Investing

Traders Are Betting Nvidia Will Smash Earnings Expectations. They're Probably Right

Published:

Earnings season continues, with great anticipation continuing to hover around a few remaining companies yet to release their numbers. Perhaps the most notable (and important) upcoming earnings report will come courtesy of Nvidia (NASDAQ:NVDA), which reports its earnings after market close on Wednesday, November 20.

This earnings report will undoubtedly shed light on the AI chip maker’s performance and progress in dominating this high-growth (and high-margin) market. Most analysts and market participants certainly expect another beat-and-raise quarter, and I’m in this camp as well.

However, the company’s commentary in its upcoming earnings call could be even more important for investors to digest. Having a clearer picture of where demand is likely to come from (and how robust said demand will be) will be crucial to determining where this stock could be headed in the weeks and months to come.

Here’s where Wall Street analysts are pegging Nvidia’s incoming earnings at, and where I think the stock could be headed following these results.

Between November 2022 and 2024, Nvidia’s stock surged nearly 1,000%, driven largely by the surge in interest around artificial intelligence and related stocks. However, Nvidia (like many stocks in the market) has seen even more volatile moves around its earnings reports, often surging or declining in the high single-digits on a given day around the report, depending on what was announced, and how big the beat and raise from the company was.

Indeed, it’s been a long time since Nvidia hasn’t beaten expectations and provided a substantial forward guidance raise. The consensus is that this will certainly be the case in this report.

Accordingly, it should be no surprise that analysts have been quick to update their target prices ahead of this upcoming earnings report. On Monday, Melius Research raised its price target on Nvidia stock to $185 per share, calling Nvidia a “once-in-a-lifetime opportunity” due to early-stage AI growth. Analyst Ben Reitzes highlighted Nvidia’s upcoming Blackwell chip and projected a 24% rise in data center spending by major AI investors like Microsoft and Amazon, reaching $282 billion in 2025. Despite a recent dip in the company’s share price at the time of writing, this is a stock that’s clearly got longer-term momentum behind it.

Additionally, Piper Sandler’s Harsh Kumar raised Nvidia’s price target to $175, maintaining an overweight rating and naming it a top large-cap pick. He cited Nvidia’s AI accelerator dominance and upcoming Blackwell launch, calling it a “must-own” stock. Kumar noted Nvidia is well-positioned to dominate the growing AI accelerator market in 2025. I tend to agree.

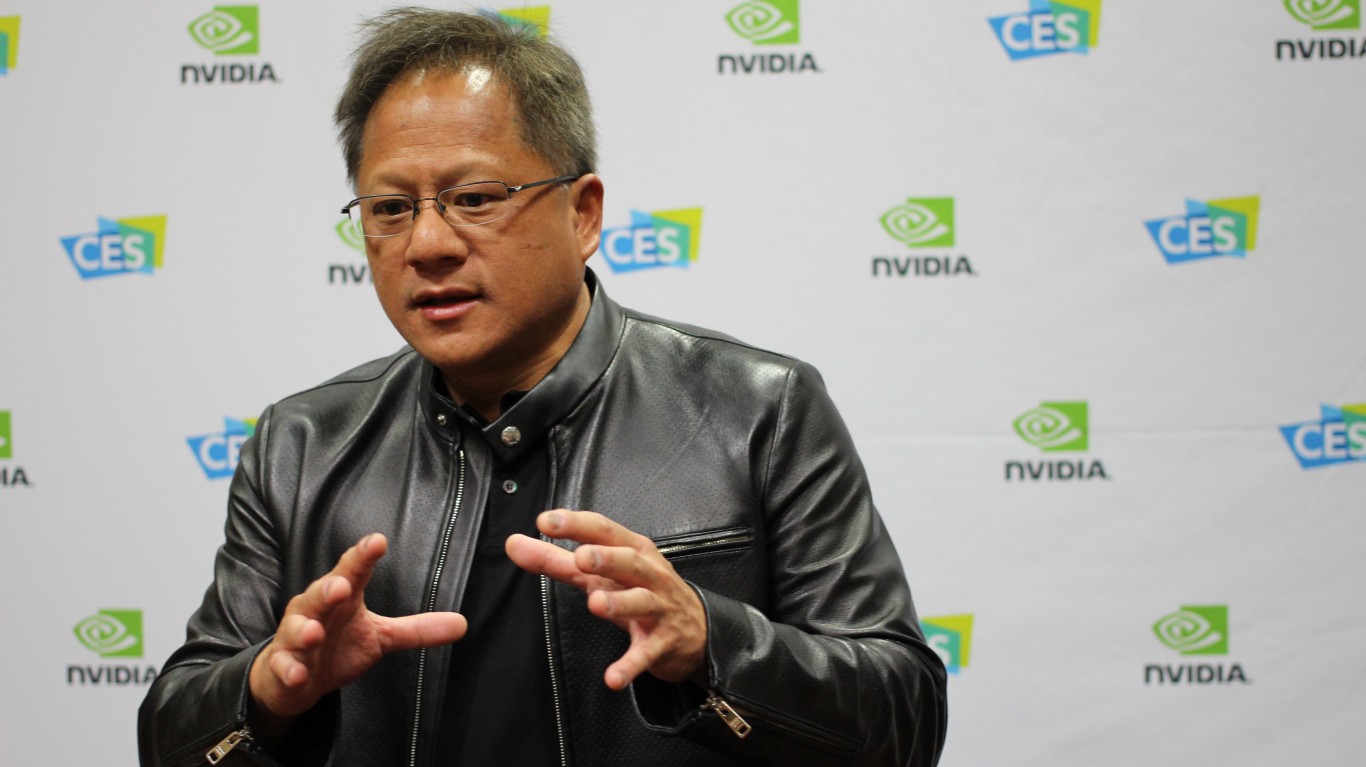

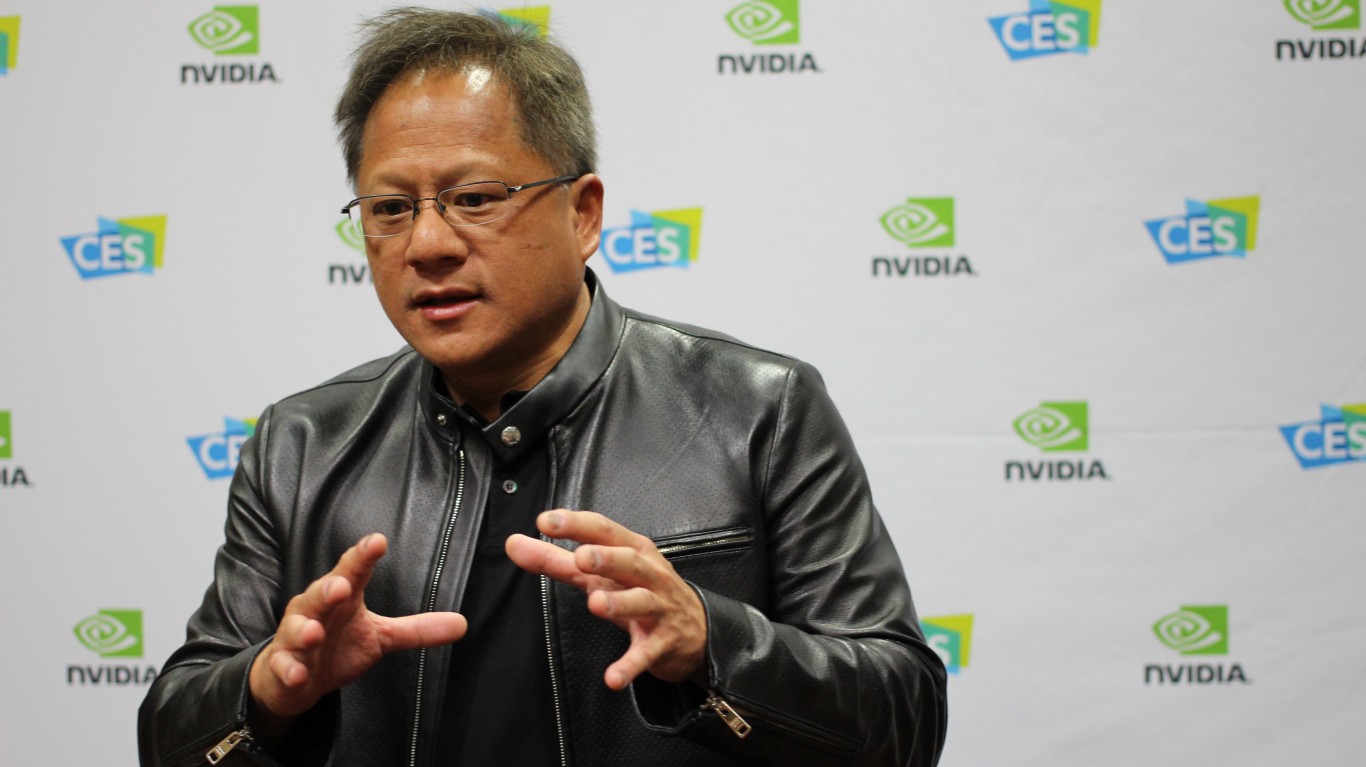

Investors are expected to focus less on Nvidia’s Q3 results and more on future guidance, especially guidance around the company’s ongoing Blackwell GPU launch. Nvidia’s CEO Jensen Huang has called demand for the company’s Blackwell chips “insane,” and most market predictions are that these chips will likely be sold out for a year or more. However, there are some potential complications, with reports of these chips overheating, and a reallocation of chips tied to Super Micro, potentially putting a wrench in this story. We’ll have to see how the company deals with these potential headwinds in its earnings call.

That said, it’s clear that Nvidia’s broader growth prospects remain robust. Analysts at PwC predict the global AI market could reach $15.7 trillion, with Nvidia poised to benefit in a disproportionate way from this growth. In terms of companies that are monetizing the AI trend well, and turning revenue growth into earnings growth, there really is no better option in the market right now.

If Nvidia can continue to raise its forward guidance, and see its triple-digit revenue and earnings growth rate accelerate this quarter, all bets are off with respect to how high this stock could head from here. Analysts and market participants will also be paying close attention to the company’s reported gross margins, which should come in above 70%. That will be a key figure I’ll be paying attention to during the report.

Recent revenue hit $30 billion, surpassing its annual total from a few years ago. While Q3 fiscal 2025 guidance projects slower double-digit growth to $32.5 billion, this reflects challenging comparisons after Nvidia’s 2,600% stock surge over five years. I think the company will blow expectations out of the water once again, but we’ll see.

In any case, this upcoming earnings report from Nvidia will be pivotal. This company really represents the health of the broader AI trade, so if some steam is lost, I’d expect most companies benefiting from AI tailwinds to take a hit as well. The bar is undoubtedly set high, so while I won’t make predictions around where the numbers will come in exactly, I do think there’s ultimately a whisper number out there that’s higher than the company’s previous guidance that will have to be beat, and by a wide margin, for Nvidia’s share price to rise substantially.

The thing is, the company has pretty consistently blown expectations out of the water, so the safer bet is likely that this stock heads higher into Thursday’s session. We’ll see. But one thing’s for sure – most investors I know will be paying close attention to this report, and you probably should be too.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.