Investing

SoFi Technologies (SOFI) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

SoFi Technologies (NASDAQ: SOFI) made its public debut on June 1, 2021, through a merger with a special purpose acquisition company (SPAC), Social Capital Hedsophia Holding Corp. V, led by Chamath Palihapitiya. Before the merger, the company was originally known as Social Finance, which started as a student loan financing firm before expanding into loans, and mortgage products among other finance products.

After the SPAC acquisition, SoFi was equipped with substantial capital to enhance its technology stack to better scale its 2020 acquisition of Galileo. The Galileo platform was developed to deploy a wide range of financial services quickly, giving SoFi the tools to take numerous financial products to a mass market.

SoFi IPO’d at $10 per share and quickly jumped 150%, but the stock has been lackluster since, now trading at $15.91 per share, down 38.29%.

However, investors only care about what happens from this point on, particularly over the next 1, 3, and 5 years and beyond. Let’s crunch the numbers and give you our best guess on SoFi’s future share price. No one has a crystal ball and even the Wall Street “experts” are often wrong more than they are right in predicting future stock prices. But we give you our revenue and earnings projections as our peer-to-peer valuation.

12/3/2024

SoFi experienced a slight decline of 0.4% during mid-day trading today, dipping to a low of $15.83.

11/26/2024

SoFi saw a slight increase of 0.1% in its share price today, reaching a high of $15.84. Trading volume was much lower than average, however, with only 9.3 million shares exchanging hands (an 80% decrease from the usual daily volume).

11/25/2024

SoFi’s stocks continue to rise, closing 0.64% higher today after a 14% gain over the past six trading sessions.

11/22/2024

SoFi has introduced new options contracts for February 2025. These new contracts offer a longer time frame for potential options traders.

11/21/2024

Wall Street has recently shown bullish interest in SoFi. Out of 33 unusual trades, 54% were bullish calls, with a total value of $4.35 million. In contrast, only 39% were bearish puts, valued at $184,500.

11/20/2024

SoFi’s stock price increased following Mizuho’s upgraded price target. Today shares were trading up 1.2% and as high as $14.89, reaching a new 52-week high for the company.

11/19/2024

The Mizuho Financial Group has raised its price target for SoFi from $14 to $16, leading to a rise of 3% in today’s shares.

11/18/2024

SoFi is seeing significant options trading activity today, with 278,208 options contracts traded so far. This represents 27.8 million shares of SoFi stock, equivalent to the stock’s average daily trading volume over the past month. The $14 call option expiring on November 22nd has been particularly active, with 17,563 contracts traded, representing 1.8 million shares.

11/15/2024

SoFi’s stock declined slightly today, trading as low as $13.08. Trading volume was also lower than average.

11/14/2024

SoFi has announced that the company’s CFO, Chris Lapointe, will participate in a fireside chat discussion during the upcoming UBS Global Technology and AI Conference on December 3rd.

Here’s a table summarizing performance in share price, revenue, and profits (net income) from IPO.

| Share Price | Revenue | Net Income | |

| 2021 | $12.50 | $977.3 | ($483.9) |

| 2022 | $15.81 | $1,519.2 | ($320.4) |

| 2023 | $4.62 | $2,067.8 | ($300.7) |

| 2024 LTM | $8.22 | $2,343.5 | ($113.3) |

*Revenue and Net Income in millions

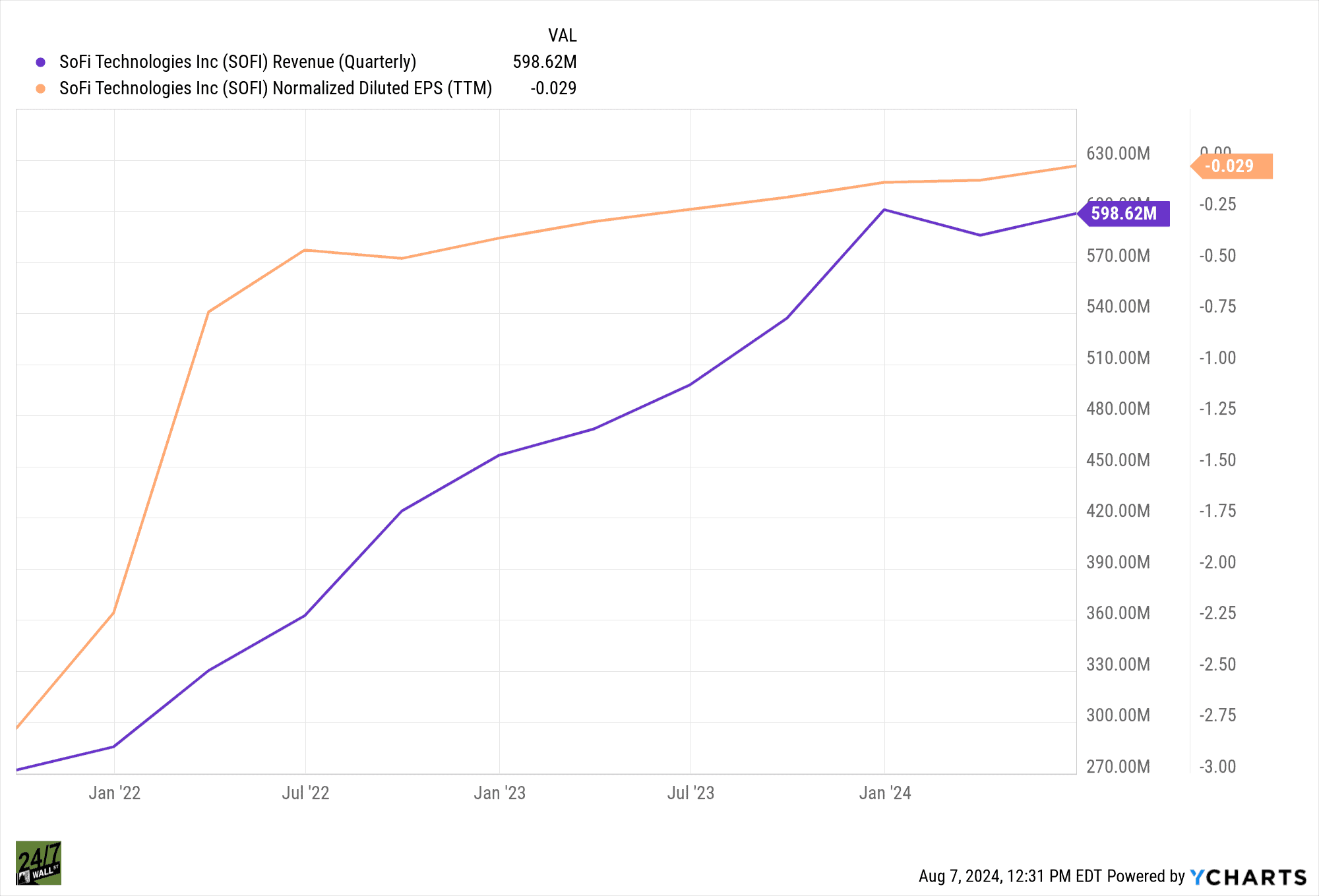

In the last 4 years, SoFi has more than doubled revenue but that top-line growth also carried a jump in total operating costs, particularly the $720 million in sales and marketing expense in 2023. However, the increases in operating costs are money well spent with in-house technology improvements and member-generating marketing spending.

SoFi is close to hitting an inflection point in profitability and has done a stellar job of expanding revenue and improving earnings per share (EPS).

As SoFi’s revenue grows, it becomes more profitable, meaning its costs per customer decrease. This scalability is important because it indicates that as the company grows, it will become even more profitable. Given that the industry is growing and SoFi is outperforming its peers, there’s strong optimism that SoFi’s earnings per share will continue to rise.

The Wall Street consensus 1-year price target for SoFi Technologies is $9.00, which is a -43.43% downside over today’s stock price. Of the 15 analysts covering the stock, the stock is a consensus “Hold” with a 2.88 rating. (1 being a “Strong Buy” and 5 a “Strong Sell”).

| Year | Est. Revenue ($B) | Est. Net Income ($B) | Est. EPS Normalized | Price to Sales Multiple | Est. Market Cap ($B) |

| 2024 | $2.47 | $0.164 | $0.08 | 3.5 | $8.64 |

| 2025 | $2.84 | $0.32 | $0.21 | 3.5 | $9.94 |

| 2026 | $3.45 | $0.584 | $0.43 | 3.5 | $12.08 |

| 2027 | $3.79 | $0.707 | $0.62 | 3.5 | $13.27 |

| 2028 | $4.33 | $0.902 | $0.83 | 3.5 | $15.16 |

| 2029 | $4.84 | $1.096 | $1.02 | 3.5 | $16.94 |

| 2030 | $5.34 | $1.279 | $1.10 | 3.5 | $18.69 |

24/7 Wall Street compared other fintech/ lenders when deciding on our price-to-sales valuation of 3.5 times for the entire time frame of our analysis. Included in the analysis were Block (NYSE:SQ), PayPal (NASDAQ: PYPL), Upstart Holdings (NASDAQ: UPST), LendingClub (NYSE: LC), and Affirm (NASDAQ: AFRM) which gives us a blending valuation of around 3.3 times sales.

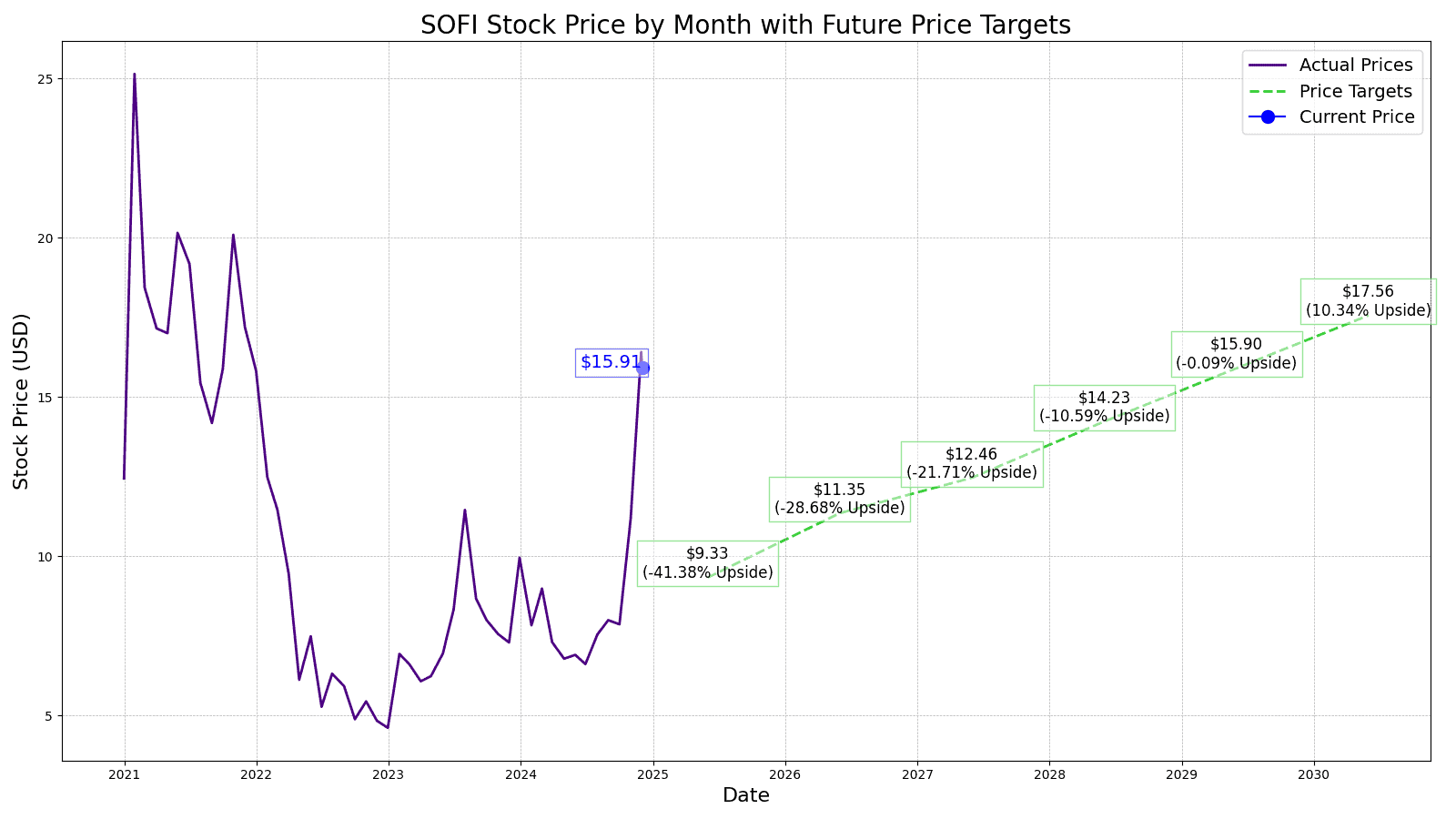

We expect to see revenue growth of 15.3% and EPS of $0.21 for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for SoFi at $9.33 in 2025, which is -41.36% higher than the stock is trading today.

Going into 2026, we estimate the price to be $11.35, with revenue growth coming in at 14.2% year-over-year. With an EPS of $0.43, this would represent a -28.66% loss over today’s share price of $15.91.

Heading into 2027, we expect the stock price increase not to be as pronounced, with earnings estimates of $0.62 per share. The stock price target for the year is $12.46. That is a 9.81% increase from the previous year, but still down -21.68% from today’s stock price.

When predicting more than 3 years out, we expect SoFi to remain growing its top line at 12% and be more efficient, with an EPS of $0.83 suggesting a stock price estimate at $14.23 or a loss of -10.56% under the current stock price.

We expect SoFi to continue its growth and generate $1.02 per share of earnings. With a price-to-earnings multiple of 15, the stock price in 2029 is estimated at $15.9, or a gain of -0.06% under today’s price.

We estimate SoFi’s stock price to be $17.56 per share with a 10% year-over-year revenue growth. Our estimated stock price will be 10.37% higher than the current stock price of $15.91.

| Year | Price Target | % Change From Current Price |

| 2024 | $8.11 | Upside of -49.03% |

| 2025 | $9.33 | Upside of -41.36% |

| 2026 | $11.35 | Upside of -28.66% |

| 2027 | $12.46 | Upside of -21.68% |

| 2028 | $14.23 | Upside of -10.56% |

| 2029 | $15.90 | Upside of -0.06% |

| 2030 | $17.56 | Upside of 10.37% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.