Investing

Jamie Dimon Just Warned of Stagflation—Here's How to Prepare

Published:

Last Updated:

Lately, we’ve been hearing quite a bit of pessimistic market commentary from some pundits and big names on Wall Street. Still, the stock market has found a way to soar higher. With the so-called Trump rally now in full swing, questions linger as to whether the cautiously optimistic and outright bearish folks will find the need to change their tune.

Indeed, the stock market gains continued on Thursday as the Federal Reserve slashed interest rates by a quarter point. Fed chairman Jerome Powell said he’s “feeling good” about the economy.

The modest rate cut helped push bond yields lower just a day before yield, and stock prices rose together. Perhaps most comforting was Powell’s comments about the state of the economy. However, not everyone thinks a rosy economy is ahead or that stocks will continue to put up strong gains for investors.

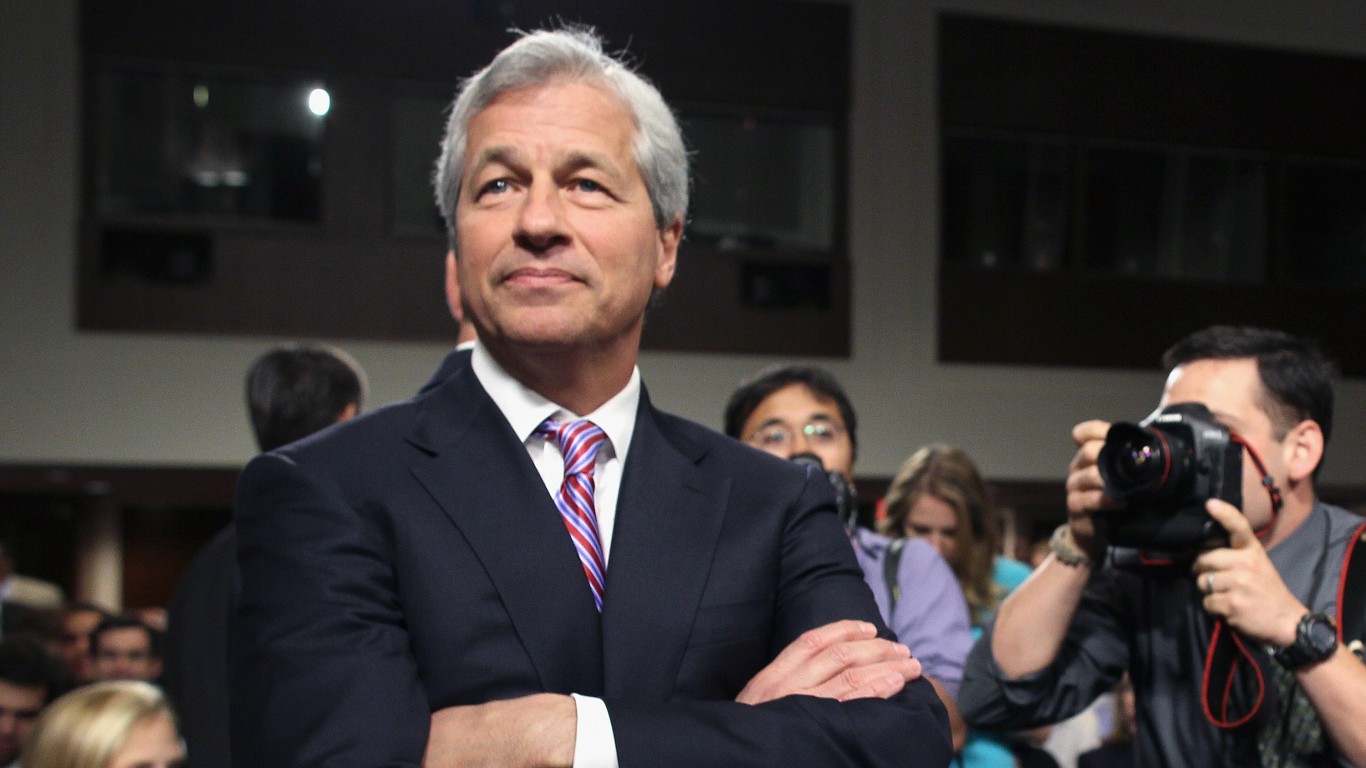

Just a few weeks ago, we heard about the dire Goldman Sachs (NYSE:GS) call that a “lost decade” for stock gains would be ahead. And more recently, we heard one of the biggest names in finance, JP Morgan (NYSE:JPM) CEO Jamie Dimon warning about the potential for stagflation — an environment that entails high inflation and stagnant economic growth. Indeed, such a climate would be the worst of both worlds.

Though Dimon’s commentary is somewhat concerning, stock investors shouldn’t panic or adjust their portfolios in a panicked state. Sure, Dimon is one of the most brilliant men in banking, and his knack for forecasting economic trends is outstanding. But the future will always be hard to tell, and betting on certain trends taking hold, I believe, isn’t as profitable a strategy as playing the long game and staying invested in all sorts of economic conditions, including stagflation.

For now, Dimon views stagflation as “the worst outcome.” And while he’s not ruling it out, his remarks on rising deficits and higher spending do support a case that could make stagflation possible. If the Fed cuts rates too far as Donald Trump looks to slash taxes, there’s no question that national deficits could swell further.

In any case, Trump believes that growth and not excess taxation is key to dealing with the deficit. Could deregulation and the incentivization of bringing jobs and business to America be the way to chip away at the deficit over the long haul?

Only time will tell. Either way, shockingly high tariffs (think 60% on Chinese goods) could have a drastic inflationary impact. And if consumers feel the pinch of such inflation while artificial intelligence (AI) displaces some from the workforce, we may just have the toxic combo of high inflation and stalling economic growth.

Indeed, the right precursors are needed to pave the way to stagflation. At this juncture, I’d say Dimon is right not to rule it out because if the right cards fall into place, the economy may party like it’s the 1970s.

While I wouldn’t call for stagflation, I do think it doesn’t hurt to be prepared for such a rare occurrence. So, the big question is how does one go about readying for a world where inflation is stubbornly high and economic growth is lacking?

Sticking with the defensive stocks could be key to moving ahead as the economy hits a setback. While lower-cost AI stocks could still make sense in such an environment since AI stands out as a secular trend that can keep boats rising, even through harsher economic conditions, I would insist on the high-quality consumer staple stocks.

Most notably, Walmart (NYSE:WMT) is a robust retailer that may make sense to pick up, as most other investors go after Trump’s stocks, which have been heated since election day. Indeed, most people lose when inflation hits.

In the case of Walmart, I’d say it’s a firm that can win from a climate where inflation is high and the economy is weak. The company is the place to go if you want great value for a wide range of necessities. If times get really tough and prices start inching higher again, Walmart stands out as a winner.

Additionally, precious metals, like gold, could continue to perform well as inflation weighs heavy on the dollar while economic prospects erode. As always, gold is a fantastic way to prepare for the rainiest days, and arguably, stagflation is one of the stormiest outcomes there could be.

Stagflation may be on Dimon’s mind, but I wouldn’t load up on gold and Walmart shares at these prices if your portfolio is already balanced and equipped to deal with an inflation resurgence and perhaps a mild economic downturn. That said, if you’re too aggressive and lacking in defensives, it can’t hurt to think about what to buy if stagflation does actually rear its ugly head within the next several years.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.