Investing

Quantum Computing (QUBT) Crashes Amid Doubts About Technology's Viability

Published:

Quantum Computing (NASDAQ:QUBT) has been one of the best quantum computing stocks to buy with shares soaring 2,620% over the past three months. The promise of the nascent computer technology went stratospheric after Alphabet‘s (NASDAQ:GOOG)(NASDAQ:GOOGL) Google suggested it was much further along on its path toward real-world applications than many previously believed.

That has all come crashing down hard after Nvidia (NASDAQ:NVDA) CEO Jensen Huang said people were putting the cart before the horse and there were decades ahead before quantum computing would have any utility.

Shares of Quantum Computing plunged in midday trading today, falling 48% from yesterday’s close. It may be a bit of an overreaction, but the market quickly lost faith that QUBT stock was worth its $2 billion market valuation.

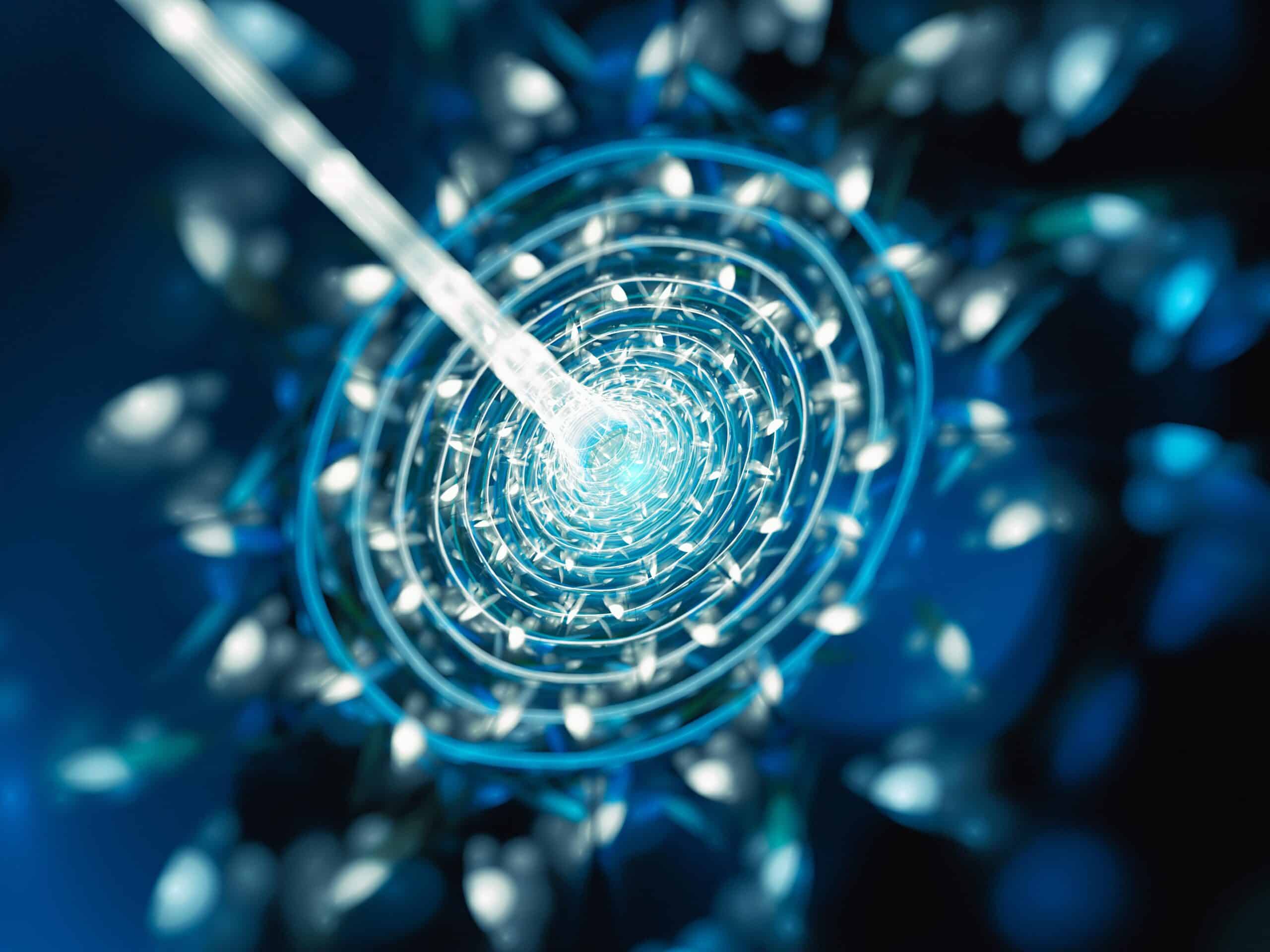

Quantum computing, particularly in the age of artificial intelligence, looked like it would be the next stage of evolution. Its promise lies in becoming the 4-D chess of computing. Where traditional computers break data into very two-dimensional 1s and 0s, quantum computers use quantum bits, or qubits. Unlike binary 1s and 0s, qubits can be either or, or both at the same time. There are also an infinite number of possibilities in between, called superposition.

Qubits also possess a property called “entanglement,” which is like superposition on steroids. They can actually communicate and cooperate thereby expanding their possible permutations exponentially.

Quantum computers take all that data and explore the complex patterns of probability occurring to determine the likely outcome of any particular sequence happening. It allows quantum computers to determine all potential outcomes simultaneously. It has huge ramifications for the healthcare, finance, telecom, and energy industries.

This past October, the quantum computing market began to explode. International Business Machines (NYSE:IBM) opened its first European quantum data center in Germany, allowing its customers to execute workloads on utility-scale quantum computing systems. The data center features two utility-scale quantum computers with the 127-qubit IBM Quantum Eagle chip.

That was followed In December by Google announcing its Willow chip would “pave the way to a useful, large-scale quantum computer.”

Quantum computing is seen as the next stage of computing and has many possible real-world uses. For example, it could help pharmaceuticals design new drugs or help logistics companies determine optimal routes for delivery trucks. The dark side of quantum computing’s potential is hackers could also harness its power to break into otherwise secure encryption data. The problem is they’re not very good at what they do yet.

That was part of the excitement around Google’s Willow chip as it can reportedly exponentially reduce errors. The tech giant said, “This cracks a key challenge in quantum error correction that the field has pursued for almost 30 years.”

Quantum Computing Inc was seen as one of the leading players in the space, particularly after it secured a contract in late December from the National Aeronautics and Space Administration’s Goddard Space Flight Center for its imaging technology called Dirac-3. But the reality of the quantum computing market just got doused in a bucket of cold water.

In a Q&A session last night at CES 2025, Nvidia’s Huang told attendees, “If you kind of said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30 it’s probably on the late side. If you picked 20, I think a whole bunch of us would believe it.”

It suggests despite the spate of favorable news, the technology is still not ready for prime time. The market suddenly agreed QUBT stock and the rest of the sector was not worth the valuations the market was assigning, at least not for another generation.

Quantum computing technology was always seen as a high-risk, high-reward bet. What many seemed to forget in their rush to get in early was that while the risk is ever-present, the reward is nowhere near guaranteed.

Quantum Computing may yet bounce back from the depths to which it’s fallen. Just don’t expect it to claw back all the gains QUBT shares made over the past few months. It may be a long slog forward for the next 15 to 30 years.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.