Investing

Should You Buy the 3 Highest Yielding Dividend Stocks in the Dow Jones?

Published:

The Dow Jones is one of Wall Street’s most iconic benchmarks and it tracks 30 of America’s largest companies. It was made over 128 years ago but is still relevant and a crucial barometer of the U.S. economy.

The recent year-end market rally pushed it past the 45,000-point threshold but things have soured a little; the DJIA has been on a seven-day losing streak. This is the longest losing streak since 2020. If you combine that fact with another potential Federal Reserve rate cut that is coming this December — combined with more cuts coming next year — there’s good reason to believe that high-yield dividend stocks are going to look much hotter in the future. The biggest dividend-paying stocks are on the Dow Jones and it’s worth taking a look at whether or not it’s worth buying these dividend stocks as 2024 comes to a close.

As for my methodology, I used a screener to sort the dividend stocks with the highest yields. As of writing, Amgen (NASDAQ: AMGN) leads Johnson & Johnson (NYSE: JNJ) by just 0.01% in terms of yield.

Verizon (NYSE: VZ) has been more of a “meh” investment in the past couple of years as a huge chunk of its earnings are spent on servicing its debt load of $174.2 billion. Net interest losses were at $1.6 billion in just Q3 alone. That’s a massive chunk of Verizon’s $4.3 billion pre-tax income.

However, as interest rates inevitably come down, I do think that it’s worth buying into Verizon’s “bad” balance sheet. It’s up to debate whether or not we’re going to see ultra-low interest rates in the coming year, but even if that debt is halved, the earnings impact will likely translate into VZ going up and paying more in dividends.

It will also make VZ stock look much more attractive to yield-hungry investors.

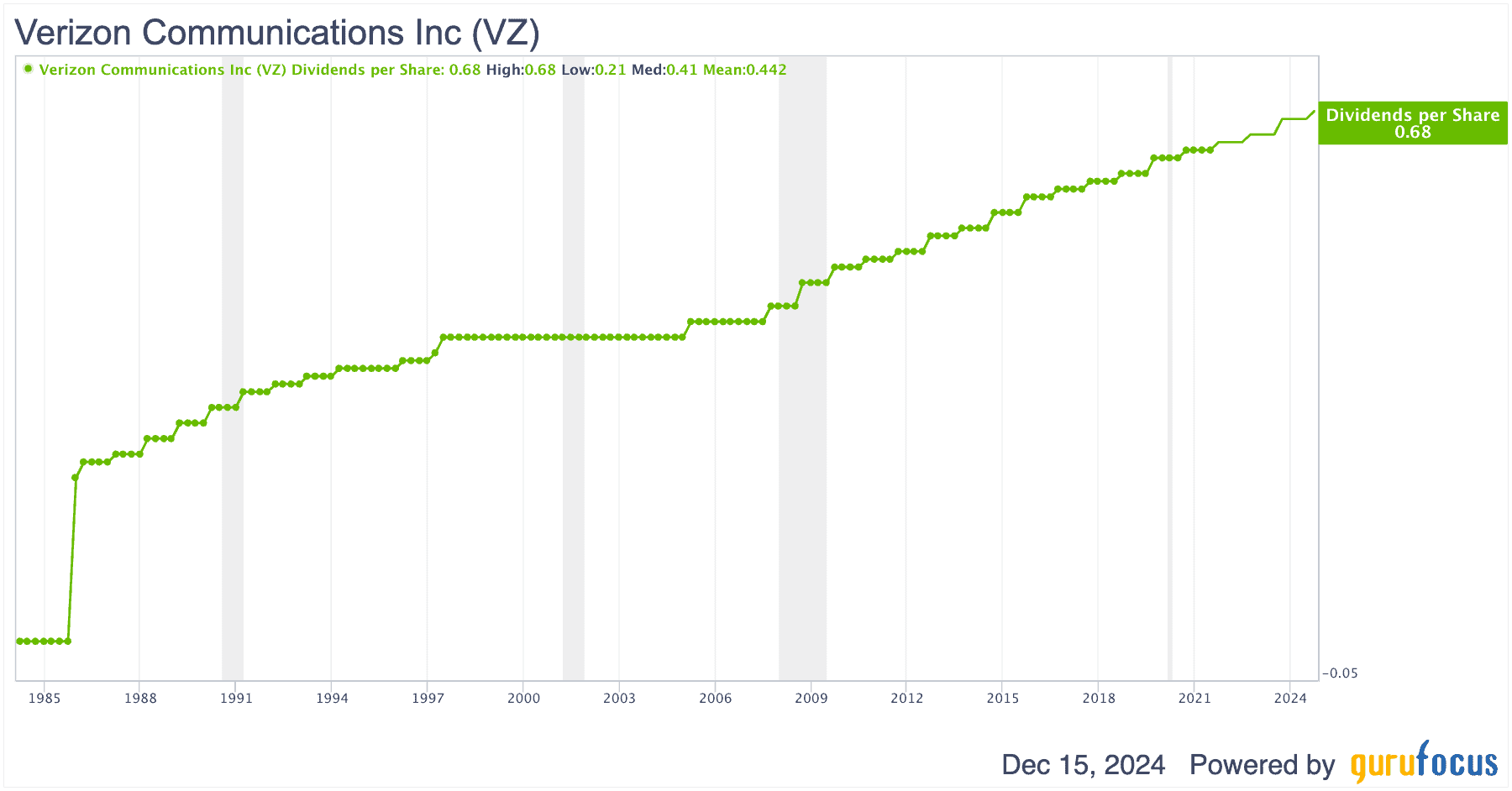

Dividends per share have been going up consistently and the stock is sitting at a neutral level where the downside risk isn’t that big of a concern. In my opinion, VZ is a buy.

Chevron (NYSE: CVX) is more of a mixed bag. The energy sector is highly dependent on the broader economy. If you’re skeptical of the market rally and you believe that we are in for a recession in the coming quarters, CVX stock should not be on your buy list. Oil stocks are among the hardest hit during recessions.

And even if there isn’t a recession, Chevron still faces risks in the future with the incoming Trump administration. He may be friendly to fossil fuels, but that does not mean that oil prices will remain hot. In fact, Trump plans to drill more and the expanded energy production will likely mean lower oil prices. Bloomberg reported that “Banks are gearing up for US oil prices to fall below $60 a barrel by the middle of President-elect Donald Trump’s new term in office, according to a survey from law firm Haynes Boone LLP.” That’s nearly $11 less than where oil is right now.

CVX stock currently trades at $154; you’re paying 17 times earnings for the stock. In comparison, the median earnings multiple in the oil and gas industry is at 11.5 times. Thus, there’s a lot of downside risk here if things go wrong in the coming years — if.

Regardless, I’m not too overly bearish on Chevron due to the financials here. Chevron’s headline Q3 earnings of $4.5 billion did decline significantly from $6.5 billion last year, but despite the lower earnings, Chevron posted $9.7 billion in cash flow from operations and returned a record $7.7 billion in cash to shareholders. Chevron’s 2025 capital expenditure budget of $14.5 to $15.5 billion will also reduce costs by $2 billion year-over-year.

So, is CVX stock worth buying? The cash flow trends here would push me over the edge to say yes. There isn’t anything wrong with the economy or the oil market right now, so not buying Chevron out of future speculation could lead you to miss out on some gains.

Amgen is a biotech company. Its stock has declined almost 17% from its November peak, and the yield inflation from that decline is mainly why it is on that list. That doesn’t mean it’s a bad business to buy into. The company’s Q3 2024 results were particularly strong, with total revenues increasing 23% to $8.5 billion compared to Q3 2023. Product sales growth was at 24% and was driven by 29% volume growth. Even if you exclude their Horizon Therapeutics acquisition, organic product sales grew by 8%.

Their obesity drug MariTide showed promising Phase 2 results and achieved approximately 20% average weight loss in people without Type 2 diabetes and 17% in those with the condition. Obesity drugs have been very popular and are largely the reason why Eli Lilly (NYSE: LLY) and Novo Nordisk (NYSE: NVO) both shot up to sky-high levels.

Debt is a problem here. They have $60.4 billion in debt against $9 billion in cash. That’s after a $4.5 billion debt decrease year-to-date. However, as I’ve discussed before, the impact of this debt is going to become less of a problem as rates come down.

I think Amgen is a buy after the recent dip. Obesity drugs are in demand and they’ll likely be entering the market in the coming years. And even without obesity drugs, Amgen is very profitable with $3.3 billion in free cash flow in Q3. In comparison, FCF was $2.5 billion in Q3 2023. Ten of their products also achieved double-digit sales growth in Q3 2024 and according to guidance, we’re looking at $33.4 billion in sales for all of 2024, or an increase of ~18% year-over-year.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.