In 2025, the exchange-traded fund (ETF) landscape could shift in big ways. For one, no investor can claim with any degree of certainty which direction the market will be headed. And with so much capital flowing into ETFs from investors of all kinds, added market-wide volatility from potential downturns or melt-ups could lead to more widespread volatility than we’ve seen in the past. For industry-specific ETFs, this can be a key drawback for certain passive long-term investors.

However, long-term investors looking to put capital to work in the market for a decade or two have done well owning widely diversified baskets of stocks in recent decades. Barring a depression of some kind, forward returns for the next 10 to 20 years should be positive. And as the saying goes, the best time to plant a tree was yesterday – the second best time is today.

For passive and active investors alike looking to build out their portfolio in 2025, I think there are a myriad of great options to choose from in the ETF world. However, these three ETFs are ones I’d consider to be among the best of the best. Here’s why.

Key Points About This Article:

- For passive and active investors alike, the good news is that there are plenty of great options to choose from to get investing in 2025.

- Here are three of the best options I think long-term investors may want to consider to buy and hold for the next decade or two.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Vanguard Total Stock Market ETF (VTI)

I’ve long touted the Vanguard Total Stock Market ETF (NYSEMKT:VTI) as one of the top ETFs long-term investors should consider for retirement. That’s due to the fundamental structure of this particular fund, which closely mirrors the historical S&P 500 return, while offering greater diversification. That’s because this ETF actually holds more than 3,600 stocks, tracking the total stock market index within the U.S. across a myriad of small and mid-cap names as well.

In other words, VTI is a great option for long-term investors looking to buy the entire market, not just the 500 largest U.S. companies. For those who believe that capital may rotate out of large-caps and into small and mid-cap stocks (following an incredible run for large-caps overall in recent years), this particular ETF could be the best way to play this trend.

While market analysts anticipate some price fluctuations for VTI in 2025, this is a fund that’s broadly expected to increase over the course of the next year. If the soft-landing narrative continues to play out as it has in recent years, that’s certainly a strong likelihood. And while headwinds could certainly materialize, this ETF’s rock-bottom expense ratio of just 0.03% (three basis points) is about as low as it goes for funds providing this level of diversification.

Schwab U.S. Dividend Equity ETF (SCHD)

For investors looking to tilt their portfolios more toward high-quality dividend-paying stocks, the Schwab US Dividend Equity ETF (NYSEMKT:SCHD) may be a great option to consider. This ETF tracks the Dow Jones U.S. Dividend 100 Index, which is comprised of companies with at least 10 years of dividend growth, excluding REITs to avoid overrepresentation. The index ranks companies using a composite score based on financial strength (cash flow to debt), business performance (return on equity), and dividend appeal (yield and five-year growth rate). Thus, there’s a quality component to the holdings chosen by this ETF, which is a factor I particularly like.

With the top 100 companies in this space included in the ETF (market cap weighted), this fund provides investors with outsized exposure to the largest (and mostly highest-quality) companies in this space. Thus, for those seeking diversification within a dividend strategy, this is a fund I think is worth considering for more than its 3.3% dividend yield (more than twice that of the S&P 500).

Now, this ETF does carry an expense ratio of double VTI, but at 6 basis points (0.06%), that’s still incredibly cheap, given this fund’s focus on quality. Finding a portfolio of established dividend-paying stocks supported by reliable cash flows isn’t easy, and many investors would easily pay an active manager a much higher fee to construct a similar portfolio. Thus, for passive and active investors alike, this is a top fund I think is worth considering in 2025.

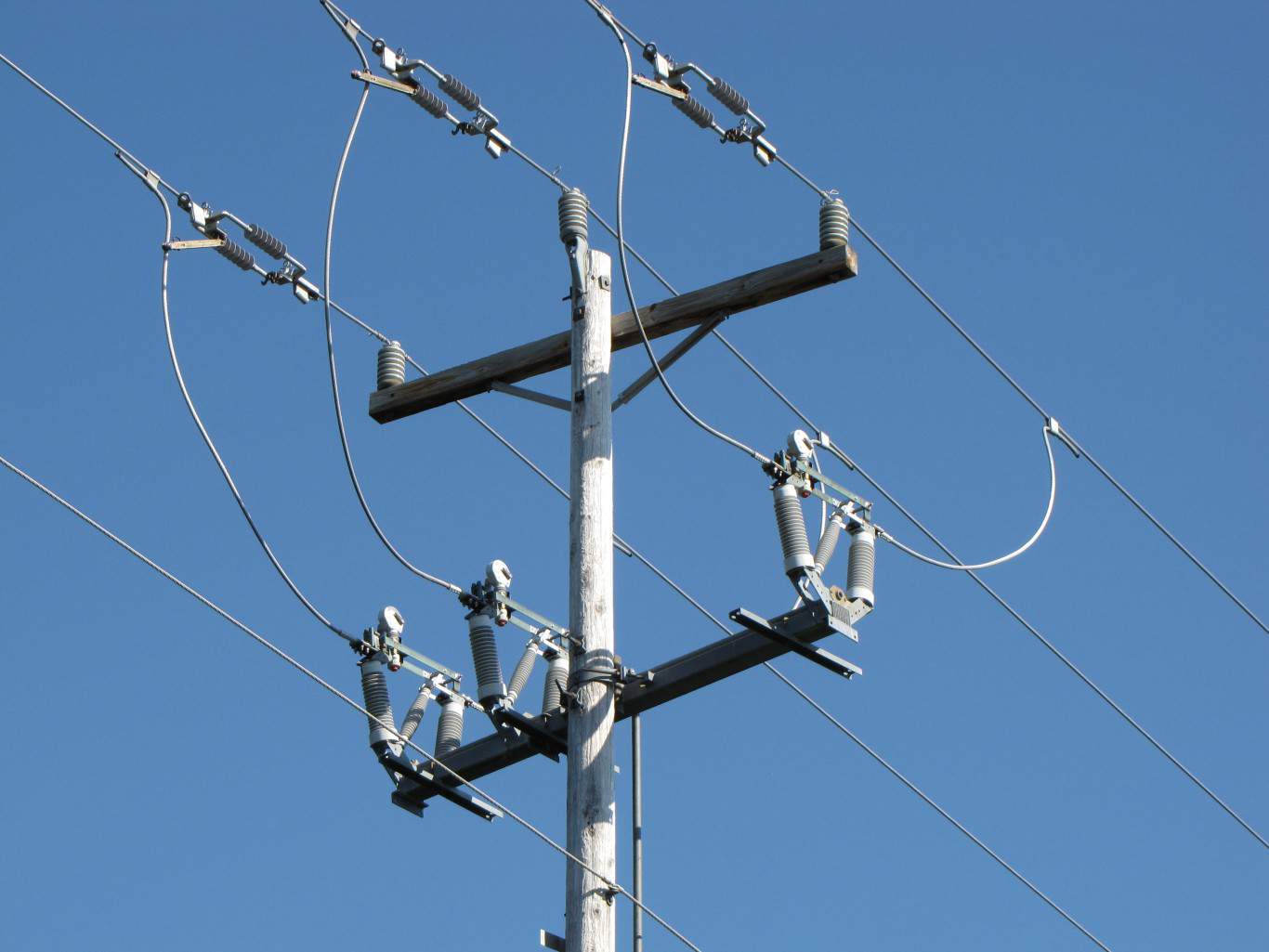

Vanguard Utilities ETF (VPU)

Moving even further down the specialization spectrum, the Vanguard Utilities ETF (NYSEMKT:VPU) is a sector-specific ETF I think most long-term investors may want to consider, for a few reasons.

Most importantly, VPU tracks the performance of 70 utilities-focused companies. The companies held in this fund operate electricity, water, and natural gas utilities, providing investors with exposure to business models that provide incredibly reliable cash flow growth profiles over time. The utilities sector is one that’s proven to be highly defensive (great during periods of market turmoil). And with 70 of the best companies in this space within this particular basket, investors certainly have plenty to gain by being able to sleep soundly at night holding such a fund in their portfolio.

Additionally, there are specific growth catalysts for this sector that provide a rationale for growth-oriented investors to consider VPU. Surging energy usage, courtesy of data centers running AI servers, have provided clear tailwinds for this sector that didn’t previously exist. Investors looking to gain “picks and shovels” exposure to the AI trend with lower volatility have flocked to this sector, leading to incredible capital appreciation upside over the past year (in addition to a robust dividend yield of 2.8%).

For those who think these trends will continue, this is a top ETF to consider in 2025 in my view.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.