Investing

Nvidia Stock Finished 2024 With a Correction. It's Time to Buy as the AI King Seeks Big Efficiency Gains.

Published:

Last Updated:

Nvidia (NASDAQ:NVDA) stock has been the envy of the entire technology sector for yet another year, capping off 2024 with a nice 178% gain. Of course, the Nvidia party will eventually end, likely in tears and frustration. But until demand for top-of-the-line AI chips fades significantly, the rally may still have legs. In any case, expect NVDA shares to be a wild ride in the new year as new Blackwell hardware takes to the stage.

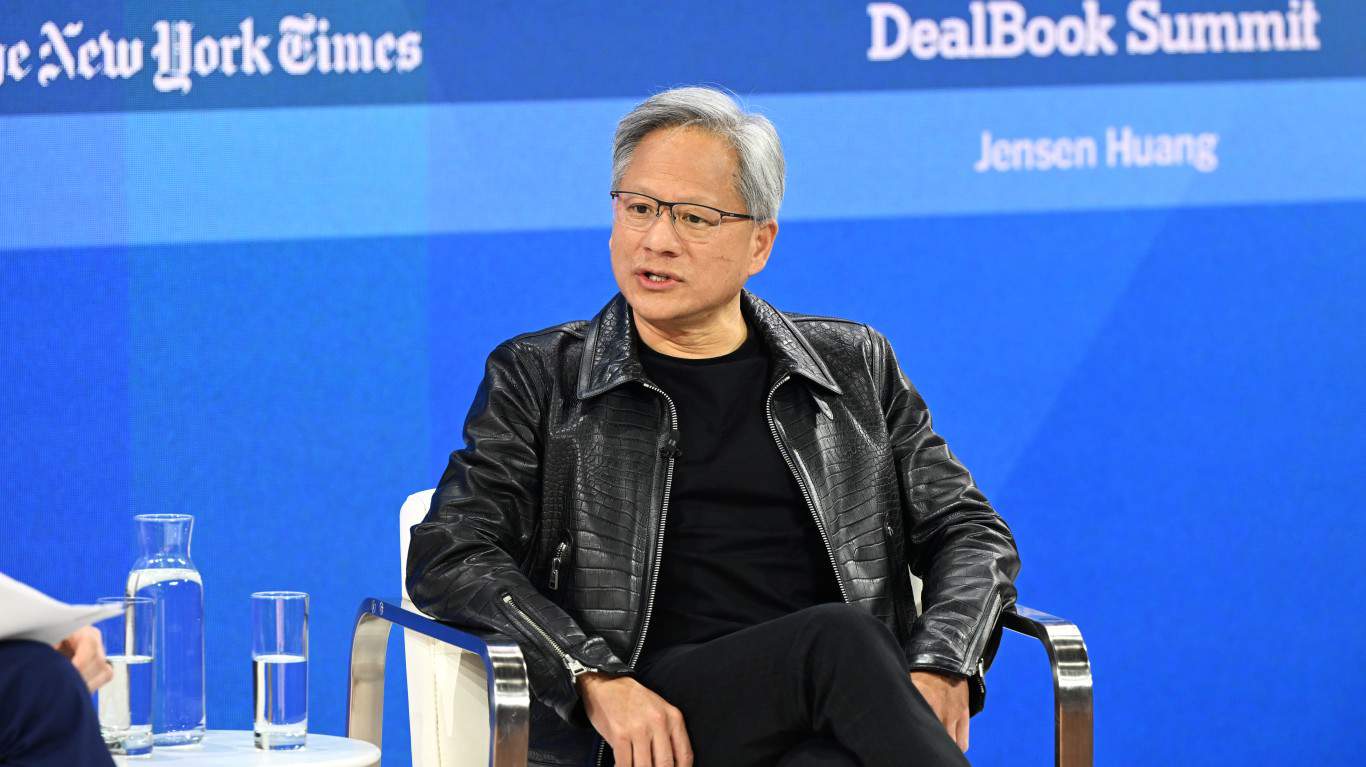

Nvidia had a weak finish to an extraordinary year.

As AI shoots for greater efficiencies, Nvidia remains a tough name to top.

If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

It’s not just AI chips that make Nvidia such a beast, though. The company’s software adds to the ecosystem, acting as water and alligators in the firm’s already wide economic moat. As investors look for a “Blackwell bounce” and a “Rubin rise” that could shortly follow going into 2026, investors will continue to ask themselves what a fair price is to pay for the profoundly dominant GPU maker in an era where some of Nvidia’s biggest customers are rolling up their sleeves with the willingness to spend on custom silicon of their own.

Indeed, Nvidia is not the only game in town. But, then again, it never has been. What it has been is the very best in the AI accelerator scene. Whenever you have a gigantic target on your back, as Nvidia does, with firms rushing to make their own AI chips, software, and all the sort, it can be tough to keep that moat intact and continue to gain dominance.

When many potential rivals are in the Magnificent Seven cohort, with an AI market that’s rapidly evolving by the day (it seems like there’s a new ground-breaker in AI every week!), it can be very difficult to stay sprinting at full speed on the so-called expectations treadmill.

With a Chinese startup recently pulling the curtain on its DeepSeek V3 language model, a model that’s competitive with ChatGPT-4o, questions linger as to what the next big step will be for AI.

Given the capability of the Chinese model and the low cost it took to train it (using older Nvidia H800 GPUs), a cloud of uncertainty surrounds what the future holds for large language models (LLMs) and America’s dominance as an AI superpower. In many ways, the AI world is changing rapidly. And it’s all right not to have all the answers at this instant, just as it was challenging to pinpoint which winners would stand tallest from the tech run-up in the 1990s.

In any case, the DeepSeek AI model shines a bright light on what could be a shift towards more energy-efficient models. Whether small language models (SLMs) are the future remains another question entirely. It would certainly be better to have more AI processes running in hand from a privacy and latency standpoint. In any case, I think recent DeepSeek news is not necessarily a sign that Nvidia will lose some of its luster.

At the end of the day, Nvidia is a leader in efficiency gains, with Blackwell reportedly making massive efficiency gains (1.7x better efficiency than Hopper). And when Rubin hits the market next year, look for Nvidia to shoot for an even larger reduction in energy consumption.

Perhaps those nuclear power plants to power AI data centers could be overdoing it!

In any case, I think Nvidia is just one of the driving forces behind AI chip efficiency gains. Add the Nvidia software suite into the equation and I do view the company as absolutely vital to shrinking hefty, unrefined models into smaller, more efficient ones that aren’t such a drain on the grid.

Additionally, the recent acquisition of Israeli firm Run:ai, which makes software to help drive AI chip efficiencies, I believe, reinforces Nvidia’s standing as the king of efficiency gains in AI. Given Nvidia’s efficiency focus, I view the recent year-end correction in NVDA stock as more of an opportunity for dip-buyers to start the new year right.

Sure, the industry is changing faster than most can keep up with. However, Nvidia is one of the driving forces behind such rapid change. Perhaps America’s edge lies in its easier access to Nvidia’s latest and greatest chips and software, which can provide the most firepower and leading efficiencies. Given this, I’d argue that NVDA stock remains a buy for 2025.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.