Investing

NIO (NIO) Stock Price Prediction and Forecast 2025-2030

Published:

Last Updated:

NIO (NYSE:NIO) is one of the hottest EV car companies in the world and a top 10 largest in the world (3rd largest in China). NIO stock made its debut on the New York Stock Exchange on September 12th, 2018, at $6.26 per share.

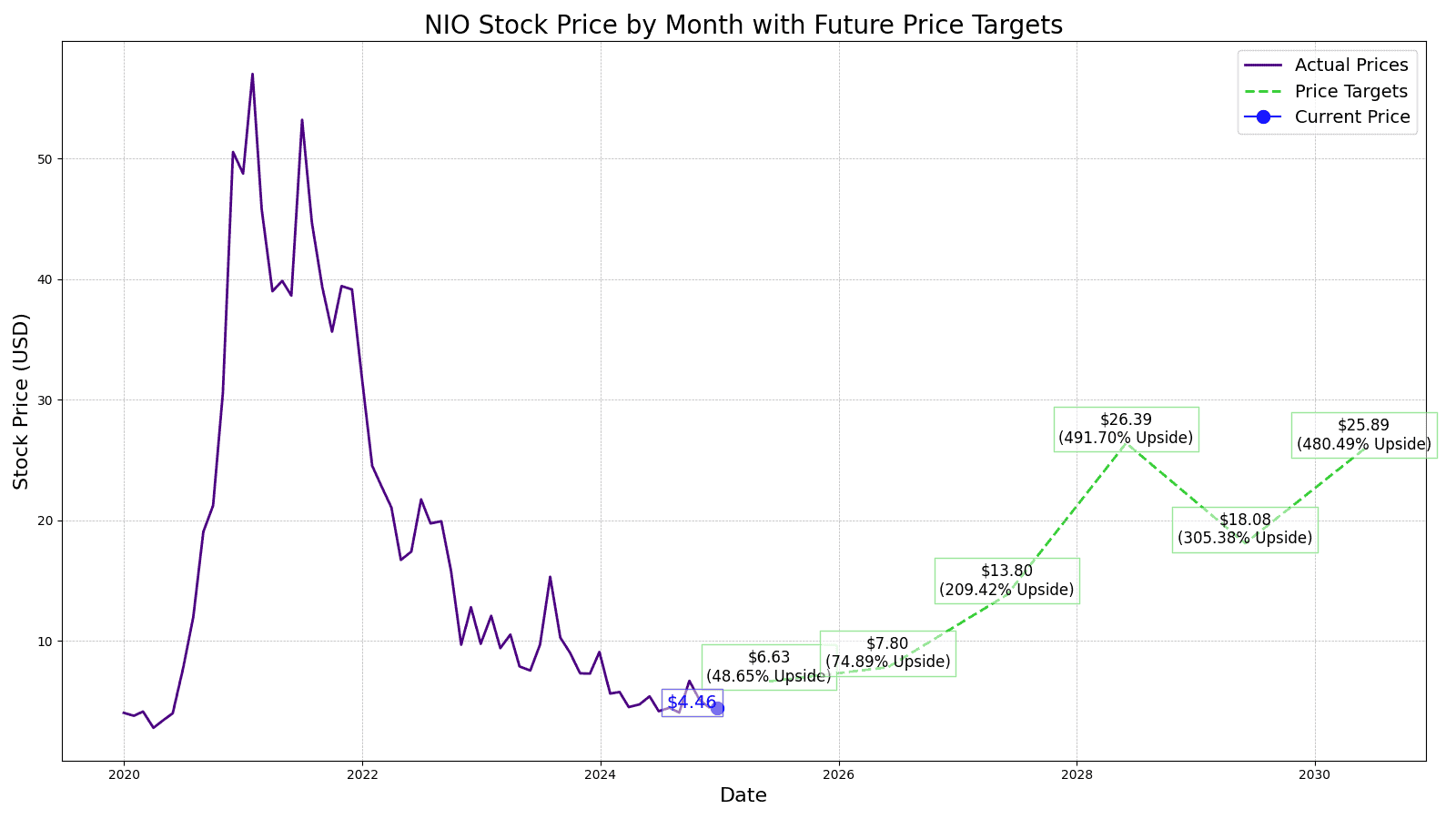

Within 3 years of trading, NIO stock hit an all-time high of $62.84 in February 2021 before plummeting 92.90% to today’s price of $4.46 per share.

While the share price run-up in early 2020 was purely a momentum push, NIO brand in the EV market was not tarnished. In fact, the car company is still seen as a premium EV player and one of the first companies to address range anxiety issues by creating battery swap technology as a supplement to charging.

24/7 Wall Street aims to provide readers with our assumptions about the stock’s prospects going forward, what growth we see in NIO stock for the next several years, and what our best estimates are for NIO’s stock price each year through 2030.

12/20/2024

NIO’s stock is up 3.4% today, trading as high as $4.59 with 13,656,837 shares changing hands.

12/18/2024

NIO shares are on the rise as anticipation grows for the upcoming launch of the company’s new sub-brand, Firefly. This weekend will mark the official unveiling of Firefly, a brand dedicated to premium smart electric vehicles designed for global urban consumers. Today, NIO released Firefly’s logo for the first time.

12/16/2024

NIO has expanded its battery swap network in China. The company added six new stations today, bringing the total count to 2,802. So far, NIO has installed 62 new stations this month, with the aim of meeting an ambitious target of 200 battery swap stations by the end of December.

12/13/2024

Nio’s shares dropped more than 2% in U.S. trading and nearly 4% in Hong Kong and Singapore today. Yesterday, NIO hosted a media event in Shanghai, but it appears it was not as successful with investors as planned.

12/12/2024

NIO’s third plant, F3, is scheduled to commence operations in the third quarter of 2024. This aligns with NIO’s ambitious goal of delivering 44,000 vehicles in 2025, a large increase from its projected output for this year.

12/11/2024

NIO shares were down 6.6% yesterday, trading as low as $4.80. The number of shares traded was also down 51% below average.

12/9/2024

NIO experienced a large gap up at the market open today. After closing at $4.61 on Friday, NIO’s stock opened at $4.94 (a 7.16% increase). In addition to the price surge, NIO also saw unusual options activity today, with 294,778 purchased call options, a 53% increase compared to the average volume of 193,100 call options.

12/6/2024

NIO’s new partnership with Mastercard includes many new experiences and innovative payment solutions. Mastercard cardholders will gain access to exclusive NIO benefits like charging, battery swapping, maintenance, car rental, and business travel privileges. In addition, NIO users will have the option to make contactless payments directly from their vehicle.

12/5/2024

NIO is teaming up with Mastercard to enhance user experiences and expand its global reach. The partnership will focus on improving payment solutions, user services, and international business growth.

12/3/2024

NIO’s shares surged today by 3.9%, peaking at $4.60.

11/27/2024

Goldman Sachs has taken a bearish stance on NIO, downgrading its rating from “neutral” to “sell” and lowering the price target to $3.90. This decision is primarily driven by concerns over NIO’s product pipeline, production ramp-up, and financial performance.

The following is a table of NIO’s revenues, operating income, and share price for the first few years as a public company.

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Share Price (End of Year) |

Revenues (CNY) | Operating Income | |

| 2018 | $5.39 | 4,951.2 | (9,595.6) |

| 2019 | $3.45 | 7,824.9 | (11,079.2) |

| 2020 | $40.00 | 16,257.9 | (4,607.6) |

| 2021 | $16.70 | 36,136.4 | (4,496.3) |

| 2022 | $7.87 | 49,268.6 | (15,640.7) |

| 2023 | $4.71 | 55,617.9 | (22,655.2) |

Revenue and operating income in Billion CNY (1CNY=.14 USD)

Now let’s take a look at Rivian (NASDAQ:RIVN) the first few years it was a publicly traded company (here is Rivian’s stock price forecast):

| Share Price (End of Year) |

Revenues | Operating Income | |

| 2021 | $50.24 | $55.0 | ($4,220.0) |

| 2022 | $19.30 | $1,658.0 | ($6,856.0) |

| 2023 | $10.70 | $4,434.0 | ($5,739.0) |

| TTM | $15.35 | $4,997.0 | (5,790.0) |

The revenue growth for both firms is similar but Rivian’s operating loss is more than double the yearly operating loss of NIO.

NIO formerly contracted its manufacturing to Jianghuai Automobile Group, paying a fee for each vehicle produced in addition to fixed cost. They have since acquired the factory from JAC. This agreement is beneficial for a young start-up in a very capital-intensive market. However, when scale is reached, the variable cost model has its downsides.

| Year | Revenue | Shares Outstanding | P/S Est. |

| 2025 | 97,052 | 2,050 mm | 1x |

| 2026 | 114,172 | 2,050 mm | 1x |

| 2027 | 134,643 | 2,050 mm | 1.5x |

| 2028 | 257,634 | 2,050 mm | 1.5x |

| 2029 | 176,533 | 2,050 mm | 1.5x |

| 2030 | 189,548 | 2,050 mm | 2x |

Revenue in CYN millions

Compared to Rivian and Tesla, NIO’s price-to-sales valuation will be moderately discounted. While NIO is in solid financial standing and has a premium brand image, it’s still uncertain how much competition the company will face in China and expanding overseas. The company is already spending a quarter of revenues on R&D and if NIO can’t capitalize on this spend, the stock price will be sluggish compared to North American EV manufacturers.

Wall Street analysts have NIO’s stock price over the next year to be $6.94 which gives the stock a 55.61% upside over today’s price of $4.46. Of the 26 analysts covering the stock, the consensus recommendation is a 2.07 ‘Outperform’ Score.

We expect to see a revenue growth of 60% for 2025, with a price-to-sales multiple of 1x, which puts our price target at $6.63, an upside of 48.65%.

Going into 2026, we estimate the price to be $7.80, with another strong 50%+ revenue bump. However, with EBITDA still well in the negative, we see the market not rewarding the stock as much and giving it a lower valuation multiple, resulting in an upside of 74.89%.

Heading into 2027, we expect the stock price increase to leap forward to $13.80 with another strong 50%+ revenue growth year-over-year. That is a 97% year-over-year gain and up 209.42% from today’s stock price.

When predicting more than 3 years out, we expect NIO’s P/S ratio in 2028 to be 1.5x and top-line growth of 50%. In 2028, we have NIO’s revenue coming in around $36 billion, suggesting a stock price estimate at $26.39 or a gain of 491.70% over the current stock price.

24/7 Wall Street expects NIO’s stock to continue its revenue growth and to generate $25 billion in revenue. The stock price in 2029 is estimated at $18.08, or a gain of 305.38% over today’s price.

We estimate NIO’s stock price to be $25.89 per share. Our estimated stock price will be 480.49% higher than the current stock price.

| Year | Price Target | % Change From Current Price |

| 2024 | $6.94 | Upside of 55.61% |

| 2025 | $6.63 | Upside of 48.65% |

| 2026 | $7.80 | Upside of 74.89% |

| 2027 | $13.80 | Upside of 209.42% |

| 2028 | $26.39 | Upside of 491.70% |

| 2029 | $18.08 | Upside of 305.38% |

| 2030 | $25.89 | Upside of 480.49% |

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.