Investing

After Day of Carnage, Is It Time to Buy Quantum Computing Stocks Again?

Published:

The carnage in quantum computing stocks Wednesday saw shares of Rigetti Computing (NASDAQ:RGTI), Quantum Computing (NASDAQ:QUBT), and IonQ (NASDAQ:IONQ) plunge 40% or more.

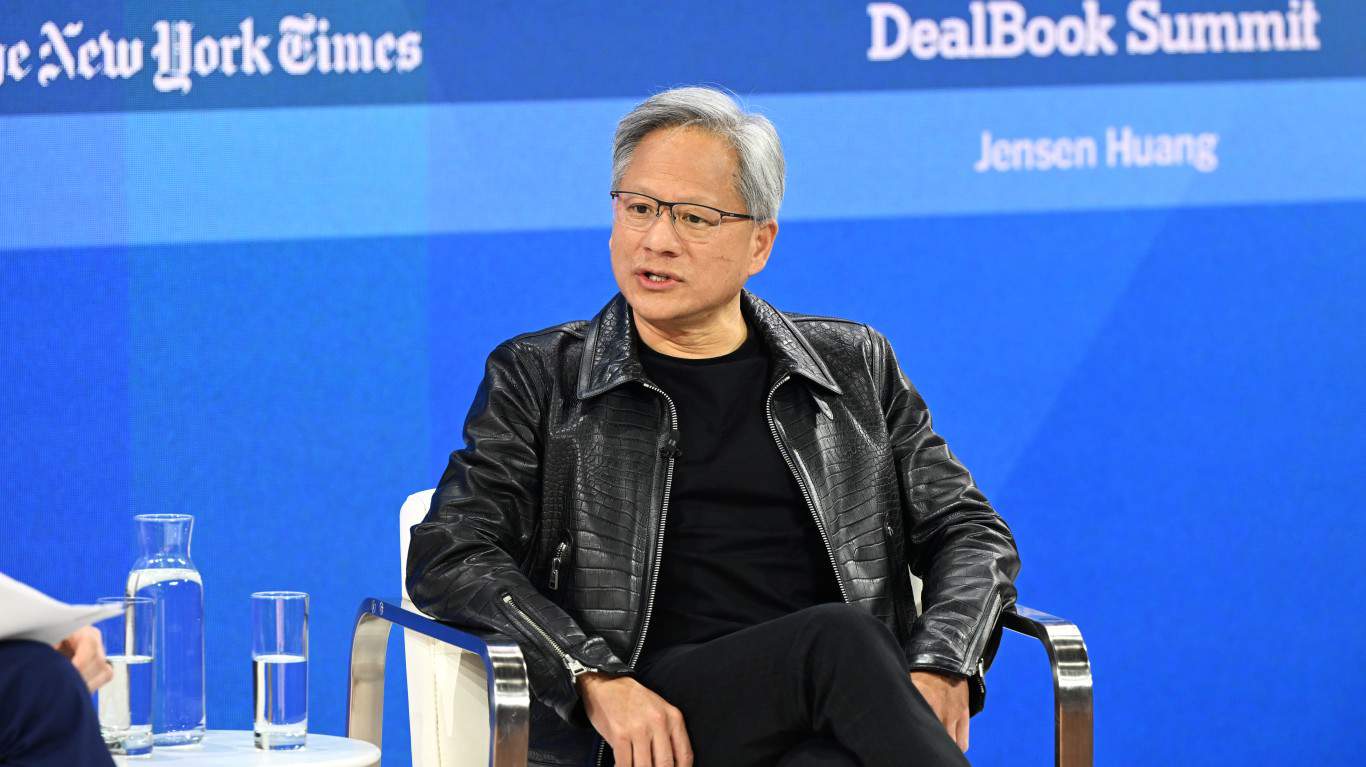

Comments made by Nvidia (NASDAQ:NVDA) CEO Jensen Huang that the sector won’t see viability for another two decades gutted these former high-flying stocks. Because their shares were vastly overvalued following a massive run-up last year, it indicated we may have not seen the last of the freefall they experienced.

Although the stock market is closed due to a national day of mourning for former President Jimmy Carter, the sector was inching higher in off-hours trading with RGTI up almost 3%, QUBT 4% higher, and IONQ rising 6%. Shares could still turn south again when the market reopens on Friday, but was the damage overdone? Should investors jump in at these new, dramatically lower prices?

24/7 Wall St. Key Points:

At a Q&A session at CES 2025 Tuesday night, Huang told attendees, “If you kind of said 15 years for very useful quantum computers, that would probably be on the early side. If you said 30 it’s probably on the late side. If you picked 20, I think a whole bunch of us would believe it.”

That was a harsh assessment for quantum computing companies that had been market darlings in 2024, many of whom saw their stocks soar 1,000% or more. It suggested the valuations assigned to these businesses could no long be justified and the exponential growth envisioned by investors was unsustainable.

Questions were already lingering at the start of the year. Doubts about revenue growth, widening losses, and an inexorable cash burn grew over the viability of their business models. Huang’s view of the sector’s ability to deliver to market practical solutions in the near-term simply threw gasoline on the smoldering embers and ignited a conflagration of their stocks.

While losing one-third to almost one-half of your market capitalization in a single day seems extreme, quantum computing stocks are still not very cheap. These companies have negligible sales relative to their valuations making them grossly overvalued even after this significant reset in their stock prices.

Rigetti Computing, for example, whose stock plummeted 45% yesterday, has just $8.5 million in revenue over the first three quarters of its fiscal year giving it a price-to-sales ratio north of 200. Its market cap is still some $2.4 billion. Quantum Computing has just $311,000 in sales giving it an astronomical P/S ratio, but a $1.3 billion market cap.

IonQ, with revenue of $31.4 million, is arguably the best situated of the bunch, but it still trades at 174 times sales and is valued at $6.6 billion. All the companies, though, continue to run up substantial losses, in many instances much larger than the year ago period. It suggests even if sales are growing, it only worsens their predicament as the more they sell the greater the losses they incur.

A case can be made that a one-day drop of the magnitude witnessed yesterday was excessive. Nvidia’s CEO’s comments could be seen in one sense as self-serving because it offers something of a competing product in its Quantum Cloud, which offers access to a quantum computing platform through APIs capable of running its CUDA-Q projects over a host of NVIDIA’s graphics processing unit systems.

Further, Nvidia’s DGX Quantum combines its Grace Hopper superchips with Quantum Machines OPX+ control system to run hybrid algorithms, quantum error correction, calibration, and control at maximum performance levels.

Yet the melt up in share price last year was equally excessive and completely unwarranted based on quantum computing stock fundamentals. It means now is not the time to be getting back into these stocks. These companies still need to prove they can live up to the potential the technology promises. While that may hapen, the time isn’t today and there may be additional pricing resets coming in the very near future.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.