BigBear.ai (NASDAQ:BBAI) fell for the third consecutive day, but the losses accelerated as BBAI stock crumpled 16.2%. The stock is down almost 27% over those three days. It’s lost more than a third of its value since its all-time high achieved at the end of 2024.

Yesterday’s decline, though, had more to do with the tech industry’s CES 2025 show in Las Vegas that runs from Jan.7 to Jan. 10 and suggests BigBear’s decline may not be over yet.

24/7 Wall St. Key Points:

- BigBear.ai (BBAI) got caught in a downdraft yesterday that pulled its shares 16% lower by the time the market closed.

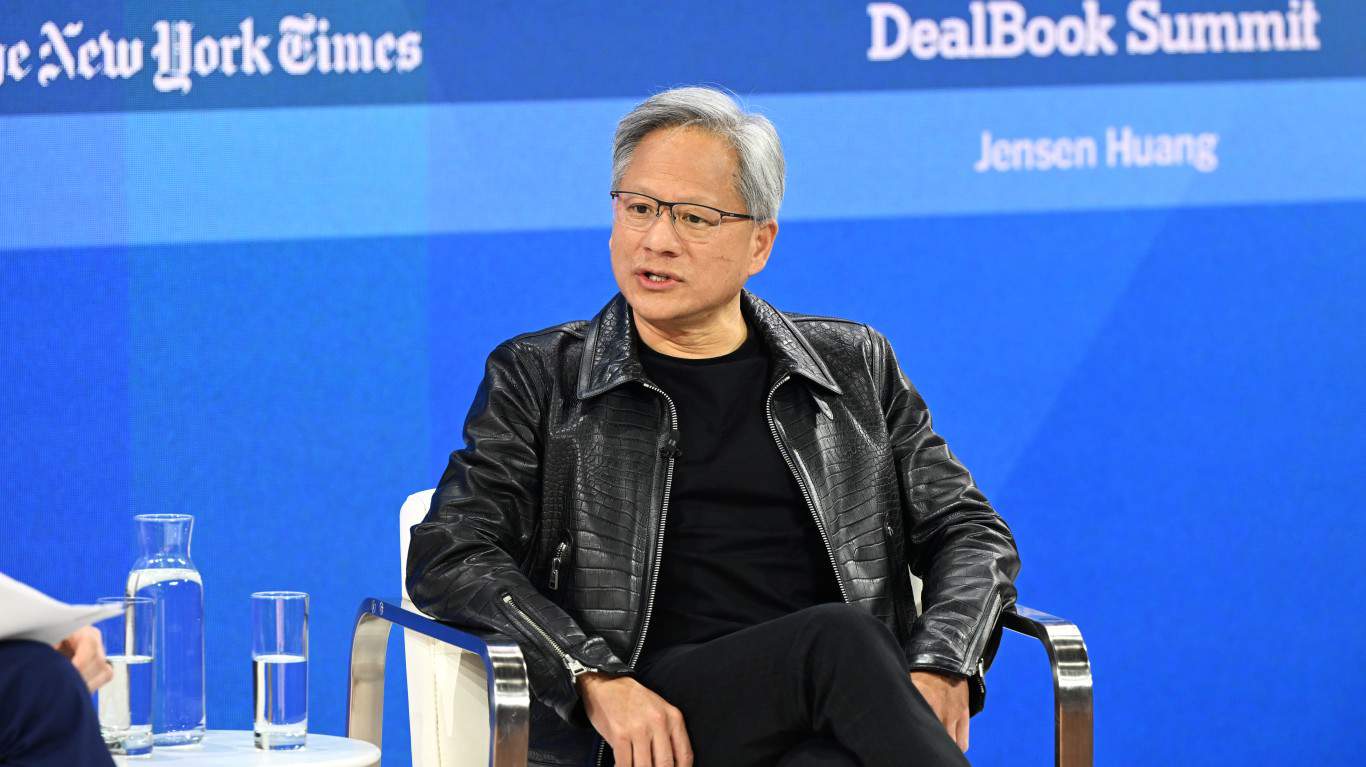

- There were several factors that likely contributed to the sharp drop, not least of which was comments made by Nvidia (NVDA) CEO Huang at CES 2025.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

All AI, all the time

The consumer electronics show is an event where companies gather to debut their latest technology and gadgets for the coming year. Artificial intelligence was more than front and center at the tech extravaganza, it was the show. Nvidia (NASDAQ:NVDA) CEO Jensen Huang even gave the keynote address on Monday.

AI continues to also dominate the news cycle as President-elect Donald Trump stood with DAMAC Properties CEO Hussain Sajwani to announce the Emirati billionaire would be investing $20 billion in the U.S. to build AI data centers.

It’s clear the environment for AI technology is as rich as it has ever been, and BigBear.ai has even been tagged as the next Palantir Technologies (NASDAQ:PLTR). Yet throughout this period, the stock of the AI data mining and analytics firm is falling. What gives?

Big shoes to fill

While BigBear has many similarities to its larger rival in that they are both targeting the artificial intelligence and machine learning cloud-based markets, and they even have a partnership together, that is where the comparisons end.

BigBear only has a literal handful of companies that account for more than half of its revenue. That is a risky concentration that could blow up if any of them leave or contracts or cancelled. It’s happened before. A contract with the U.S. Air Force ended and one of its biggest customers, Virgin Orbit, went bankrupt, a period when BBAI stock lost three quarters of its value.

Its partnership with Palantir hasn’t generated any real value either other than being able to point to it in an attempt to hitch its wagon to its bigger, better financed peer.

The company is also a perennial money-loser. So far across the first three quarters of its fiscal year, BigBear.ai has lost $149 million, a near fourfold increase from the year-ago period.

A confluence of factors sinking the ship

BigBear.ai stock was falling before the market even opened yesterday. BBAI stock closed at $3.96 per share the day before and opened at $3.72 per share. It fell as low as $3.19 per share, a near 20% dropoff, before gaining back some ground.

There are likely two reasons for the decline. First, there could be some residual effect from Palantir Technologies having a Deutsche Bank analyst reiterating his sell rating on the stock. While raising his one-year price target to $26 per share, that still implies 68% downside risk.

More important was the commentary from Nvidia’s Huang during a Q&A session at CES. He suggested that quantum computing was still a good 20 years away from viability. While that caused the sector to implode yesterday, with many names losing nearly half their value, the downdraft also brought down a bunch of other stocks that had similarly risen to nosebleed valuations on little more than a whim. BigBear.ai was one of them.

Key takeaways

The AI-powered data analytics firm had ridden investor enthusiasm for the technology to new heights last year. BBAI stock doubled in value in 2024. But there is a lot of consternation about many of these companies not having the fundamental basis to support the sky-high multiples the market assigned.

Huang’s remarks seemed to be a wakeup call to investors that all of these high-flying stocks may not be able to justify the exponential growth experienced, BigBear.ai among them. This might not be the last of BBAI stock’s decline either. It has experienced multiple dramatic pullbacks over the past three years, so what we’re seeing now may be the start of the next one.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.