Investing

Marvell Is Still Overlooked And Could Surge Much Higher Over the Next Year

Published:

Most of the discussion in the market around AI stocks right now is centered on top chip stocks, and for good reason. Whether it’s Nvidia (NASDAQ:NVDA), AMD (NASDAQ:AMD) or another AI-related play, investors clearly want as much exposure to the growth artificial intelligence technology will provide, and chip makers are among the top ways investors are playing this trend.

That makes sense, as picking winners with any revolutionary new technology can be a gamble. By investing in chip stocks, investors can gain broader exposure to this trend with less theoretical idiosyncratic risk. That’s a good thing over the long-term, making the aforementioned two names top picks in this current environment.

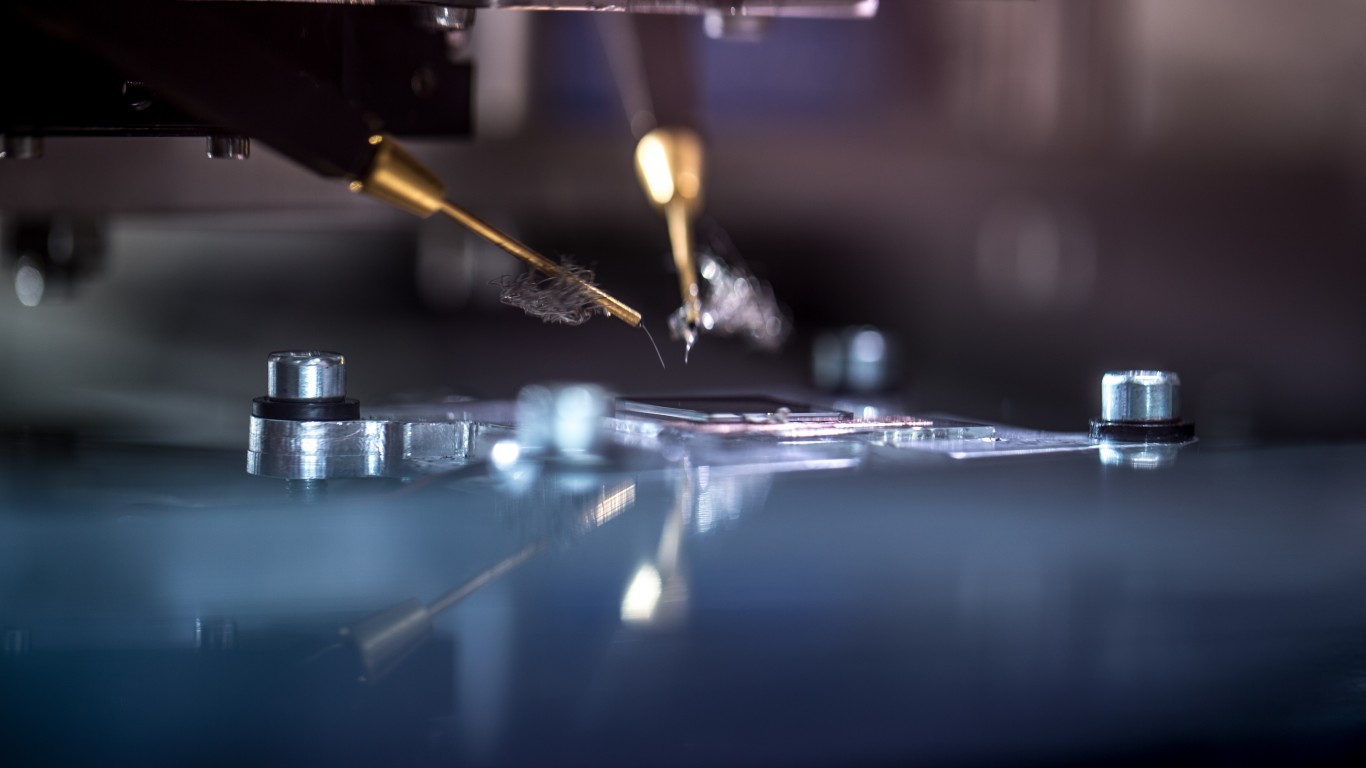

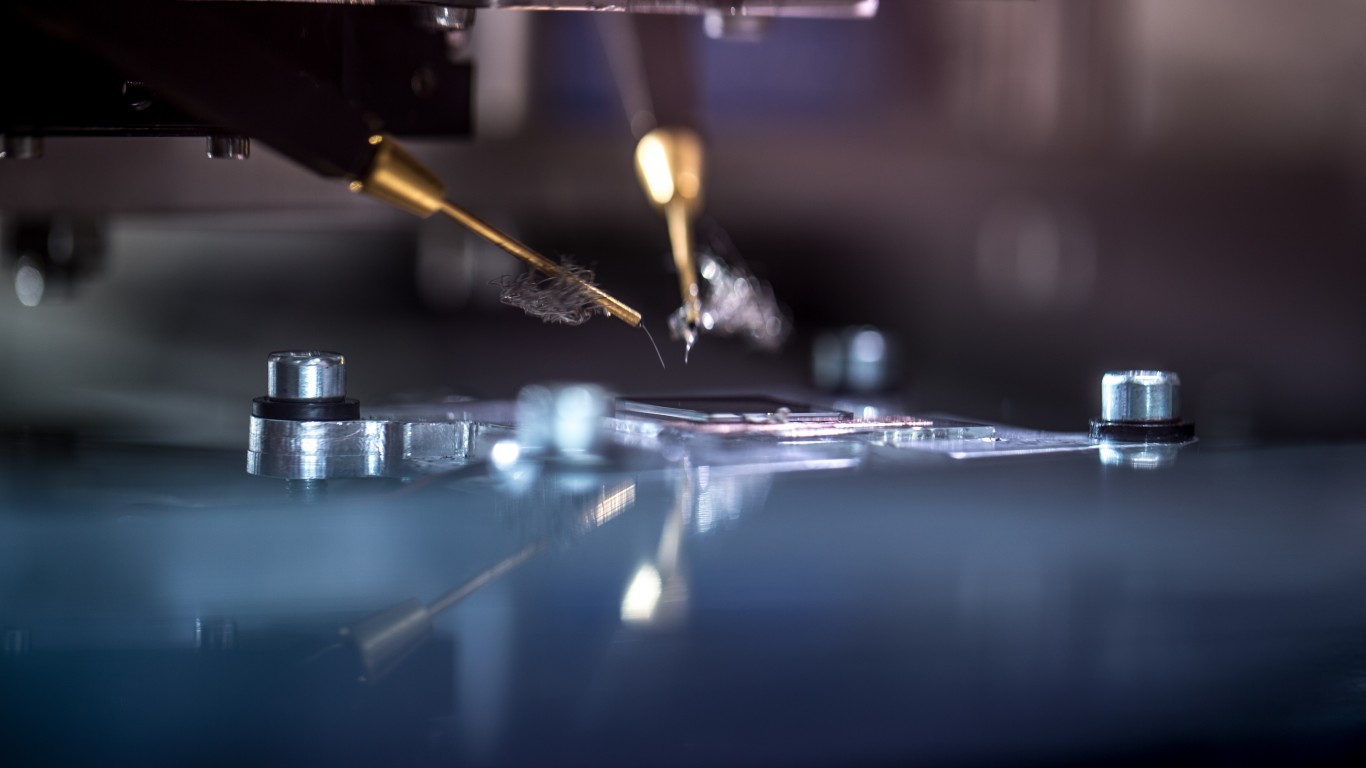

However, other chip makers such as Marvell Technology (NASDAQ:MRVL) are relatively overlooked in my view. The company provides infrastructure semiconductors serving key customers in the data centers, networking and automotive sectors. With custom chip solutions offered to a range of top blue-chip mega-cap tech companies as well, Marvell has become a bit more of a niche play on the rise of companies seeking to develop their own chips. Personally, I think this is a trend worth watching.

Here’s why Marvell’s recent rise could be just beginning, and why I think MRVL stock is one to watch in 2025.

Marvell’s recent results have certainly blown away expectations, with Q3 revenue growth in the company’s data center segment of 94% year-over-year actually outpacing the 92% growth seen in Q2. Thus, like other major chip makers such as Nvidia, triple-digit growth rates (or at least near-triple-digit growth) in AI-related business lines has propelled this stock toward its all-time high, with MRVL stock up nearly 80% on a year-to-date basis at the time of writing.

I do think there are strong drivers the market is highly pricing into this stock. We’ve all seen the incredible outperformance Nvidia and other top high-performance chip makers have provided, and Marvell is a company that’s starting to be included in this discussion.

Previously, the declines Marvell has seen (and has continued to see in recent quarters) in its Enterprise Networking and Carrier Infrastructure segments acted as an anchor of sorts on its capital appreciation potential. However, with the company’s Consumer segment seeing robust triple-digit growth and new AI chip production ramping up, investors are clearly pricing in continued earnings growth in the quarters to come. Notably, in Q3 the company brought in $0.81 in EPS, which on a going forward basis would value the stock at just under 40-times earnings, assuming growth continues to materialize as expected in 2025. That’s not incredibly expensive, given the company’s AI-driven demand and custom solutions, its innovation and 10,000+ patents ensuring long-term growth and differentiation.

The key question as to whether Marvell’s current valuation multiple makes sense centers on the durability and stability of future demand for the company’s custom AI chips. So far this year, we’ve seen strong adoption build, with some of the largest tech companies announcing plans to work with Marvell to build and develop their own internal chips. A shift appears to be building around both customization and cost control – Marvell appears to be at the right place at the right time in terms of providing these factors to its clientele.

The company’s strong Q3 2024 adjusted results are evidence of this trend, and I do think there are reasons why Marvell could continue to see a higher multiple over time. This is a company that produces meaningful cash flow. And with $868.1 million in cash and $3.97 billion in long-term debt, the company’s balance sheet seems reasonably well-constructed right now, particularly if growth in the company’s data center segment continues.

Strong demand for AI ASICs and interconnect products have led to near-triple-digit growth in this segment, which now comprises 72% of total revenue (up from 39% last year). Other markets have continued to lag due to industry-wide challenges, but investors are clearly skating to where the puck is headed here. Forward guidance continues to improve, with the company now expecting overall revenue growth in the coming quarters to be around 26%, and I wouldn’t expect to see additional beats on the horizon.

While Marvell may not be as fast-growing as other chip peers in the market (with legacy businesses muddying the results), this is a company that I think is riding certain secular tailwinds right now. Tech giants want to have autonomy over the construction of their own chips, and will certainly be looking to rein in costs over the coming years. Nvidia’s chips are the most powerful in this space, but they’re also vastly more expensive than those Marvell can offer, which have greater customization potential. That’s a tradeoff I think will become more attractive for other customers in this space, and is what makes this stock worth considering here.

Again, I think the company’s forward price-earnings multiple under 40-times is certainly reasonable, because if Marvell can continue to beat earnings expectations into 2026, this is a stock that would be very undervalued relative to its peers and is one I think could easily make new all-time highs next year, assuming these underlying catalysts continue.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.