Nvidia (NASDAQ:NVDA) has been a stellar, once-in-a-lifetime opportunity for investors. Over the past five years the stock has appreciated over 2,240%. If you had invested $10,000 into the artificial intelligence chipmaker in 2019, it would be worth more than $233,000 today.

24/7 Wall St. Key Points:

- Nvidia (NVDA) has been a tremendous investment, growing over the last five years to become the second-most valuable company on the market.

- While the AI chipmaker has been buying stakes in other companies, there is one stock it likes better than all others and has been buying shares hand over fist.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Most of those gains would have come in the last two years. Although AI has been around for years, the launch of OpenAI‘s ChatGPT chatbot opened the floodgates for innovation in the space. And Nvidia has been one of the primary beneficiaries.

The semiconductor stock recorded $10.9 billion in annual revenue at the end of 2019 when its graphics processing units (GPU) were primarily being used to power gaming machines, cryptocurrency mining operations, and the metaverse. At the end of its fiscal 2025 third quarter last month, it reported a record $35.1 billion in a single three-month period.

Year-to-date it has produced $92.2 billion in revenue and is expecting to report sales of $128.7 billion for the full year, a near 12-fold increase in sales from five years ago.

The growth has catapulted Nvidia into the second-most valuable spot on the stock market at $3.4 trillion, behind only Apple (NASDAQ:AAPL).

Beginning in last year’s third quarter, though, Nvidia began investing heavily in other companies. Its 13-F filings with the Securities & Exchange Commission show the value of the stocks it owns totals $433 million, It has positions in companies such as SoundHound AI (NASDAQ:SOUN) and Arm Holdings (NASDAQ:ARM), and just last quarter, it took a near-5% stake of Applied Digital (NASDAQ:APLD).

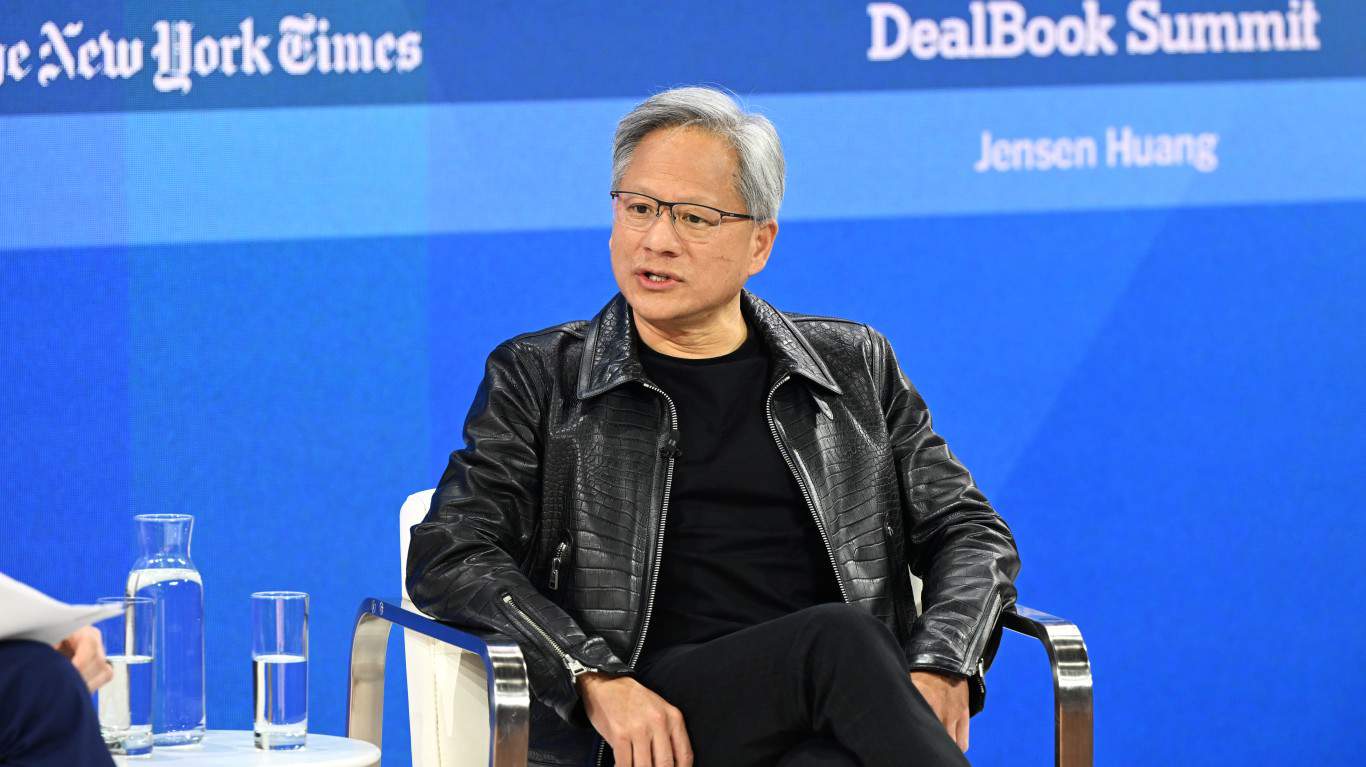

Notwithstanding the other stock purchases, there is one stock Nvidia CEO Jensen Huang loves more than any other. He has scooped up its shares any chance he gets, and has spent more money on this one company than any of those other stocks.

One stock to rule them all

Every single quarter for over two straight years, Huang bought shares of the one business he knows better than any other: Nvidia.

Now, it’s not traditional stock purchases like those of SoundHound or Arm Holdings. Rather, it is share repurchases, and Huang has been buying back Nvidia stock hand over fist. For the last 10 straight quarters, he spent over $45.4 billion on the stock.

While the buybacks are meant to offset dilution from shares issued to employees, Nvidia’s repurchase plan is one of the largest on Wall Street this year and one of the largest ever. In August it authorized an additional $50 billion worth of stock be repurchased, double last year’s authorization and suggestive it is going to pick up the pace of buybacks. It follows NVDA stock’s big 10-for-1 stock split in June.

Nvidia can easily afford to repurchase its stock because it produces so much free cash flow. With relatively little long-term debt, not needing to risk overcapacity by building out too much infrastructure, and a regulatory climate not conducive to making big acquisitions, buying back its stock is a viable, shareholder-friendly alternative.

Key takeaway

Some analysts have viewed the optics of Nvidia buying back stock when Huang has been selling shares as poor, but insiders can sell shares for any number of reasons, often completely unrelated to the health of the business. It’s more notable when they are buying shares.

That doesn’t mean I would recommend buying shares right now. NVDA stock is not cheap. It trades at 55 times earnings, 30 times sales, and goes for 60 times the free cash flow it produces. Yet so long as you have a long-term mindset, buying a bit of Nvidia to have some skin in the game isn’t a bad idea. You would have some good company with the chipmaker itself.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.