Investing

Microsoft (MSFT) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Everyone knows Microsoft (NASDAQ: MSFT) and its best-known products, including the Windows operating system and Microsoft 365 suite of productivity apps, but its growing cloud computing platform, Azure, is the future of the company.

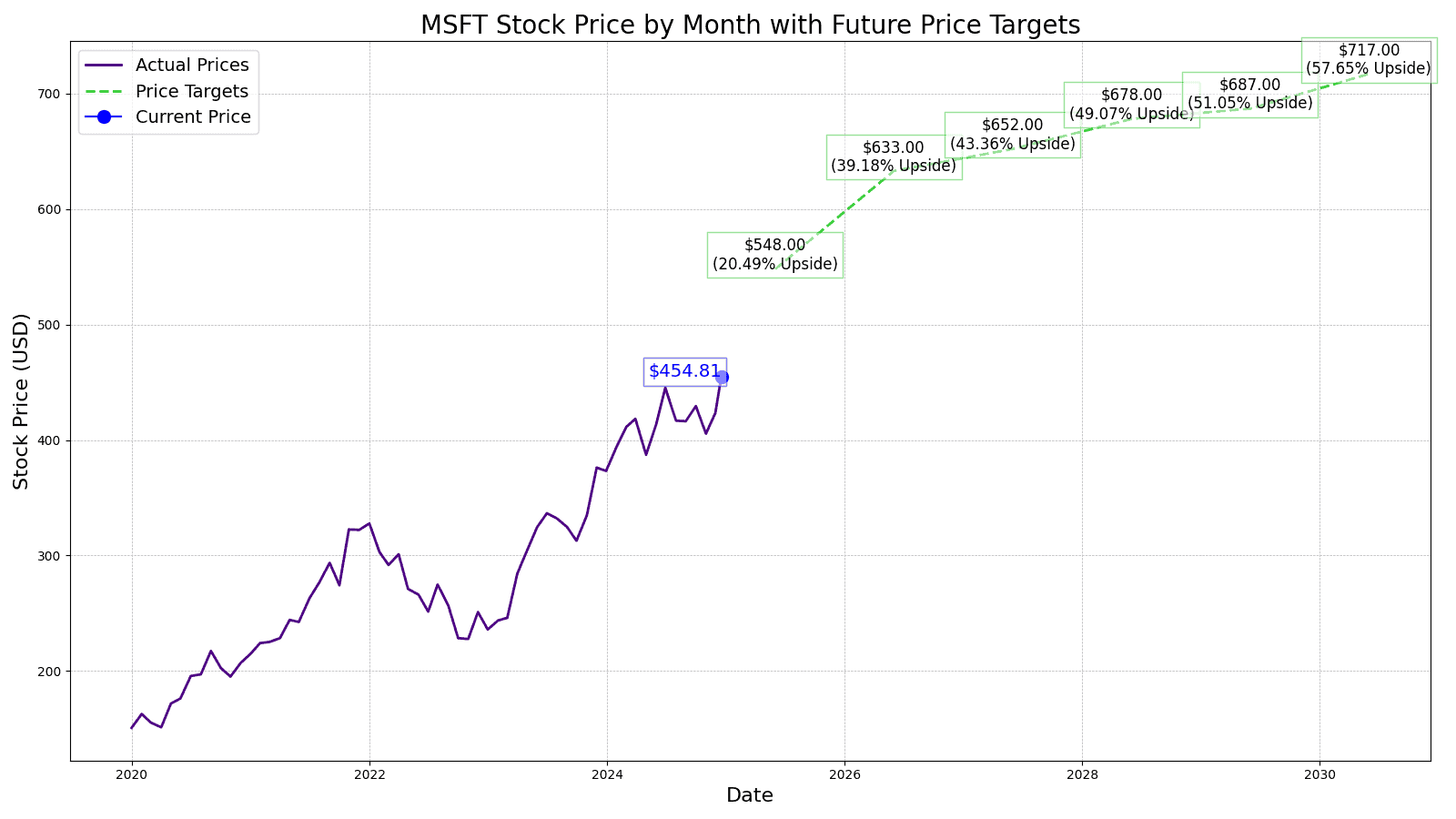

Microsoft stock has been a millionaire maker for decades, with a stock split-adjusted IPO price of $0.14, which means at today’s stock price of $454.81, the stock is up 467325.49%. That would have turned a $1000 investment at Microsoft’s IPO into $4.67 million today.

As one of the most valuable companies in the world, the only thing investors focus on is what the stock will do over the coming years. Wall Street analysts only go as far as 1 year out when giving a stock prediction. But long-term investors want to know where Microsoft might be several years down the road.

24/7 Wall Street aims to give you our assumptions on the stock and provide our insights around the numbers coming from Microsoft and which markets the company is operating in that are most exciting to us.

12/16/2024

Last October, Amazon announced a five-year, $1 billion deal with Microsoft to provide 1.5 million employees with Microsoft 265 tools like Word, Excel, and Outlook. However, due to a recent cyberattack, believed to be linked to Russia, Amazon is delaying the deployment of the deal.

12/13/2024

Microsoft shareholders recently rejected a proposal urging the company to assess the risks of its AI technologies being used in the fossil fuel industry. The proposal sought to have Microsoft investigate the potential dangers of using its AI in projects that significantly contribute to carbon emissions.

12/11/2024

Google has petitioned the U.S. Federal Trade Commission (FTC) to intervene in Microsoft’s exclusive partnership with OpenAI. Google argues that this exclusive deal could stifle competition and give Microsoft an unfair advantage in the readily revolving AI landscape. Microsoft, in contrast, is accusing the FTC of improperly leaking confidential information related to its ongoing antitrust investigation. The company has formally requested an investigation into these alleged attacks.

12/10/2024

Microsoft shareholders have voted against NCPPR’s recent proposal and will not explore investing in Bitcoin. Microsoft already has established processes in place to manage and diversify its treasury for the long-term benefit of its shareholders, and thus the company deemed a public assessment of Bitcoin investment to be necessary.

12/9/2024

Microsoft shareholders will vote tomorrow on a proposal to publically assess adding Bitcoin to the company’s balance sheet. The vote comes as Bitcoin trades around $98,050, having recently hit a record high. The proposal was submitted by the National Center for Public Policy Research (NCPPR). However, Microsoft’s board recommends voting against it, as the company already evaluates a wide range of assets (including Bitcoin) as part of its investment strategy.

12/6/2024

Microsoft’s AI division is poised for major growth, with Berstein analysts projecting it to surpass a $10 billion annual revenue run rate by the end of the next quarter.

12/5/2024

Microsoft is launching an experimental preview of Copilot Vision for a limited number of Copilot Pro subscribers. Copilot Vision will allow users to have AI-powered conservation about the web content they’re using in Microsoft Edge. By analyzing web pages, Copilot Vision can answer questions, summarize information, and provide insights.

12/3/2024

Microsoft is facing legal scrutiny once again, this time in the UK. The company is accused of abusing its market power in operating systems to charge exorbitant fees for businesses using its software on rival cloud platforms. Filed in the UK’s Competition Appeal Tribunal, the lawsuit seeks over £1 billion in damages.

11/27/2024

Microsoft has partnered with Coles Group (CLEGF), an Australian retail company. The five-year deal aims to further enhance Coles’ cloud and AI capabilities.

11/26/2024

Indiana has secured an important deal with tech giants Microsoft, Amazon Web Services, and Google. The agreement aims to minimize the potential impact of increased energy demand from data center construction on the state’s residents. A key part of the deal requires the tech companies to contribute $1.5 million annually for five years to the Indiana Community Action Association.

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Share Price | Revenues | Net Income | |

| 2014 | $46.16 | $86.83 | $22.07 |

| 2015 | $46.70 | $93.58 | $12.19 |

| 2016 | $56.21 | $91.15 | $20.54 |

| 2017 | $72.26 | $96.57 | $25.49 |

| 2018 | $108.04 | $110.36 | $16.57 |

| 2019 | $138.06 | $125.84 | $39.24 |

| 2020 | $205.01 | $143.02 | $44.28 |

| 2021 | $286.50 | $168.09 | $61.27 |

| 2022 | $276.41 | $198.27 | $72.74 |

| 2023 | $330.72 | $211.92 | $72.36 |

| TTM | $465.39 | $279.99 | $86.18 |

Revenue and net income in $billions

In the last decade, Microsoft’s revenue grew 222% while its net income went from $22.07 billion to over $86 billion (in the trailing 12 months). A big driver of profits over the past decade was Microsoft’s Intelligence cloud business, which grew 18% annually and drove operating profits of $37.88 billion in 2023 from $8.44 billion in 2014.

As Microsoft looks to the second of the decade, a few key areas will determine its performance.

The current consensus 1-year price target for Microsoft stock is $500.00, which is a 9.94% upside from today’s stock price of $454.81. Of all the analysts covering Microsoft, the stock is a consensus buy, with a 1.39 “Buy” rating.

24/7 Wall Street’s 12-month forecast projects Microsoft’s stock price to be $495. We see Azure continuing its 20+% growth and earnings per share coming in right at $11.80.

| Year | Revenue | Net Income | EPS |

| 2024 | $244.97 | $88.93 | $13.32 |

| 2025 | $278.00 | $99.25 | $15.67 |

| 2026 | $321.63 | $115.65 | $18.10 |

| 2027 | $370.79 | $136.81 | $20.40 |

| 2028 | $416.08 | $151.87 | $22.62 |

| 2029 | $453.39 | $166.56 | $25.45 |

| 2030 | $503.13 | $181.71 | $28.70 |

Revenue and net income in $billions

We expect to see revenue growth just over 8% and EPS of $15.67 for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Microsoft at $548.00 in 2025, which is 20.49% higher than the stock is trading today.

Going into 2026, we estimate the price to be $633.00, with small revenue gains but margins expanding and an EPS of $18.10. We expect to see Microsoft’s P/E ratio steep down slowly each year through 2030. The stock price estimate would represent a 39.18% gain over today’s share price of $454.81.

Heading into 2027, we expect the stock price increase not to be as pronounced and earnings estimates of $20.40 per share, the stock price target for the year is $652.00. That is a 3% year-over-year gain from the previous year, but still up 43.36% from today’s stock price.

When predicting more than 3 years out, we expect Microsoft’s P/E ratio to drop to 30x in 2028 but grow its top line 14%. In 2028, we have Microsoft’s revenue coming in around $420 billion and an EPS of $22.62 suggesting a stock price estimate at $678.00 or a gain of 49.07% over the current stock price.

24/7 Wall Street expects Microsoft to continue its 10% revenue growth again and to generate $12.30 per share of earnings. With a price to earnings multiple of 35, the stock price in 2029 is estimated at $687.00, or a gain of 51.05% over today’s price.

We estimate Microsoft’s stock price to be $717.00 per share with a sub 10% year-over-year revenue growth. Our estimated stock price will be 57.65% higher than the current stock price of $454.81.

| Year | Price Target | % Change From Current Price |

| 2024 | $495.00 | Upside of 8.84% |

| 2025 | $548.00 | Upside of 20.49% |

| 2026 | $633.00 | Upside of 39.18% |

| 2027 | $652.00 | Upside of 43.36% |

| 2028 | $678.00 | Upside of 49.07% |

| 2029 | $687.00 | Upside of 51.05% |

| 2030 | $717.00 | Upside of 57.65% |

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.