In the world of crypto, Coinbase (NASDAQ:COIN) is a leading centralized exchange that has become ubiquitous among U.S. investors, due to the fact that this is the premier company that’s worked to establish itself as a reputable exchange for trading cryptocurrencies. Most investors who have nibbled in this space are aware of Coinbase, and the company’s relatively easy-to-use platform that allows for trading in some of the most established tokens in the market. Unlike other decentralized exchanges, which require a great deal of technical know-how to operate, Coinbase provides a platform to settle transactions nearly instantaneously, becoming the middle man of choice for most investors.

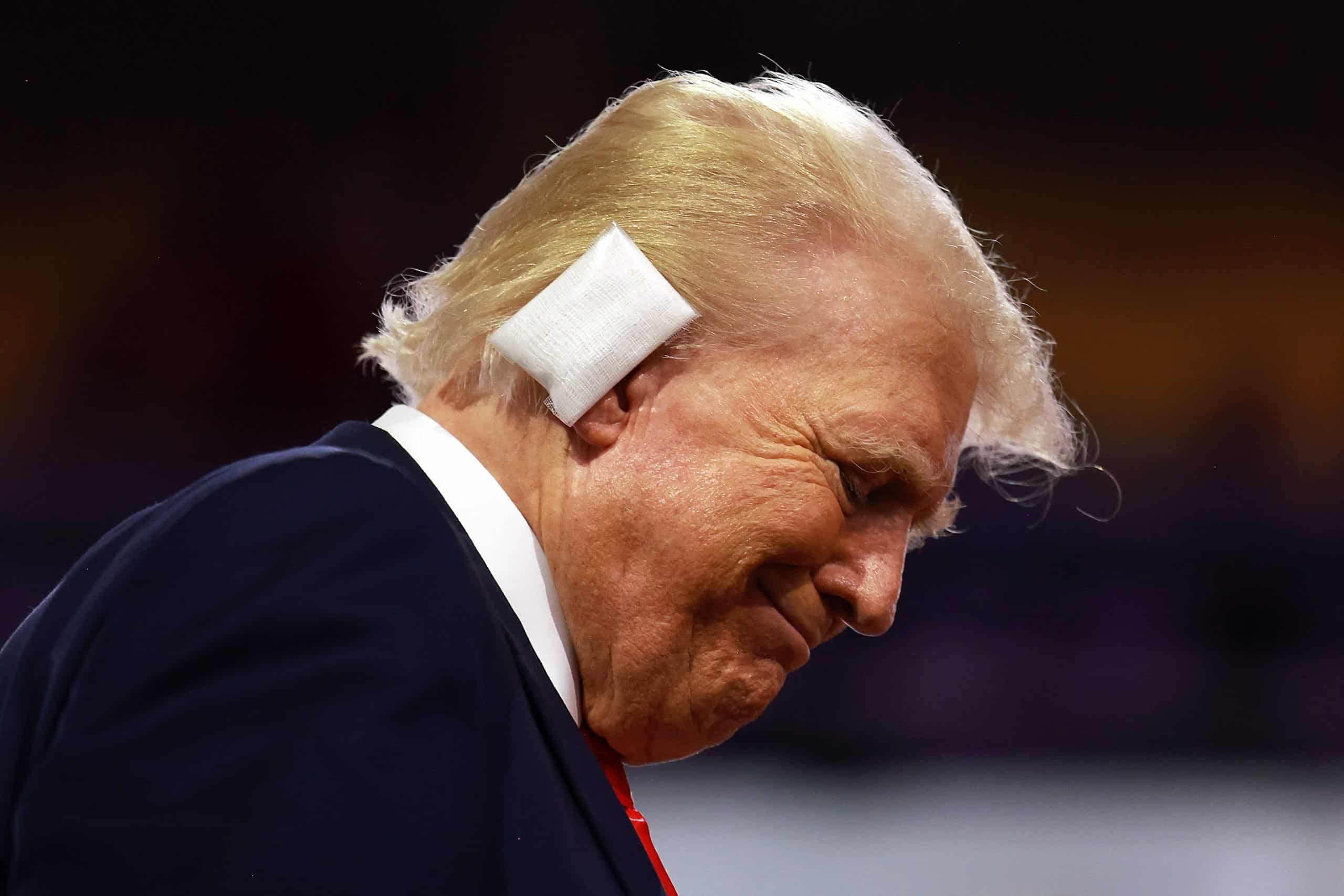

This includes both retail and institutional investors. With the rise of spot ETFs for both Bitcoin (CRYPTO:BTC) and Ethereum (CRYPTO:ETH), institutional money managers have stepped into the crypto game in a much bigger way over the course of 2024. And with Donald Trump officially securing the presidency for the second time, the question is whether crypto will get a corresponding boost (and Coinbase will therefore see its transaction fee revenue surge).

Coinbase stock is up a whopping 30% today on this news. Let’s dive into the question of whether this stock has what it takes to double over the course of the next year.

Key Points About This Article:

- Coinbase is the leading centralized crypto exchange in the U.S. market, and is getting a massive 30% boost from news that Donald Trump will once again become president.

- Let’s dive into the probability and possibility that Coinbase stock doubles over the course of president Trump’s incoming second term.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Trump and Crypto

Donald Trump has made crypto investing one of his key (and unique) platform pitches for young voters. Enabling innovation to happen state-side has been one of his key promises to investors, with others in the Republican Party pushing the former (and soon-to-be current) president to adopt a much more friendly regulatory approach to this space.

It’s certainly true that plenty of innovation happens on the blockchain, and it’s probably better for the U.S. to lead the way globally in the development of this technology. But by opening up markets and allowing for greater certainty for investors, the hope many Coinbase investors have is that this will open the floodgates of capital to this space. As the leading centralized crypto exchange in the U.S. that earns most of its revenue from transaction fees, that’s a good thing.

Generally speaking, as crypto prices go up, so too do trading volumes. Investors won’t miss an opportunity to make money, and the crypto market is surging today. The overall market has seen a one-day gain of more than 7% at the time of writing, and I think this move could actually intensify in the coming days. We’ll see, but these developments are certainly bullish for Coinabse moving forward.

Will Coinbase’s Fundamentals Surge As Quickly As the Market?

The news that Donald Trump will be stepping into the White House once again has clearly invigorated crypto investors in a way I haven’t seen in some time. Today’s surge is reminiscent of some of the daily moves we used to see in the post-pandemic era, and it’s becoming clear that momentum is squarely favoring bulls. If this market continues to perform in a similar fashion to other hype-driven bull markets, I think it’s entirely possible that Coinbase stock doubles over the course of the Trump presidency. And given the voracity of today’s move, it does appear some investors are ramping up bets that a doubling before the year is out could be on the table.

Coinage stock has plunged considerably from its peak – the crypto giant went public near the peak of the market, and has been on a relative decline over the past three years as the market has normalized.

However, if we do see the sort of enthusiasm we saw in 2020 and 2021 build into 2025, I wouldn’t be surprised to see another bubble-like valuation pop up for the likes of Coinabse. Interestingly, at current levels, this stock does seem fairly valued at roughly 32-times trailing earnings, so there could be some material upside from here if the market is correct in predicting an earnings surge on the horizon.

The Verdict

In my view, Coinbase could be among the preeminent ways investors can play the so-called “Trump trade” right now. This is a company that should benefit directly from a Trump presidency and the policies the Republican administration is likely to put in place.

As far as momentum trades are concerned, Coinbase appears to have some of the most robust fundamentals of any stock in the market right now. This is one I’d encourage investors to at least keep an eye on through the rest of this year.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: are you ahead, or behind on your retirement goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With SmartAsset’s free tool, you can connect with vetted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.