The biggest trend in the stock market over the past two years has been artificial intelligence, and it has a tremendous runway for growth going forward. There’s not one trillion-dollar stock today that doesn’t have its hand in some way holding onto AI. In fact, it’s why many of them have broken through the $1 trillion capitalization threshold in the first place.

Yet some brilliant people on Wall Street don’t seem to care. Their portfolios, while having exposure to many of those companies, see bigger opportunities elsewhere and are putting their money to work there.

24/7 Wall St. Key Points:

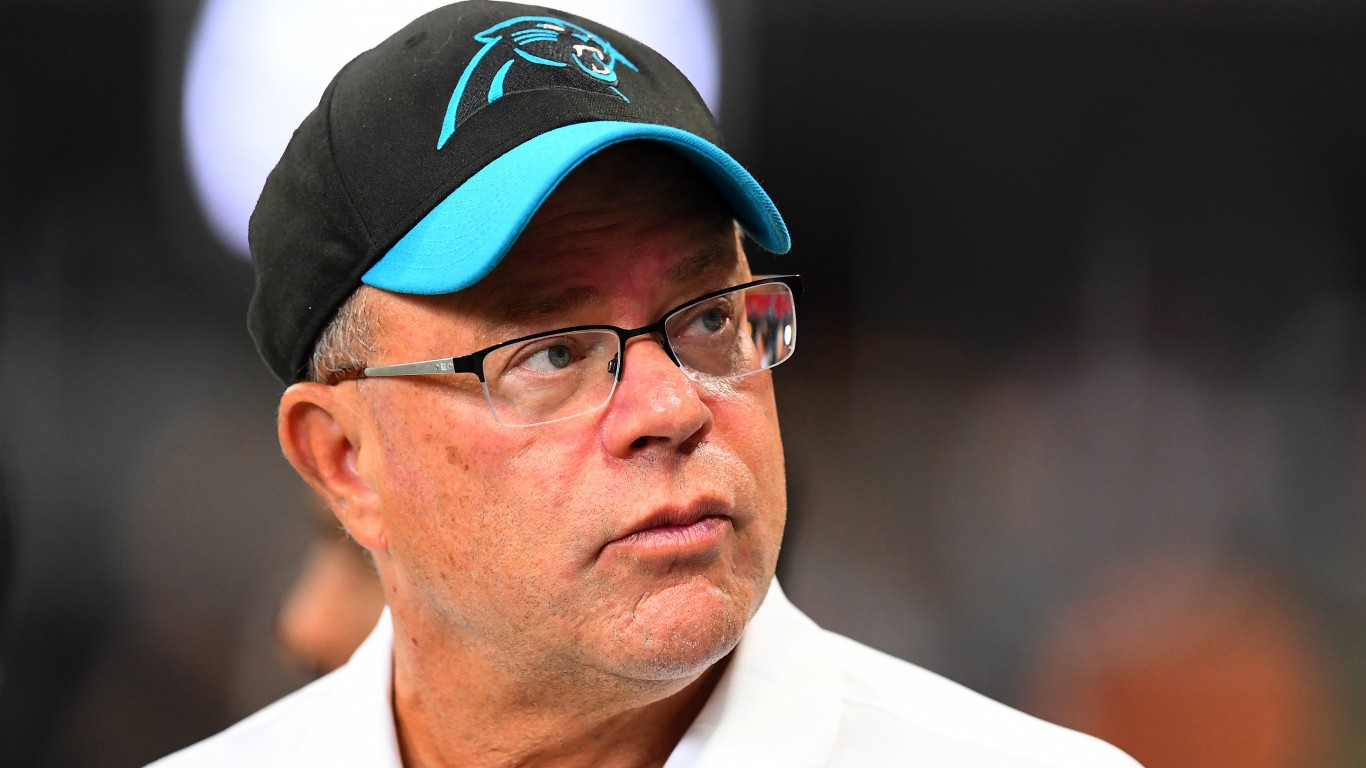

- Billionaire David Tepper has steered his Appaloosa Management hedge fund to impressive gains over the years and has more than doubled the performance of the S&P 500 over the last three years.

- Tepper told CNBC that China was the market to invest in these days and he is putting his money where his mouth is, doubling his stake in two Chinese stocks in the third quarter.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

One of those is billionaire investor David Tepper, whose Appaloosa Management hedge fund with $6.7 billion in assets under management, was busy selling down almost all of his positions. Although he did establish four new holdings in the third quarter, he also increased his position in just a handful stocks. Of those, only two were seen as worthy of nearly doubling their size or nearly so: PDD Holdings (NASDAQ:PDD) and JD.com (NASDAQ:JD).

There is good reason for Tepper betting big on China. Back in September, the superinvestor appeared on CNBC’s Squawk Box show and explained that Chinese stocks are severely discounted because of the country’s economy. However, Beijing launched a massive stimulus program that surprised the market in its size. It cut interest rates, cut mortgage rates on housing, a $114 billion fund to raise share prices, and $71.3 billion in incentives to buy back company stock.

Tepper said the combination of low stock valuations and government-backed stimulus and share repurchases made China the top market to invest in. So let’s see why the billionaire might be interested in these two companies in particular.

PDD Holdings (PDD)

Fast-growing discount e-commerce stock PDD Holdings is making its mark through two online platforms, Pinduoduo and Temu. Although Pinduoduo was PDD’s primary site and launched in 2015 for the domestic market, Temu, which started in 2022, has quickly become its leading platform globally.

According to The Wall Street Journal, Temu has become the second-most-visited shopping site in the world behind Amazon (NASDAQ:AMZN), helping PDD enjoy a 44% increase in revenue in the third quarter, or $14.15 billion, and generating a 46% in operating profits to $3.46 billion. Still, that was less than what Wall Street had been anticipating.

Although Temu’s U.S. share remains small compared to Amazon, which still controls about 40% of the market, that could erode quickly as more sellers flock to the platform because it doesn’t charge them fulfillment or advertising fees.

PDD stock is down 32% in 2024 and trades at less than 10 times earnings and estimates, and goes for a fraction of analyst long-term earnings growth estimates.

Tepper well more than doubled his position in PDD in the third quarter, which now accounts for 10.6% of Appaloosa’s portfolio. That is second only to Chinese peer Alibaba (NYSE:BABA), which commands 15.8% of the portfolio.

JD.com (JD)

The billionaire investor also nearly doubled his stake in PDD rival JD.com, raising his holdings 97%, making it the seventh largest position in the portfolio. The e-commerce giant hasn’t had as hard of a time as PDD this year as shares are up 26% year-to-date.

Even so, JD stock is down 24% from their recent high, but that has attracted other hedge fund operators like Michael Burry of The Big Short fame, who also doubled his stake in the online retailer in the third quarter.

JD is angling to make itself the low price everyday leader in the space, committing to invest $1.4 billion in a subsidy program to attract price-sensitive consumers to its platform. It is also picking up market share and the stock remains attractively priced.

Like its rival, JD goes for around 10 times earnings and estimates, but also trades at a tiny fraction to the $155 billion in annual sales it generates. Wall Street forecasts it will grow earnings over 14% annually for the next five years.

Tepper bought about 3 million shares of JD.com last quarter. With a average buy-in price of around $30 a share, he is sitting on a slight gain at the moment, but one that could rise substantially if his investment thesis proves true.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.