Investing

Prediction: ACM Research (ACMR) Stock Will Double During Trump's Presidency

Published:

Few chip companies are as well positioned to flourish under Donald Trump’s presidency as specialized semiconductor equipment manufacturer ACM Research (NASDAQ:ACMR).

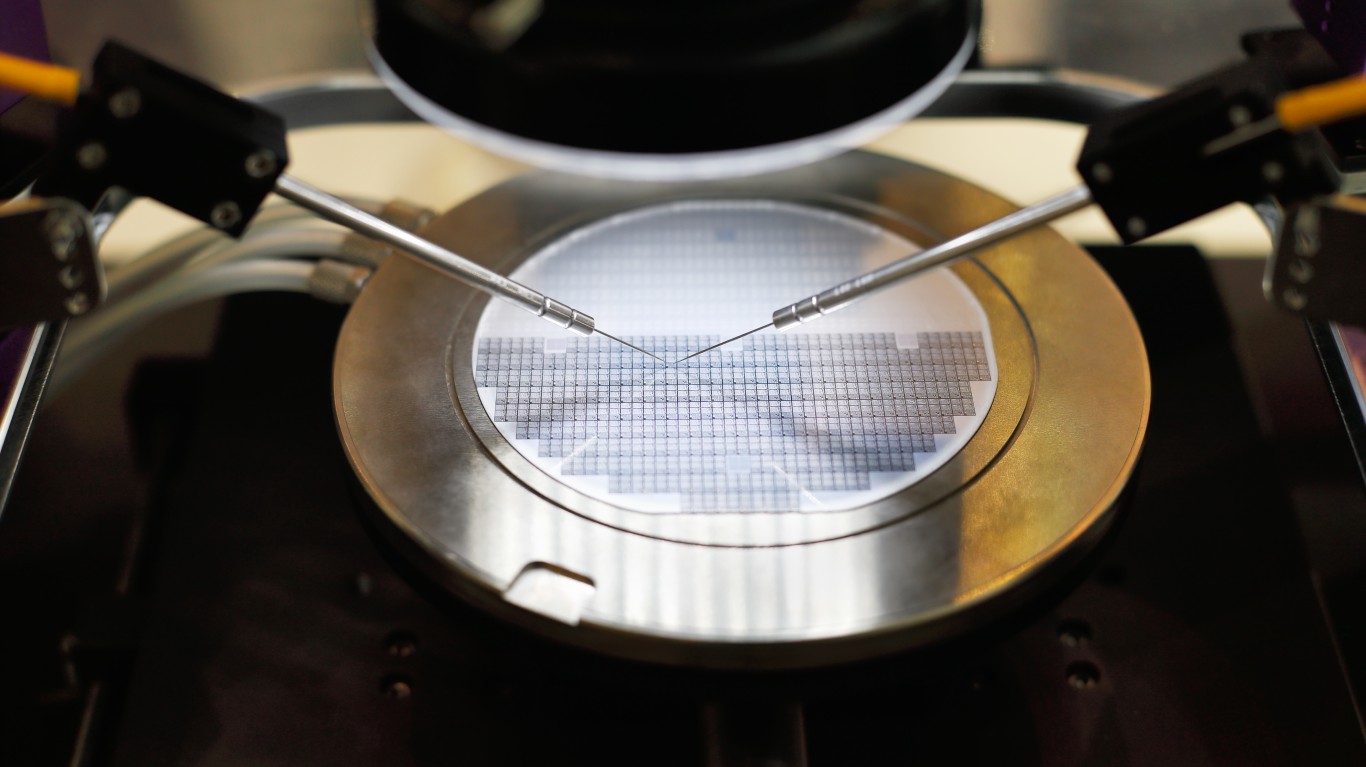

The company makes wafer cleaning and packaging equipment necessary for the manufacture of advanced artificial intelligence chips. Its machines eliminate contaminants from wafer surfaces at the front end of the chip processing cycle, an important step for chip manufacturers that need pristine surfaces before they start manufacturing the wafers.

Even though it is a U.S.-listed stock, it is a China-based company. And despite Trump’s promise of across-the-board tariff’s on U.S. trading partners early in his presidency — with rates running as high as 60% on Chinese-imported goods — ACM Research should be largely unaffected. In fact, its business will show incredible strength and easily allow its stock to double over the next four years.

ACM Research will benefit from what is known as domestic substitution. Beijing is already encouraging Chinese companies to use domestic suppliers, which will only be amplified as the trade war between the U.S. and China escalates.

Its just-reported third-quarter earnings showed revenue jumping 21% year-over-year to $204 million as shipments soared 23%. Profits flowed 20% higher to $30.9 million, or $0.45 per share. While wafer cleaning is its biggest segment and remains an important category for the tech stock, ACM Research is seeing significant opportunities in other areas as well. 3D structures; advanced packaging solutions; plasma-enhanced chemical vapor deposition (PECVD), which is using plasma to deposit thin films of solid material onto a substrate from a gaseous state; and more, are all enjoying strong growth.

ACM just increased its long-term revenue target from $1 billion to $3 billion and it is targeting owning more than half the market in some of its most important categories.

Its largest customer is Semiconductor Manufacturing International, China’s largest chip foundry, that accounted for nearly 17% of total revenue last year while SiEn, a mainland China power-chip company, represents another 15.4% of sales. An additional 13.4% of its revenue comes from mainland China memory chip maker ChangXin Memory Technologies.

Expect its business to surge as it has substantially scaled its business in China and Korea. SK Hynix (OTC:HXSCL), a leading South Korean memory chipmaker, is another significant ACMR customer.

Yet ACM Research isn’t just ceding the U.S. market either. Last month it completed the purchase of a new facility in Oregon, which includes a 5,200 square foot cleaning room. It plans to move in next year to provide easier access for customers for advanced tools evaluation. ACM says it plans on having a strong footprint in the U.S. as it looks forward to participating in the growth of the U.S. chip market.

It is neatly straddling the trade tensions between the two countries and will benefit no matter which way the situation goes.

Although ACMR stock is down less than 2% for the year, shares are off 44% from their 52-week high. It trades at just 10 times earnings estimates, less than twice sales, and a tiny fraction of its estimated long-term earnings growth rate. Wall Street forecasts profits to grow 47% annually over the next five years.

With the market offering investors a steep discount and the prospects for significant sales growth and market share gains especially in China as a result of Trump’s presidency, look for ACMR stock to easily double over the next four years.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.