Investing

3 Billionaire Hedge Fund Managers Going Heavy Into Chinese Stocks

Published:

Hedge fund managers play a crucial role in the financial markets, acting as the decision-makers for hedge funds. These funds are specialized investment vehicles that allow institutional investors to put capital to work in the markets. The idea is rather simple – these funds offer tailored strategies to certain wealthy investors, allowing them to make bespoke bets on the market one way or another. As their name suggests, many such funds operate as hedged vehicles, allowing investors to profit from the downside of various stocks or sectors. This is in contrast to most long-only funds, which allow investors to bet on the upside of companies over long periods of time.

Indeed, the returns hedge fund managers provide can vary wildly, and some are clearly better than others. But the three hedge fund managers I’m going to discuss in this article are certainly among the best. Thus, they’re closely followed by many in the investing community, and their picks are often directionally correct. They better be – it’s a performance based industry, so getting it right is very important for these fund managers.

Here’s why these three hedge fund managers appear to be ramping up bets on Chinese stocks, and what that may portend for investors moving forward.

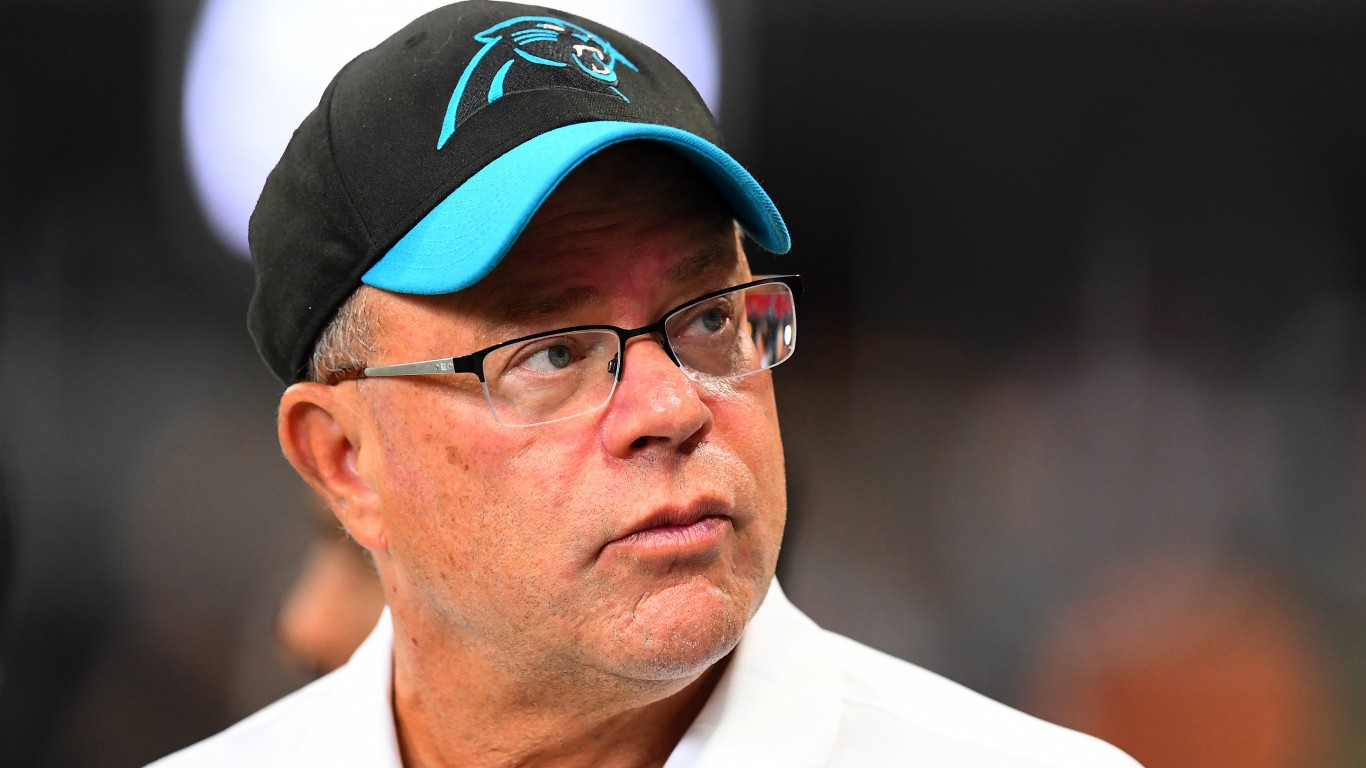

In 2010, David Tepper famously predicted a stock surge which later became known as the “Tepper Rally.” This surge in the overall market following stimulus from the Federal Reserve drove the S&P 500 up 45% over the course of two and a half years. On October 1, he made a similar call, urging investors to consider Chinese stocks and a range of other vehicles such as ETFs to get in on what he saw as a stimulus-driven bonanza in China. Given the voracity and prescience of his previous bet, many investors do appear to have followed suit.

Chinese stocks have rallied hard this year on the back of hopes that ramped up Chinese stimulus measures could provide a boon to the world’s second-largest economy, which has been struggling of late. Tepper’s view that the “don’t fight the Fed” narrative in the U.S. could spill over into foreign markets is certainly intriguing. And Tepper is putting his money where is mouth is, placing a very large bet (valued at around $750 million) on Alibaba (NYSE:BABA), a top Chinese e-commerce company.

His ownership stakes include other top tech and e-commerce companies in China, reflecting his view that the undervalued nature of these securities relative to U.S. stocks, as well as a wave of stimulus which could be ongoing, should boost valuations over the medium-term. So far, it looks like he’s been right.

Michael Burry is well-known for his portrayal by Christian Bale in the movie “The Big Short.” Based on a book written by Michael Lewis (one of my favorite authors), the story tells of one unique hedge fund manager who foresaw the housing crisis during the Great Recession and made a very large short bet to capitalize on what ended up being a catastrophe. While Burry was early, he was right, and he netted his clients a tremendous profit from this trade.

So, suffice it to say, investors pay attention when Burry speaks about a particular focus. Of late, his focus has clearly shifted toward China, with his hedge fund Scion Capital placing 46% of its portfolio in Chinese tech stocks. By Q2, Burry’s top holdings included Alibaba (21.3%), Baidu (12.4%), and JD.com (12.3%), investments he began in late 2022. Despite recent rallies, Chinese stocks have significantly lagged behind the S&P 500 over the past few years, as illustrated by the underperformance of the iShares MSCI China ETF. That said, Burry is clearly making a bet that the performance of both markets will eventually converge over time, leading to a major investment opportunity.

Burry began accumulating his position in Chinese stocks during the last quarter of 2022, and has since added to his positions according to more recent 13-K filings. I think Burry is among the most contrarian thinkers in the market, and one that’s generally right about the movements of particular markets over long periods of time. Maybe we’re early, and maybe that’s a good thing.

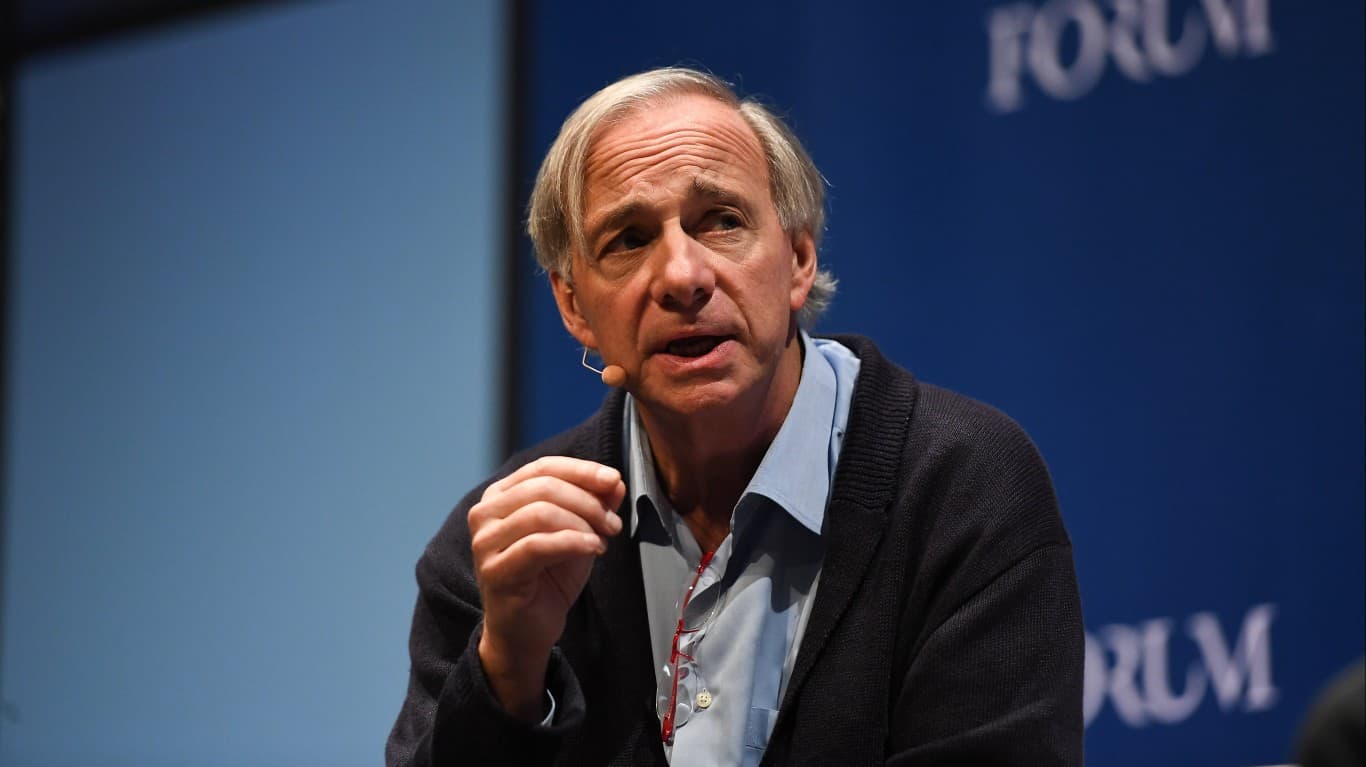

Ray Dalio is best-known as the founder of Bridgewater Associates, which is one of the largest bond funds and investment management firms in the world. He’s another top hedge fund manager who has expressed a strong commitment to investing in Chinese stocks, despite acknowledging the challenges facing China’s economy. His recent comments indicate that he views the current market conditions as an opportune time to invest in what he describes as “cheap” Chinese equities.

Dalio began investing in China in 2023, putting around $3 billion to work in this market. He has made previous calls that a major economic restructuring may be needed to bolster the economy in China. In particular, China’s struggling property sector has been a thorn in his side (along with many investors), as falling prices and developer failures have resulted in greater economic risks overall for the Chinese economy.

However, as Dalio and others have pointed out, we’re talking about the world’s second-largest economy with the largest middle class. Millions of Chinese individuals are joining the middle class each year, and if the Chinese government can engineer a debt restructuring for specific sectors such as housing, this is an economy that could certainly have plenty of growth upside over the long-term.

Dalio’s concerns around China’s housing market and debt load aside, it’s worth noting that China’s GDP has historically doubled around every five years. If the country can get its debt and leverage situation under control, Dalio could make a tremendous amount of money on this bet. We’ll have to see how it pans out, but each hedge fund manager on this list clearly share the view that the future looks bright for China, despite where depressed valuations suggest the economy could be headed from here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.