Nvidia (NASDAQ:NVDA) could be staring at a crypto avalanche that might cost it dearly. The U.S. Supreme Court refused to consider an appeal by the chipmaker for a securities fraud lawsuit by investors accusing it of misleading shareholders over how important the cryptocurrency market was to its business.

The rejection of the case means a lower court decision allowing the lawsuit to move forward stands. It seeks unspecified monetary damages to recoup the lost value of the NVDA stock held by the investors.

24/7 Wall St. Key Points:

- A long-running securities lawsuit alleging misrepresentation by Nvidia (NVDA) management over comments about crypto mining could haunt the chipmaker.

- While subsequent events show selling during Nvidia’s dark days was a mistake, the AI chip stock could face legal liability as the lawsuit gains new life.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Mining the chance to recoup losses

Artificial intelligence is Nvidia’s bread and butter these days. The chip maker’s data center segment, which houses its AI business, accounts for approximately 87% of total revenue. Yet it wasn’t always this way.

As everyone knows, its graphics processing units (GPU) were originally aimed at the PC and console gaming market because their large and complex processing capabilities for game graphics were a perfect match.

However, as the chips got better and faster, other businesses found them useful. The metaverse, for example, which was wildly popular for 15 minutes, found its advanced computing abilities well-suited for the graphics heavy alternative realities. It’s why hyperscalers are using them in their AI data centers, although the latest generation chips far exceed what playing Minecraft of World of Warcraft need. But before all of these, there was crypto mining.

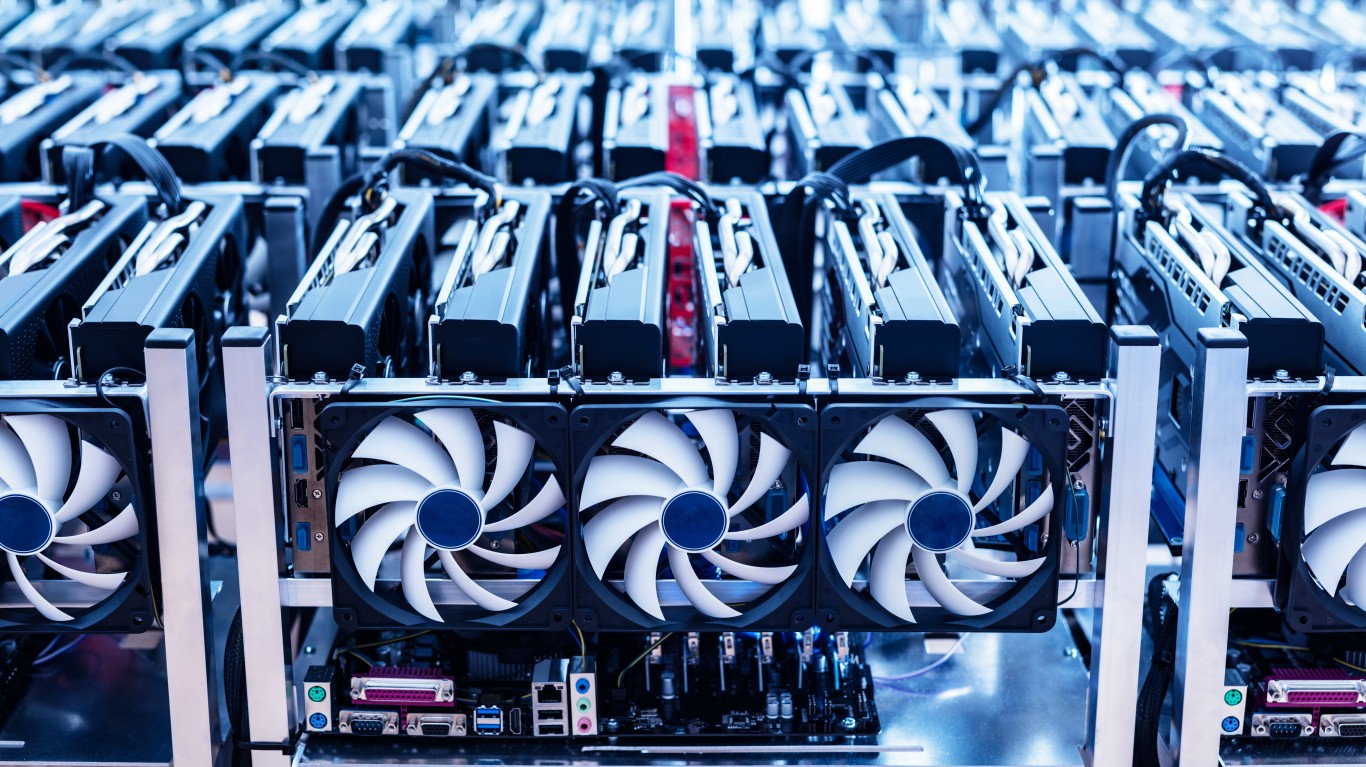

Originally miners used gaming GPUs to mine Bitcoin (CRYPTO:BTC) and Ethereum (CRYPTO:ETH), but the outsized demand for them caused supply constraints driving prices higher. Nvidia eventually designed crypto-centric cards that lacked video output ports, such as the Nvidia CMP HX, that was specifically designed to optimize mining operations. It took advantage of the chip’s superior processing capabilities by allowing a larger number of GPUs to be controlled by a single central processing unit (CPU).

As revenue and profits surged from their sales, Nvidia downplayed just how much crypto meant to its business. When the mining market collapsed, NVDA stock fell and the trial lawyers pounced.

Downplaying crypto’s importance

The lawsuit alleges Nvidia CEO Jensen Huang misrepresented how much of the company’s record-breaking earnings from its GeForce GPUs were due to crypto mining instead of gaming.

Huang and CFO Colette Cress took great pains to minimize during their earnings conference calls to minimize crypto’s impact on its financial results. They stressed the installed base of gamers and the growth of the gaming market to indicate where surging revenue and profits were coming from.

However, when the crypto mining market collapsed, so did Nvidia’s sales. As did its stock. Between October 2018 and January 2019, NVDA stock lost more than half its value. Shares fell from a split-adjusted $7.23 per share all the way down to $3.34 per share.

No one at the time knew that the metaverse would come and revive sales or the advent of AI would supercharge growth. At the time it looked as though Nvidia could be wandering in the wilderness for some time.

Key takeaways

It certainly appears the great lengths Huang and others went in a bid to say its gains were unrelated to crypto could be bad for the company. It could be on the hook for significant sums of money related to the alleged fraud.

Of course, in retrospect, it seems silly. From that low point to today, Nvidia stock has put on a master class in capitalizing on opportunity, growing 4,000% over the last five years. A $10,000 investment in NVDA at the time would be worth almost $410,000 today.

It also highlights the folly of jumping in and out of stocks based on a single moment in time of bad news. Had investors bought the stock for the long haul and simply held on and didn’t sell, not only would they not have lost any money but they could be quite wealthy today.

That doesn’t take away from what appears to be misrepresentations by management. Coupled with concern over an anti-monopoly probe in China and slowing growth, a cold front could be moving in that chills Nvidia’s stock.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.