The new year is nearly upon us, and it promises to bring many changes. Investors and portfolio managers are positioning themselves going forward, and they likely are taking another look at energy stocks. Investing in the sector remains popular, as it offers plenty of opportunities. And not all of them rely on the price of petroleum. Including alternative energy stocks, where should investors seeking opportunities in energy be looking now?

24/7 Wall St. Key Points:

-

Where should investors seeking opportunities in energy for 2025 be looking now?

-

Wall Street is particularly optimistic about Enovix Corp. (NASDAQ: ENVX).

-

Also: Take this quiz to see if you’re on track to retire. (sponsored)

Let’s take a look at energy stocks for which Wall Street analysts have big expectations for the next year.

| Stock | Mean Target | Upside |

| ChargePoint Holdings Inc. (NYSE: CHPT) | $2.10 | 89.2% |

| Civitas Resources Inc. (NYSE: CIVI) | $73.40 | 72.7% |

| Devon Energy Corp. (NYSE: DVN) | $50.19 | 65.2% |

| Enovix Corp. (NASDAQ: ENVX) | $27.25 | 226.3% |

| Fluence Energy Corp. (NASDAQ: FLNC) | $26.77 | 81.8% |

| Frontline PLC (NYSE: FRO) | $28.04 | 112.9% |

| Sunrun Inc. (NASDAQ: RUN) | $18.88 | 109.5% |

| Tidewater Inc. (NYSE: TDW) | $86.86 | 81.8% |

Clearly, as far as Wall Street is concerned, Enovix has the greatest potential upside of these energy stocks in the coming year. Does that mean that its shares are undervalued? Or perhaps one overzealous analyst has skewed the mean?

Why Invest in Enovix?

Enovix stock is more than 41% lower than its 2021 initial public offering (IPO) share price. Shares were last seen trading below $9 apiece. They hit an all-time high near $40 a share in late 2021.

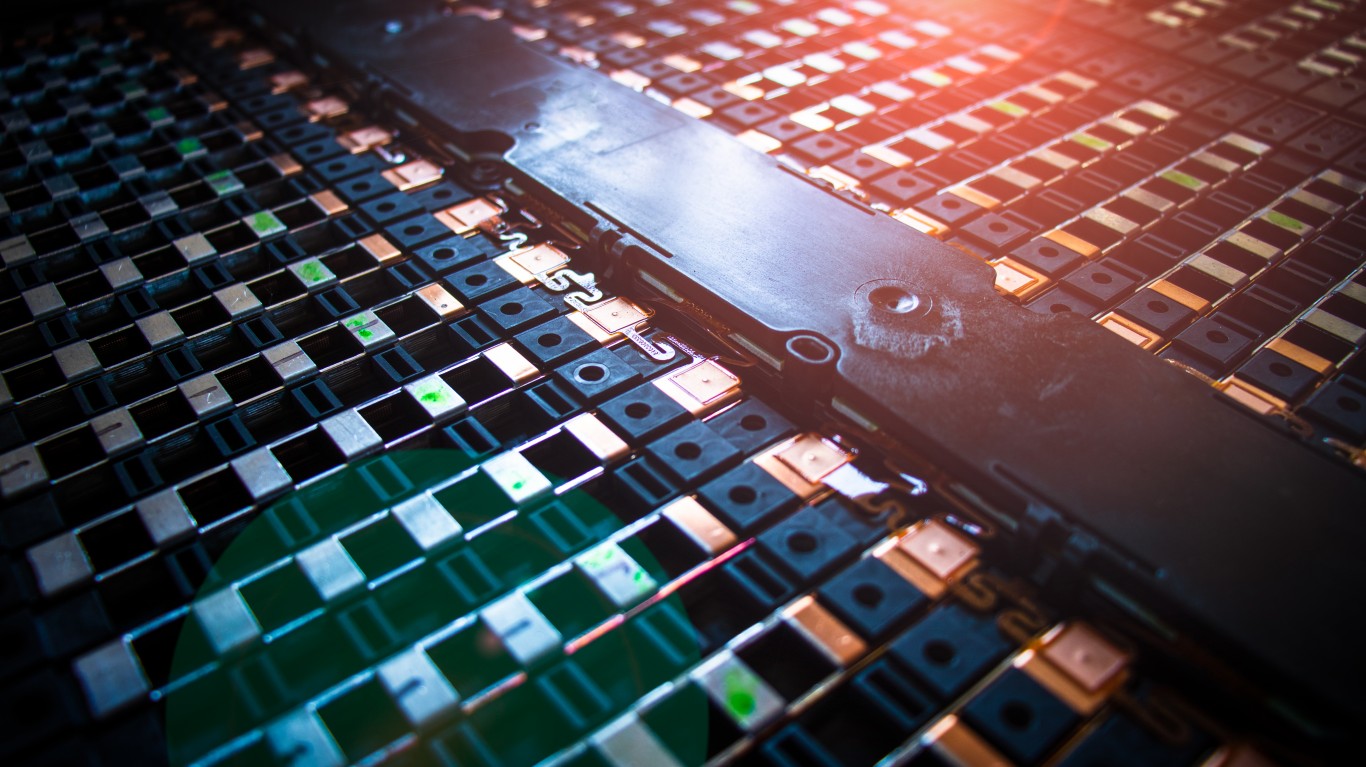

The company claims to be the leader in advanced silicon-anode lithium-ion battery development and production. It says it aims to provide designers of category-leading mobile devices with a high-energy battery so they can create more innovative and effective portable products, as well as to help enable widespread utilization of renewable energy.

The company does not offer a dividend. The stock is on track to end 2024 with a more than 20% loss, far underperforming the broader markets. Shares have mostly retreated since hitting a 52-week high back in July. So, the question is whether the shares are poised for a rebound. Let’s have a look at what Wall Street expects.

The Company

The company designs, develops, and manufactures advanced silicon-anode lithium-ion batteries. Its 3D cell architecture is proprietary and helps its offerings to have higher energy density, longer cycle life, and higher capacity. The batteries are intended to power a variety of technologies, including wearables, Internet of Things, smartphones, laptops and tablets, as well as industrial, medical, and electric vehicles industries.

Enovix is based in Fremont, California, which is in the San Francisco Bay area. The company was founded in 2007. In July of 2021, it went public. The company competes with or is similar to:

- Albemarle Corp. (NYSE: ALB)

- Bloom Energy Corp. (NYSE: BE)

- FREYR Battery Inc. (NYSE: FREY)

- Plug Power Inc. (NASDAQ: PLUG)

- QuantumScape Corp. (NYSE: QS)

The company posted strong revenue growth for the third quarter, and it recently began shipping battery cells to customers from its Malaysia fab. Earlier in the year, Oppenheimer named the stock a top pick, and Enovix just announced that its chief financial officer has stepped down and the search for a replacement is underway.

The Stock

Since the beginning of the year, the share price has ranged between $5.70 and $18.68. The stock is down more than 21% year to date, while the Nasdaq is up over 31% in that time. Note that the $27.25 consensus price target would be a multiyear high. The consensus recommendation of analysts has been to buy shares for at least three months. Benchmark, Cantor Fitzgerald, and J.P. Morgan reiterated Buy-equivalent ratings recently.

Institutional investors hold about 47% of the shares. BlackRock and Vanguard have notable stakes. Note that more than 48 million shares, or over 30% of the float, are held short. Also, a director sold 7,500 shares this month.

Wall Street expectations for where the stock goes in the next 52 weeks vary widely but are all especially positive. Even the lowest target signals that the share price has plenty of room to run in the next 52 weeks.

| Low target | $10.00 | 19.8% |

| Mean target | $27.25 | 226.3% |

| High target | $100.00 | 1,097.6% |

While Wall Street is optimistic about Enovix stock, note the sizable short interest. That indicates bets that the share price will fall. Also, note that Enovix often makes lists of meme stocks. Those are stocks that generate a lot of speculative interest but may lack fundamental value and be highly volatile.

Wall Street does not seem too concerned about that, however, at least in the short term.

The Top Energy Stock Billionaire Investors Are Buying Hand Over Fist

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.