Investing

Retirees: The Only 3 ETFs You Need to Own for Passive Income and Growth in Your Golden Years

Published:

We’re all hopefully going to age into retirement. And as we continue to invest our money toward our golden years, many investors may wonder – what’s the best path toward the kind of wealth-building journey that will make these years the most memorable and enjoyable?

That’s of course a nearly impossible question to answer, given that every investor is unique. But there are a few exchange-traded funds (ETFs) I think do hit on many of the key principles long-term investors focus on, making them great vehicles for compounding and wealth creation over a long period of time.

The three funds I’m going to discuss in this article each provide income to retirees, though to different degrees. I’m going to cover one sector-specific ETF, one index ETF, and one yield-focused ETF to try to paint the picture that it’s possible to create meaningful dividend income over time, while also remaining highly diversified (and even tilt one’s concentration to specific sectors that can amplify yield over the long-term).

If I were going to structure a dividend-producing portfolio, I’d probably start with these three ETFs. I say that because that’s exactly what I’ve done – these three funds are staples of my investing strategy right now.

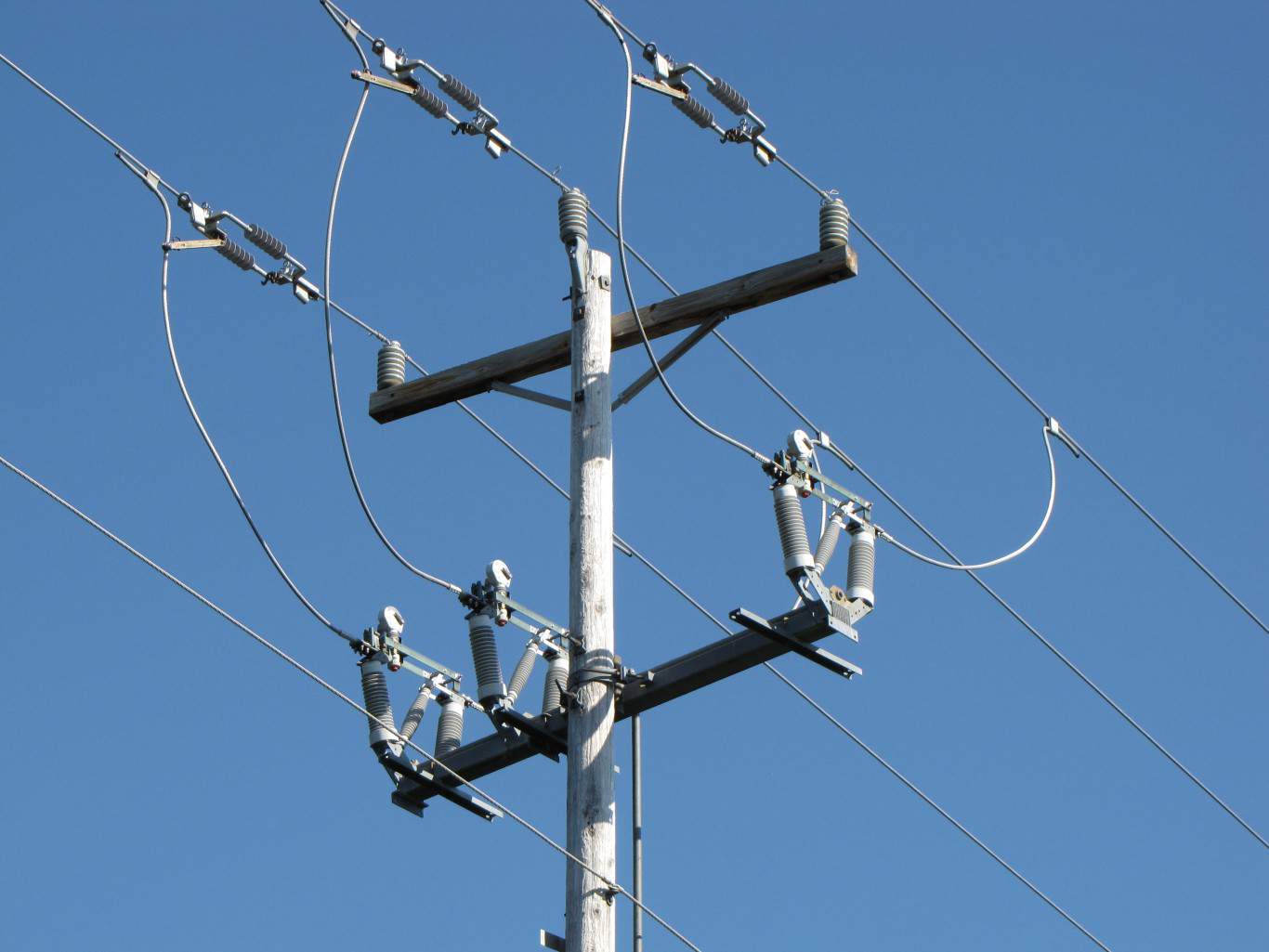

The Vanguard Utilities ETF (VPU) was launched in 2004 and is among the most popular exchange-traded funds for institutional and retail investors looking to gain low-cost exposure to the utilities space. It’s an ETF I own personally, and one I think is worth holding onto over the long-term. I’ve seen some interesting statistics that the utilities sector has actually outperformed the S&P 500 over the past two decades, so this is clearly a sector that’s worth overweighting in a portfolio. At least, that’s my take on it, and apparently many large money managers agree.

This ETF tracks the MSCI US Investable Market Utilities 25/50 Index, covering large-, mid-, and small-cap U.S. utility companies. With a clearly-stated focus on utility companies, this ETF is ideal for retirement portfolios due to stable demand and regulated pricing. In downturns, this ETF has outperformed the market, gaining 4.4% in 2018 and 1.1% in 2022. Thus, for those who see recessionary forces on the horizon, this is a top option I’d pick as a way to ramp up defensive exposure right now.

On the growth front, there are also a number of key drivers that have taken this ETF higher. Electricity demand is expected to surge much faster than previously thought due to the rise of AI and the energy needs of companies looking to break into this space. If we do see this growth materialize, utility companies will continue investing to earn higher returns for investors, which should be passed through in the form of higher dividends (which will be worth more in a lower rate environment) and share buybacks.

Overall, this is a top ETF I think long-term investors should own, and that goes double for any pullbacks we may see moving forward.

For investors seeking more broad market exposure, the Vanguard S&P 500 ETF (VOO) would be a top option I’d encourage investors to consider. The VPU ETF tracks the S&P 500 by holding its full portfolio of listed equities. Reflecting the performance of 500 top U.S. companies, this ETF provides precise market returns for investors. So, for those who don’t want to go through the hassle and brain damage of picking stocks (and watching them drop during specific periods), owning the market can be a great option.

In my view, passive investing is the way to go for 90% of the population. This ETF, and others that track broader indices, provide the kind of “sleep at night” exposure most readers may be after. Even if you’re an active stock picker, holding a good chunk of VOO (or another similar index) can reduce idiosyncratic risk and allow for more peace of mind. That alone may be worth it.

And over the long run, this fund has averaged an impressive 10.26% average annual return since 1957. So, investors won’t bemoan periods of massive declines as much when they think about the long-term picture of the stock market as a compounding machine.

Providing broad diversification by tracking the S&P 500, this is the low-cost ETF I’d encourage most investors looking for U.S. equity exposure to consider.

For those entering or nearing retirement, passive income streams may be a greater priority than growth. That makes sense, and it’s one of the main reasons why the Schwab U.S. Dividend Equity ETF (SCHD) holds $66.9 billion in assets. This fund, as its name suggests, holds a diversified dividend stock portfolio which is offered with a rock-bottom MER, making SCHD a top choice for long-term investors.

Notably, SCHD recently completed a 3-for-1 share split on October 10th. So, investors can gain exposure to this fund with a smaller up-front investment, something that can help beginner investors get started. I personally like these splits for this reason, though they don’t have any material impact for stocks from a fundamental perspective (and there’s certainly much less of a hype-driven bump for ETFs).

SCHD tracks the Dow Jones U.S. Dividend 100 Index, focusing on dividend quality and financial strength. Like the other ETFs on this list, SCHD has seen impressive growth in recent years, with more of its total returns coming from dividends than capital appreciation, but with the fund seeing very similar returns to the overall market.

For those looking to go overweight dividend stocks, this would be a top option I’d encourage investors to consider.

| ETF | Ticker Symbol | 5-Year Annualized Returns (%) |

|---|---|---|

| Vanguard Utilities ETF | VPU | +8.49% |

| Vanguard S&P 500 ETF | VOO | +15.70% |

| Schwab U.S. Dividend Equity ETF | SCHD | +12.70% |

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.