Investing

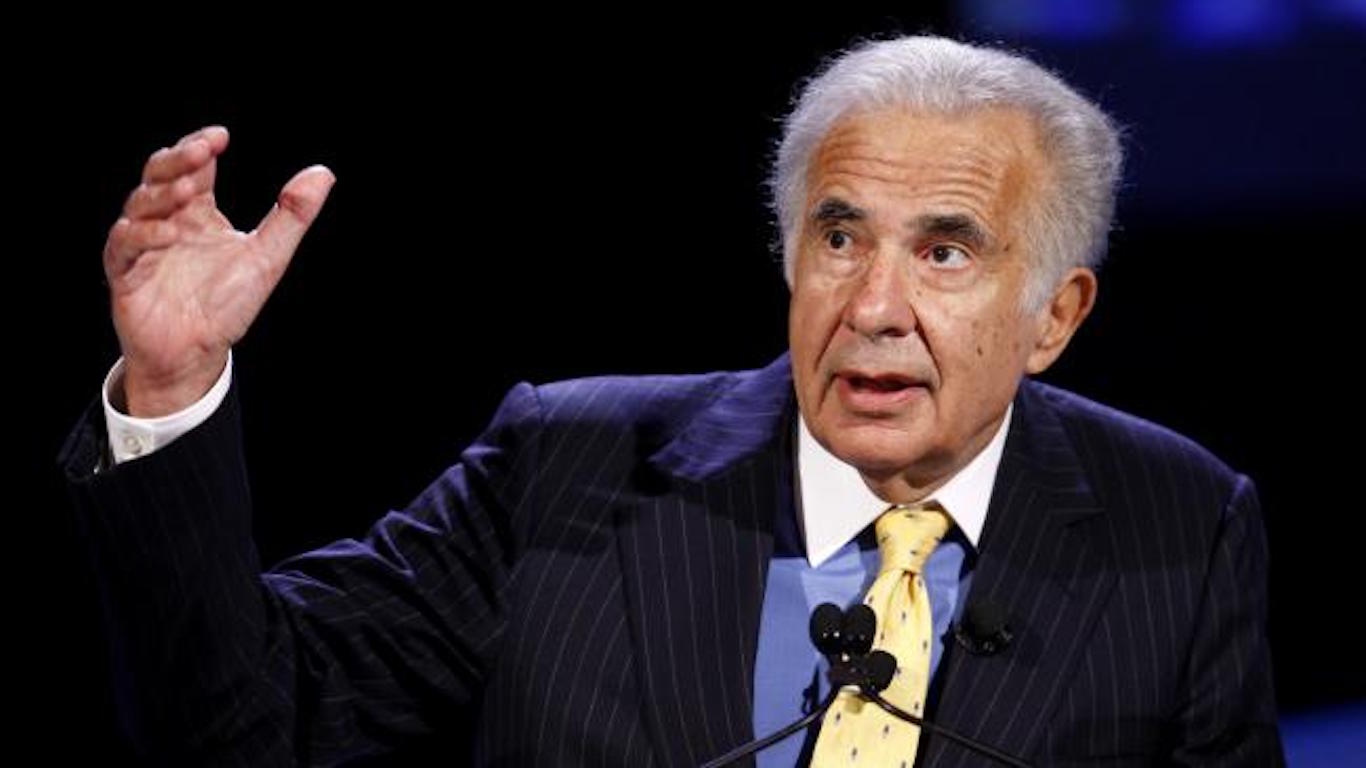

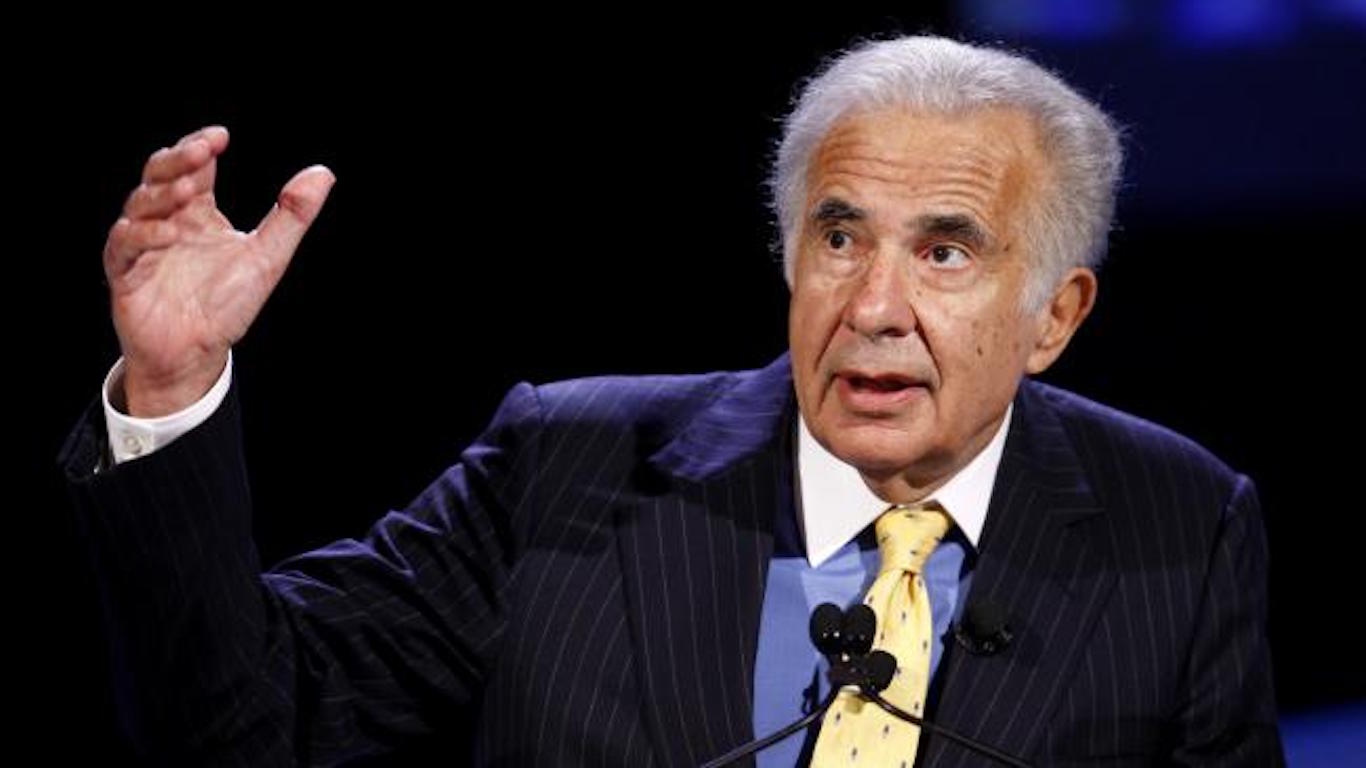

Billionaire Carl Icahn Trims 3rd-Largest Holding to Prop Up His Struggling Empire

Published:

It has not been a good year for billionaire activist investor Carl Icahn.

His publicly traded company, Icahn Enterprises LP (NASDAQ:IEP), lost 43% of its value in 2024 through Dec. 13. IEP’s market cap is close to falling below $5 billion. Its shares once traded at 14 times their current price.

How the billionaire got here is beyond obvious: In August, the Securities and Exchange Commission fined Icahn and Icahn Enterprises $2 million for failing to disclose billions in personal loans obtained by pledging IEP stock. As a result, the company’s shares lost 41% in a single month.

Icahn filed his latest 13F holdings report on Nov. 14, and there were a couple of big moves in the third quarter, which ended Sept. 30.

Not surprisingly, one of the biggest was the billionaire’s effort to prop up his struggling empire. It’s too soon to tell if the move will pay off for the 88-year-old.

Icahn’s Q3 2024 holdings report showed that the billionaire held 14 stocks valued at $9.88 billion at the end of September. In the three months between July and September, Icahn added to three holdings and reduced his position in another.

Icahn sold 1.39 million shares in Southwest Gas Holdings, the third-largest position in his equity portfolio valued at $739 million at the end of September, accounting for nearly 8% of it after the share sale. Icahn’s proceeds were approximately $106.7 million.

The billionaire first invested in the natural gas distributor in Q3 2021 and continued until Q3 2023. According to Icahn’s 13F from September 2023, he held a little over 11 million shares of the company, so the sale of shares in Q3 2024 was the first since.

In October 2021, Icahn launched a proxy fight with the company, seeking to appoint an entirely new board and carry out a tender offer for all its stock at $75 a share. At the time they were trading slightly below $70.

The company and Icahn reached a settlement in May 2022 that saw Icahn appoint three directors to the board. Three existing directors resigned to make space for Icahn’s appointees. At the same time, the CEO, John P. Hester, also resigned. The company’s Executive Vice President, Karen Haller, was appointed CEO. She remains in the position 31 months later.

On Sept. 25, Icahn added 26.89 million depositary units in Icahn Enterprises to his holdings. These units were issued as payment-in-kind for the dividends on 406,313,986 depositary units held on the record date. At that time, they were worth $346 million, each at $12.88.

While Icahn didn’t pay cash for the units received, the Southwest Gas share sale in the third quarter was likely executed to raise cash to help pay for more shares of CVR Energy (NYSE:CVI), Icahn’s second-largest holding, accounting for 16.06% of his multi-billion-dollar equity portfolio. IEP owns 66.34% of the renewable fuels and petroleum refining business.

Icahn Enterprises cut its second quarterly dividend in November in 16 months, lowering it by 50% to 50 cents. It was $2 a share in the first half of 2023, and it’s now $2 for the entire year. Icahn plans to use the savings to buy more shares of CVR.

According to S&P Global Market Intelligence, as of Sept. 30, IEP had $2.29 billion in cash, $6.97 billion in total debt, and $4.68 billion in net debt, almost 94% of the holding company’s market cap.

You would think that Icahn would use the cash savings from the dividend cut to pay down its debt. The billionaire believes that CVR stock is undervalued at current prices.

“Rarely have I seen a stock market with such extreme valuations—with some companies trading at unjustifiable premiums and others being massively undervalued. These undervalued situations have created great opportunities for activists,” Barron’s reported Icahn’s comments from the company’s press release about the dividend cut.

I watched the HBO documentary Icahn: The Restless Billionaire a few months ago. It gave me a new appreciation for the man and his investment philosophy.

However, regarding value creation, Warren Buffett, who’s six years older, has created far more value for Berkshire Hathaway (NYSE:BRK.B) shareholders than Icahn. Through Dec. 13, Berkshire stock has gained 104% over the past five years, 188% more than Icahn on a relative basis.

Given Icahn’s stake in IEP accounts for 61.23% of his nearly $10 billion equity portfolio, it’s likely that we will continue to see the billionaire selling other stocks in the portfolio to prop up Icahn Enterprises in future quarters.

It is very much in doubt whether it will be enough to return IEP stock to the low $50s, where it traded as recently as April 2023.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.