Investing

SoFi Technologies (SOFI) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

SoFi Technologies (NASDAQ: SOFI) made its public debut on June 1, 2021, through a merger with a special purpose acquisition company (SPAC), Social Capital Hedsophia Holding Corp. V, led by Chamath Palihapitiya. Before the merger, the company was originally known as Social Finance, which started as a student loan financing firm before expanding into loans, and mortgage products among other finance products.

After the SPAC acquisition, SoFi was equipped with substantial capital to enhance its technology stack to better scale its 2020 acquisition of Galileo. The Galileo platform was developed to deploy a wide range of financial services quickly, giving SoFi the tools to take numerous financial products to a mass market.

SoFi IPO’d at $10 per share and quickly jumped 150%, but the stock has been lackluster since, now trading at $13.82 per share, down 46.39%.

However, investors only care about what happens from this point on, particularly over the next 1, 3, and 5 years and beyond. Let’s crunch the numbers and give you our best guess on SoFi’s future share price. No one has a crystal ball and even the Wall Street “experts” are often wrong more than they are right in predicting future stock prices. But we give you our revenue and earnings projections as our peer-to-peer valuation.

11/12/2024

SoFi is modifying its robo-advisor, which will now feature an annual fee. The annual fee, which kicks in on December 10th, is designed to cover the costs of managing and maintaining the platform, as well as providing access to a team of financial advisors.

11/11/2024

SoFi’s shares increased today 8.46%, marking the fifth consecutive trading day of gains. In the past month, SoFi’s stock has increased 57%.

11/8/2024

SoFi’s stock price increased by 4.6% today, reaching a high of $12.45. Trading volume, however, was much lower than average.

11/7/2024

SoFi saw a modern 1.5% increase in its share price today, reaching a high of $12.10. Trading volume was significantly lower than average, with only 12 million shares changing hands.

11/6/2024

SoFi’s shares rose 3% today following the U.S. presidential election.

11/5/2024

SoFi’s stock price increased 5.3% today, trading as high as $11.52.

11/1/2024

Despite beating analyst estimates for both earnings and revenue in the third quarter, SoFi’s stock price initially fell. However, recently the stock price surged, possibly due to investor confusion.

10/29/2024

SoFi reported strong third-quarter results, with a 35% year-over-year increase in members to 9.4 million. While revenue growth was slightly slower at 30%, CEO Anthony Noto expressed confidence in the company’s “durable” growth trends.

The company also saw improvements in credit quality, with declining charge-offs and delinquencies on personal loans. This positive trend is expected to contribute to increased net interest income, which grew 25% during the quarter.

10/28/2024

SoFi’s stock price has experienced a significant surge, reaching a 52-week high of $11.3. The stock has climbed 64.05% over the past year, outperforming many of its peers.

10/25/2024

SoFi’s stock is on the rise today after LendingClub’s announcement that bank partners are returning to its loan marketplace. This positive trend suggests potential growth opportunities for SoFi, which is set to report its quarterly earnings on October 29th.

Here’s a table summarizing performance in share price, revenue, and profits (net income) from IPO.

| Share Price | Revenue | Net Income | |

| 2021 | $12.50 | $977.3 | ($483.9) |

| 2022 | $15.81 | $1,519.2 | ($320.4) |

| 2023 | $4.62 | $2,067.8 | ($300.7) |

| 2024 LTM | $8.22 | $2,343.5 | ($113.3) |

*Revenue and Net Income in millions

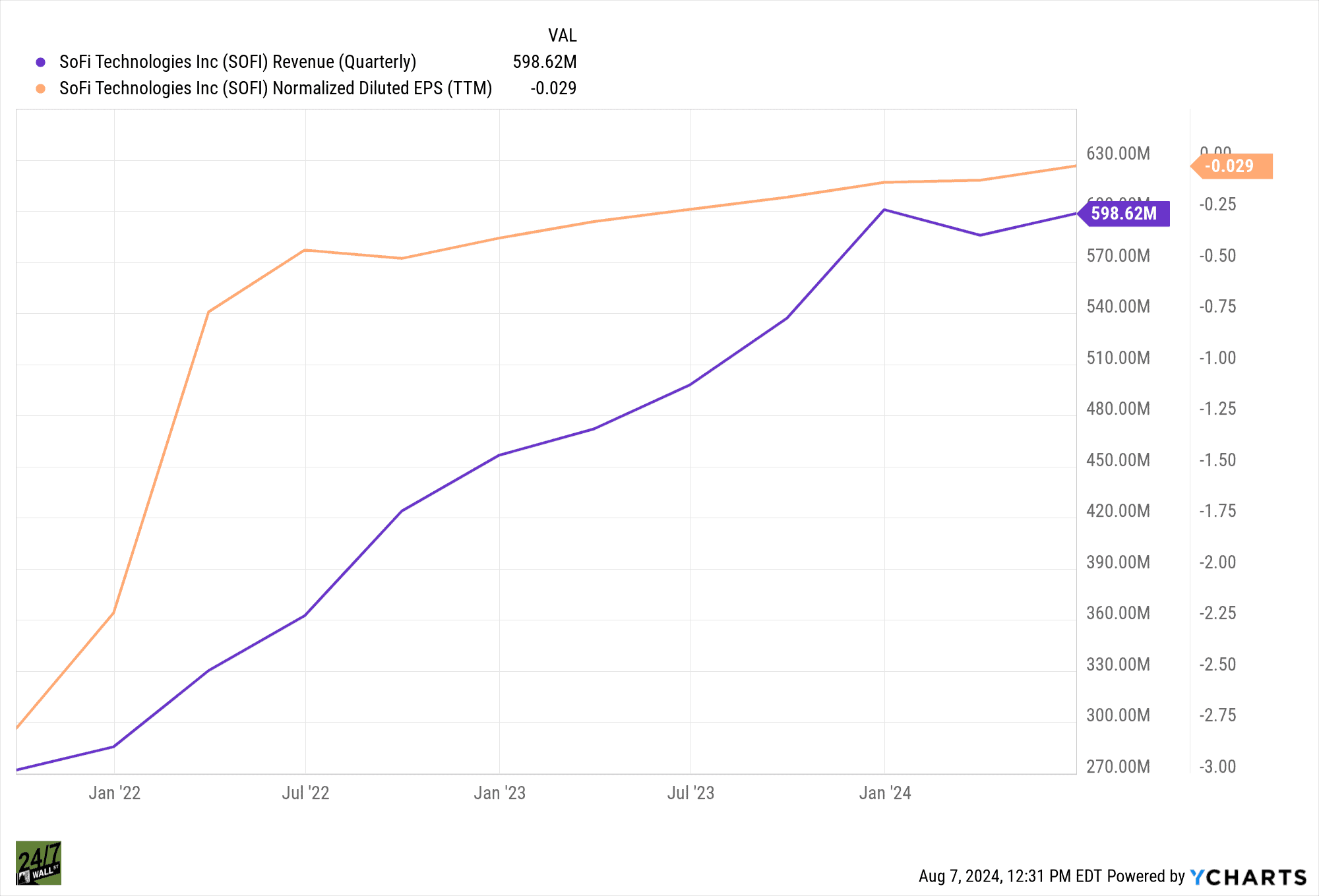

In the last 4 years, SoFi has more than doubled revenue but that top-line growth also carried a jump in total operating costs, particularly the $720 million in sales and marketing expense in 2023. However, the increases in operating costs are money well spent with in-house technology improvements and member-generating marketing spending.

SoFi is close to hitting an inflection point in profitability and has done a stellar job of expanding revenue and improving earnings per share (EPS).

As SoFi’s revenue grows, it becomes more profitable, meaning its costs per customer decrease. This scalability is important because it indicates that as the company grows, it will become even more profitable. Given that the industry is growing and SoFi is outperforming its peers, there’s strong optimism that SoFi’s earnings per share will continue to rise.

The Wall Street consensus 1-year price target for SoFi Technologies is $9.00, which is a -34.88% downside over today’s stock price. Of the 15 analysts covering the stock, the stock is a consensus “Hold” with a 2.88 rating. (1 being a “Strong Buy” and 5 a “Strong Sell”).

| Year | Est. Revenue ($B) | Est. Net Income ($B) | Est. EPS Normalized | Price to Sales Multiple | Est. Market Cap ($B) |

| 2024 | $2.47 | $0.164 | $0.08 | 3.5 | $8.64 |

| 2025 | $2.84 | $0.32 | $0.21 | 3.5 | $9.94 |

| 2026 | $3.45 | $0.584 | $0.43 | 3.5 | $12.08 |

| 2027 | $3.79 | $0.707 | $0.62 | 3.5 | $13.27 |

| 2028 | $4.33 | $0.902 | $0.83 | 3.5 | $15.16 |

| 2029 | $4.84 | $1.096 | $1.02 | 3.5 | $16.94 |

| 2030 | $5.34 | $1.279 | $1.10 | 3.5 | $18.69 |

24/7 Wall Street compared other fintech/ lenders when deciding on our price-to-sales valuation of 3.5 times for the entire time frame of our analysis. Included in the analysis were Block (NYSE:SQ), PayPal (NASDAQ: PYPL), Upstart Holdings (NASDAQ: UPST), LendingClub (NYSE: LC), and Affirm (NASDAQ: AFRM) which gives us a blending valuation of around 3.3 times sales.

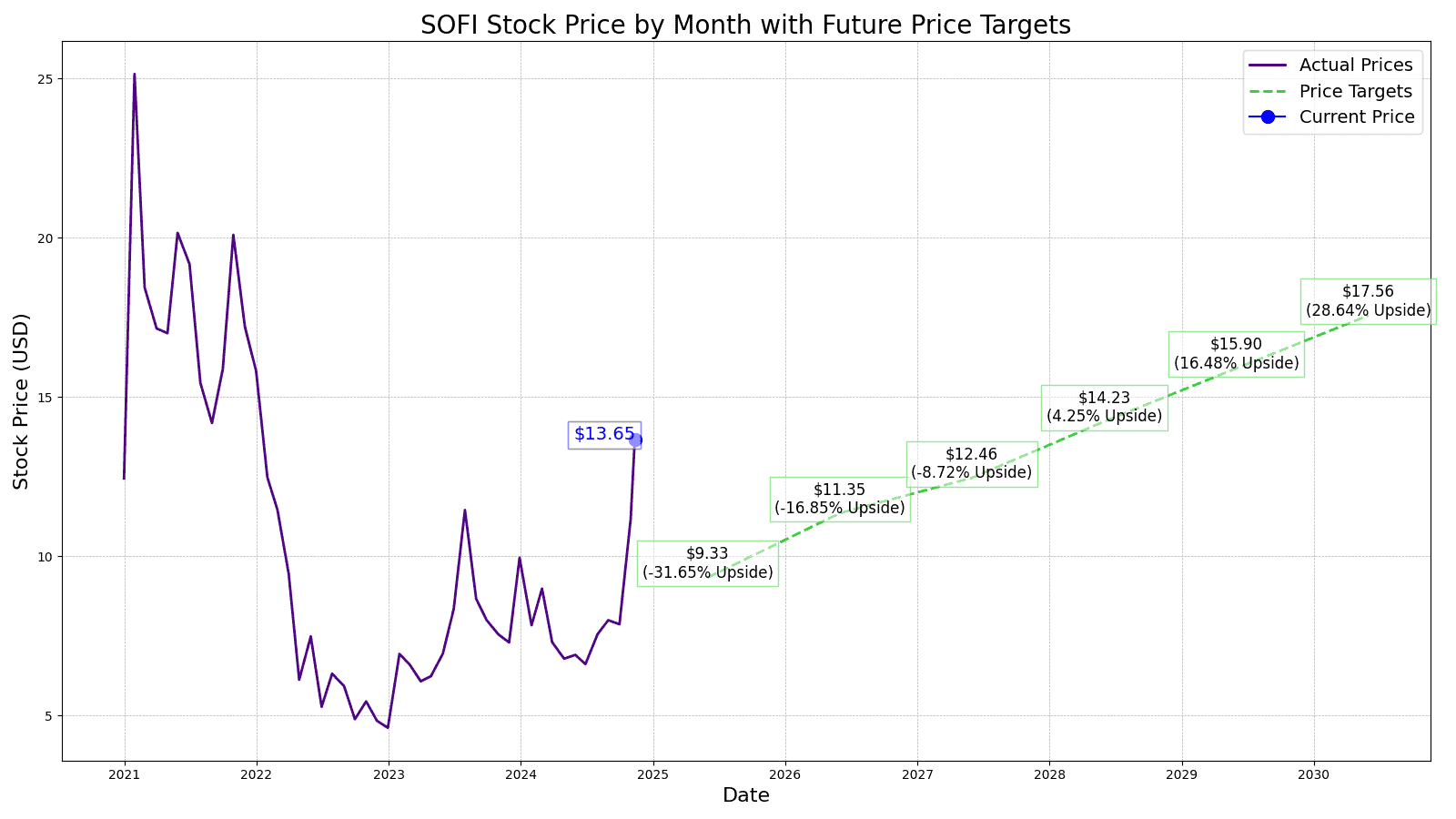

We expect to see revenue growth of 15.3% and EPS of $0.21 for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for SoFi at $9.33 in 2025, which is -32.49% lower than the stock is trading today.

Going into 2026, we estimate the price to be $11.35, with revenue growth coming in at 14.2% year-over-year. With an EPS of $0.43, this would represent a -17.87% loss over today’s share price of $13.82.

Heading into 2027, we expect the stock price increase not to be as pronounced, with earnings estimates of $0.62 per share. The stock price target for the year is $12.46. That is a 9.81% increase from the previous year, but still down -9.84% from today’s stock price.

When predicting more than 3 years out, we expect SoFi to remain growing its top line at 12% and be more efficient, with an EPS of $0.83 suggesting a stock price estimate at $14.23 or a gain of 2.97% over the current stock price.

We expect SoFi to continue its growth and generate $1.02 per share of earnings. With a price-to-earnings multiple of 15, the stock price in 2029 is estimated at $15.9, or a gain of 15.05% over today’s price.

We estimate SoFi’s stock price to be $17.56 per share with a 10% year-over-year revenue growth. Our estimated stock price will be 27.06% higher than the current stock price of $13.82.

| Year | Price Target | % Change From Current Price |

| 2024 | $8.11 | Upside of -41.32% |

| 2025 | $9.33 | Upside of -32.49% |

| 2026 | $11.35 | Upside of -17.87% |

| 2027 | $12.46 | Upside of -9.84% |

| 2028 | $14.23 | Upside of 2.97% |

| 2029 | $15.90 | Upside of 15.05% |

| 2030 | $17.56 | Upside of 27.06% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.