Stocks are quite expensive right now no matter where you look. If you are looking at AI stocks specifically, you’re probably screening through nosebleed valuations across the board. AI startups are among the most expensive right now. The premium being slapped here by Wall Street comes with its own risks, as they’re likely to be hit the hardest when the current rally ends. Of course, many investors are completely fine taking that risk. And if you are one of them, consider checking out this roundup of some AI and EV stocks under $10. But if you are investing for the long run, these AI startups should not constitute a big portion of your portfolio.

That begs the question: how do you profit from AI stocks if you’re missing out on most of the action? I think the most rational answer would be: patience. You could still invest in AI stocks that have more established underlying businesses and can continue operating regardless of the market cycle. No stock is safe from a downturn or a recession, but if you want AI stocks that will last when the pendulum swings the other way, having these well-established AI stocks in your portfolio is a good idea.

24/7 Wall St. Key Points:

- AI stocks have been continuously rallying and some of them have the fundamentals to do so for years.

- It is a good idea to buy into fundamentally strong AI stocks that you can hold forever instead of gambling on those trading high on hype.

- You’re unlikely to miss out on the gains with these AI stocks and keep your downside risk limited at the same time.

Taiwan Semiconductor (TSM)

If you take a good look at the AI semiconductor stocks in the market right now, you’ll quickly realize that most of them are fabless semiconductor companies; they design and market semiconductor chips without manufacturing them in-house. Taiwan Semiconductor (NYSE: TSM) is where the manufacturing is actually done. It does not have a peer competitor anywhere close to matching it in scale or tech. The moat here is massive.

Nvidia (NASDAQ: NVDA), Broadcom (NASDAQ: AVGO), AMD (NASDAQ: AMD), and even Intel (NASDAQ: INTC) are all deeply reliant on Taiwan Semiconductor’s manufacturing. TSMC produces nearly all of Nvidia’s and AMD’s advanced chips and Broadcom is partnering with TSMC for the chips it is selling to Google (NASDAQ: GOOG), Meta (NASDAQ: META), and TikTok’s parent company ByteDance. Plus, Intel is expected to spend $14 billion on manufacturing chips at TSMC in 2024-2025.

Taiwan Semiconductor is now investing more than $65 billion in its Arizona fabs, so even protectionism is unlikely to harm it. You’re paying around 33 times trailing earnings here. That’s a much better deal than most other major semiconductor stocks.

Thus, if you’re looking for an AI stock to hold for the long run without worrying about the constant competition and volatility here, I believe TSM stock is the go-to.

Arista Networks (ANET)

Arista Networks (NYSE: ANET) sells cloud networking infrastructure through its Arista EOS network stack and has AI-enabled solutions for it. It also has data centers and hybrid cloud campuses. Cloud Networking Products are its primary revenue source and constituted $5 billion of its $5.9 billion revenue last year.

ANET stock has been one of the most consistent in the AI sector and I think it can maintain this consistency since cloud-related products have beaten estimates time and time again and no slowdown seems to be on the horizon. There were murmurs of a “cloud slowdown” as far back as 2022, but — thanks to AI — demand has remained solid.

Revenue grew 20% year-over-year to $1.81 billion in Q3 versus the $1.78 billion consensus estimate. Adjusted EPS of $2.4 also handily beat expectations of $2.26. Hyperscale customers like Microsoft (NASDAQ: MSFT) and Meta are to thank for the overperformance, and there haven’t been any indications of them slowing down their AI and cloud spending.

I would caution that ANET is more on the expensive side. It trades at 46 times forward earnings. However, you’re going to have to clench your teeth for any AI stock with a 40%-plus net margin with this kind of growth in the current market.

They also completed a 4-for-1 stock split on Dec 4, 2024.

Dell Technologies (DELL)

Dell Technologies (NYSE: DELL) still has the reputation of being a PC manufacturer. Laptops are probably the first thing that springs to mind when you talk about Dell, but if you look at the stock, you’d be right to think that Laptops are not why DELL stock is going hot.

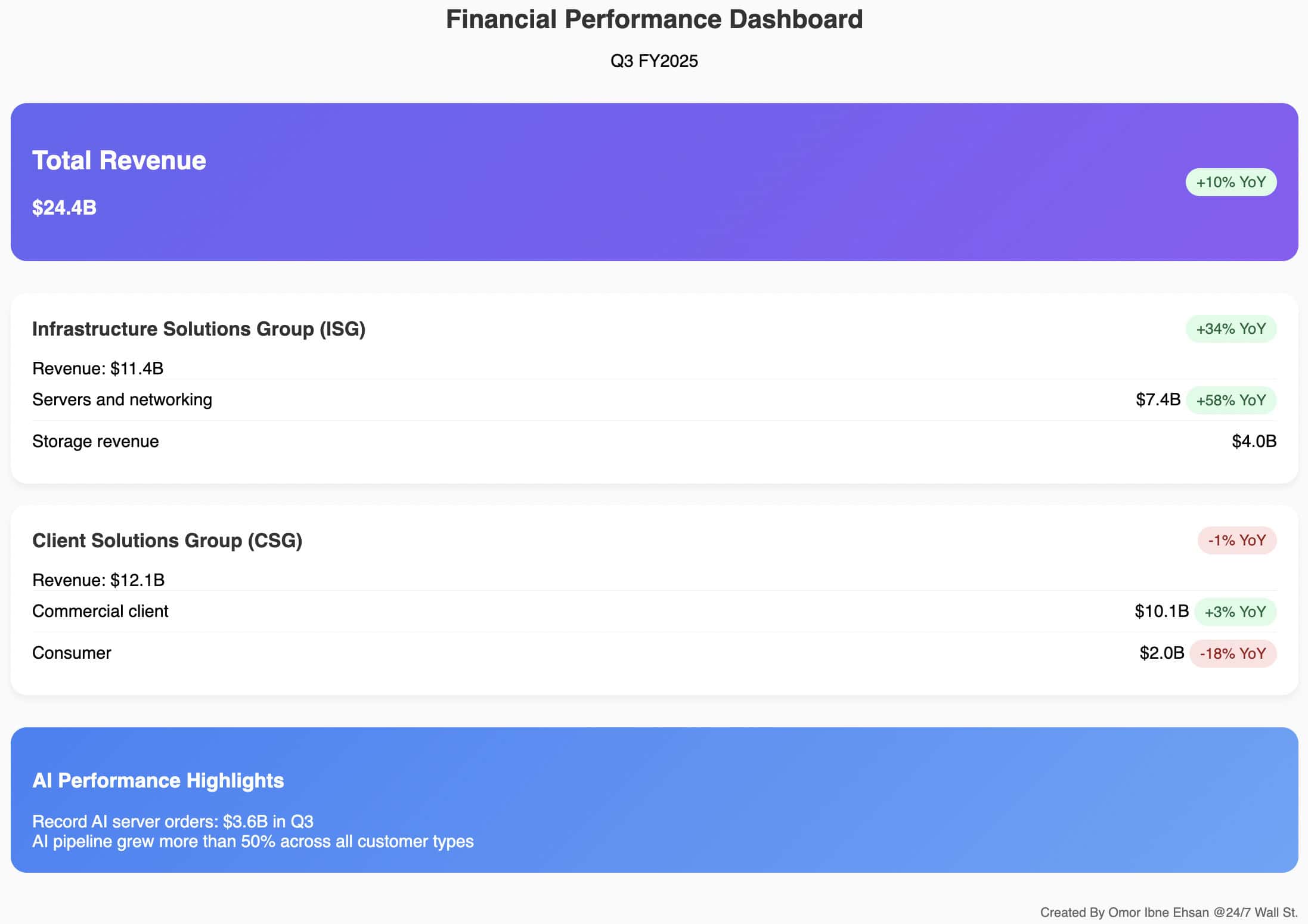

Record AI server orders reached $3.6 billion in Q3 2024 and the AI pipeline expanded by over 50% across all customer types. Dell is quickly becoming an AI/cloud computing giant.

Profits are also pretty solid. Dell has consistently beaten estimates and operating income grew 12% year-over-year, with EPS growing 16% year-over-year.

You’re paying about 13 times forward earnings for all this. Even if you take the $26 billion of debt into account, I believe this is quite cheap — especially in the current environment — and more than accounts for the “deceleration” in server sales that many analysts see post-Blackwell.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.