Investing

Eli Lilly (LLY) Stock Price Prediction and Forecast 2025-2030

Published:

Last Updated:

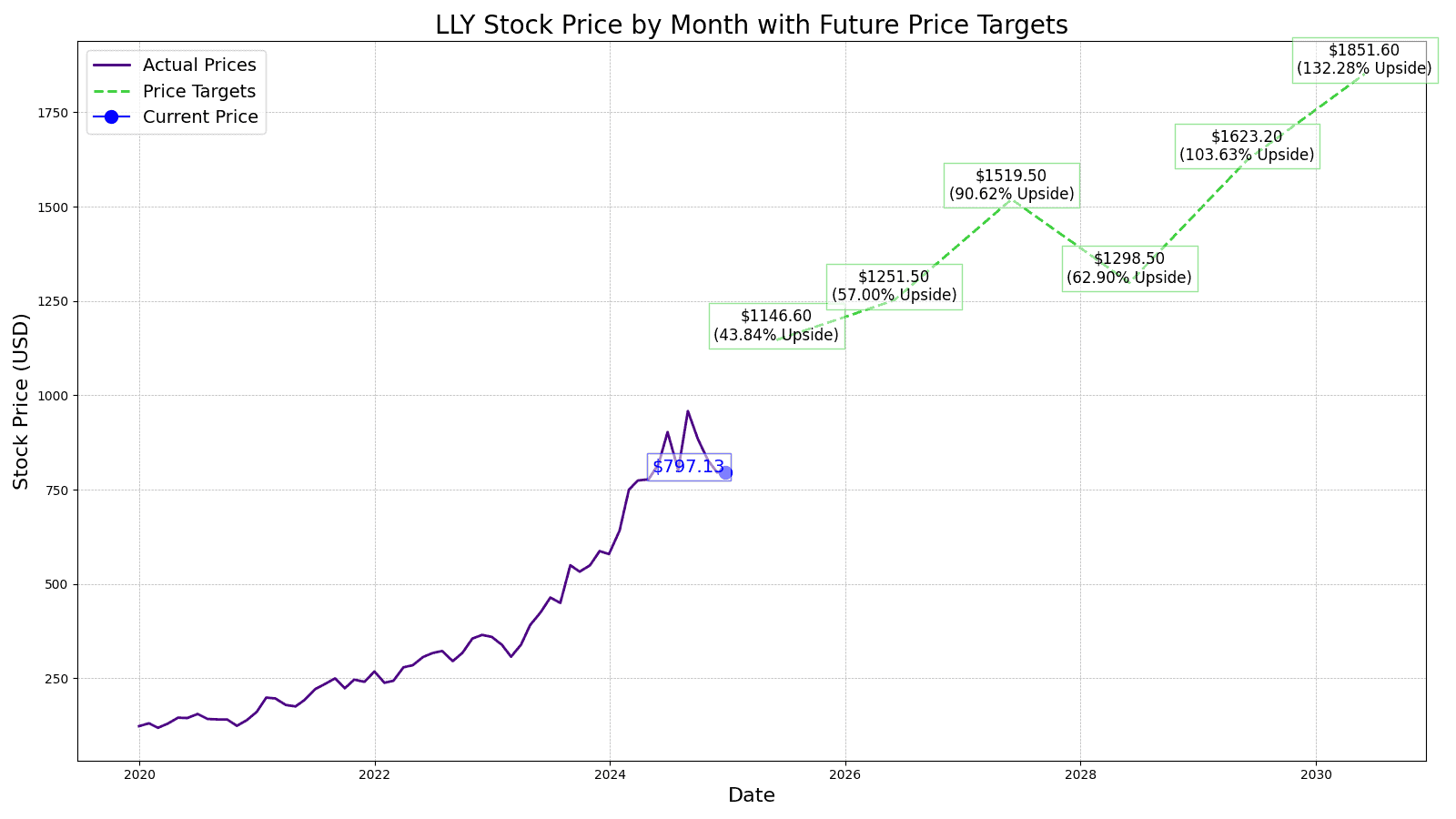

Since the start of 2020, Eli Lilly’s (NYSE: LLY) stock price chart has been straight up and to the right, up 502.93% and currently trading at $797.13.

The company has been around since 1876 and the stock didn’t go public until 1952 but in the last 4 years, Eli Lilly went from a $100 billion market capitalization to $740 billion today, which also makes it a potential stock split stock.

However, as investors, we care about the stock price years down the line and what Eli Lilly will do in the next 3 to 5 years and beyond.

That is why 24/7 Wall Street looks at projected revenue and net income to give you our best estimate of future stock prices from 2025 to 2030.

Other “experts” look at past growth rates and assign future stock prices to those past numbers. However, we will walk you through our assumptions and give you the key drivers we see propelling Eli Lilly’s stock in the future.

12/24/2024

Beginning in March 2025, some patients in Britain will have access to Mounjaro, Eli Lilly’s obesity drug, through the National Health Service (NHS). This follows approval from the UK’s health technology assessment body, which evaluates the cost-effectiveness of new treatments.

12/20/2024

The FDA has approved Eli Lilly’s obesity drug, Zepbound (tirzepatide), as the first treatment for obstructive sleep apnea in the U.S.

12/19/2024

The Food and Drug Administration (FDA) has reaffirmed its earlier decision that the shortage of tirzepatide (the active ingredient in Eli Lilly’s diabetes and weight loss drugs Mounjaro and Zepbound) has ended. This decision means that most compounding pharmacies will be required to cease production of compounded tirzepatide within the next 90 days.

12/18/2024

Kinsula (donanemab-azbt), Eli Lilly’s Alzheimer’s medication, has been approved by China’s National Medical Products Administration. In addition, EVA Pharma, in collaboration with Eli Lilly, has received approval from the Egyptian Drug Authority for its insulin glargine injection. This approval marks a milestone in providing affordable insulin to millions of people with diabetes in low- and middle-income countries.

12/16/2024

Eli Lilly’s Omvoh (mirikizumab) has been recommended by the European Medicines Agency’s Committee for Medicinal Products for Human Use to treat adults with moderate to severe Crohn’s disease. The drug was previously approved for ulcerative colitis in the U.S., Japan, and the EU.

12/13/2024

Recent reports show that Eli Lilly’s weight-loss drug Mounjaro is more popular in the UK than Wegovy by Novo Nordisk. Surveys suggest that users perceive Mounjaro to be more effective in weight loss, and online pharmacies have seen a shift to Mounjaro prescriptions.

12/12/2024

Ro, a telehealth company, has teamed up with Eli Lilly to improve patient access to Zepbound (tirzepatide). Through LillyDirect, patients can now obtain Zepbound at a self-pay price, making it more affordable.

12/11/2024

Eli Lilly’s experimental breast cancer drug, imlunestrant, has shown promising results in a Phase 3 clinical trial. When combined with Verezenio, the drug significantly extended the lives of patients with HER2-negative, ER-positive breast cancer compared to standard hormone-suppressing therapies.

12/10/2024

Eli Lilly plans to investigate the potential use of its popular weight-loss medications to treat addictive behaviors like smoking, alcohol abuse, and drug addiction. CEO Dave Ricks stated that these medications may have broader applications beyond weight loss and that the company will initiate clinical trials to explore these possibilities.

12/9/2024

Eli Lilly is planning to introduce Tirzepatide (or Mounjaro), the company’s diabetes and obesity drug, to the Indian market next year. The company has already received marketing authorization from Indian regulatory authorities for both Type 2 diabetes and obesity indications.

How did Eli Lilly’s stock price soar so much in the past few years? Let’s take a look at the numbers:

| Share Price | Revenues* | Net Income* | |

| 2016 | $80.36 | $21.22 | $2.74 |

| 2017 | $77.55 | $19.94 | ($0.21) |

| 2018 | $122.13 | $21.49 | $3.23 |

| 2019 | $140.83 | $22.32 | $8.32 |

| 2020 | $206.46 | $24.54 | $6.19 |

| 2021 | $238.31 | $28.32 | $5.58 |

| 2022 | 329.07 | $28.54 | $6.25 |

| 2023 | $745.91 | $34.12 | $5.24 |

*Revenue and Net Income in Billions

Since 2016, Eli Lilly’s revenue grew by 60% but income grew by 91%. Typically you wouldn’t expect a company growing at its top line by 7% annually to see an 828% increase in share price, however, investor sentiment for the next line of drugs front ran the stock price.

For example, in 2016 Eli Lilly was trading 13 times the trailing 12 months earnings and the market has increased its valuation each year and currently trades at a 125 times earnings multiple.

This raises the valid question, is Eli Lilly overvalued or will future revenues make up for the expensive valuation?

The current Wall Street consensus 1-year price target of Eli Lilly stock is $1030.00, which is 29.21% higher than today’s price of $797.13. Of the 26 analysts covering Eli Lilly stock, the current rating is 1.67 or “Outperform” with 1-year price targets as high as $1,100 and as low as $540.00.

24/7 Wall Street sets its 1-year price target at $1,040. Taking a look at the sum of its parts, we see Eli Lilly’s vertices valued as follows:

| Endocrinology | $735/ share |

| Oncology | $122/ Share |

| Cardiovascular | $4/ Share |

| Neuroscience | $16/ Share |

| Immunology | $38/ Share |

| Others and Pipeline | $110/ Share |

| Cash | $17/ Share |

Valuing Eli Lilly’s stock price for the coming years, we will take a look at expected revenue and net income and give our best estimate of the market value of the company by assigning a price-to-earnings multiple.

| Revenue | Net Income | EPS | |

| 2025 | $52.8 | $17.29 | 19.11 |

| 2026 | $62.5 | $22.49 | 25.03 |

| 2027 | $70.87 | $27.12 | 30.39 |

| 2028 | $80.68 | $32.2 | 25.97 |

| 2029 | $87.99 | $36.45 | 40.58 |

| 2030 | $96.67 | $41.12 | 46.29 |

*Revenue and net income reported in billions

We expect Eli Lilly’s P/E ratio in 2025 to be 60 with an EPS of $19.11, resulting in a price target of $1140.00 This prediction is based on strong revenue growth of 18.37% to $52.80 billion and net income expansion to $17.29 billion, continuing the upward trajectory from previous years.

For 2026, we anticipate a P/E ratio of 50 with an EPS of $25.03, leading to a price target of $1250.00. This reflects significant revenue growth of 18.37% to $62.50 billion and an increase in net income to $22.49 billion, driving higher earnings per share.

Heading into 2027, we project the P/E ratio to remain at 50, with EPS increasing to $30.39. This results in a price target of $1520.00. Continued revenue growth of 13.39% to $70.87 billion and net income expansion to $27.12 billion justifies this substantial increase in stock price.

With an EPS of $25.97 and a P/E ratio of 50 in 2028, we forecast the stock price to be $1300.00. A slight dip in EPS growth is expected, but sustained strong performance in net income to $32.20 billion and revenue growth of 13.84% to $80.68 billion keeps the stock highly valued.

By 2029, we estimate Eli Lilly’s EPS to rise to $40.58, with the P/E ratio adjusting to 40. This gives us a price target of $1623.00. The continuous revenue growth of 9.06% to $87.99 billion and net income expansion to $36.45 billion supports this higher valuation.

Price Target: $1850.00

Upside: 132.08%

By 2030, we estimate Eli Lilly’s EPS to rise to $46.29, with the P/E ratio adjusting to 40. This gives us a price target of $1850.00. The continuous revenue growth of 9.86% to $96.67 billion and net income expansion to $41.12 billion supports this higher valuation.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2025 | $1140.00 | Upside of 43.01% |

| 2026 | $1250.00 | Upside of 56.81% |

| 2027 | $1520.00 | Upside of 90.68% |

| 2028 | $1300.00 | Upside of 63.09% |

| 2029 | $1623.00 | Upside of 103.61% |

| 2030 | $1850.00 | Upside of 132.08% |

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.