Investing

Eli Lilly (LLY) Stock Price Prediction and Forecast 2025-2030

Published:

Last Updated:

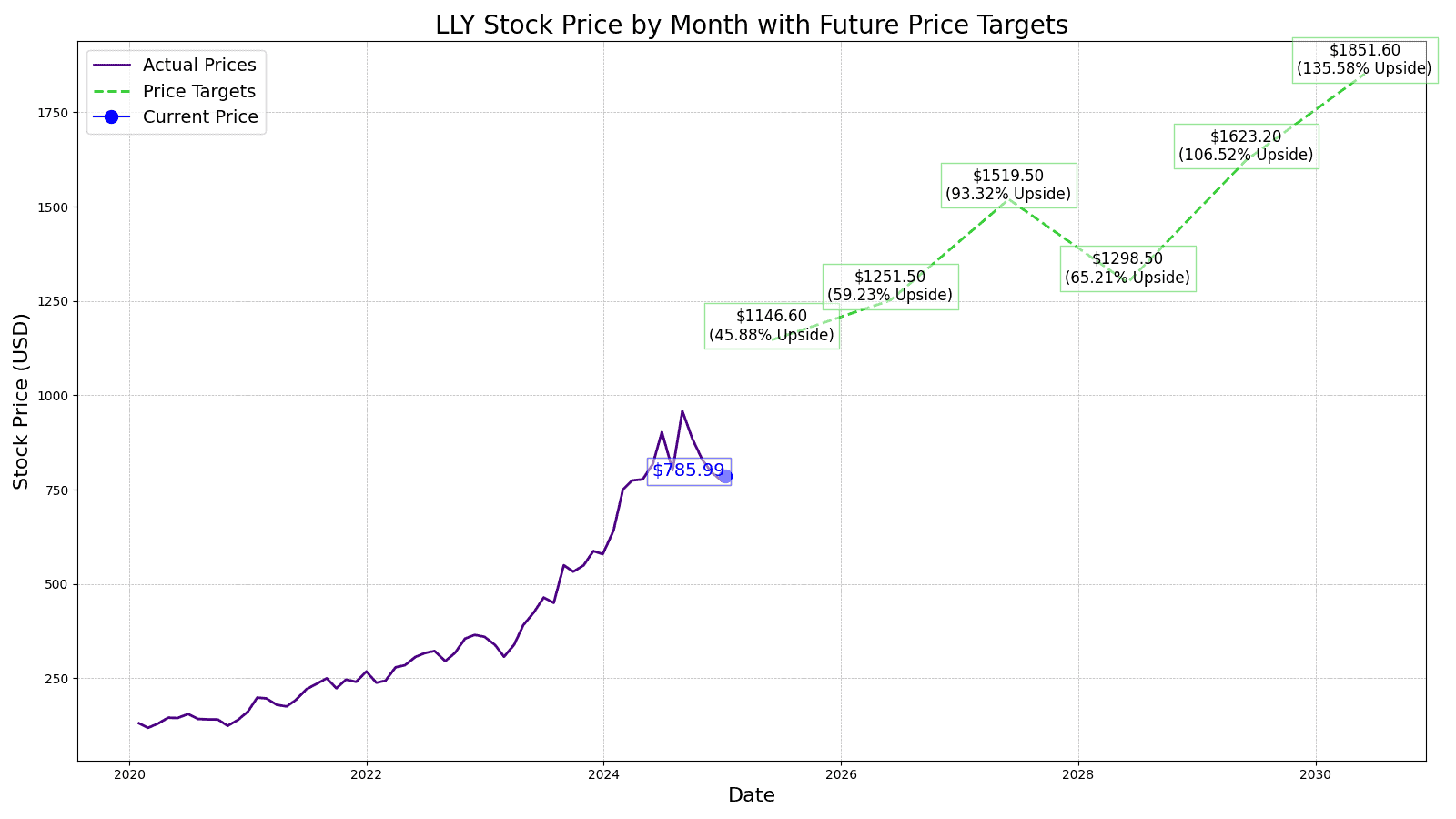

Since the start of 2020, Eli Lilly’s (NYSE: LLY) stock price chart has been straight up and to the right, up 494.50% and currently trading at $785.99.

The company has been around since 1876 and the stock didn’t go public until 1952 but in the last 4 years, Eli Lilly went from a $100 billion market capitalization to $740 billion today, which also makes it a potential stock split stock.

However, as investors, we care about the stock price years down the line and what Eli Lilly will do in the next 3 to 5 years and beyond.

That is why 24/7 Wall Street looks at projected revenue and net income to give you our best estimate of future stock prices from 2025 to 2030.

Other “experts” look at past growth rates and assign future stock prices to those past numbers. However, we will walk you through our assumptions and give you the key drivers we see propelling Eli Lilly’s stock in the future.

1/10/2025

Eli Lilly is close to acquiring Scorpion Therapeutics, a biotech company specializing in cancer treatments. The initial payment is expected to be around $1 billion, with an additional $1.5 billion that could be paid later if Scorpion achieves specific research milestones.

1/8/2025

Truist Securities has reiterated its “Buy” rating on Eli Lilly’s stock with a $1,029 price target. They are closely monitoring the performance of the company’s obesity drugs Mounjaro and Zepbound, particularly in the cardiometabolic area.

1/7/2025

Eli Lilly’s stock saw a positive day, up 1.3%. Trading activity was notably strong in call options, with 11,152 contracts traded. Eli Lilly’s next earnings report is anticipated on February 6th, which may be a contributing factor to the increased market activity and volatility.

1/6/2025

Peptide drugs like Mounjaro and Zepbound currently require injections, but the biotech sector is actively exploring methods to deliver these drugs orally in a pill form. Eli Lilly is investing in Orbis Medicine’s €90 million Series A funding round, announced just today. While Orbis hasn’t specified which disease its drug research will target, much of the company’s focus revolves around areas already proven successful with injectable biologic drugs.

1/3/2025

Eli Lilly has officially entered the legal battle between the Outsourcing Facilities Association (OFA) and FarmaKeio Custom Compounding against the U.S. Food and Drug Administration (FDA). As anticipated by many, the company has filed a motion to become a defendant in the case.

12/30/2024

Eli Lilly saw a decline of 1.4% in its share price today, trading as low as $771.00. Trading volume was much lower than average, with 444,906 shares traded (an 86% decrease from the average session volume).

12/27/2024

Elon Musk has publically favored Eli Lilly’s weight loss drug, Mounjaro, over Novo Nordisk’s Ozempic. Musk claims Mounjaro has fewer side effects and is more effective. This endorsement comes shortly after Musk made a lighthearted reference to Ozempic in a humorous social media post dressed as Santa Claus.

12/24/2024

Beginning in March 2025, some patients in Britain will have access to Mounjaro, Eli Lilly’s obesity drug, through the National Health Service (NHS). This follows approval from the UK’s health technology assessment body, which evaluates the cost-effectiveness of new treatments.

12/20/2024

The FDA has approved Eli Lilly’s obesity drug, Zepbound (tirzepatide), as the first treatment for obstructive sleep apnea in the U.S.

12/19/2024

The Food and Drug Administration (FDA) has reaffirmed its earlier decision that the shortage of tirzepatide (the active ingredient in Eli Lilly’s diabetes and weight loss drugs Mounjaro and Zepbound) has ended. This decision means that most compounding pharmacies will be required to cease production of compounded tirzepatide within the next 90 days.

How did Eli Lilly’s stock price soar so much in the past few years? Let’s take a look at the numbers:

| Share Price | Revenues* | Net Income* | |

| 2016 | $80.36 | $21.22 | $2.74 |

| 2017 | $77.55 | $19.94 | ($0.21) |

| 2018 | $122.13 | $21.49 | $3.23 |

| 2019 | $140.83 | $22.32 | $8.32 |

| 2020 | $206.46 | $24.54 | $6.19 |

| 2021 | $238.31 | $28.32 | $5.58 |

| 2022 | 329.07 | $28.54 | $6.25 |

| 2023 | $745.91 | $34.12 | $5.24 |

*Revenue and Net Income in Billions

Since 2016, Eli Lilly’s revenue grew by 60% but income grew by 91%. Typically you wouldn’t expect a company growing at its top line by 7% annually to see an 828% increase in share price, however, investor sentiment for the next line of drugs front ran the stock price.

For example, in 2016 Eli Lilly was trading 13 times the trailing 12 months earnings and the market has increased its valuation each year and currently trades at a 125 times earnings multiple.

This raises the valid question, is Eli Lilly overvalued or will future revenues make up for the expensive valuation?

The current Wall Street consensus 1-year price target of Eli Lilly stock is $1030.00, which is 31.04% higher than today’s price of $785.99. Of the 26 analysts covering Eli Lilly stock, the current rating is 1.67 or “Outperform” with 1-year price targets as high as $1,100 and as low as $540.00.

24/7 Wall Street sets its 1-year price target at $1,040. Taking a look at the sum of its parts, we see Eli Lilly’s vertices valued as follows:

| Endocrinology | $735/ share |

| Oncology | $122/ Share |

| Cardiovascular | $4/ Share |

| Neuroscience | $16/ Share |

| Immunology | $38/ Share |

| Others and Pipeline | $110/ Share |

| Cash | $17/ Share |

Valuing Eli Lilly’s stock price for the coming years, we will take a look at expected revenue and net income and give our best estimate of the market value of the company by assigning a price-to-earnings multiple.

| Revenue | Net Income | EPS | |

| 2025 | $52.8 | $17.29 | 19.11 |

| 2026 | $62.5 | $22.49 | 25.03 |

| 2027 | $70.87 | $27.12 | 30.39 |

| 2028 | $80.68 | $32.2 | 25.97 |

| 2029 | $87.99 | $36.45 | 40.58 |

| 2030 | $96.67 | $41.12 | 46.29 |

*Revenue and net income reported in billions

We expect Eli Lilly’s P/E ratio in 2025 to be 60 with an EPS of $19.11, resulting in a price target of $1140.00 This prediction is based on strong revenue growth of 18.37% to $52.80 billion and net income expansion to $17.29 billion, continuing the upward trajectory from previous years.

For 2026, we anticipate a P/E ratio of 50 with an EPS of $25.03, leading to a price target of $1250.00. This reflects significant revenue growth of 18.37% to $62.50 billion and an increase in net income to $22.49 billion, driving higher earnings per share.

Heading into 2027, we project the P/E ratio to remain at 50, with EPS increasing to $30.39. This results in a price target of $1520.00. Continued revenue growth of 13.39% to $70.87 billion and net income expansion to $27.12 billion justifies this substantial increase in stock price.

With an EPS of $25.97 and a P/E ratio of 50 in 2028, we forecast the stock price to be $1300.00. A slight dip in EPS growth is expected, but sustained strong performance in net income to $32.20 billion and revenue growth of 13.84% to $80.68 billion keeps the stock highly valued.

By 2029, we estimate Eli Lilly’s EPS to rise to $40.58, with the P/E ratio adjusting to 40. This gives us a price target of $1623.00. The continuous revenue growth of 9.06% to $87.99 billion and net income expansion to $36.45 billion supports this higher valuation.

Price Target: $1850.00

Upside: 135.37%

By 2030, we estimate Eli Lilly’s EPS to rise to $46.29, with the P/E ratio adjusting to 40. This gives us a price target of $1850.00. The continuous revenue growth of 9.86% to $96.67 billion and net income expansion to $41.12 billion supports this higher valuation.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2025 | $1140.00 | Upside of 45.04% |

| 2026 | $1250.00 | Upside of 59.04% |

| 2027 | $1520.00 | Upside of 93.39% |

| 2028 | $1300.00 | Upside of 65.40% |

| 2029 | $1623.00 | Upside of 106.49% |

| 2030 | $1850.00 | Upside of 135.37% |

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.