Investing

Microsoft (MSFT) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Everyone knows Microsoft (NASDAQ: MSFT) and its best-known products, including the Windows operating system and Microsoft 365 suite of productivity apps, but its growing cloud computing platform, Azure, is the future of the company.

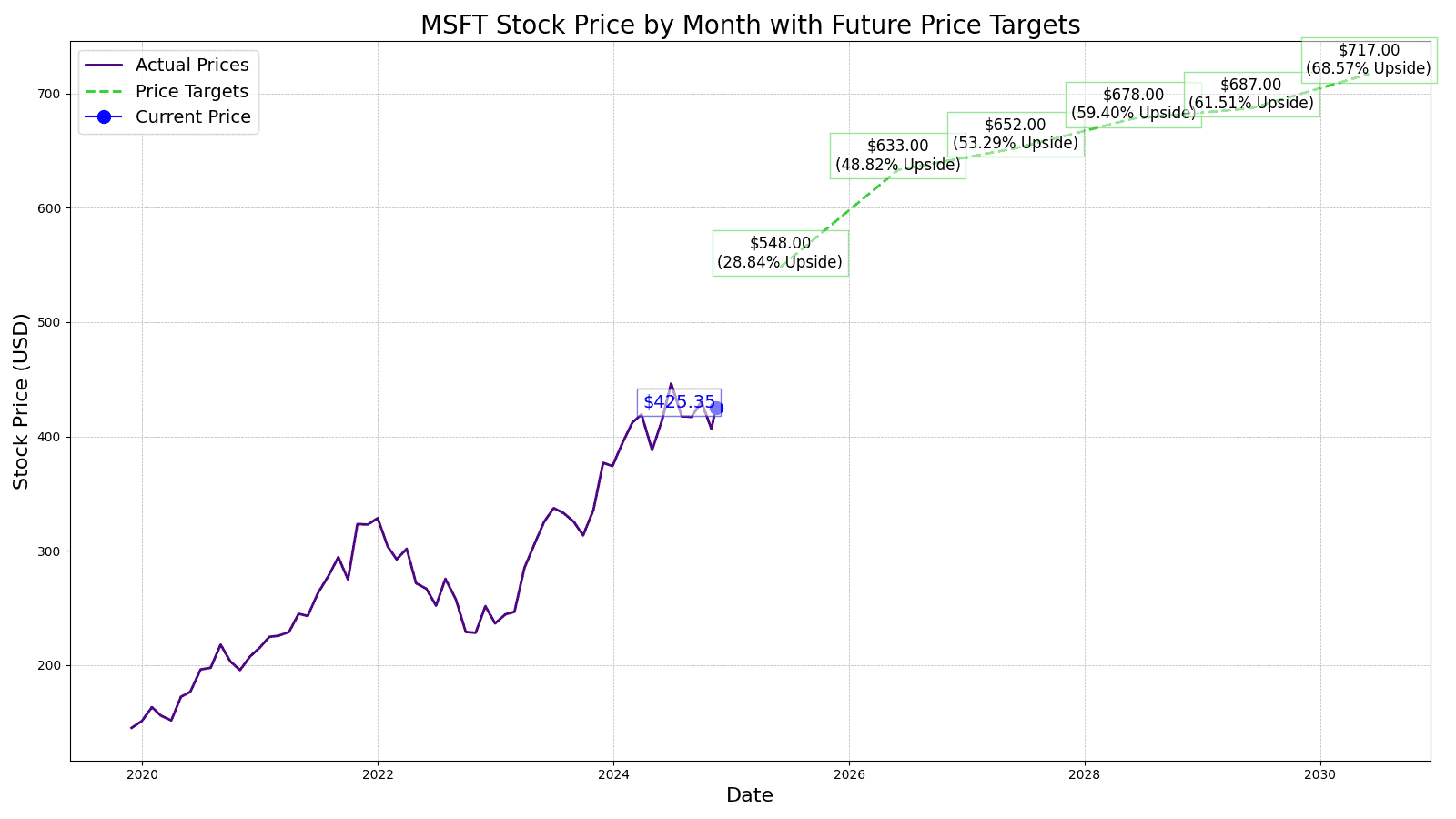

Microsoft stock has been a millionaire maker for decades, with a stock split-adjusted IPO price of $0.14, which means at today’s stock price of $425.35, the stock is up 437053.13%. That would have turned a $1000 investment at Microsoft’s IPO into $4.37 million today.

As one of the most valuable companies in the world, the only thing investors focus on is what the stock will do over the coming years. Wall Street analysts only go as far as 1 year out when giving a stock prediction. But long-term investors want to know where Microsoft might be several years down the road.

24/7 Wall Street aims to give you our assumptions on the stock and provide our insights around the numbers coming from Microsoft and which markets the company is operating in that are most exciting to us.

11/14/2024

Microsoft is under investigation by the Federal Trade Commission (FTC) for potential anti-competitive behavior in its cloud computing business. The FTC is concerned that Microsoft might be using its dominant position in productivity software to unfairly limit customers’ choices, particularly with the company’s cloud services making it difficult for customers to switch to other cloud providers.

11/12/2024

Despite a broader market downturn today, Microsoft rose 1.20% to $423.03.

11/11/2024

Isabell Sheang has rejoined Microsoft as a group product marketing and go-to product manager. In her new role, Sheang will lead a team focused on global strategies for Windows Commercial. Sheang previously worked for Microsoft from 2008 to 2016, in addition to working at VMWare and as an adjunct professor at the University of Washington.

11/8/2024

Microsoft is testing out a greener approach to data center construction with Cross-Laminated Timber (CLT). CLT is a fire-resistant wood material that can greatly lower carbon emissions compared to traditional materials like steel and concrete. By using CLT, Microsoft aims to cut carbon emissions by 35% and reduce greenhouse emissions by 65%.

11/7/2024

Released three years ago, Windows II now accounts for 35.55% of the market. This surge in popularity comes as Microsoft prepares to end support for Windows 10, charging a fee for extended service.

11/6/2024

Microsoft is expanding the capabilities of Windows on Arm by testing an important update that will enable more x64 software and games to run under Prism emulation. The update is specifically designed for Copilot Plus PCs powered by Qualcomm’s Snapdragon X Elite or X Plus processors.

11/5/2024

Microsft is set to invest nearly $10 billion in AI cloud provider CoreWeave over the next decade. The company recently signed a deal with CoreWeave to use its data centers for AI model training. However, Microsoft will continue to compete with CoreWeave through its Azure cloud business.

11/4/2024

Microsoft has purchased a large piece of land in North Carolina. The company acquired the 1,350-acre Person County Mega Park last week for $26.85 million. Microsoft hasn’t revealed specific plans for the plot.

10/31/2024

Microsoft released its quarterly earnings report, which showed a 16% increase in sales, reaching $65.6, and an 11% rise in profit to $24.7 billion ($3.30 per share), exceeding Wall Street expectations.

10/29/2024

Microsoft has made several accusations against Google, claiming that Google is trying to discredit Microsoft’s cloud business, Azure. Google has also filed an antitrust complaint against Microsoft.

10/28/2024

Microsoft will release its quarterly earnings report on Wednesday after the market closes. Analysts predict a 14% year-over-year surge in revenue, reaching $64.65 billion. Net income is projected to increase to $23.2 billion ($3.11 per share), up from the previous year’s $22.29 billion ($2.99 per share).

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Share Price | Revenues | Net Income | |

| 2014 | $46.16 | $86.83 | $22.07 |

| 2015 | $46.70 | $93.58 | $12.19 |

| 2016 | $56.21 | $91.15 | $20.54 |

| 2017 | $72.26 | $96.57 | $25.49 |

| 2018 | $108.04 | $110.36 | $16.57 |

| 2019 | $138.06 | $125.84 | $39.24 |

| 2020 | $205.01 | $143.02 | $44.28 |

| 2021 | $286.50 | $168.09 | $61.27 |

| 2022 | $276.41 | $198.27 | $72.74 |

| 2023 | $330.72 | $211.92 | $72.36 |

| TTM | $465.39 | $279.99 | $86.18 |

Revenue and net income in $billions

In the last decade, Microsoft’s revenue grew 222% while its net income went from $22.07 billion to over $86 billion (in the trailing 12 months). A big driver of profits over the past decade was Microsoft’s Intelligence cloud business, which grew 18% annually and drove operating profits of $37.88 billion in 2023 from $8.44 billion in 2014.

As Microsoft looks to the second of the decade, a few key areas will determine its performance.

The current consensus 1-year price target for Microsoft stock is $500.00, which is a 17.55% upside from today’s stock price of $425.35. Of all the analysts covering Microsoft, the stock is a consensus buy, with a 1.39 “Buy” rating.

24/7 Wall Street’s 12-month forecast projects Microsoft’s stock price to be $495. We see Azure continuing its 20+% growth and earnings per share coming in right at $11.80.

| Year | Revenue | Net Income | EPS |

| 2024 | $244.97 | $88.93 | $13.32 |

| 2025 | $278.00 | $99.25 | $15.67 |

| 2026 | $321.63 | $115.65 | $18.10 |

| 2027 | $370.79 | $136.81 | $20.40 |

| 2028 | $416.08 | $151.87 | $22.62 |

| 2029 | $453.39 | $166.56 | $25.45 |

| 2030 | $503.13 | $181.71 | $28.70 |

Revenue and net income in $billions

We expect to see revenue growth of just over 8% and EPS of $15.67 for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Microsoft at $548.00 in 2025, which is 28.84% higher than the stock is trading today.

Going into 2026, we estimate the price to be $633.00, with small revenue gains but margins expanding and an EPS of $18.10. We expect to see Microsoft’s P/E ratio steep down slowly each year through 2030. The stock price estimate would represent a 48.82% gain over today’s share price of $425.35.

Heading into 2027, we expect the stock price increase not to be as pronounced and earnings estimates of $20.40 per share, the stock price target for the year is $652.00. That is a 3% year-over-year gain from the previous year, but still up 53.29% from today’s stock price.

When predicting more than 3 years out, we expect Microsoft’s P/E ratio to drop to 30x in 2028 but grow its top line 14%. In 2028, we have Microsoft’s revenue coming in around $420 billion and an EPS of $22.62 suggesting a stock price estimate at $678.00 or a gain of 59.40% over the current stock price.

24/7 Wall Street expects Microsoft to continue its 10% revenue growth again and to generate $12.30 per share of earnings. With a price-to-earnings multiple of 35, the stock price in 2029 is estimated at $687.00, or a gain of 61.51% over today’s price.

We estimate Microsoft’s stock price to be $717.00 per share with a sub-10 % year-over-year revenue growth. Our estimated stock price will be 68.57% higher than the current stock price of 425.35.

| Year | Price Target | % Change From Current Price |

| 2024 | $495.00 | Upside of 16.37% |

| 2025 | $548.00 | Upside of 28.84% |

| 2026 | $633.00 | Upside of 48.82% |

| 2027 | $652.00 | Upside of 53.29% |

| 2028 | $678.00 | Upside of 59.40% |

| 2029 | $687.00 | Upside of 61.51% |

| 2030 | $717.00 | Upside of 68.57% |

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.