Investing

NIO (NIO) Stock Price Prediction and Forecast 2025-2030

Published:

Last Updated:

NIO (NYSE:NIO) is one of the hottest EV car companies in the world and a top 10 largest in the world (3rd largest in China). NIO stock made its debut on the New York Stock Exchange on September 12th, 2018, at $6.26 per share.

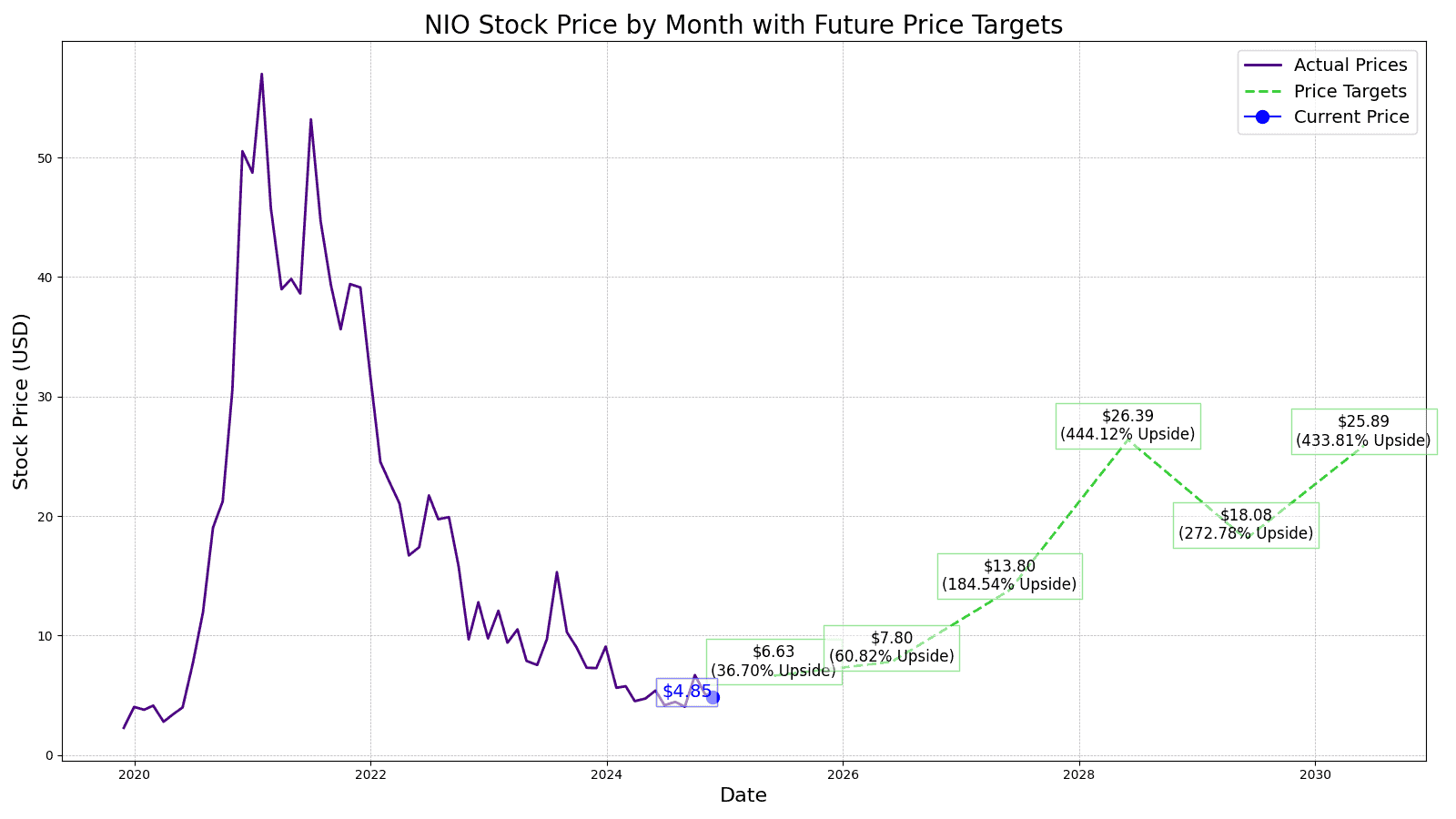

Within 3 years of trading, NIO stock hit an all-time high of $62.84 in February 2021 before plummeting 92.28% to today’s price of $4.85 per share.

While the share price run-up in early 2020 was purely a momentum push, NIO brand in the EV market was not tarnished. In fact, the car company is still seen as a premium EV player and one of the first companies to address range anxiety issues by creating battery swap technology as a supplement to charging.

24/7 Wall Street aims to provide readers with our assumptions about the stock’s prospects going forward, what growth we see in NIO stock for the next several years, and what our best estimates are for NIO’s stock price each year through 2030.

11/22/2024

NIO’s shares increased 2.6% today, trading as high as $4.84.

11/21/2024

NIO delivered 61,855 total vehicles during the third quarter. This represents an 11.6% increase compared to the same period in 2023 and a 7.8% from the previous quarter. The majority of deliveries (61,023 vehicles) came from NIO’s premium smart electric vehicle brand. In addition, the company delivered 832 vehicles from its ONVO brand.

11/20/2024

Macquarie has downgraded NIO from “Outperform” to “Neutral”, citing concerns over weaker demand and production ramp-up issues. The firm has also significantly reduced its price target to $4.80, reflecting a 27% decrease.

11/19/2024

NIO is set to release its third-quarter earnings report tomorrow before the market opens. Wall Street analysts anticipate a 1.5% year-over-year increase in revenue to $2.65 billion, coupled with an adjusted loss of $0.31 per share.

11/18/2024

NIO is scheduled to release its third-quarter earnings report this Wednesday. The company’s stock is facing bearish pressure, sitting below key moving averages like the 8-day, 20-day, and 50-day SMAs. However, recent buying interest suggests a potentially bullish reversal if earnings exceed expectations. Analysts predict NIO to report a $2.53 revenue and an EPS loss of 30 cents per share for the third quarter.

11/15/2024

NIO’s stock price dipped slightly today, in part due to ongoing investor worries about challenges facing Chinese electric vehicle companies in the U.S. market, particularly due to potential tariff increases.

11/14/2024

NIO’s CFO, Stanly Qu, says that the company now has over 150 battery swap stations in Shanghai. These stations do over 100 services a day, although they only need 60 to 70 to break even each day. A single battery swap station can provide 480 services each day as well.

11/12/20-24

NIO’s sub-brand, Onvo, experienced a major decline in sales this past week. Compared to the previous week’s 1,300 units, sales dropped by 37% to 820 units.

11/11/2024

The Swiss National Bank significantly reduced its investment in NIO during the third quarter. The bank’s stake in the company decreased by 67%, as revealed in a recent regulatory filing.

11/8/2024

NIO’s stock price fell by 4.7% today, reaching a low of $5.02. Trading volume was also significantly lower than average.

The following is a table of NIO’s revenues, operating income, and share price for the first few years as a public company.

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Share Price (End of Year) |

Revenues (CNY) | Operating Income | |

| 2018 | $5.39 | 4,951.2 | (9,595.6) |

| 2019 | $3.45 | 7,824.9 | (11,079.2) |

| 2020 | $40.00 | 16,257.9 | (4,607.6) |

| 2021 | $16.70 | 36,136.4 | (4,496.3) |

| 2022 | $7.87 | 49,268.6 | (15,640.7) |

| 2023 | $4.71 | 55,617.9 | (22,655.2) |

Revenue and operating income in Billion CNY (1CNY=.14 USD)

Now let’s take a look at Rivian (NASDAQ:RIVN) the first few years it was a publicly traded company (here is Rivian’s stock price forecast):

| Share Price (End of Year) |

Revenues | Operating Income | |

| 2021 | $50.24 | $55.0 | ($4,220.0) |

| 2022 | $19.30 | $1,658.0 | ($6,856.0) |

| 2023 | $10.70 | $4,434.0 | ($5,739.0) |

| TTM | $15.35 | $4,997.0 | (5,790.0) |

The revenue growth for both firms is similar but Rivian’s operating loss is more than double the yearly operating loss of NIO.

NIO formerly contracted its manufacturing to Jianghuai Automobile Group, paying a fee for each vehicle produced in addition to fixed cost. They have since acquired the factory from JAC. This agreement is beneficial for a young start-up in a very capital-intensive market. However, when scale is reached, the variable cost model has its downsides.

| Year | Revenue | Shares Outstanding | P/S Est. |

| 2025 | 97,052 | 2,050 mm | 1x |

| 2026 | 114,172 | 2,050 mm | 1x |

| 2027 | 134,643 | 2,050 mm | 1.5x |

| 2028 | 257,634 | 2,050 mm | 1.5x |

| 2029 | 176,533 | 2,050 mm | 1.5x |

| 2030 | 189,548 | 2,050 mm | 2x |

Revenue in CYN millions

Compared to Rivian and Tesla, NIO’s price-to-sales valuation will be moderately discounted. While NIO is in solid financial standing and has a premium brand image, it’s still uncertain how much competition the company will face in China and expanding overseas. The company is already spending a quarter of revenues on R&D and if NIO can’t capitalize on this spend, the stock price will be sluggish compared to North American EV manufacturers.

Wall Street analysts have NIO’s stock price over the next year to be $6.94 which gives the stock a 43.09% upside over today’s price of $4.85. Of the 26 analysts covering the stock, the consensus recommendation is a 2.07 ‘Outperform’ Score.

We expect to see a revenue growth of 60% for 2025, with a price-to-sales multiple of 1x, which puts our price target at $6.63, an upside of 36.70%.

Going into 2026, we estimate the price to be $7.80, with another strong 50%+ revenue bump. However, with EBITDA still well in the negative, we see the market not rewarding the stock as much and giving it a lower valuation multiple, resulting in an upside of 60.82%.

Heading into 2027, we expect the stock price increase to leap forward to $13.80 with another strong 50%+ revenue growth year-over-year. That is a 97% year-over-year gain and up 184.54% from today’s stock price.

When predicting more than 3 years out, we expect NIO’s P/S ratio in 2028 to be 1.5x and top-line growth of 50%. In 2028, we have NIO’s revenue coming in around $36 billion, suggesting a stock price estimate at $26.39 or a gain of 444.12% over the current stock price.

24/7 Wall Street expects NIO’s stock to continue its revenue growth and to generate $25 billion in revenue. The stock price in 2029 is estimated at $18.08, or a gain of 272.78% over today’s price.

We estimate NIO’s stock price to be $25.89 per share. Our estimated stock price will be 433.81% higher than the current stock price.

| Year | Price Target | % Change From Current Price |

| 2024 | $6.94 | Upside of 43.09% |

| 2025 | $6.63 | Upside of 36.70% |

| 2026 | $7.80 | Upside of 60.82% |

| 2027 | $13.80 | Upside of 184.54% |

| 2028 | $26.39 | Upside of 444.12% |

| 2029 | $18.08 | Upside of 272.78% |

| 2030 | $25.89 | Upside of 433.81% |

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.