Investing

4 of the Highest-Yielding S&P 500 Stocks for 2025 With 6% and More Dividends

Published:

Dividend stocks are a favorite among investors for good reason. They provide a steady income stream of passive income and offer a promising avenue for total return. Total return, a comprehensive measure of investment performance, encompasses interest, capital gains, dividends, and distributions realized over time.

The S&P 500 has gained more than 20% in 2023 and 2024.

It is the first time investors have seen multiple 20% years since the 1990s.

Despite the gains, many of the members of the legacy index have traded sideways.

Are the top S&P 500 dividend stocks right for your portfolio? Make a 2025 resolution to contact a financial advisor near you for a portfolio review.

For example, if you buy a stock at $20 that pays a 3% dividend, and it goes up to $22 in a year, your total return is 13%. That is, 10% for the increase in stock price and 3% for the dividends paid.

While Wall Street has cheered the strength of the venerable S&P 500 over the past two years, the reality is that due to their massive market capitalizations, the Magnificent 7 technology giants, led by Apple Inc. (NASDAQ: AAPL) and Nvidia Corp. (NASDAQ: NVDA), have disproportionately influenced the market-cap-weighted Nasdaq composite and S&P 500 indexes.

The good news for growth and income investors looking for total return and passive income is that many of the top dividend names in the index still offer some of their highest yields in over a year and some solid upside potential. We screened the list and found four that all pay a 6% and higher dividend with Buy ratings at top Wall Street firms offering excellent entry points.

Since 1926, dividends have contributed approximately 32% of the total return for the S&P 500, while capital appreciations have contributed 68%. Therefore, sustainable dividend income and capital appreciation potential are essential for total return expectations.

This tobacco company offers value investors a great entry point and a rich 7.58% dividend. Altria Group Inc. (NYSE: MO) manufactures and sells smokable and oral tobacco products in the United States through its subsidiaries.

The company provides cigarettes primarily under the Marlboro brand, as well as:

It sells its tobacco products primarily to wholesalers, including distributors and large retail organizations, such as chain stores.

Altria used to own over 10% of Anheuser-Busch InBev N.V. (NYSE: BUD), the world’s largest brewer. The company sold 35 million of its 197 million shares through a global secondary offering earlier this year. That represents 18% of their holdings but still leaves 8% of the outstanding shares in their back pocket. They also announced a $2.4 billion stock repurchase plan partially funded by the sale.

This top cell tower company offers incredible growth and income possibilities with a massive 6.91% dividend. Crown Castle International Corp. (NYSE: CCI) is one of the largest U.S. wireless tower companies, with over 40,000 towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every primary U.S. market.

The company’s core business is leasing space on its wireless towers, primarily to wireless carriers, government agencies, and broadband data providers.

This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology, and wireless service – bringing information, ideas, and innovations to the people and businesses that need them.

Crown Castle is one of the best stocks in the sector for more conservative investors. Its high yield distribution and low volatility make it a good holding for accounts seeking growth, income, and less risk.

This blue-chip chemical giant offers a very hefty 7.22% dividend. LyondellBasell Industries N.V. (NYSE: LYB) operates as a chemical company in:

The company operates in six segments:

It produces and markets olefins and co-products, polyethylene and polypropylene, propylene oxide and derivatives, oxyfuels and related products, and intermediate chemicals, such as styrene monomer, acetyls, ethylene oxide, and ethylene glycol.

In addition, the company produces and markets compounding and solutions, including:

Polypropylene compounds

Further, it develops and licenses chemical and polyolefin process technologies; manufactures and sells polyolefin catalysts; and serves food packaging, home furnishings, automotive components, and paints and coatings applications.

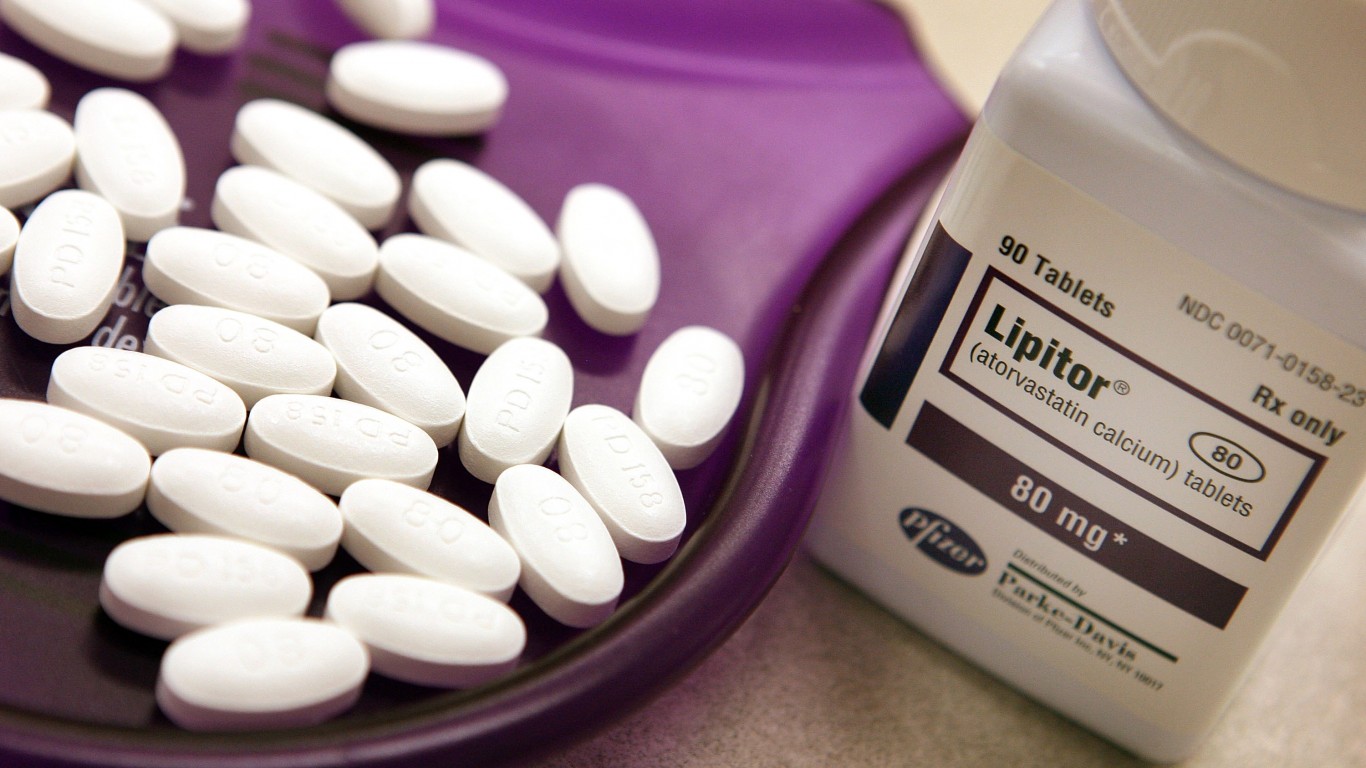

This top pharmaceutical stock was a massive winner in the COVID-19 vaccine sweepstakes but has been beaten down over the last three years as many are not getting boosters. Pfizer Inc. (NYSE: PFE) discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide and pays a hefty 5.75% dividend, which has risen yearly for the past 14 years.

The company offers medicines and vaccines in various therapeutic areas, including:

Pfizer also provides medicines and vaccines in various therapeutic areas, such as:

Trading not far from its lowest split-adjusted level in 13 years, the stock is an incredible bargain at current levels and pays a massive dividend.

The pharmaceutical giant recently posted 2025 revenue guidance of $61 billion to $64 billion. Patient investors will receive one of the highest S&P 500 blue-chip dividends, and shares trade at a very reasonable 9.08 times estimated 2025 earnings. In addition, the company boasts a substantial forward product pipeline.

Seven Magnificent Blue-Chip Dividend Stocks to Buy in 2025 and Hold Forever

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.