Investing

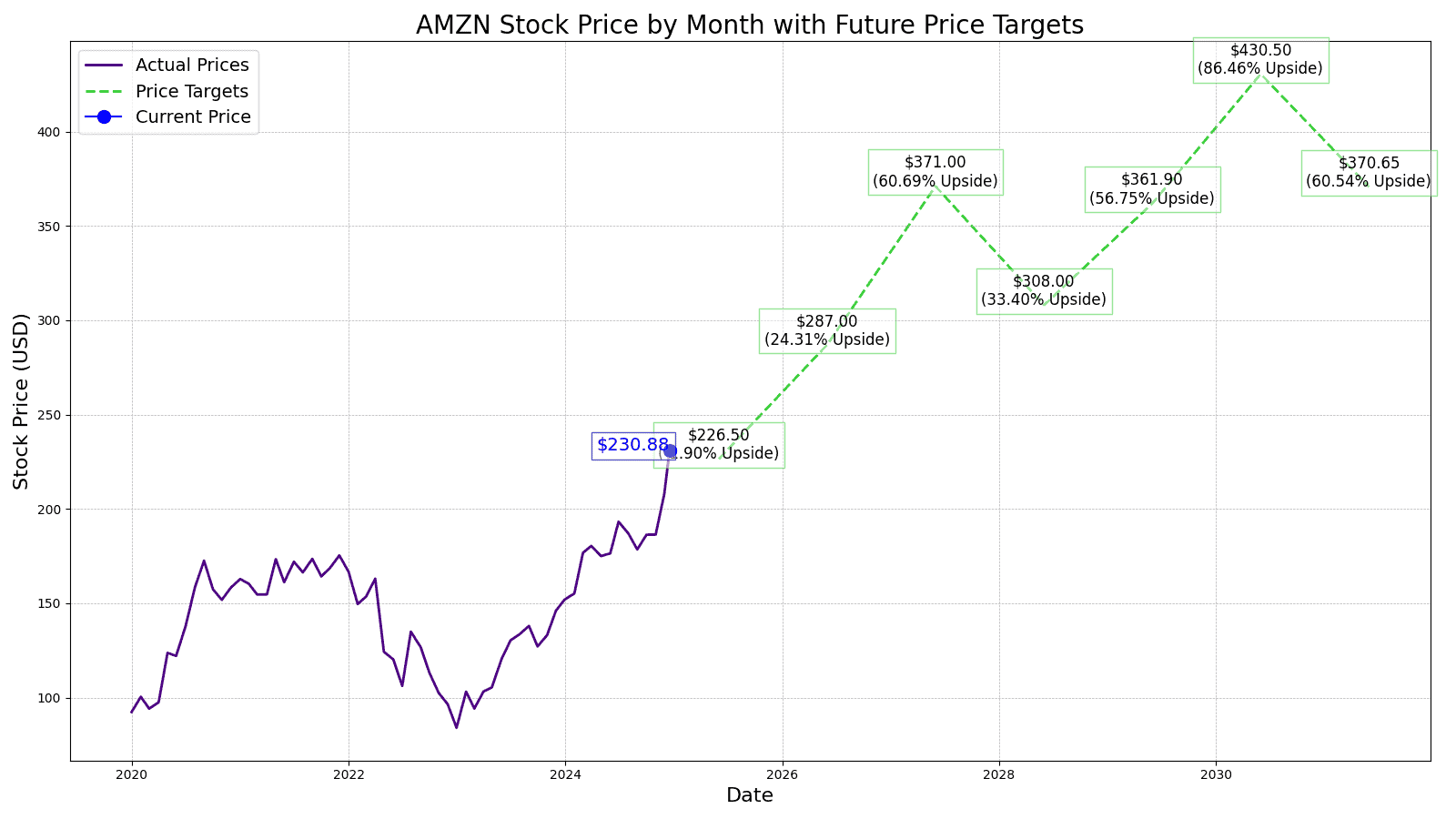

Amazon Stock (AMZN) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Outside of NVIDIA’s (NASDAQ: NVDA) recent share price going stratospheric, Amazon (NASDAQ: AMZN) has been a Wall Street darling since the company IPO’d in May 1997 at a split-adjusted price of $.07.

Today, Amazon stock trades for $230.88, which means that stock is up over 236456.97% since May 1997, turning every $1000 invested into $2.366 million today.

The only thing that matters from this point on is what the stock will do for the next 1, 5, and 10 years and beyond. Let’s crunch the numbers and give you our best guest on Amazon’s future share price. No one has a crystal ball and even the Wall Street “experts” are often wrong more than they are right in predicting future stock prices. We will walk through our assumptions and provide you with the story around the numbers (other sites just pick a share price without explaining why they suggest the price they do).

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2017.

| Share Price | Revenues* | Net Income* | |

| 2014 | $19.94 | $89.0 | ($.241) |

| 2015 | $15.63 | $107.0 | $.596 |

| 2016 | $32.81 | $136.0 | $2.371 |

| 2017 | $37.90 | $177.9 | $3.03 |

| 2018 | $58.60 | $232.9 | $10.07 |

| 2019 | $73.26 | $280.5 | $11.59 |

| 2020 | $93.75 | $386.1 | $21.33 |

| 2021 | $163.50 | $469.8 | $33.36 |

| 2022 | $167.55 | $514.0 | ($2.72) |

| 2023 | $85.46 | $574.78 | $30.42 |

*Revenue and Net Income in Billions

In the last decade, Amazon’s revenue grew about 540% while its net income moved from losing money to 30.42 billion in profits this past year. The ride up wasn’t always smooth, however. For example, in 2020, sales jumped 38%, and net income nearly doubled. 2021 saw a continued boom as people moved to e-commerce shopping during Covid. However, all those sales being “pulled forward” led to challenges in 2022, and the company swung to a surprise loss. As Amazon embarks into the back half of the decade, a few different key areas will determine its performance.

The current consensus 1-year price target for Amazon stock is $220.00, which is a -4.71% upside from today’s stock price of $230.88. Of all the analysts covering Amazon, the stock is a consensus buy, with a 1.37 “Buy” rating.

24/7 Wall Street’s 12-month forecast projects Amazon’s stock price to be $225. We see AWS continue its current 12% growth rate but see Amazon’s advertising business outperforming analyst expectations, particularly in the 4th quarter of 2024 with more streaming ad impressions being sold.

Add all these numbers up and take out some amount for “new bets” the company will surely be investing in (and a potential dividend boost)and we see revenue in 2030 at $1.15 trillion and $131 billion in net income. Today, the company trades for about 50X earnings, which we’ll take down to 35 times as the company matures (but continues showing growth). In our analysis, Amazon is worth $2.6 trillion in 2030. Here are our revenue, net income, and company size estimates through 2030:

| Revenue | Net Income | Total Enterprise Value | |

| 2024 | $638 | $48.56 | $1.93 |

| 2025 | $710 | $62.13 | $2.12 |

| 2026 | $788 | $79.68 | $2.19 |

| 2027 | $867 | $96.53 | $2.29 |

| 2028 | $957 | $114.17 | $2.39 |

| 2029 | $1,049 | $136.69 | $2.5 |

| 2030 | $1,149 | $131.39 | $2.6 |

*Revenue and net income reported in billions and TEV in trillions

We expect to see revenue growth just over 11% and EPS of $5.74 for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Amazon at $287 in 2025, which is 24.31% higher than the stock is trading today.

Going into 2026, we estimate the price to be $371, after revenue estimates to come in around 10% higher year-over-year. With an EPS of $7.42 and in our opinion the last year Amazon trades near its current P/E of 50, 2026 could mark the year Amazon starts trading at a more mature valuation closer to 35 times earnings. That would represent a 60.69% gain over today’s share price of $230.88.

Heading into 2027, we expect the stock price increase not to be as pronounced as more tempered growth is expected from Amazon and even with earnings estimates of $8.80 per share, the stock price target for the year is $308.00. That is a 17% year hit from the previous year, but still up 33.40% from today’s stock price.

When predicting more than 3 years out, we expect Amazon to continue growing its top line at 10% but be more efficient and operating margins to grow. In 2028, we have Amazon’s revenue coming in around $957 billion and an EPS of $10.34 suggesting a stock price estimate at $361.90 or a gain of 56.75% over the current stock price.

24/7 Wall Street expects Amazon to continue its 10% revenue growth again and to generate $12.30 per share of earnings. With a price to earnings multiple of 35, the stock price in 2029 is estimated at $430.50, or a gain of 86.46% over today’s price.

e estimate Amazon’s stock price to be $370 per share with 10% year-over-year revenue growth but compressed margins from more competition in its AWS unit. Our estimated stock price for Amazon will be 60.54% higher than the current stock price, marking a double in Amazon’s stock price today of $230.88.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2024 | $226.50 | Upside of -1.90% |

| 2025 | $287.00 | Upside of 24.31% |

| 2026 | $371.00 | Upside of 60.69% |

| 2027 | $308.00 | Upside of 33.40% |

| 2028 | $361.90 | Upside of 56.75% |

| 2029 | $430.50 | Upside of 86.46% |

| 2030 | $370.65 | Upside of 60.54% |

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.