operations in Italy. The data center will be a key data hub for North Africa and the Mediterranean and will expand its AI infrastructure and cloud systems.

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Share Price | Revenues | Net Income | |

| 2014 | $46.16 | $86.83 | $22.07 |

| 2015 | $46.70 | $93.58 | $12.19 |

| 2016 | $56.21 | $91.15 | $20.54 |

| 2017 | $72.26 | $96.57 | $25.49 |

| 2018 | $108.04 | $110.36 | $16.57 |

| 2019 | $138.06 | $125.84 | $39.24 |

| 2020 | $205.01 | $143.02 | $44.28 |

| 2021 | $286.50 | $168.09 | $61.27 |

| 2022 | $276.41 | $198.27 | $72.74 |

| 2023 | $330.72 | $211.92 | $72.36 |

| TTM | $465.39 | $279.99 | $86.18 |

Revenue and net income in $billions

In the last decade, Microsoft’s revenue grew 222% while its net income went from $22.07 billion to over $86 billion (in the trailing 12 months). A big driver of profits over the past decade was Microsoft’s Intelligence cloud business, which grew 18% annually and drove operating profits of $37.88 billion in 2023 from $8.44 billion in 2014.

As Microsoft looks to the second of the decade, a few key areas will determine its performance.

The current consensus 1-year price target for Microsoft stock is $500.00, which is a 17.84% upside from today’s stock price of $424.32. Of all the analysts covering Microsoft, the stock is a consensus buy, with a 1.39 “Buy” rating.

24/7 Wall Street’s 12-month forecast projects Microsoft’s stock price to be $495. We see Azure continuing its 20+% growth and earnings per share coming in right at $11.80.

| Year | Revenue | Net Income | EPS |

| 2024 | $244.97 | $88.93 | $13.32 |

| 2025 | $278.00 | $99.25 | $15.67 |

| 2026 | $321.63 | $115.65 | $18.10 |

| 2027 | $370.79 | $136.81 | $20.40 |

| 2028 | $416.08 | $151.87 | $22.62 |

| 2029 | $453.39 | $166.56 | $25.45 |

| 2030 | $503.13 | $181.71 | $28.70 |

Revenue and net income in $billions

We expect to see revenue growth of just over 8% and EPS of $15.67 for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Microsoft at $548.00 in 2025, which is 29.15% higher than the stock is trading today.

Going into 2026, we estimate the price to be $633.00, with small revenue gains but margins expanding and an EPS of $18.10. We expect to see Microsoft’s P/E ratio to steep down slowly each year through 2030. The stock price estimate would represent a 49.18% gain over today’s share price of $424.32.

Heading into 2027, we expect the stock price increase not to be as pronounced and earnings estimates of $20.40 per share, the stock price target for the year is $652.00. That is a 3% year-over-year gain from the previous year, but still up 53.66% from today’s stock price.

When predicting more than 3 years out, we expect Microsoft’s P/E ratio to drop to 30x in 2028 but grow its top line 14%. In 2028, we have Microsoft’s revenue coming in around $420 billion and an EPS of $22.62 suggesting a stock price estimate at $678.00 or a gain of 59.78% over the current stock price.

24/7 Wall Street expects Microsoft to continue its 10% revenue growth again and to generate $12.30 per share of earnings. With a price to earnings multiple of 35, the stock price in 2029 is estimated at $687.00, or a gain of 61.90% over today’s price.

We estimate Microsoft’s stock price to be $717.00 per share with a sub-10% year-over-year revenue growth. Our estimated stock price will be 68.97% higher than the current stock price of $424.32.

| Year | Price Target | % Change From Current Price |

| 2024 | $495.00 | Upside of 16.66% |

| 2025 | $548.00 | Upside of 29.15% |

| 2026 | $633.00 | Upside of 49.18% |

| 2027 | $652.00 | Upside of 53.66% |

| 2028 | $678.00 | Upside of 59.78% |

| 2029 | $687.00 | Upside of 61.90% |

| 2030 | $717.00 | Upside of 68.97% |

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.