Investing

Tomorrow's Multi-Trillion-Dollar AI Opportunities Nvidia Is Taking Lead on Today

Published:

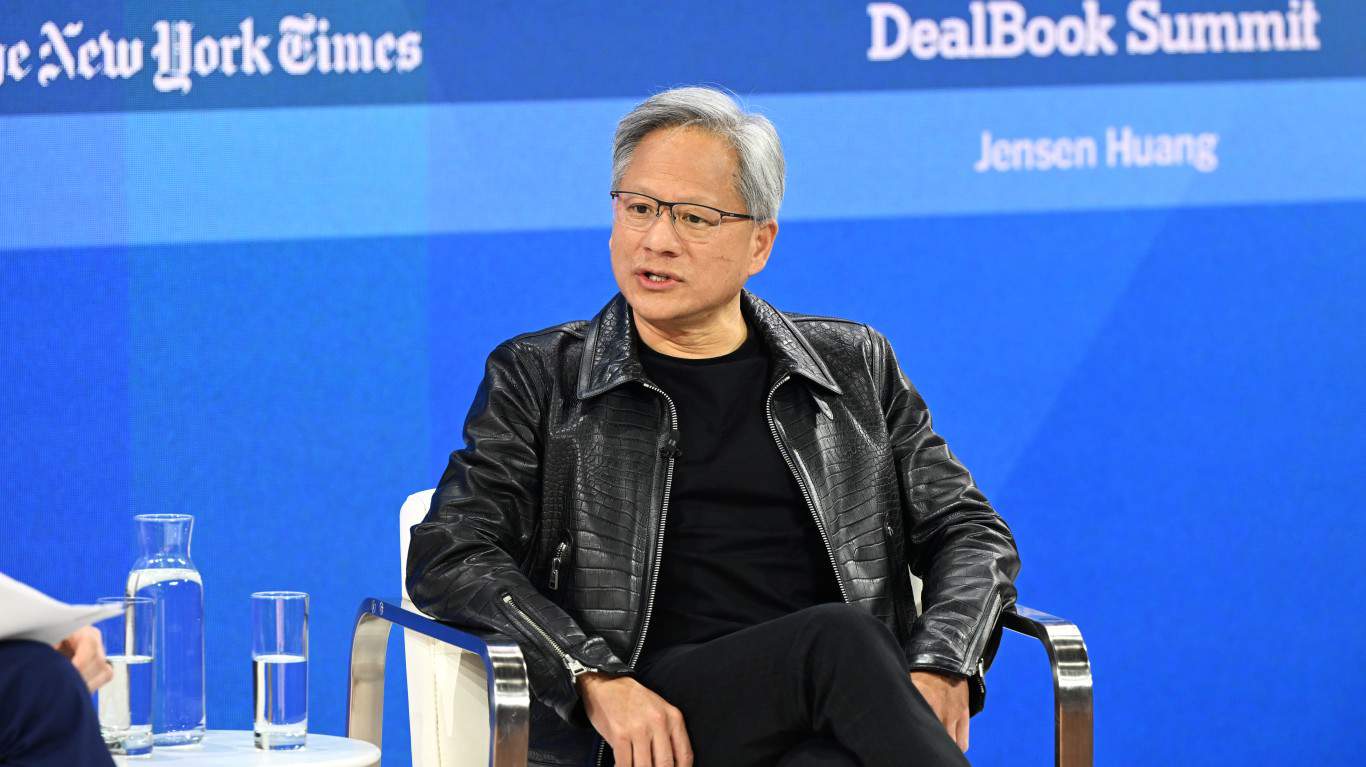

There was a lot to unpack coming out of CES 2025 last week, not least of which was Nvidia (NASDAQ:NVDA) CEO Jensen Huang’s vision for the future.

He gave the keynote address at the tech conference where companies revealed their latest breakthrough technologies and innovations. Nvidia had a few reveals of its own, not least of which was its Project DIGITS personal computer for researchers, data scientists, and developers to run comprehensive artificial intelligence models locally.

AI, of course, has become central to Nvidia’s future, so a lot of Huang’s comments centered on where the technology is today and where it is heading tomorrow. He painted a vision of a moment where AI doesn’t just enhance our daily lives, but fundamentally reshapes industries, creating multi-trillion dollar opportunities.

It foresees a deeper integration of AI into our physical world through what he calls “Agentic AI,” and a transformation of the physical world through “physical AI.” Each of these are multi-trillion-dollar opportunities that Nvidia is taking the lead on, so investors really want to know is what it could mean for Nvidia’s stock.

Huang’s highlighted that AI agents are poised to become the new digital workforce, automating tasks that are mundane, repetitive, or require complex decision-making. AI agents will manage your calendar, perform customer service, and even handle logistics in warehouses.

According to Huang, this shift towards AI agents represents a major leap from the current wave of AI, which focuses on data processing and generation, to AI that can act, reason, and interact with the physical world like humans do.

This could revolutionize sectors like manufacturing, healthcare, automotive, and more. AI could take on roles from assembly line workers to autonomous vehicle drivers, thereby saving costs, increasing efficiency, and spawning new industries. Huang said Agentic AI is “likely to be a multi-trillion dollar opportunity.”

Following “Agentic AI,” Huang introduced the concept of “Physical AI,” where AI transcends the digital realm to interact directly with the physical world. Physical AI involves AI systems that can perceive, reason, plan, and act in real-world environments. It’s about teaching robots to understand physics, handle objects with dexterity, and navigate spaces designed for humans.

Huang predicted this could be “the ChatGPT moment for general robotics,” where AI-driven robots become as commonplace and transformative as AI in our digital interactions.

With Nvidia’s Cosmos platform, for example, the company is at the forefront of enabling this shift, providing foundational models that could lead to robots in homes, factories, and beyond, creating enormous economic opportunities.

Arguably one of the most exciting areas Huang mentioned was in autonomous vehicles. Nvidia’s partnerships with companies like Toyota (NYSE:TM) and Aurora Innovation (NASDAQ:AUR) for self-driving technology suggest a future where cars and trucks drive themselves, reducing accidents, traffic, and the need for human drivers in certain scenarios. This one sector alone could be valued in the trillions of dollars, considering the global economy’s reliance on transportation.

However, the question top of mind most with investors remains, does Nvidia stock still make for a good investment? Nvidia has already seen its stock soar in recent years due to its leading position in AI chip manufacturing. The stock’s performance correlates with the AI boom, but we still need to hit pause.

NVDA stock has rocketed to premium valuations. Shares trade at 56 times earns, 30 times next year’s estimates, and 28 times sales. While that reflects investor confidence in its growth potential, considering the dramatic melt-up in the shares, there’s is the ever-present risk of a correction if expectations aren’t met or there is a broader market downturn.

And Nvidia isn’t alone in looking towards the future. Nvidia might be leading, but competitors like Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC) are not far behind. New entrants in AI chip design could challenge Nvidia’s market share, too.

There is also the question of saturation, or just how much AI hardware the market can absorb before it stabilizes or new technologies replace current solutions.

Given Huang’s vision and Nvidia’s strategic position, the stock remains compelling for those with a long-term investment horizon. Nvidia isn’t just selling chips. It is also selling the infrastructure for an AI-powered future. The company’s focus on software, partnerships, and expanding into new markets like robotics and autonomous systems positions it to capture significant value from the ongoing AI revolution.

Under Huang’s leadership, Nvidia sees AI transforming into a multi-trillion-dollar industry through agentic AI and robotics. While the stock might be expensive, the potential for continued innovation and market expansion makes Nvidia an attractive investment, provided one is prepared for the volatility that comes with such high expectations.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.