Investing

Why Dave Ramsey Is Wrong About This Key Piece of Financial Advice

Published:

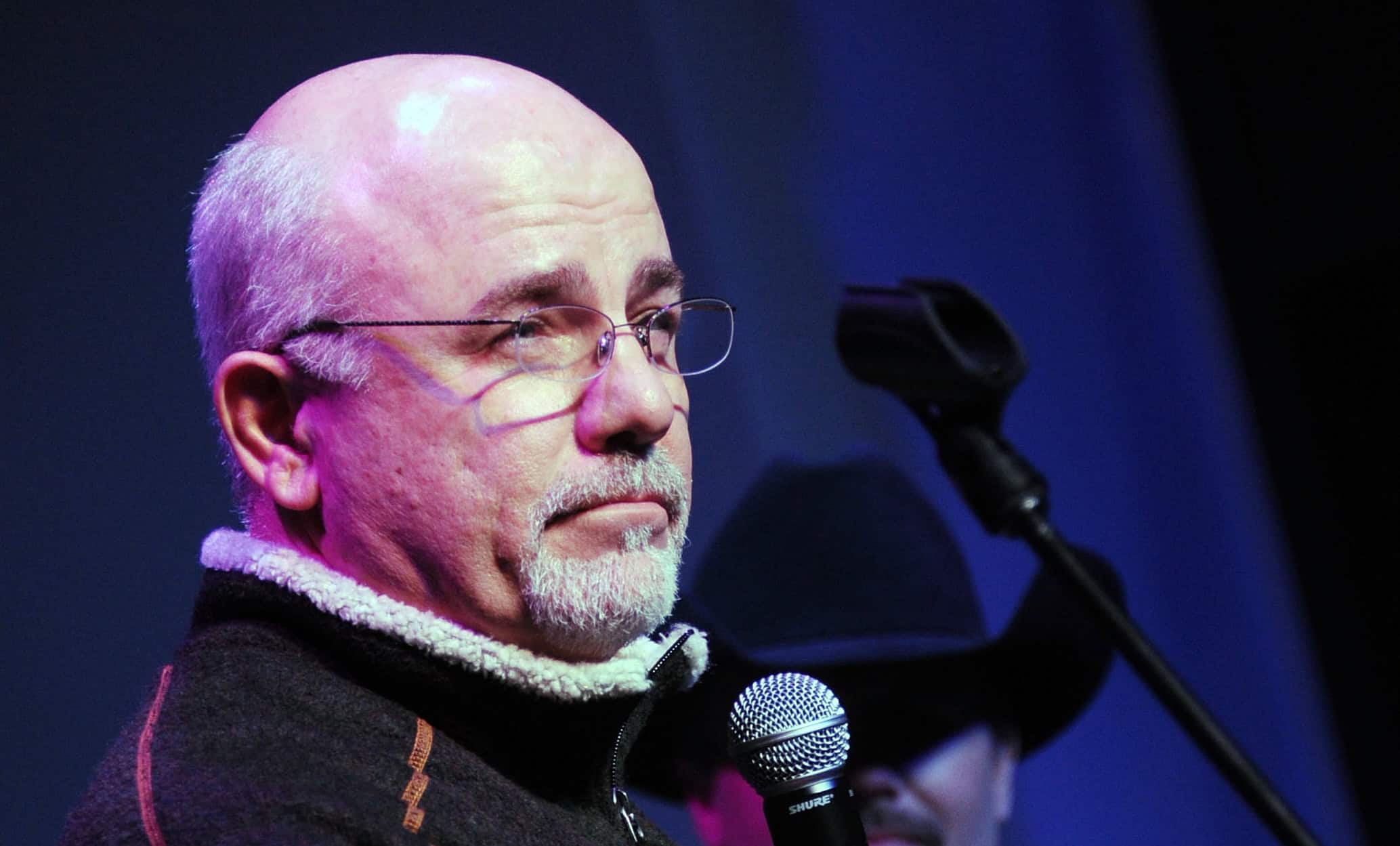

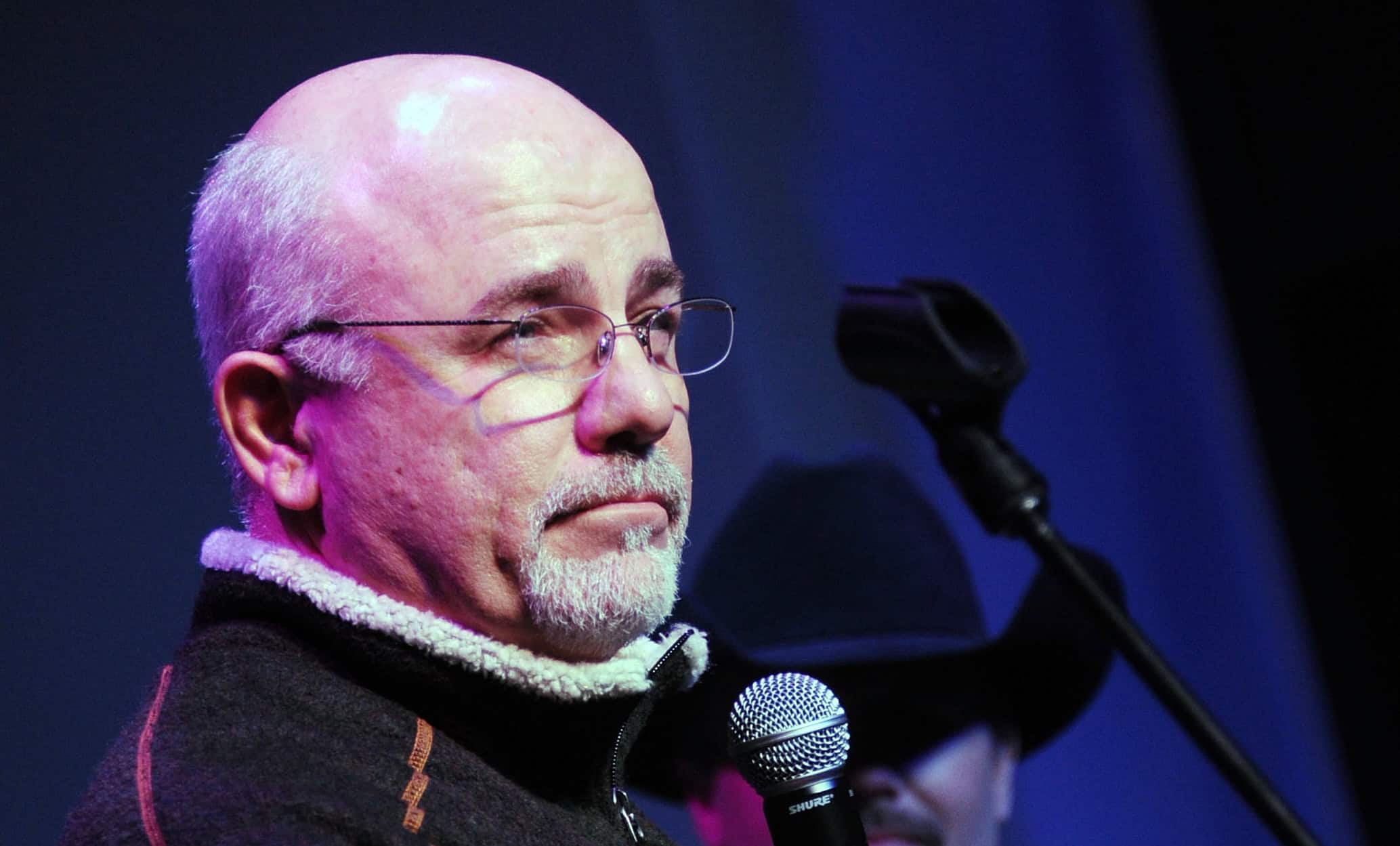

Dave Ramsey is among the most prominent personal finance experts in the game, with decades of experience in providing individuals with various strategies which can help them pay down debt and grow their wealth over the long-term.

I have to say, I agree with most of Dave Ramsey’s advice. And for the average Joe just looking to get a start on paying down their debt and rebuilding their lives, his strategies can certainly work. I’m not knocking the whole system he’s put together, it’s impressive.

However, Dave Ramsey’s debt snowball method is one that has become a popular strategy for tackling debt, and it’s one that I simply can’t mathematically agree with. Yes, Ramsey has said that those who get themselves into serious levels of debt weren’t thinking mathematically, and that’s a fair point – a great deal of this process is mental and emotional. But here’s why I think investors may want to consider the “debt avalanche” method instead.

The debt snowball method is a debt reduction strategy popularized by Dave Ramsey that prioritizes psychological momentum over mathematical efficiency. This strategy is aimed at focusing individuals on paying off the smaller possible debt first, while making minimum payments on all other forms of debt. In other words, if an investor has five different credit cards, paying off the smallest balance first will free up a payment which can be used on the next-largest card, and so on.

The obvious benefits of such a strategy is that those looking to pay down debt can get an easy win up front, and see their progress build as they move along. This is what Dave Ramsey is after. Similar to going to the gym, it’s human nature to want to see some sort of results up front, and failing to see what is meaningful progress in short order can be discouraging.

However, I’d argue that an individual with two debts (a $5,000 loan at 8% and a $25,000 credit card at 22%) needs to prioritize the credit card first, due to the sheer amount of interest this individual is paying in excess of the loan. I’d also argue that paying down debt is a long-term game, and consistency is the most important thing. I think those looking to actually commit to a massive endeavor like paying off a sum that may seem impossible to pay off need to come to terms with the fact it won’t be an enjoyable process. Small wins up front may not ultimately matter three or four years down the road when an individual or couple is still a few years away from paying everything off.

Indeed, the mathematically correct choice (which would pay off all debts much faster) would be the debt avalanche method, which I’ll dive into more here.

What I described above (a simplistic example, but it works) is essentially the debt avalanche method. By paying off the $25,000 credit card with a much higher interest rate first (and making the minimum payment on the smaller loan), an individual will get further along in their debt reduction journey. That’s just mathematically correct. And while such an individual may not get the immediate gratification of paying off the smaller loan right away, the amount of interest this person will pay over the time it takes him or her to pay off the $30,000 total will be far less with the avalanche method due to how interest compounds over time.

The other way of thinking about these two strategies is to turn things around, and consider two investments yielding 22% and 8%, respectively. Obviously, any rational investor would choose the 22% yielding investment, all else being held equal. In essence, paying down the 22% credit card provides a risk-free 22% return. You can’t get that in today’s market.

Thus, this individual’s circumstances could improve much, much faster by paying down the high interest rate debt down first. Of course, there’s nuance to this method (like everything). If an individual has two loans of substantially different amounts (say, $25,000 and $5,000) with interest rates that are within 50 basis points of each other (0.5%), I tend to think applying the debt snowball to those similar-interest loans makes sense. It’s all about balance when it comes to these strategies.

As mentioned above, there’s nuance to everything. To say one debt repayment method is better than another is difficult, because human nature and emotion are part of the process. Those looking to pay down debt should get started by simply making more than the minimum payments. Making any step in the right direction (debt snowball or avalanche, doesn’t matter) will get an individual closer to their goal, and I’m all for that.

However, for those looking to pay down as much debt as quickly as possible and put oneself in a position to eventually invest and grow one’s wealth, it’s been mathematically proven that the debt avalanche method is the way to go. Perhaps some therapy is needed to get past the emotional element of debt repayment. But things will get better when living within one’s means, generally speaking.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.