Cardano (ADA-USD) is among the top-performing cryptocurrencies in the market, at least in recent weeks. This top proof-of-stake blockchain project remains a top-10 project by market capitalization in the crypto sector, and has surged an impressive 110% over the past month alone. The most significant chunk of this move has unsurprisingly taken place following the recent shift in Washington (more on that later). But over the past year, this token’s gains have certainly raised eyebrows, and the question is whether another doubling could be ahead on the horizon.

At this point in time, I do think it’s entirely possible Cardano could double again from here. Indeed, when one looks at the outsized moves other more volatile tokens have made (even over the past few weeks), such a move doesn’t appear to be wishful thinking at all.

Development on the blockchain could see significant growth, if we do have an influx of capital and investor/user interest in blockchain-based applications. Right now, many investors are viewing projects like Cardano from an investment angle, but there’s also interesting use-case dynamics to consider as well. As a top Ethereum competitor, a rising tide should lift Cardano’s boat to a significant degree, as this project touts some of the most advanced blockchain technology in the crypto sector.

Let’s dive into the bull case behind what could lead to a doubling of Cardano’s valuation over the course of the next year.

Key Points About This Article:

- Cardano is among the top crypto projects with the most momentum right now, driven by various political tailwinds.

- Such tailwinds could propel this top crypto to another doubling on the horizon, if the stars align.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Traders Are Riding Political Coattails

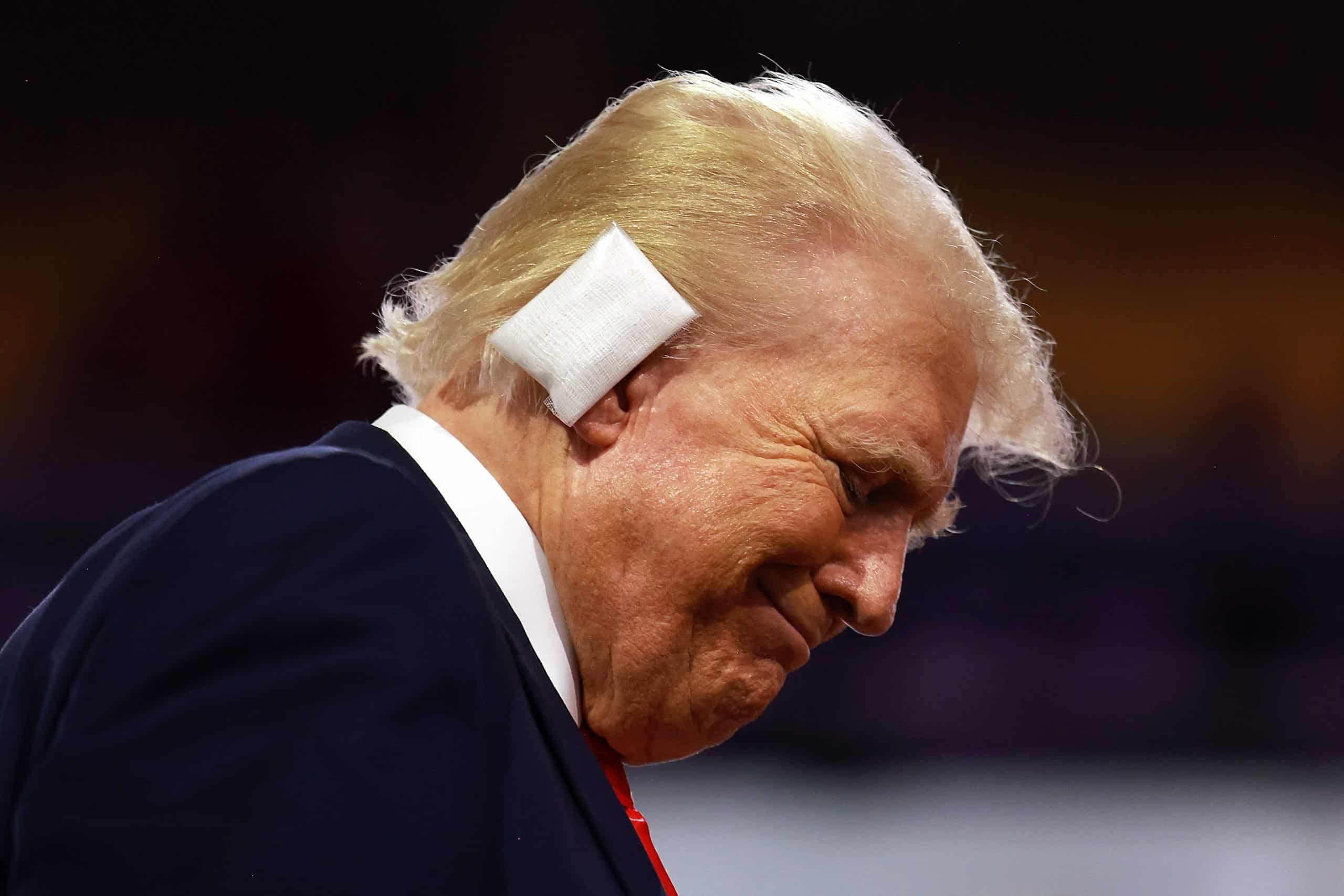

Cardano jumped 30% on Nov. 10 following the re-election of Donald Trump to the presidency. This move wasn’t contained to Cardano – most other cryptocurrencies saw similar rises in the days following the election results. However, there are specific reasons why Cardano saw a bigger surge than other top-tier tokens over the past few weeks, and these reasons have everything to do with politics.

Cardano founder Charles Hoskinson is among the leading minds in the crypto sector, and is one of the more prominent figures investors look to for commentary on where blockchain technology is headed. Indeed, any founder of a top-10 crypto project is going to get such attention. So, when someone like Charles Hoskinson is rumored to play a big role in shaping crypto policy in Washington, investors take note.

Undoubtedly, Trump and his team will need some big brain power behind any sort of reforms the administration pushes through on the crypto front. Someone like Charles Hoskinson will certainly help the administration on this front, and will also have quite the incentive to push for regulatory changes that would benefit Cardano (and other similar projects) to a significant degree. Just what will be announced remains to be seen, but I wouldn’t be surprised to see Cardano added to a list of approved assets put forward by the SEC (when the chairman role shifts), and investors have clearly already priced in such an outcome moving forward.

In a recent podcast, Hoskinson revealed Input Output would open a Washington office to support policy development and expressed hopes to contribute directly once Trump takes office. That’s enough of a reason for many investors to re-consider their portfolio weighting to this particular asset. In my view, Cardano should be a big winner from this regime change in Washington, and a doubling over the coming year is a move I certainly wouldn’t rule out.

Big Moves, Big Momentum

With Cardano’s recent move, it may not be surprising to many investors to learn that this token’s RSI hit overbought levels. While such a move does signal many in the market may potentially be taking profits, it also signals that there’s extreme momentum behind Cardano right now. Assuming there’s some sort of period of consolidation on the horizon, it’s entirely possible that subsequent surges (potentially into overbought territory once again) could propel a sustained rally in this token. Indeed, we’ve seen how volatile the crypto sector can be, and how overbought such tokens can look for extended periods of time.

But it’s also true that this extreme near-term momentum could spell a period of potential volatility to the downside as well. Risks are heightened when it comes to Cardano (and most digital assets) right now, and that’s something investors will need to contend with. However, many experts have likened Cardano’s current trend to its 2020 bull run, which saw the token surge 4,000% (yup, a 40x return) over a very short period of time. And while such a surge may certainly not be in the cards this time around (given Cardano’s rather high market capitalization of nearly $26 billion), momentum can do wonders for this sector, as we’ve seen historically.

These political tailwinds could last for some time, but I’d be cautious over the near-term. In my view, paying attention to technical indicators when it comes to trading these particular digital assets is much more important than other assets (such as equities) which can be valued on the basis of future cash flows.

Cardano Looks Like a Buy

If I were a speculator (which I’m not), Cardano would certainly be an asset I’d be interested right now. At this point in the cycle, Cardano’s momentum does appear to be real, and this project does appear to have all the makings of a top-tier holding in the crypto world.

For those betting on a sustained Trump rally, this could be a token worth holding through year end, with a target of around $1.50 per token. Trading sub-$0.75 at the time of writing, that’s where I’d start looking to take profits if I were long this particular asset right now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.