Investing

Passive Income Investors Will Love this Safe ETF For the Yield and Value

Published:

In February, Los Angeles-based investment manager Capital Group will mark three years since it launched its first actively managed transparent ETFs.

“Our suite of six ETFs represents the hallmark of our investing, including three growth strategies offering varying degrees of domestic and international exposure, a core US equity fund, and a US equity fund that emphasizes income. ” shared Holly Framsted, director of ETFs for Capital Group.

One of the six launched was the Capital Group Dividend Value ETF (NYSEARCA:CGDV). It’s been a big hit, with both dividend and value investors amassing $11.9 billion in 33 months.

If you’re into passive income, CGDV ought to be on your holiday wish list. Here are three reasons why I feel this way.

According to the ETF’s website, the fund “Seeks to produce consistent income that exceeds the average yield of the S&P 500 by focusing on companies that pay dividends or have the potential to pay dividends.”

It invests in dividend-paying common stocks of larger, established U.S. companies with market caps of $4.0 billion. It can also invest up to 10% of its net assets in mid- and large-cap stocks outside the U.S.

With the S&P 500 yield around 1.2%, the lowest since the 2008-2009 financial crises, that’s not too high a bar. There are approximately 288 stocks in the index with a yield of over 1.2%.

CGDV is attractive because it combines dividend income with capital appreciation generated from buying stocks at attractive prices, giving you value for your money.

The five portfolio managers who manage the fund all have at least 23 years of service with Capital Group and an average of 29. Not every industry does well with older, more experienced employees. Active investment is one where gray hairs are a good thing.

CGDV has 51 stocks invested in its net assets, with the top 10 holdings accounting for 39% of the portfolio. Cash is included in the top 10, with a weighting of 3.19%. The remaining 41 stocks account for about 57.81% of the portfolio, so the smallest weight of its holdings is 0.48% for TFI International (NYSE:TFII), a prominent Canadian trucking company growing by buying smaller firms.

It’s much easier to be a value investor with a focused portfolio like CGDV.

For example, according to Morningstar, its current P/E ratio is 17.70, about 17% lower than the ratio for the SPDR S&P 500 ETF Trust (NYSEARCA:SPY). Across the board, whether we’re talking price-to-sales, price-to-book, or price-to-cash flow, it’s considerably less.

Of the top 10 holdings, only three in SPY are also in CGDV: Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Meta Platforms (NASDAQ:META). CGDV’s top three sectors by weight are industrials (21.0%), technology (15.2%), and health care (14.4%). The weights for these three sectors in SPY are 8.5%, 31.8%, and 10.5%, respectively.

With active management, it can go where the value is, rather than holding nearly a third of the portfolio in overpriced tech stocks. CGDV’s holdings might have slightly lower sales and earnings growth, but it gladly gives that up to avoid overweighting in a sector ready for a correction.

Regarding company size, 75% of the holdings in CGDV are large caps, compared to 82% for SPY. Value stocks in the ETF account for 44% of the net assets (36% large cap and 8% mid-cap), compared to 28% for SPY.

While you can argue that value has been a losing proposition for the past three decades, veteran financial newsletter writer Mark Hulbert argued in July that there is a better time to give up on value investing.

Reversion to the historical mean is just around the corner.

The ETF’s 30-day SEC yield is 1.86%, 74 basis points higher than SPY. Its total return over the past year is virtually identical to SPY at 31.06%, 69 basis points less than the passive S&P 500 ETF. The only reason for the difference is that CGDV has a management expense ratio of 0.33%, which is 24 basis points higher than SPY. Otherwise, they’re tied.

While the S&P 500 may continue to deliver double-digit annual returns over the next few years, reversion to the mean may dampen the index’s performance. This provides value investors with a genuine opportunity to outperform growth for the first time in a very long time.

The portfolio managers that Capital Group have assembled for CGDV should enable the ETF to take advantage of any crack in the growth story in 2025 and beyond. If you’re not one to mindlessly follow the herd, CGDV is the perfect ETF to gain exposure to both income and value.

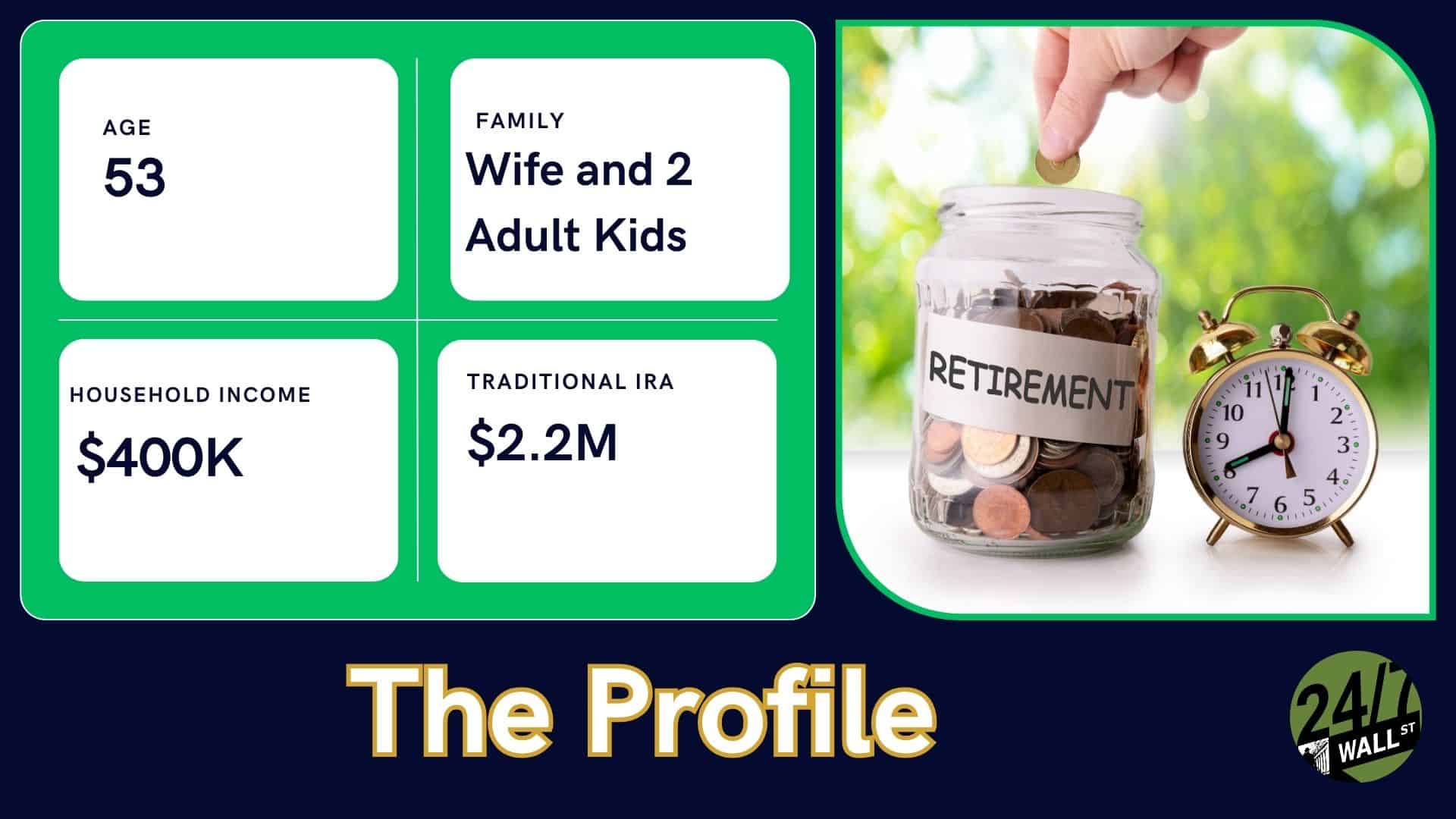

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.